Other Aspects Of A Tenants Credit Report

Its worth mentioning that an overlooked benefit to requiring a credit report from a potential tenant is that the credit report helps to verify a potential tenants identity. When authorizing the credit report, the tenant must provide personal information and answer several questions to validate that they are who they say they are. While it is extremely uncommon, sometimes individuals will rent a property using an alias. If this occurs, it is a major red flag.

A final point to make on credit reports is the confidentiality of the information. The details of an individuals credit report are extremely personal to them when your potential tenant authorizes you to view these details, they are trusting that you will keep the information confidential and that you will only use it to judge whether they are qualified to rent your investment property.

Once youve used the credit report and all other screening information to make a decision on a tenant, learn how to appropriately accept or deny prospective tenants.

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

What If I Don’t Earn Enough To Qualify For An Apartment

Dont panic! There are ways to potentially sweeten the deal for landlords and to show them you will be able to afford apartments.

Some will take a higher deposit or will accept several months payment in advance.

Others will accept you if you hire a guarantor to cosign with you. Even more may be willing to rent to you if you purchase rent guaranty insurance.

Find out how a guarantor can help you .

Also Check: Business Cards That Don’t Report To Personal Credit

What Score Do You Need To Rent A House

Each landlord has a different requirement for . If you are applying to rent with a large established property manager, they will probably have a stricter tenancy agreement when it comes to credit rating. They are also likely to check the electoral roll to look into your background.

Meanwhile, a private landlord may not even request credit checks. Instead, an individual landlord may just be satisfied that you will pay the rent if you name a family member as a guarantor.

Checking My Rental History Report: What Does My Landlord See

- By Hayley Grgurich | Last updated July 2, 2021

Lets say youre apartment hunting and youve found a gem. It wasnt easy and youre cutting it closer than youd like to your move-out date, but the place is perfect. Now you just need to pass the landlords screening process.

Most renters know their credit score and can provide the necessary security deposit and personal references, but theres one more big piece to the puzzle: your rental history report.

If you dont know whats on it, you run the risk of being rejected for an apartment because of mistaken information or issues that look problematic on paper, but could easily be explained.

To be confident youre putting your best application forward, its a good idea to get a copy of your rental history in advance and review its contents, keeping your potential landlords perspective in mind.

Read Also: Is 611 A Good Credit Score

Who Can Obtain My Free Credit Report

- In response to a court order

- In connection with a credit transaction for which you are being considered or are otherwise involved, such as a loan application

- For employment or investment purposes

- For the purposes of underwriting your insurance

- If you apply for government benefits, or

- For any other legitimate business purpose, such as renting.

Check Your Credit Score With Creditwise From Capital One

According to a TransUnion study, checking your credit score can potentially lead to more positive credit behavior. About one-third of consumers in the study who monitored their credit were able to increase their credit score over the course of a year.

One way to monitor your credit is by using . With CreditWise you can access your free TransUnion credit report and weekly VantageScore 3.0 credit score anytimeâwhether youâre a Capital One customer or not. And it wonât hurt your credit score.

You can also get free credit reports from each of the three major credit bureaus. Visit AnnualCreditReport.com to learn how.

Your credit is just one factor that landlords use to determine whether to accept you as a tenant. But itâs an important one. Knowing what they look for can help you figure out where you could improve.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

Also Check: How To Get Credit Report With Itin Number

Once You Are Successfully Renting Improve Your Credit And Overall Financial Life:

Getting your rent payments reported to all three credit bureaus is a smart way to build your credit score and also ensure that future landlords see your positive track record as a tenant. In some cases, you may even be able to report up to two years of prior rent payments, which is a great way to show a new landlord that you’re a responsible tenant.

If you use RentTrack, you’re not only assured that your responsible payments are reported, but you’ll also see your credit score with a breakdown of all the factors affecting it. You can also sign up for instant Credit Protection alerts, so in the event any negative information is unfairly reported, you can take immediate steps to protect your credit.

Once you know what landlords are looking for on your credit report, you’re one step closer to finding a new place to live. Proactively addressing those financial trouble spots might just might be the fuel you need to arrive at your desired destination: a new apartment.

Landlord Credit Check: What To Expect

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Because many landlords check applicants’ credit, your credit history could make a big difference in your next apartment search.

For would-be renters, the credit-check process may seem mysterious. If you’re wondering what landlords scrutinize when they check your credit, here’s an insider’s look, along with strategies for landing a place to live.

You May Like: Cbcinnovis On My Credit Report

Who Should Pay The Fee

In some states, you can request that prospective tenants pay an application fee to cover the cost of the background and credit checks, or you can absorb the cost yourself. Ultimately, its up to you to decide who ends up paying for the rental credit check. Some areas may impose a limit on how much you can charge an applicant, so be sure to comply with state and municipality laws.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: What Company Is Syncb Ppc

What Factors Affect A Tenants Credit Score

Many factors negatively impact a tenants credit score. For example, the tenants score might be low if:

- Their credit history isnt long enough.

- They dont have enough accounts to show a credit history.

- They have a poor payment history or reoccurring late payments.

- Theyve filed for bankruptcy or foreclosed on a home.

- Theyve been evicted from a previous residence.

- They recently moved to the country.

- Theyve had a bill sent to collections.

While the credit score is important, look at it as part of the larger credit story. A great renter might have suffered a setback and have a low credit score, but they could be working to build it back up. And someone with an excellent score may turn out to be a less-than-desirable renter.

Factors That Influence Credit Scores

To use credit scores as part of the tenant screening process, you dont necessarily need to know what factors influence credit scores. Understanding what goes into the score, however, will help you see the bigger picture of what these scores really represent.

Some of these factors will matter more to you as a landlord than others. If a tenant can explain their below-average credit score as a result of factors that dont affect your business, you might be able to work with tenants who may otherwise seem like the wrong fit.

Remember, each credit bureau uses a different formula to determine credit score, so each factor considered will likewise vary.

You May Like: Does Snap Finance Report To The Credit Bureau

How Do I Check My Credit Score

What Do Apartment Leasers See When They Pull Your Credit

When you fill out a rental application and hand it to the landlord, she will use the information to check you out. She may even hire a tenant screening service to do the check. Either way, at some point she will get a copy of your credit report. Its a good idea to know what a landlord can see on your credit report and how she evaluates your credit information.

Read Also: Does Paypal Credit Affect My Credit Score

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

The Differences In The Bureaus

Conceptualizing the difference in scoring systems at each credit bureau can be difficult without more direct comparisons.

FICO is one type of credit score that provides a credit score based on payment habits and the amount of debt the individual currently has on their credit lines. Experian, Equifax, and TransUnion all use VantageScore credit scores, which use the same factors, but a different formula.

While a FICO score is just a number, the credit reports issued by Experian, Equifax, and TransUnion all include more detailed information as well.

The exact information you get from any report will be dependent on where the report comes from, what credit scoring model is used, and what information you request.

You May Like: Syncb/ppc Closed Account

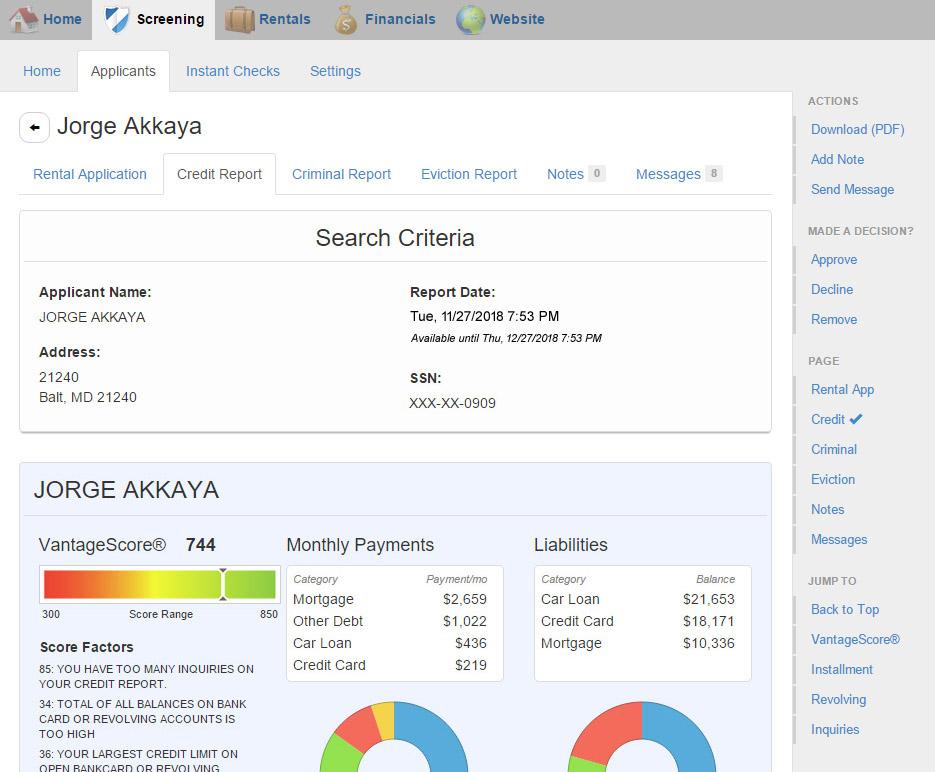

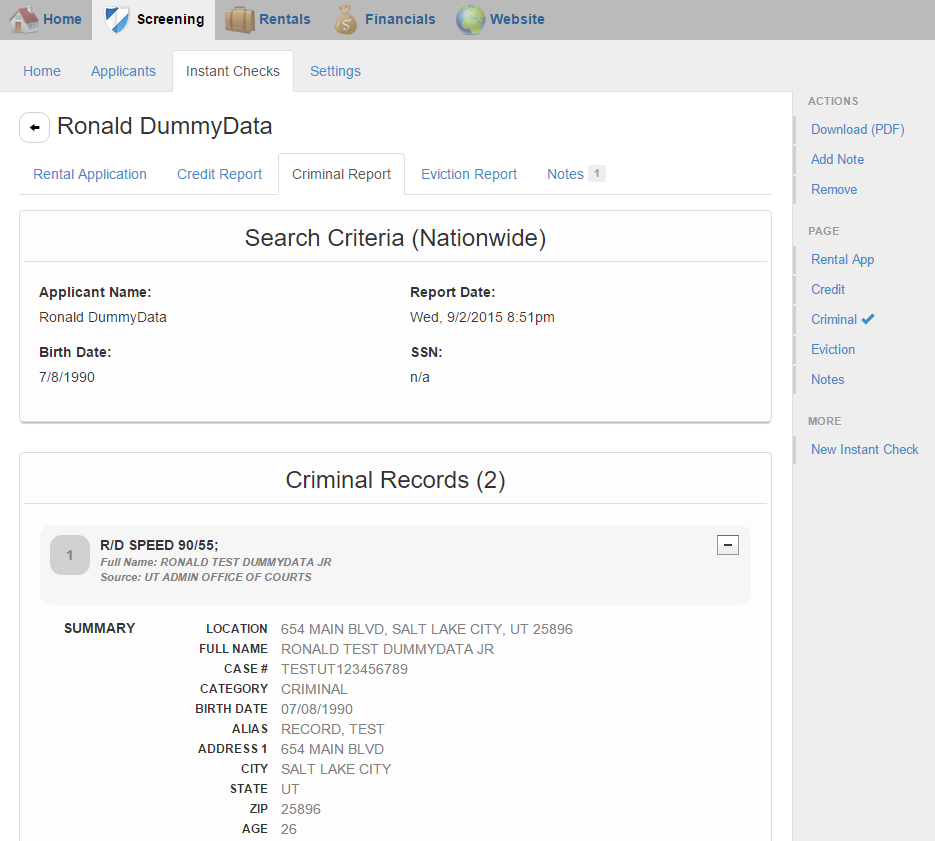

Why Do I Need To Run A Credit Check On Prospective Tenants

A credit check is just one part of an applicants background, but this basic screening may give you a foundational understanding of their financial health. Note: It is strongly recommended that you consider reaching out to legal counsel that is familiar with both credit reports and tenancy laws.

According to a SmartMove® survey, 84% of landlords cited payment problems as their top concern. A credit check is a prudent method of inquiry that may reveal what to reasonably expect from your renter in terms of their financial behavior.

Dont Forget To Check With All Three Credit Bureaus

As we mentioned in our last blog, its always a good idea to look at your credit report so that you can see exactly what a future landlord might see, but make sure you do so with all three credit bureaus. The credit bureaus are independent of one another, and they could all have different information in their reports.

Take the guesswork out of finding a bad credit or no credit rental by relying on Ways 2 Rent. Contact us today to get started.

- Categories:

Recommended Reading: Does Paypal Credit Affect Credit

Should You Credit Check A Guarantor

Yes, you absolutely should credit check a guarantor.

A guarantor is essentially responsible for making rental payments if the tenant cant, for this reason you need to conduct the usual checks on a guarantor that you would on a tenant. If the credit report reveals that the guarantor is overindebted or has struggled to make payments in the past, you may want to request that the tenant uses a different guarantor.

So thats the end of our guide on landlord credit reference checks. Remember that you should look at each case on its own merit. A bad credit score isnt necessarily indicative that a person isnt reliable, and you probably shouldnt ignore a credit report that shows a history of unreliable payments.

Let us know if we missed anything or if there are any questions youd like us to answer in this post, you can get in touch on Facebook or Twitter.

Read More Like This.

Average Tenant Credit Score Ranges

What is the average number you can expect to see when checking into what should be considered an acceptable credit score for renting?

Here at RentPrep, we run a lot of for the landlords who use our services. This gives us some insight into what you might see from renters. We are not the only ones who have insight into acceptable credit scores, however.

These are some of the most popular numbers used as a measure of what is an average credit score for tenants in America.

649

This is the exact average score we have seen in one year of data among all of the reports weve completed. This means if the score is lower than 649, it should be at least a little concerning.

These numbers are based on the data we have here at RentPrep. We run thousands of credit checks every month and this is a result of our findings. Understand that this is not based on all renters, but it is based on renters of landlords who run background checks.

673 699

According to an article from ValuePenguin, the average credit score of Americans in a 2021 report was 688 for the Vantage scoring model and 711 for a FICO model. Keep in mind that this is not industry-specific it takes into account everybody and not just renters. Renters statistically have a lower credit score than homeowners.

662

According to Time.com, the most at-risk demographic are adults aged 20 to 29 who have an average score of 662. This score is considered fair, but any score lower than 579 should start raising serious concerns.

Don’t Miss: Does Lending Club Show On Credit Report