How Often Should You Check Your Credit Report

Experts recommend that you check your credit report at least once a year. Taking a full deep dive with a credit report to ensure no inaccuracies, make sure you know where you stand and use a monitoring service that keeps you informed. We can help you stay informed with a credit monitoring service. Sign up for Chase Credit Journey to help monitor your credit.

If youre planning to make a major purchase soon, or even in the somewhat distant future, you should regularly check up on your credit report. You want to make sure your report is as accurate as possible to get the best interest rates.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

What You Need To Order Your Free* Experian Credit Report

Before we can process your request and to protect your identity, you will be required to provide the credit reporting information we hold on you from ONE of the following identification documents. Please ensure you have acceptable photo identification ready before completing the report request.

Primary Identification:

Recommended Reading:

Ram Credit Information Is Now Experian

Our logo and company name has changed from RAM Credit Information to Experian. By combining RAMCIs data expertise and local knowledge together with Experians world leading capabilities, we will better serve consumers and businesses in Malaysia. Established more than 125 years ago, Experian is a global leader in consumer and business credit reporting and services and has a long history of investment and commitment to Malaysia.

Also Check: Does Paypal Credit Report To The Credit Bureaus 2019

You May Like: Is Credit Rating Linked To Address

What You Will See On Your Experian Credit Report

Information on your Experian Credit Report has been provided to us from credit providers as a result of your application for credit, and publicly available information from government departments or agencies. This may mean we dont have your latest residential address or employer listed. This is quite common. It may be the case that you have not applied for credit while residing at your new address or with your new employer, or the information hasnt been shared with us.

The information in your Experian Credit Report may include:

| Personal information |

How Often Should I Check My Credit Report

Its generally recommended that you check your credit reports a minimum of one time a year, but you can check them as often as you like. Before you apply for credit, it can be a good idea to review your reports for errors to increase your chances of securing more favorable terms, such as lower interest rates.

You May Like: How Long Are Late Payments On Your Credit Report

Why Is It Important To Check My Credit Report

Its important to check your credit report because credit reporting mistakes happen. They can be the result of a creditor reporting inaccurate information or a sign of identity theft. If the error lowers your , it can decrease your approval odds when applying for a loan and it could prevent you from securing the best rate.

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

You May Like: Zebit Report To Credit Bureau

Read Also: What Can You Get With A 700 Credit Score

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Why Join Credit Savvy

With Credit Savvy, you get free access to your Experian credit score and credit file information. You can track your progress with monthly updates and get alerts about key changes to your credit file.

Youll also see how your score compares to other Australians. You can learn how to improve and protect your score and see how you can use it to get a better deal.

We’ve teamed up with Experian, one of Australia’s official credit reporting bodies, to provide you with access to your Experian score and credit file information.

You May Like: Does Minimum Payment Affect Credit Score

Why Credit Is Important For People With Disabilities

Establishing a credit history and maintaining a good credit score are important for people with disabilities because they can ease financial concerns and help you reach your goals. A good credit score can help you qualify and get better terms and rates for loans and credit cards, while a low score can impact you in many ways, such as your ability to get a new cellphone, how much you’ll pay in deposits when you set up your utilities and more. These factors can be especially important if you’re living on SSI or SSDI.

Unfortunately, many people with disabilities don’t have the access to the affordable credit they need, according to a National Disability Institute survey. Much of this stems from a reluctance to take on debt, and often leaves people in a bind when they need money quickly. Therefore they may be more likely to borrow from payday, auto title or pawn loans, which can be very expensive and carry restrictive terms.

When you get an accessible credit report, you’ll open yourself up to broader financial opportunities to help you achieve your goals. Get started by requesting your accessible credit report today.

Heres What You Should Do After a Data Breach

Resources

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

What You Need To Order Your Free Experian Credit Report

Before we can process your request and to protect your identity, you will be required to provide the credit reporting information we hold on you from ONE of the following identification documents. Please ensure you have acceptable photo identification ready before completing the report request.

Acceptable Identification:

- Current Australian Drivers Licence

- Current Australian Passport

- Australian Medicare Card

- Centrelink Card

Read Also: Is 777 A Good Credit Score

What Is An Experian Credit Report

An Experian Credit Information Report is a detailed summary of your credit history. It includes all the records of your payments, debts, defaults, loans, credit cards, recent enquiries and length of credit history. It gives lenders like banks and non-banking finance companies an idea of your creditworthiness.

Review Your Report & Dispute Any Errors

Reading your credit report is one of the most vital steps when it comes to building credit and maintaining it. While reviewing your report, make sure your personal and account information is accurate.

Common credit reporting errors to look for include the following:

- Incorrect name or address

- Paid accounts that are listed as open

- Account balance or credit limit errors

- Accounts that dont belong to you

If you spot an error, dispute it with each credit bureau that lists it on your report or the creditor that reported it. The investigation will typically take 30 days to complete. Once its over, the credit bureau will remove the information if it finds that it is in fact an error.

Read Also: How Do You Know Your Credit Score

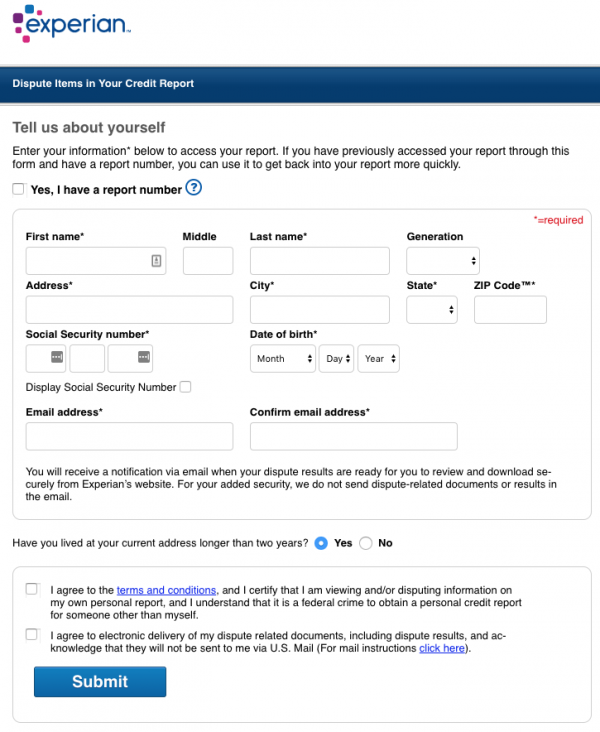

Ways To Dispute Information On Your Credit Report

TransUnion and Equifax have their own processes for disputing credit reports, but Experian provides three methods for submitting disputes:

- Online: Get access to your Experian credit report and initiate a dispute at the Experian Dispute Center . There is no cost to you for using this service.

- : To initiate a dispute by phone, you’ll call the number displayed on your Experian credit report. If you’d like to have a copy of your credit report delivered to you by mail, call .

- : You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013. .

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through December 2022, everyone in the U.S. can get a free credit report each week from all three nationwide credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get atAnnualCreditReport.com.

You May Like: Is 789 A Good Credit Score

Disputes Related To Accounts Or Public Records

- The information you disputed has been updated.

- The information you disputed might have been verified as accurate by the data furnisher, but other information on your account unrelated to your dispute has been updated.

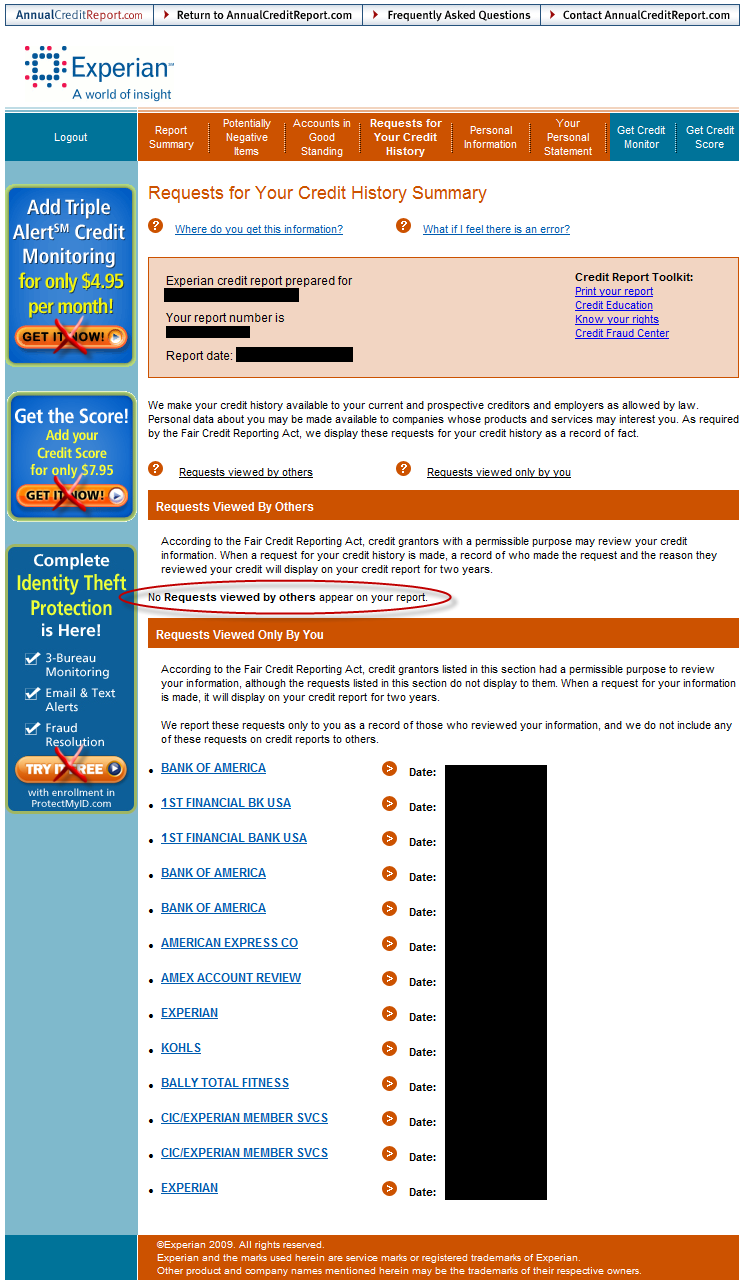

How To Track Your Dispute Status

Once you’ve submitted your dispute, Experian will send you alerts via email whenever there is a status update. If you already have an account with Experian, you can also view your dispute alerts in the main Alerts section of your Experian account. Alerts you’ll receive while Experian processes your dispute include:

- Open: This indicates the dispute process has been initiated.

- Update: Your dispute investigation has been completed and your credit report is being updated with the results.

- Dispute results ready: Your credit report has been updated with the results of the dispute investigation.

Recommended Reading: Is 653 A Good Credit Score

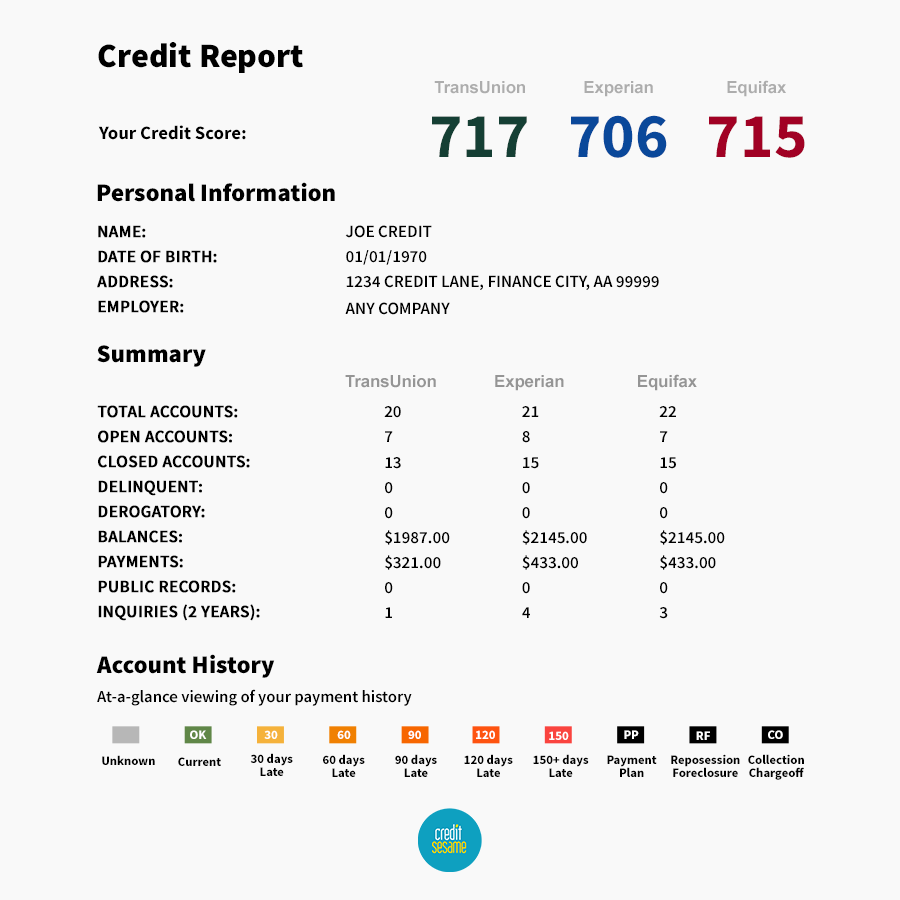

Experian Credit Reports: How To Read Them

Learn how the Experian vocabulary words pertain to these parts if youd want to learn how to interpret an Experian credit report.

- Personal information

- Bankruptcy and court judgments

However, the sections and labels differ from those seen on a TransUnion or Equifax credit report. Experians glossary contains definitions and credit report codes that will help you better understand your credit report and the data it contains. You may enhance your credit score by disputing and fixing inaccuracies in your report. In addition, Experian employs the FICO® Score, which is a scoring methodology.

Your credit score can be improved by using a service such as Experian BoostTM.1 Experian Boost assists you in reporting and adding to your credit file positive payment history on bills you are already paying. Its possible that youre thinking about things like your phone bill, utilities, and streaming service fees here.

What Are The Documents Required To Generate My Credit Report

In order to get your Experian credit report online, you will have to head to the Experian website and fill all the necessary information such as personal details, contact information, PAN number, address details and others. Once you complete the process, you will have to verify your identity in order to ensure that only you have access to your Experian Credit Information Report.

Also Check: Does Snap Finance Report To Credit Bureaus

How To Dispute Credit Report Information

Through December 31, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you discover information on your credit report that shouldn’t be there, you can request to have it removed in a process known as a dispute. To dispute credit report information, you’ll need to contact the credit bureau in whose report you found the error.

It’s important to check for accuracy in your credit reports from the three major credit bureaus, Experian, TransUnion and Equifax. You can do that by requesting a free credit report from each of the bureaus at AnnualCreditReport.com once a year. Outdated or incorrect entries, such as a timely payment misreported as late or a collections account listed as open even though you’ve paid it off, can lower your credit scores. Correcting these issues can, in turn, improve your credit scores.

You should check all your credit reports for accuracy, and file disputes with each bureau separately to ensure the information is updated everywhere.

What Do Your Free My Credit Check And My Credit Expert Reports Look Like

Each of Experians free credit reports includes your credit score and payment behaviour in a simple and easy to understand format. Information is grouped for you to see what activity has the biggest impact on your credit score and finances. The free credit report is an in-house credit bureau check.

We have included quick tips to explain the data and give advice on how to better manage your credit. On the dashboard, you will be able to see an overview of your credit report you dont need to spend hours sifting through a lot of data.

The free credit check platform includes:

- Your personal details

Dont Miss: Does Paypal Credit Report To Credit Bureaus

Read Also: How Can You Boost Your Credit Score

Request Credit Reports & Answer Any Security Questions

After you fill out the form, you can request your credit reports from the three major credit bureaus. Youll likely be asked to answer some security questions to verify your identity. For example, you may be asked when you were born or information about past accounts you may have owned. In addition, you may be asked to provide your phone number to receive a one-time password.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Don’t Miss: What Does An 800 Credit Score Mean

Your Credit Report And Your Credit Score

Even though they have a significant link, your credit report and credit score are not the same thing. When you utilize credit, your credit report and credit score are affected. This includes recent credit inquiries and the number of accounts you have opened or canceled.

In contrast, your credit rating is based on your credit history. Much to getting an assignment graded on how well you do your work in school, this works in the same way. Like your grades in school, you are graded on how responsible you are with money.

Depending on your score, lenders and credit card issuers can decide whether or not to provide you with a loan or credit product, and if so, what interest rate you would be charged. Credit rating formulas might vary widely, therefore its important to be aware of this. As a result, you may have a FICO or a VantageScore depending on the credit rating technique used.

Your credit report includes information on your credit utilization. Reports are available that cover everything from personal information to information on all of your financial accounts , as well as any bad information that may have been gathered about you. However, your credit score is completely omitted from your credit report.

Generate Your Report Online

Once you access your credit reports, download them to your computer or print them before you exit out of the window for later review.

If you have trouble requesting an online copy of your credit reports, you can also request to receive a free copy by mail or phone. To receive a free copy by mail, fill out the mail request form and send it to this address:

Annual Credit Report Request ServiceP.O. Box 105281

The form asks you the same questions as the online form.

If you prefer calling instead, dial 877-322-8228.

Don’t Miss: Does Amex Plan It Affect Credit Score

Free Annual Credit Report

To support you during the uncertainty caused by COVID-19, we offer a free credit report weekly at annualcreditreport.com through April 20, 2022.

Get your free weekly report online through April 20, 2022 at annualcreditreport.com. You can always get a free report every 12 months.

With this credit report youll get:

- Fast, free access to your credit report online

- Control of your credit data, with free reports available from all three credit reporting agencies in one place

- The option to buy a one-time VantageScore® 3.0 credit score