Rolling Over Negative Equity To A Car Loan

Is Transferring a Car Loan Affect Your Credit Score?

Whether or not you should roll over negative equity to your next car loan will depend on your personal circumstances.

Every lender has different requirements for loan approvals, and your situation may be different from someone elses.

Generally, lenders dont want to approve loans with excessive negative equity, since the payment may be too high to support your existing income.

Instead, theyd rather approve loans close to the value of your current vehicle.

The biggest problem with rolling over negative equity is that it increases the amount you borrowed, as well as interest charges.

It can also raise the terms of your loan, so make sure to check your agreement to be sure youre not paying an early payoff fee.

Despite these problems, you should still consider rolling over negative equity to your next car loan, and there are some things you can do to minimize the impact on your credit score.

Its a great way to estimate the value of your car by asking a dealer to calculate its trade-in value.

This value can be used to calculate your Negative Capital, which is equal to the difference between your cars current price and the amount that you owe.

If you are unable to afford a car, you might consider rolling over your negative equity to another loan.

If you are unable to make your car payments, you might consider downsizing to a smaller vehicle.

You can sell the car or trade the car to pay off any remaining negative equity.

Manage Your Credit Like A Boss

Some people like to blame credit card companies or lenders for their poor credit.

But for most people, there is no one more influential on your credit than you. When you commit to always make at least the minimum payment by the due date going forward, you are taking smart steps to improve your credit.

By responsibly managing your credit, the question of âwhat credit score do car dealers use to determine interest rates and approve applications?â will be less of a concern.

If you need a little extra help building credit, consider tools like Self or other credit-building tools to help build your credit and increase your savings. Once you do this, you can work towards your larger life goals – like buying a car. When you take charge of your credit, you can manage your credit … like a boss.

About the author

Eric Rosenberg is a former bank manager and corporate finance worker with a bachelorâs degree and MBA in finance. See Eric on and .

About the reviewer

Lauren Bringle is an Accredited Financial Counselor® with Self Financialâ a financial technology company with a mission to help people build credit and savings. See Lauren on and .

Editorial Policy

Learn How They Can Affect Scores Both Positively And Negatively

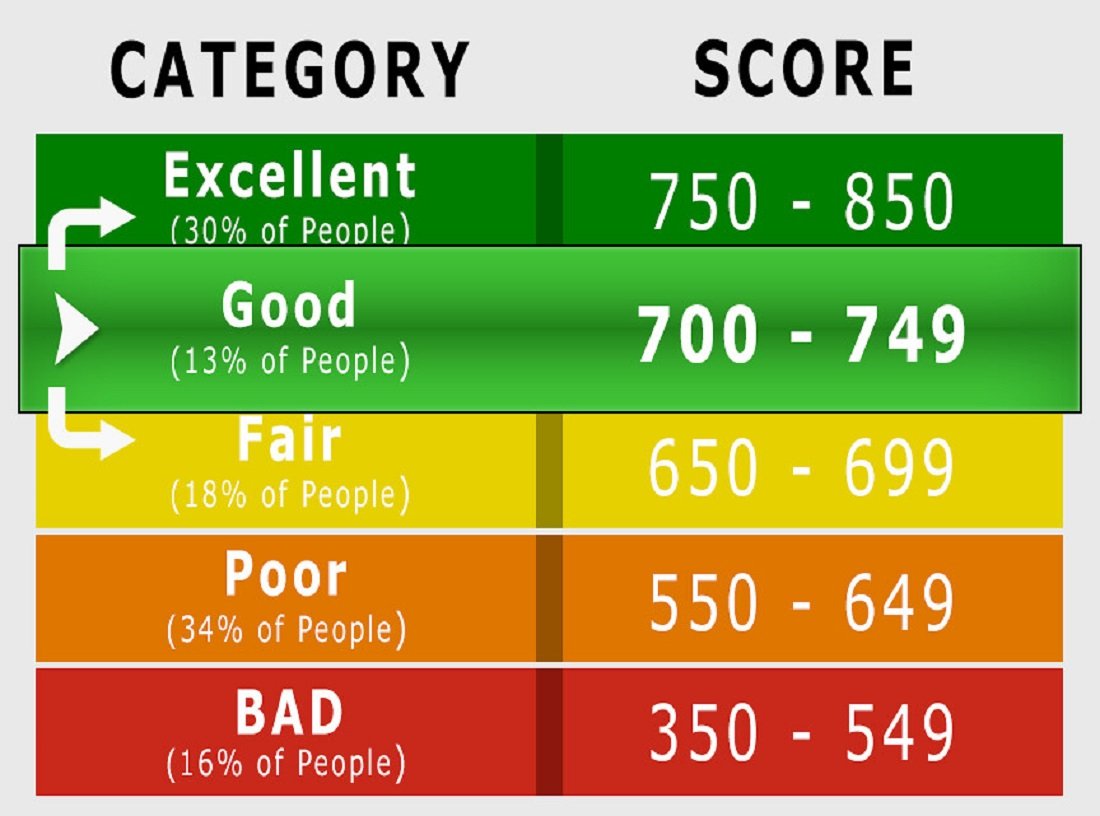

A balance transfer can be a good way to pay down . Depending on several factors, though, balance transfers can help or hurt a credit score, as well. Someone with excellent credit may qualify for some of the best balance-transfer cards. Those with scores not as high may still qualify for good dealsbut may not be granted initial credit lines sufficient to transfer large balances and may want to ask their existing card issuers to consider lowering rates on any balances not able to be transferred.

For example, initially applying for several different cards with low introductory rates can negatively affect credit. Fifteen percent of a credit score is based on the length of time a consumers credit accounts have been open: The longer the accounts have been open, the better the score. Opening several new accounts brings down the average age of all credit accounts, hurting a score.

In addition, every time a consumer applies for credit, a hard inquiry is also made on their . Each hard inquiry has the potential to lower a score several points.

To minimize the negative effect on a credit score, do your research and only apply for one card. Try to find out if you can qualify for one of the best balance transfer cards currently available. Alternatively, asmall personal loan may be better suited for helping you combat your debt.

Don’t Miss: Does Debt Consolidation Hurt Your Credit Score

How An Auto Loan Affects Your Credit Score

Multiple factors go into deciding your FICO score, such as the average age of your various accounts, the length of your credit history, and your borrowing and spending habits.

For example, taking out a new car loan or signing up for a credit card lowers the average age of your accounts. But depending on whether you’ve held different accounts for a longer or shorter period, the change in your score could be small or more significant.

One area that remains unaffected by an auto loan is your credit utilization. Credit utilization is the amount of revolving debt you carry month to month compared to your credit limits. Your credit card balance is an example of this.

Owning a car brings many additional expenses like fuel, maintenance, and insurance premiums. Saving money where you can on automotive-related costs keeps extra cash in your bank account for essential obligations. One way to do this is to secure an advantageous car loan. But applying for and finding one can be a hassle. Shift works with a network of trusted lenders who compete for your business, so you get the best deal on financing. And applying for financing with Shift is quick and easy, with no cost or obligation.

Does Refinancing A Car Loan Hurt Your Credit Score

Refinancing your car loan will affect your credit but that doesnt mean you shouldnt consider it.

If you wish your current auto loan was more affordable, refinancing may be a good option. It can allow you to replace your current loan with a new loan and save a lot of money on interest over time. Refinancing may also leave you with lower monthly payments and free up your monthly cash flow.

It may be a good option if your car is retaining value, interest rates are going down, or your has increased. Refinancing may also make sense if youre short on cash flow, want to add or remove a co-borrower, or are worried about repossession.

Before you take the plunge and decide to pursue this strategy, however, its important to consider how refinancing a car loan affects credit. After all, good credit is the key to landing the best interest rates and most favorable terms down the road. You dont want to refinance and later find out that your credit score has taken a large, long-term hit.

2022 Auto Refinance Rates

You May Like: Does Snap Finance Report To The Credit Bureau

Assess Your Income And Debt

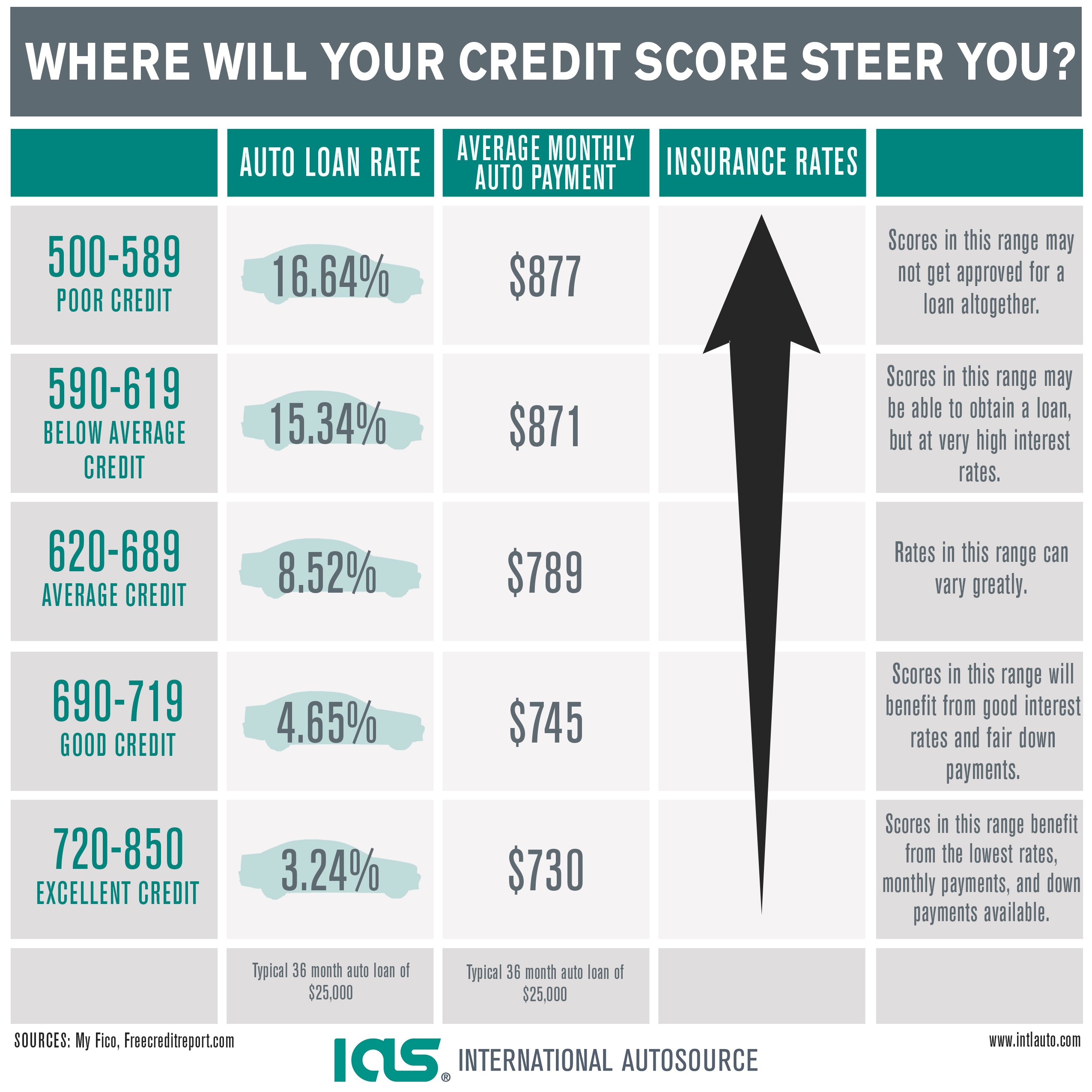

Even if you have a low credit score, lenders will also look at your monthly income against your monthly expenses to weigh your ability to repay a loan. They want to see that you can make the new monthly car payments in addition to your existing debt obligations.

This will help the lender determine whether to issue the loan and how much interest, additional fees or down payment might be required to secure the loan. The higher the risk, the more you will pay in loan fees.

So before you apply for a loan or go car shopping, total your monthly debt against how much income you receive to get a better idea of how much you really can afford to pay per month.

What To Know About Car Loan Shopping

Your application for auto financing will show up in one more place: credit inquiries. Inquiries made when you apply for credit can cost you points on your credit score. But if you group applications for car financing close together, they should count as just one.

While youre shopping for the lowest auto loan rates, you may allow multiple lenders to run credit checks and end up with several hard inquiries listed on your credit report. Thats OK.

Generally speaking, if youre shopping for an auto loan within a 30-day period, all those hard inquiries that are listed on your credit report will only count as one when your FICO score is calculated. The VantageScore has a 14-day rolling window for shopping. Play it safe and keep your search brief so that your credit score doesnt take an unnecessary hit.

About the authors:Claire Tsosie is an assigning editor for NerdWallet. Her work has been featured by Forbes, USA Today and The Associated Press. Read more

Bev O’Shea is a former credit writer at NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

You May Like: Do School Loans Affect Credit Score

How Refinancing Your Car Can Affect Your Credit Score

Your credit score is calculated based on factors related to your debt and how you repay that debt, e.g., do you always make payments on time? What is your credit history length?

These are factors of your score because they attempt to predict how likely you are to repay your debt.

Your credit score might dip when you apply for new credit

So when you do an application for a new loan, your score takes a hit because the lender runs a credit check. When you accept that new loan, your score takes another hit because you are taking on new debt, which statistically puts you at a greater risk of missing payments.

Usually, a dip when refinancing a car is only temporary

While this can all seem like its totaling up to take a big hit to your credit score, its usually not as bad as it sounds.

For one, because youre refinancing , the impact on your credit score wont be as big as it would be if you were to take on a new loan of a completely different, higher value.

Plus, the long-term effects are usually easy to avoid. In most cases, after just a few months of unmissed payments, your score will go back up.

As for the effects of the hard inquiry , that usually disappears from your credit score within a year.

On your credit report, youll see your new loan appear. Your original car loan will stay on your report for up to a decade, but it will be marked as closed in good standing.

Read Also: What Credit Bureau Does Drivetime Use

How Do Car Loans Affect Your Credit

Public transit has become a way of life for many young adults and city dwellers, but the convenience of having your own car is an advantage that many people cant pass up. Of course, that convenience comes with a cost. The average price of a new car is $34,077, and that price continues to increase annually by 2.7%!1 For most Americans, the only way to pay such a high price is with a car loan. Just like any other large loan, your credit will most likely be a factor in the amount you can receive, the APR and more.

Whether your credit is in good standing or in need of some help, you might be worried about how taking out a car loan could affect your credit. We asked Harrine Freeman, a business owner, and Mariya Palanjian, sales and marketing director at ZadCars.com, what effect car loans could have on your credit, what to expect and how you can offset the cost.

You May Like: How To See My Credit Report

How To Shop For A Car Loan

When youre borrowing a significant amount of money, you will want to find the lowest interest rate possible. During this process, you will likely allow several auto lenders to run credit checks.

Multiple credit checks will deduct points from your credit score under normal circumstances, so excessive hard inquiries should be avoided. However, when it comes to auto loans, there is an exception.

Do Car Payments Build Credit

Auto loans also offer you the opportunity to increase your credit rating by making timely loan payments and proving your reliability to major credit bureaus.

The temporary reductions in your credit score due to a hard inquiry will dissipate with time. But as you continue making timely payments on your loan, the potential for your credit rating to improve continually increases.

That happens by diversifying your credit mix, which comprises 10 percent of your FICO score. Your credit mix shows your ability to manage multiple credit types, and lenders consider it when applying for an auto loan.

Three types of loans make up your credit mix: installment loans, revolving loans, and open accounts.

Installment loans let borrowers repay their debt in equal installments over a set period.

Revolving accounts allow you to borrow money up to a specific limit and make monthly payments toward the balance.

Open accounts are lines of credit without a limit and require repayment in full each month.

Responsibly paying back your loans regardless of the type demonstrates your aptitude at handling a mix of credit types.

Read Also: What Is A Credit Score Definition

Can You Refinance An Auto Loan With Bad Credit

If your credit scores have dropped significantly since you took out your original car loan, it may be difficult to find refinancing that saves you money because lenders typically charge higher interest rates to applicants with lower credit scores. If your refinancing goal is lower monthly payments, however, you may be able to find an auto lender that specializes in borrowers with less-than-ideal credit. You may qualify for a new loan with a longer repayment period thatll cost more over time than the original loan did, but the extra expense could be worth it if it means you can pay todays bills more easily.

If youre at risk of missing a payment on your original car loan and having difficulty finding refinancing options, reach out to your lender as quickly as possible to explain the situation. While they are not obligated to do so, some lenders will work with you and may even modify your original loan terms to give you lower paymentsin exchange for a higher interest rate and potential fees.

What To Do After Auto Loan Refinancing

Once youve refinanced your car loan and accepted a temporary decline to your credit score, prove that youre a responsible borrower by establishing a good payment history. Fortunately, it only takes six months to do so. So you wont have to wait forever to see results.

To build a strong payment history, make your car payments on time. Dont forget that even one missed payment can hurt your credit. If youre worried youll forget a monthly payment, enroll in automatic payments with your lender or set up reminders in your calendar. Work hard to make your car loan payments on time and your credit score is likely to go back to where it was before you refinanced. Believe it or not, it may even improve!

Note that while your auto refinance will stay on your credit report for two years, itll only affect your score for the first 12 months. Therefore, you may want to wait at least a year before you apply for a mortgage or another type of loan. By waiting, you can increase your chances of landing a lower interest rate.

You May Like: What’s Considered A Great Credit Score

How Do Credit Limits Affect Your Credit Score

In general, increasing your credit limit will not negatively affect your FICO score, the most commonly used credit scale. Your FICO score is determined by five factors: payment history , loan amount , account age , credit types used and requests containing requests for money from your credit report. .

What Triggers A Hard Inquiry On Your Credit Report

If you see a hard inquiry listed on your credit report it is because you have applied for credit in the last two years.

This could mean that you applied for a credit card, whether it be a rewards card, a cash-back card or even abalance transfer cardlike theU.S. Bank Visa® Platinum Card.

A hard inquiry will also end up on your personal credit report when youopen a business credit card. This is because your personal credit is usually reviewed by the issuer even when applying for a small business credit card, such as theCapital One Spark Classic for Business.

When you apply for a mortgage, student or auto loan, a hard inquiry will be noted on your credit report. There’s a difference, however, between applying for multiple credit cards in a short amount of time and shopping around for the best mortgage rate in a short amount of time.

“There are certain instances, such as applying for a car loan or a mortgage, that only count as one inquiry for scoring purposes as long as they occur within a certain window of time, typically 14 to 45 days,” Shon Anderson, a certified financial planner and president at Anderson Financial Strategies, tellsCNBC Select. “The reason is they know you are probably shopping around for the best terms, and you are probably not going to get three or four car loans or mortgages all at once.”

You May Like: How Long Does Bankruptcy Affect My Credit Rating

What Effect Will Shopping For An Auto Loan Have On My Credit

Shopping for the best deal on an auto loan will generally have little to no impact on your credit score. The benefit of shopping will far outweigh any impact on your credit.

In some cases, applying for multiple loans over a long period of time can lower your credit score. Generally any requests or “inquiries” by these lenders for your credit score that took place within a time span ranging from 14 days to 45 days will only count as a single inquiry, depending on the credit scoring model used. You can minimize any negative impact to your credit by doing all of your shopping in a short amount of time. You could save hundreds or even thousands of dollars by shopping for the best rate and terms on a loan.

For example, let’s say you are looking around for an auto loan and you authorize five lenders to check your credit score within a 14 day time span. All those inquiries should count as one inquiry. If you shop for a mortgage loan at the same time you are shopping for an auto loan, the shopping you do for those two loans should count as two separate inquiries.

And don’t worry about all those promotional offers for credit cards impacting your credit score. These promotional offers do not affect your credit score.