The Cost Of A Transunion Credit Report Error

An error on your credit report can not only lower your credit score, but it can also result in the following:

- Higher interest rates for your home mortgage, credit card, and private student loans

- Higher insurance premiums for your home and car

- Loss of a job opportunity

- Denial of loan and credit applications

In extreme cases, an error on your credit report could even affect your U.S. government clearance. In fact, TransUnion lost a class action lawsuit in 2017 after consumers were flagged as terrorists on their credit report.

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your credit report. The NFCC can provide debt counseling services, help review your credit reports, work with lenders, and help create a debt management plan free of charge.

As always, be wary of predatory credit organizations or companies. Make sure to find a reputable counseling agency and keep a lookout for any red flags, like hidden fees or lack of transparency.

When looking for a credit counselor, the Federal Trade Commission advises consumers to check out each potential agency with:

- The Attorney General of your state

- Local consumer protection agencies

- The United States Trustee program

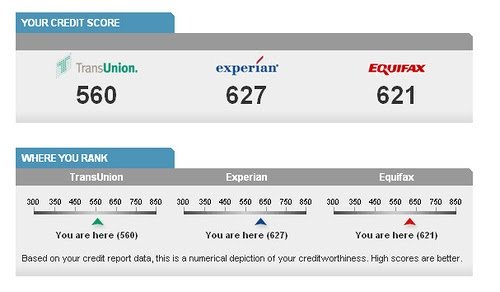

Differences Between Credit Reports

When glancing at each report, its important to double-check the accuracy of your personal information.

If they have your income lower than what its supposed to be, then it could impact your credit, especially if you carry higher balances on your credit cards, says Michael Zahaby, adjunct of finance for Florida Gulf Coast University. Along with verifying personal information, youll want to make sure each of your lenders properly reports your payment history and balance information.

Moreover, when checking your credit, theres a section for inquiries. This is where if you applied for a loan the inquiry shows up on one or more of your reports.

Its important to note the information presented on all three of your credit reports might not be consistent with each other. Some lenders might only report to TransUnion while others report to Equifax. So, dont be surprised if one account doesnt show up on all three reports.

Another way things could be confusing is when you apply for a retail credit card. The inquiry comes up as the bank issuing the card, not the retailer so dont be alarmed when this happens. However, if you noticed any errors in one of your credit reports, its important to address them right away.

Read Also: Carmax Credit Score Requirements

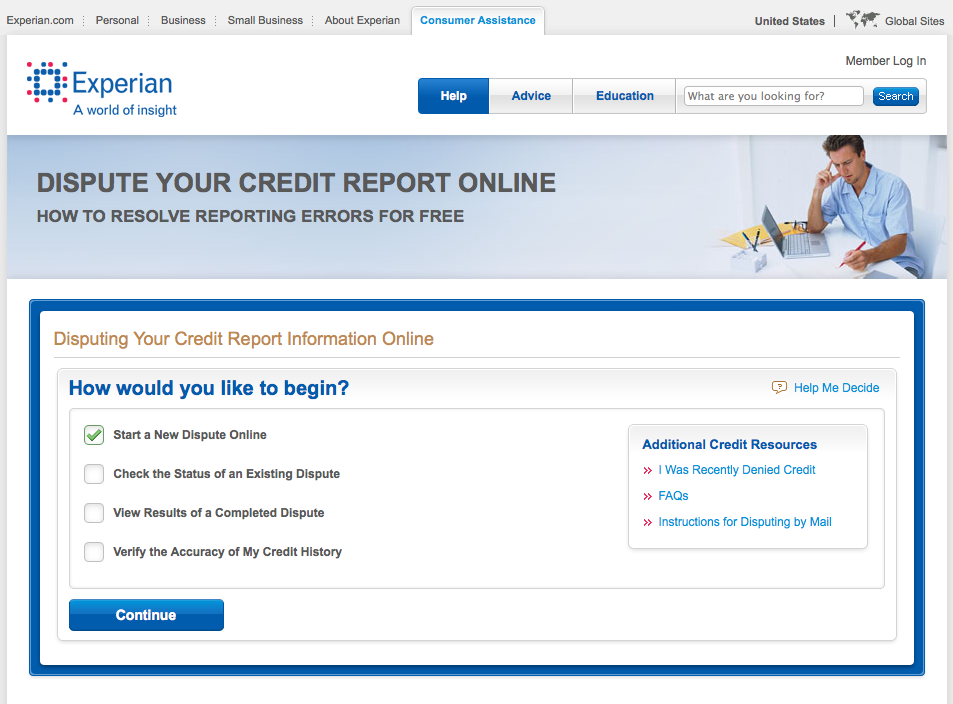

How To File A Dispute Online

To file online, you can follow these three steps:

Though filing a dispute online is convenient, you will lose some of your Fair Credit Reporting Act protections if you choose to do so without also following up via mail. When disputing through the mail, TransUnion is required to send the results of the investigation in writing to the borrower. They must also forward the dispute to the creditor and prove their method of verification.

These three requirements do not apply to online disputes.

Check Your Credit Reports For Updates

It may take some time for your credit reports to be updated. Creditors can take up to 45 days to send a credit bureau new information, according to TransUnion. If the information isnt updated after 45 days, contact the credit bureaus or data furnisher again to see why inaccurate information is still being reported.

Recommended Reading: Carmax Loans For Bad Credit

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Dispute By Mail Or Phone

It’s fast, free and easy to manage a dispute online, but if you’d prefer to dispute by mail or phone you’ll find instructions below.

To complete a dispute by mail, provide as much of the following information as possible:

- Personal Information: Name, DOB, Address, SSN

- Name of company that reported the item youre disputing and the partial account number

- Reason for your dispute

- Any corrections to your personal information

Send your documents to:

Please note: We accept either standard or certified mail.

Read Also: Is 586 A Good Credit Score

Dispute Transunion Credit Report Errors

If your TransUnion credit report contains errors you have the right to file a dispute. TransUnion will have 30 days to investigate your dispute and correct any errors. Unfortunately, credit reporting agencies do not always fix their mistakes. They may continue to report the wrong information on your credit report. They may correct it once only to report it again the next time your credit is checked.

If this is happening to you, we can help. Assert your consumer rights and get a free case review now, or call us at 1-877-735-8600.

File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

Recommended Reading: How To Remove Child Support From Credit Report

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Determine If You Should Contact The Furnisher As Well

The CFPB also recommends that you contact the company that provided the information to the credit bureau. Companies that provide information to credit bureaus are also known as furnishers. Examples of furnishers include banks and credit card issuers. If the furnishers address is listed on your credit report, send your dispute to that address or contact the company for the correct address.

You can try going directly to the furnisher and asking them to correct their reporting mistake before contacting the credit bureau, says Kevin Haney, a credit bureau expert at Growing Family Benefits. That might save a step, since all the bureau can do in its investigation is communicate to the company that the consumer says its wrong, he says.

But if the error is an identity-related mistake made by a credit bureau, go to the bureau first.

Those are the most likely to get corrected, because the bureau owns the problem so it doesnt have to reach out to anyone, Haney says.

In this case, you should also check with the other major credit bureaus to make sure the identity-related error isnt on their reports as well.

Recommended Reading: Syncb/ppc On Credit Report

Follow Up After The Investigation

Heres what to expect when the investigation is complete:

- The results of the investigation, in writing, from the credit reporting bureau.

- A free copy of your credit report, if the report has changed.

What about parties who have seen your incorrect information? You can ask the credit bureaus to notify them of the corrections, the FTC says. This includes:

- Notifying anyone who received your report in the past six months.

- Sending a corrected copy of your report to anyone who received it in the past two years.

But what if the investigation doesnt resolve your dispute? If the furnisher continues to report the error, you can ask the credit bureaus to include a statement in your credit file that describes your side of the dispute and it will be included in future credit reports. For a fee, you can usually ask the credit bureau to send a copy of the statement to anyone who has recently received a copy of your report.

Also, if you believe you were treated unfairly or a valid error remains on your credit report, you can file a complaint with the Consumer Financial Protection Bureau. The CFPB is required to forward the complaint to the company with which you have an issue. The CFPB usually will provide you with a response within 15 days.

How long can it take for an error to be corrected on your credit report after the dispute is resolved? Credit bureaus have five business days after finishing their investigation to notify you of the results.

Add A Consumer Statement

If the credit bureau confirms the information is accurate but you’re still not satisfied, submit a brief statement to your credit report explaining your position. It’s free to add a consumer statement to your credit report. TransUnion lets you add a statement of up to 100 words, or 200 words in Saskatchewan. Equifax lets you add a statement of up to 400 characters to your credit report.

Lenders and others who review your credit report may consider your consumer statement when they make their decisions.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

What Should I Do If I Find Information That Is Inaccurate On My Credit Report

Federal law allows you to dispute inaccurate information on your credit report. There is no fee for filing a dispute. You may submit your dispute to the business who provided the information to the credit reporting company and/or to the credit reporting company who included the information on your credit report.

The Federal Trade Commission’s website has information about how to dispute errors on credit reports, and the Consumer Financial Protection Bureau’s website provides additional guidance about disputing information on credit reports.

What Should I Look For In My Credit Report

When reviewing your credit report, check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

You May Like: Cbcinnovis Inquiry

Consider Contacting Your Lenders

If there is something specific to one of your accounts that you dont understand or looks wrong, it may be easier and faster to reach out to your lenders directly. You can find their contact information on your credit report. Lenders will have more details about the status of things like credit card balances and recent payments. They may be able to provide answers and resolve certain concerns quickly. If youre unsure if account information on your report is inaccurate or if an account balance just hasnt been updated yet, your lender may be able to help you. Any updates they make will be sent to us to add & /or change on your credit file.

One Free Report Every 12 Months

Everyone is entitled by law to look at their credit report from each of the three credit bureaus once every 12 months free of charge, or you can buy a credit report from each of the three bureaus if you want to view your report more often.

The three large U.S. credit bureaus Equifax, Experian and TransUnion were required by a 2003 federal law to set up AnnualCreditReport.com as a central online resource for report requests. You can also request your reports by calling 877-322-8228 or by downloading a request form and mailing it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Upon visiting AnnualCreditReport.com, users are directed to a form page and asked to provide personal identifying information, including name and address, Social Security number and date of birth.

After submitting your basic information, you go to a page allowing you to select reports from the three large credit bureaus by checking boxes next to the Equifax, Experian and TransUnion logos. You can select one or all of the credit bureaus. Instructions discuss whether you should review all three reports immediately, or whether you should spread the requests over a period of time.

If you use up your free credit report and want to check again for some reason, you can pay about $20 for each report. Or, you can get a free TransUnion credit report from CreditCards.com

Don’t Miss: Does Carvana Report To Credit Bureaus

Ways To Dispute Information On Your Credit Report

TransUnion and Equifax have their own processes for disputing credit reports, but Experian provides three methods for submitting disputes:

- Online: Get access to your Experian credit report and initiate a dispute at the Experian Dispute Center . There is no cost to you for using this service.

- : To initiate a dispute by phone, you’ll call the number displayed on your Experian credit report. If you’d like to have a copy of your credit report delivered to you by mail, call 866-200-6020.

- : You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013. .

How To Remove Items From Your Credit Report In 2021

Weve outlined how to remove negative items from your credit report, the paid services you can opt to use, and additional information to have on hand. It is important to clarify that only incorrect items can be removed. If youve done this already, but your credit score is still low, you will need to repair bad credit over time. Although accurate items cannot be removed by you or anyone else, there are still many credit report errors that can damage your score, and these are worth looking out for.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Common Credit Report Errors To Look Out For

Checking your credit report regularly to ensure your information is accurate can help you catch errors early. Here are some common errors, according to the CFPB that you should look for as you review your credit report:

- Wrong name, phone number, address, etc.

- Accounts that may belong to someone with similar personal information

- Accounts you didnt open or that list incorrect information as a result of identity theft

- Incorrect balances

- Accounts you closed that are still shown as open

- Youre listed as an account owner instead of authorized user

- Accounts mistakenly shown as late or delinquent

- Incorrect payment or account opening dates

- Repeated logs of the same debts

- Already-corrected information reappearing incorrectly

- Accounts that appear multiple times with different creditors listed

What Is A Credit Report

Your credit report is a snapshot of your financial history.

Your credit report is a snapshot of your financial history. It is one of the primary tools that credit grantors, like banks and credit card companies, use to decide whether to grant you credit.

What is in my credit report?Your credit report may include the following information:Identifying information: Your name, current and previous addresses, Social Insurance Number, telephone number, date of birth and current and previous employers

History of payments to credit grantors

Public records: Items that may affect credit worthiness such as bankruptcies and judgments

Inquiries: A list of credit grantors and other parties authorized by you and/or by law that have received your credit information

What are the next steps? GET YOUR CREDIT REPORT & SCORE

Other information, which could include banking information and/or collections

Your credit report does not include your income, purchases paid in full with cash or cheques, or information about business/personal accounts . It also does not include any information about your medical history, ethnicity, political affiliations or criminal record.

What is a consumer reporting agency or credit bureau and what does it do?

Consumer reporting agencies, like TransUnion, serve consumers and businesses by providing credit information and risk management tools to help businesses make credit-granting decisions.

Who can access my credit report?

Read Also: Does Paypal Credit Report To Credit Bureaus

How To Order Your Free Credit Report

There are two major credit reporting agencies in Canada: Equifax and TransUnion. You are entitled to one free credit report every 12 months from each of the credit rating agencies. Youll have to make a written request to receive your credit report by mail. You can receive your credit report and credit score instantly online, but it cost you money.

To avoid paying, you can request your credit report every six months, alternating between the two agencies. If you suspect youre a victim of credit card fraud or identity theft, its advisable that you request a copy of your credit report immediately.

To confirm your identity, youll need to provide your SIN and two photocopies of government-issued identification .

How Does The Dispute Process Work

If you submit a dispute to a nationwide consumer credit reporting company, the company may make changes to your credit report based on the documents and information you provided. Otherwise, they will contact the business reporting the disputed information, supply them all relevant information and any documents you provide with your dispute, instruct them to investigate your dispute, and:

- Review all information you provided about your dispute

- Verify the accuracy of the information they are reporting to the credit reporting company

- Provide the credit reporting company with a response to your dispute, including any changes to the information reported

- Update their records and systems as necessary

- The credit reporting company will then notify you of the results of the investigation

If you submit a dispute with a business, they will conduct an investigation and will send you the results of the investigation directly. They will notify the credit reporting companies of any changes that need to be made to the information as a result of the investigation.

If a dispute results in a change to your credit report, you will have up to 12 months to order a second free report through AnnualCreditReport.com in order to review the changes.

Recommended Reading: Does Carmax Accept Bad Credit