Add Trade References To Your Credit File

Many credit bureaus use trade references to get a glimpse into your payment history with vendors and suppliers. Trade references are based on a handful of factors, like the manner of payment, the current amount you owe, and the current amount thats past due. Positive trade references help boost your business credit score.

If you work with a handful of different vendors to buy supplies or materials for your business, ask them to report your payments to a business credit bureau. As long as you abide by the terms of your trade agreementlike paying within 30 or 60 days after receiving your goodsyour trade references should be positive.

If your vendors dont want to report to a credit bureau, you can still list them as a trade reference on your credit bureau accounts. The credit bureaus you report to will then follow up to gather your payment information.

Check Your Personal Credit Report

- Check your personal Credit History as reported to Equifax, Experian & TransUnion

- Look for differences in what’s been reported

- Identify problem accounts, and take steps to minimise their impact

- See the types of credit reported from your electric bill to your mortgage

- View up to 6 years’ history of your repayment performance

How Can I Build A Good Business Credit Score

Establishing a business credit score is an important step for any new small business. Its best to continue checking your report regularly so you always have a good idea of your finances. You can build a good score with these measures:

As a business owner, its important to separate personal and business credit. Maxing out your personal credit cards to fund your business can harm your personal credit score .

Once you open a business checking account in the legal business name, be sure to pay the financial transactions of the business from that account.

This can be in the form of an overdraft or credit card. Be sure to pay the credit card bill from your business checking account. By staying within 10% of your borrowing revenue, you should see your business and personal credit score improve.

Trade credit allows you to buy now and pay later, which can help solve cash flow problems. This can be useful when working with suppliers and vendors.

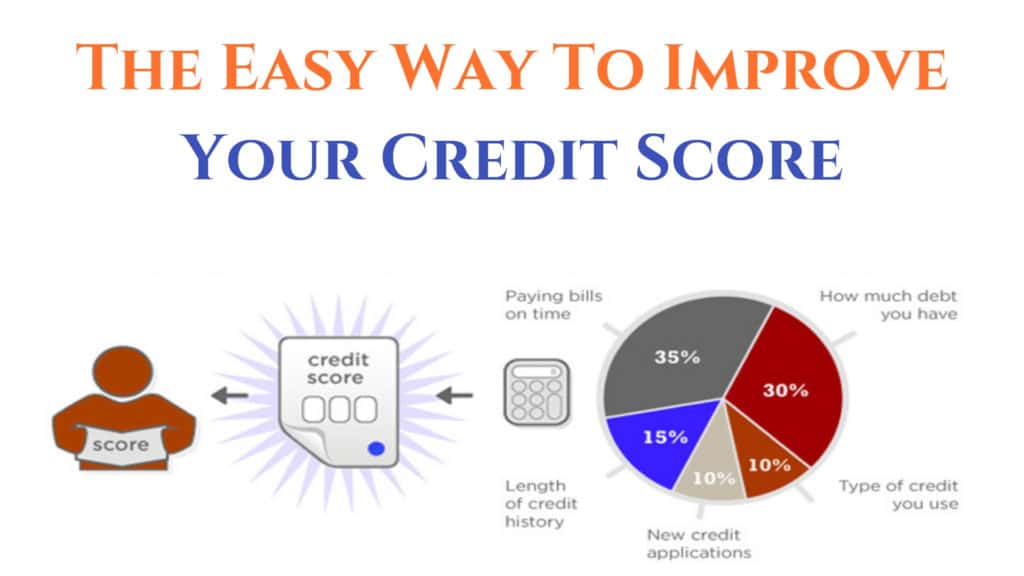

Paying your bills on time shows that you can effectively manage your debt. Late payments, especially severe ones, can negatively impact your business credit profile.

Final thoughts

Read Also: How Long A Repo Stay On Your Credit

What Is A Credit Report

A is similar to your report card from school. Essentially, its one big profile that contains your personal information, your credit-related accounts, and transactions over a predetermined number of years. If you open an account for a new credit product or make a transaction using an existing one, it typically gets recorded in your report. However, its important to note that not all credit accounts and transactions get recorded as some lenders and creditors do not report the data to one or both Canadian credit bureaus.

A record of most transactions , including cancelled accounts, inquiries, and other instances usually remains on file for around six years. However, more serious instances, such as delinquencies may remain there longer.

to learn how long information stays on your credit report.

Bad Credit Can Hurt Your Business Reputation

Did you know that your business credit report is public information? Unlike your personal credit, your companys credit history can be viewed by any potential client, vendor, or partner. A low credit score can hurt your companys credibility, as it may suggest that your business is struggling or has been run irresponsibly. A checkered credit history can also affect your ability to obtain the necessary inventory or upgrade your equipment, and it can even affect the amount you pay for utility services.

You May Like: What Credit Report Does Comenity Bank Pull

Check Your Credit Score For Free

Knowing where you stand and watching your progress can be important. With Experian, you can check your FICO® Score for free. Your account gives you a breakdown of which factors are impacting your score the most, so you can take a focused approach to improving your score. Your credit score will also automatically be tracked and updated each month.

Aim For 30% Credit Utilization Or Less

refers to the portion of your credit limit that youre using at any given time. After payment history, its the second most important factor in FICO credit score calculations.

The simplest way to keep your credit utilization in check is to pay your credit card balances in full each month. If you cant always do that, a good rule of thumb is to keep your total outstanding balance at 30% or less of your total credit limit. From there you can work on whittling that down to 10% or less, which is considered ideal for improving your credit score.

Use your credit cards high balance alert feature so you can stop adding new charges if your credit utilization ratio is getting too high.

Another way to improve your credit utilization ratio: Ask for a credit limit increase. Raising your credit limit can help your credit utilization, as long as your balance doesnt increase in tandem.

Most credit card companies allow you to request a credit limit increase online you’ll just need to update your annual household income. Its possible to be approved for a higher limit in under a minute. You can also request a credit limit increase over the phone.

You May Like: How To Remove Verizon Collection From Credit Report

If You Have A Bad Credit Score Dont Worry You Are Not Alone Thousands Of Americans Have Bad Credit Ratings And Are Finding It Difficult To Get Approved For Conventional Loans

While it is difficult to fix your credit score again, it is not impossible. There are several things you can do to improve it.

Depending on what your bad credit score, you can get up to 100 points in a short time. It happens when you are in the poor or fair areas of your credit score ranges. However, is it possible to improve your score by 100 points? Yes. Its true if you position yourself to make a profit as quickly as possible.

So how would you do that? Here are two things you can do.

How To Deal With Businesses Who Have A Poor Credit Score

Know what a poor business credit score is

Once you start watching your credit score, youâll see how hard it is to get a really good one. Try and keep some perspective when reviewing the scores of the businesses you deal with.

-

Donât worry if a business has a middle-of-the-road credit score. Just be wary if theyâre in the bottom quarter of the scale.

-

If you find that an existing client has a poor credit score, donât panic. Your personal experience of them counts for more. You only need to worry if their score is trending consistently downward.

Set cautious invoice payment terms for higher-risk businesses

You donât need to turn down businesses with bad credit scores. You can still do a deal, but you may want to structure the agreement differently.

-

Set shorter due dates so youâre not extending them as much credit.

-

Ask for an upfront deposit.

-

Charge them interest or a late payment processing fee when invoices are past due.

Lower your dependence on late payers

Businesses that consistently pay late will put you under cash flow pressure. They may diminish your ability to pay bills on time, which will affect your credit score. Make sure youâre not over-reliant on businesses that keep you waiting. Gradually try to cycle late-paying clients out of your business.

Also Check: Does Loan Me Report To Credit Bureaus

Now You Know What A Business Credit Score Is Look After Yours

The maths behind credit scores are complex and mysterious. But the basics of protecting your business credit score are not. Pay your suppliers on time by making sure you keep a reasonable cash reserve in your business. Making sure you get paid on time will help. Good invoicing systems and accounts payable practices are vital to all this.

Dispute Any Errors And Inquiries

Itâs possible to work with credit card companies and credit reporting agencies to get negative feedback removed from your credit file. Itâs important to make sure that whatâs being reported on your company is accurate and up-to-date. Hard inquiries and unpaid accounts negatively affect your report, so if you see something on your report that shouldnât be there, call to dispute it. This is a critical way to improve your business credit score.

You May Like: What Is Syncb Ntwk On Credit Report

How To Build Your Business Credit Score

Below we share our top 10 tips on how to fine tune your businesss credit score:

Check Your Credit Report

You can obtain your businessâs credit report from the major credit reporting companies such as Dun & Bradstreet, Equifax, and Experian. These reports arenât freeâeven if youâre the ownerâbut theyâre always the first necessary step in getting squared away on your credit score.

Once you know your score, you know what youâre working with and can get the information you need to raise your score, including which accounts are negatively affecting your report and any disputable items on the report.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Why Is A Business Credit Score Important

A company credit score is a vital piece of information that banks and lenders will look at when reviewing finance applications. To them, its a summary of whether you have difficulty managing your debt. As such, theyll often use your credit score to define the rates and terms of your loan. Good credit scores will mean your loan will be less expensive overall, due to you posing less of a financial risk to the lender.

Limit Credit Usage And Keep Debt Levels On The Low

Owing numerous amounts of money to the banks and other lenders will be one of the biggest factors affecting your business credit rating. While you may need a loan or two to boost the business and cover certain expenses, it is often advisable to keep any revolving debt low. Keeping low debt levels will lower your credit utilization, which works well in keeping your credit rating high.

You May Like: Does Paypal Credit Affect Credit

Do Your Due Diligence

Your companys business credit score is not just reliant on your own success but also that of those you work with. Therefore, it is a good idea to monitor the credit positions of both your suppliers and customers a problem that starts internally could end up harming your own credit score, for example, if a business you rely on goes into administration.

How To Get A Good Business Credit Score

So how do you improve your business credit score when you donât really know all the things that go into it? Here are some tips that accountants give to make sure businesses arenât red-flagged to lenders or other businesses.

Review your business credit score three to four times a year

If it dips, contact the credit scoring company. Theyâre legally obliged to tell you why. It could be because:

-

they made a mistake, in which case youâre entitled to a correction

-

a vendor reported you for withholding payments for legitimate reasons like invoice disputes â again, you can get this corrected.

Know what a good business credit score is

Your credit score doesnât need to be a 4 out of 5, or 75 out of 100 â so donât stress over a few points here and there. Most businesses will be comfortable working with you so long as youâre not in the bottom quarter.

Pay bills on time

-

Set up a good accounts payable system, so you know when bills are due.

-

Use accounting software to automate payments, so you donât forget.

-

Keep an eye on cash flow, so you can see if youâre going to struggle to make payments.

-

Be aware that big companies and utilities are more likely to report you for late payment.

Be upfront if youâre having cash flow issues

-

why youâll be running late

-

when youâll be able to pay

You May Like: How To Remove A Paid Repossession From Your Credit Report

What Is A Business Credit Score

As a consumer, you have a consumer credit score that tells lenders how much you can be trusted as compared to others and how much credit you can handle. It is a number that is based upon all the data that is collected from your credit report.

Similarly, as a business owner, you also have a business credit score. Just like a consumer credit score, a business credit score is also based on your businesss credit report. Your score tells lenders how you manage your finances and what your businesss financial situation is. For example, if you approach a financial institution to obtain fastcapital360 for your business, they will first check your business credit score, among other things, before approving your loan.

Top Tips To Improve Your Business Credit Score:

- Pay your bills on time. A negative record of paying on time can indicate a poor cash position.

- Limit your credit usage and keep debt low, however, use some credit to create a history.

- Regularly check your credit rating using an online tool and correct any mistakes immediately.

- Register your business with a credit reference agency or directory to make sure there is a record of your business. If your business is below the radar it could affect you getting credit.

- Check the credit position of your suppliers to protect yourself if something happened to them.

- Avoid closing accounts when paid off.

- If youre a start-up business, keep a close eye on your personal finances. If financial information about your business is not available, your personal data could be used as an indicator.

- Avoid County Court Judgements but if one does occur make sure its paid off immediately.

Also see: Concern over disparities in credit ratings for small companies

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Get Your Free Business Credit Check

Doing the right things to build your business credit profile is one of the most important items you can take as a small business owner. Doing so opens up financing opportunities and business relationships that make it a hell of a lot easier for you to run and grow a business.

Ready to see your credit data and start building better business credit? Check Your Personal and Business Credit For Free .

Maintain A Low Credit Utilization Ratio

A credit utilization ratio is the amount of credit youve used compared to the amount of credit you have available. Credit reporting agencies typically value lower credit utilization ratios, since it means youre not maxing out your available credit.

A good ratio is 30%, but an excellent ratio is around 10%. Lets say you have a $20,000 business line of credit. To achieve a 30% credit utilization ratio, you need to use no more than $6,000 at a time before bringing your balance back to zero.

Try these strategies to lower your credit utilization ratio:

- Bring your balances as close to zero as possible. When you regularly pay off your balances, your credit utilization ratio drops.

- Make micropayments throughout the month. Instead of paying just once a month, try making multiple smaller payments throughout the month to ensure your balance doesnt get too high.

- Increase your credit limit. Call your credit card company or credit issuer to ask for a higher limit. When you increase your limit without increasing your balance, your credit utilization ratio decreases.

- Open a new line of credit. If you open another line of credit and dont use it, youll have more total available credit, which will lower your ratio.

Read Also: What Credit Report Does Comenity Bank Pull

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it