How To Improve Your 720 Credit Score

A FICO® Score of 720 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 720 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

46% of consumers have FICO® Scores lower than 720.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Rule Out Credit Mistakes

Credit bureaus count on the accurate reporting of information furnishers such as public information sources and creditors. To err is human, and thats why credit reports may contain many mistakes.

Dont think this cant happen to you. An average person has about four credit cards and may have opened other credit accounts. With so many accounts, mistakes are bound to happen eventually.

Stay on top of mistakes by combing through your credit reports looking for reporting inaccuracies.

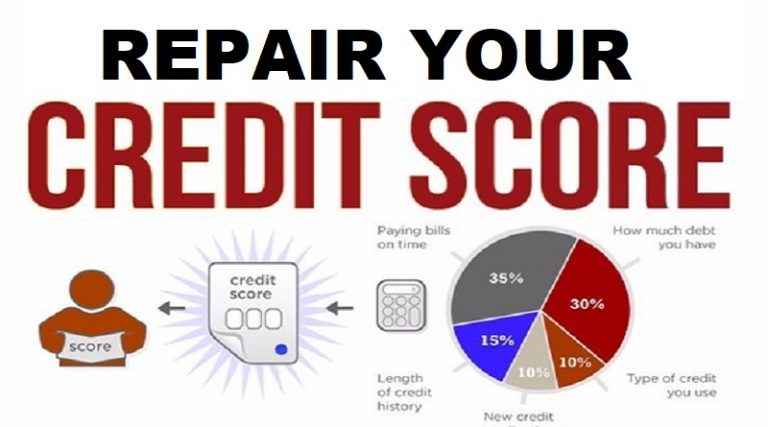

An honest mistake, such as the credit limit on your card being listed as $200 instead of $2,000 may have a considerable effect on your credit utilization rate . It contributes up to 30% of points during score calculation.

The removal of serious inaccuracies such as collection accounts may even result in a 100 points increase.

You dont have to do this process alone. The credit repair industry has arisen from the mistakes information furnishers make when reporting data. Companies such as Lexington Law file millions of challenges every year.

You can decide to delegate the work of finding and challenging mistakes to seasoned professionals. Additionally, you can fix your credit report on your own as its within your rights to do so.

You may not need paid services in the first place. Take advantage of the free consultations offered by credit firms to ask if they can help.

How To Get Approved For A Loan With Less

If you follow these steps and continue to pay all of your bills on time, your credit score will improve. Of course, it takes time. Improving your credit score from below average to good may take a couple years. If youre hoping to buy a home or get other new credit in the meantime, it may be a challenge. Here are some things to keep in mind.

You May Like: Credit Carmax

How Long Does It Take To Build Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When you have no credit, working your way up to a good credit score can feel impossibly slow.

Building a credit score from scratch can take anywhere from a month or two to six months, depending on the type of credit score you are looking at. The two main credit scoring systems vary on how soon they’ll show a score. You can establish a VantageScore within a month or two of having a credit line. Your FICO score the score used in most credit decisions takes at least six months to generate.

How Can I Raise My Credit Score From 650

4.1/5How to improve your 650 credit score

As a result, you should be able to get a card or loan with a 650 credit score. But a little bit of improvement will give you many more options and help you save a lot more money. Who Has a 650 Credit Score?

| Income Bracket | |

|---|---|

| $100K+ | 88% |

Subsequently, question is, how long does it take to get a 650 credit score? It will take you six months to accumulate enough history so a FICO score can be calculated. You should be able to get a VantageScore much more quickly. You will not be able to build a approaching 850 in that time period, but you may be able to break 700.

One may also ask, how can I improve my credit score of 661?

Here’s how to improve a 661 credit score:Pay Off Collections Accounts: Once you bring a collection account’s balance down to zero, it stops affecting your VantageScore 3.0 . Reduce Utilization: It’s best to use less than 30% of the available on your card accounts each month.

Can I get a car with a 650 credit score?

A 650 credit score auto loan interest rate can vary based on the lender you choose, down payment and even debt-to-income ratio. A 650 credit score is fair so it’s likely a borrower will be approved for a loan, the rates, however will be quite higher than if the were 720 or above.

can700can

You May Like: How To Unlock My Experian Credit Report

Associate With Someone Who Has Excellent Credit

This does not mean simply spending time in the company of those who have great credit scores.

Kyle Winkfield, managing partner of OWRS Firm, in Washington, D.C., suggests one of the best measures to see quick improvement in your credit score is to ask a family member or very close friend, who has impeccable credit and a lengthier , to add you as an authorized user on their lines of credit.

This person doesnt need to give you a credit card to use, however simply just associating you with their good credit will improve your score and they will not be impacted by the association, says Winkfield.

Translation it wont mean a free shopping spree for you. And it wont threaten the credit score of the person agreeing to this arrangement.

Building Credit Takes Time

Unfortunately, credit scores dont change overnight. Improving your credit score takes time. However, if you get started using the tips above, youll start seeing an improvement fairly quickly. By doing the right things, you should notice your score creeping up within a month or two.

And if you started with a poor score and made drastic improvements, an increase of 110 points within 6 months is totally possibly.

Most importantly, remember to use your credit wisely. Avoid debt whenever possible, pay your bills on time, and pay off your credit cards every month. Doing that has more than just a positive effect on your credit score it puts you in a great position to make the most of the money you already have.

Remember, the ultimate goal is to improve financial health its just that improving your credit score almost always has the byproduct of improving overall financial health in the process.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Greg Johnson is a writer and entrepreneur who leveraged his online business to quit his 9-5 job, spend more time with his family, and travel the world. As a money nerd, he enjoys writing about topics like budgeting, frugality, and investing. With his wife Holly, Greg co-owns two websites Club Thrifty and Travel Blue Book. Find him on Pinterest and Twitter @ClubThrifty.

Read Also: When Does Paypal Credit Report To Credit Bureau

Pay Off Debts That Are Close To The Credit Limit

Its a little-known fact that even if you pay your card bill on time, its never a good idea to hold a balance near the maximum limit. The magic ratio is 35%, says Kevin Gallegos, vice president of Phoenix operations with Freedom Financial Network.

If you have a credit card with a limit of $10,000 and you owe $3,500 on it, thats 35 percent utilization, he notes. Anything over 35% is considered is high and can impact credit scores. Over 50% will have a definite negative impact on a credit score, and a maxed-out card will very negatively impact the score. And you wanted to max just one card, eh?

Is My Credit Score Good Enough For A Mortgage

Your , the number that lenders use to estimate the risk of extending you credit or lending you money, is a key factor in determining whether you will be approved for a mortgage. The score isnt a fixed number but fluctuates periodically in response to changes in your credit activity . What number is good enough, and how do scores influence the interest rate you are offered? Read on to find out.

Read Also: How Accurate Is Creditwise Credit Score

Why Is Your Credit Score So Important

There are many reasons why your credit score is important.

Many landlords will check your credit report before renting to you. They want to make sure you can and will pay your bills on time. So a poor credit score could influence your ability to find a place to live.

Your credit score also affects how much you pay in home and auto insurance. It even affects whether or not you are approved for a cell phone plan.

Most importantly, your credit score determines the cost of your future purchases. A good credit score gets lower rates on loans and credit cards, resulting in lower overall costs.

To put this into perspective, someone who has a credit score of 650 and gets a 30-year $400,000 mortgage loan is likely to pay over $70,000 more in interest than someone who gets the same loan, but has a credit score of 750.

As you can see, you can save A LOT of money by maintaining a good credit score.

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Read Also: Does Paypal Credit Report To Credit Bureaus

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

Experian |

|---|

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

Understand Your Credit Utilization

The single most important factor in your credit score is something called credit utilization.

Sounds complicated, but it’s not.

One of the largest credit reporting agencies, Experian, explains this as follows:

…one of the most important factors in credit scores is how close your balances are to your credit limits. Credit scores add up the limits and the balances on your revolving accounts in order to calculate your overall balance-to-limit ratio, or utilization rate. The higher your utilization rate, the greater the negative impact on your scores.

You’re probably thinking that a fast way to boost your score instantly is to just pay off every single credit card and never use them, right? That’s actually wrong. Believe it or not, a 0% utilization is actually a bad thing.

In 2016, reviewed credit scores versus utilization ratios of its 15 million members and discovered a very interesting pattern.

People with 0% credit utilization actually had a worse credit score than those with 1–20% utilization.

What does this mean? It means that to build a credit score you should have plenty of available credit that you aren’t using, but you should try to use 1% to 20% of that total limit.

The rest of the actions in this article need to be tailored to your situation and your current utilization ratio. No one is starting from the same situation. For example:

Recommended Reading: How Often Do Companies Report To Credit Bureaus

Pick One Card And Use It Responsibly Each Month

This tried and true method has been used by consumers far and wide. Select one credit card and use it every month for expenses that you would normally pay for with a debit card or cash. And then, be sure to pay this card in full every month.

To improve your score, you actually want something being reported every month and this happens any time you have a balance on your account, explains Emanuel. I recommend my clients find a bill that they can charge to their credit card each month. Once the statement posts, pay it in full. That way every single month something is being reported to the credit bureaus.

Not only is something being reported to the credit bureaus. The bureaus are seeing that you are paying a bill in its entirety, consistently.

You can find out how your debt is impacting your credit scores, and learn how making more than the minimum payment can help you save money and affect your credit by setting up your own free account at Credit.com. From there, you can also create a personalized action plan to get where you want to be.

What Is A Good Credit Score To Avail A Home Loan

To avail a home loan, you need to ensure that you have a CIBIL score at least above 650. Since a home loan is a secured loan, lenders have the option of seizing your home if you are unable to repay the loan. This is why a slightly lower credit score is allowed. However, it is in your best interest to maintain a good credit score so you can get a larger loan amount at nominal interest.

You can maintain a good CIBIL score by following these simple steps:

-

Pay your EMIs on time to create a proper track record

-

Avoid having a credit card that you dont use cancel dormant credit cards

-

Manage your credit cards carefully by setting payment reminders or limit your use to one credit card

-

Avoid re-applying for loans or credit cards that you did not get approved for in quick succession

-

Dont make too make loan applications in a short span of time

-

Choose lengthy loan tenors with care and try to make part-prepayments when you can

You May Like: Open Sky Unsecured

Have You Been Denied A Credit Card Or Loan

One reason you might want to raise your credit score is that a lender or credit card issuer or credit card company turned down your credit application. Being denied credit can cause feelings of frustration or embarrassment. But the fact that you cant qualify for a financial product that you need or want is even worse.

Want to improve your credit to re-apply for a particular credit card or loan? It helps to learn the lenders eligibility requirements first.

Although a 100-point credit score increase is always nice, it might not be necessary to satisfy a particular lenders qualification standards. For example, if you have a 610 credit score and the lender requires a minimum credit score of 670, you would need to improve your score by 60 points for a chance to qualify.

When you understand a lenders qualification requirements, youll have a better idea of the number you want to work toward. Once you reach that initial threshold, theres no reason to stop working toward an exceptional .

How Long Will It Take To Raise Your Credit Score By 100 Points

The journey toward a higher credit score is different for everyone. For some people, a 100-point score increase might happen fast. Others might take months or even years to reach the same goal. People with higher credit scores may not be able to achieve a 100-point score increase at all since 850 is the highest score possible.

The following could have an influence on the amount of time it takes you to earn a 100-point increase.

Its worth noting that your credit score starting point may affect your potential for improvement as well. A low credit score has more room to increase. And certain positive actions may help a bad credit score improve quicker than a good credit score. Opening new positive accounts, for example, tends to help thin credit files more than well-established credit files with numerous accounts .

Paying down your credit utilization rate might also help you more if you have bad credit versus good credit. FICO provides a simulated example of several consumers who paid down their credit card balances by 25%. The person with the lowest starting FICO credit score had an estimated increase of 8-28 points. Still, the person with the highest starting credit score only experienced a 2-22 point estimated increase for the same action.

Recommended Reading: Does Barclaycard Report To Credit Bureaus