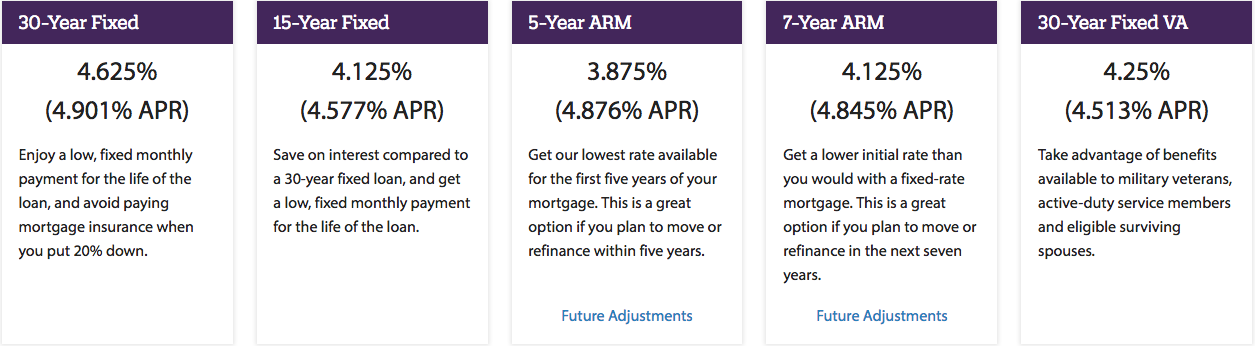

What Types Of Mortgages Does Quicken Loans Offer

While noting that they offer diverse loan options, Quicken Loans says it specializes in plain vanilla mortgages, which are generally defined as easy-to-close home loans.

That means average to excellent credit scores, W-2 borrowers with steady employment history, and no major red flags.

This isnt to say they wont fund loans for self-employed borrowers or those with a checkered past, but they specialize in the former.

They offer all types of home loans, including conventional , along with FHA loans, VA loans, and USDA loans.

Quicken also offers jumbo loans that exceed the conforming loan limit, with down payments as low as 10%.

They offer all types of financing on primary residences, second homes, and investment properties, on properties up to 40 acres.

With regard to transaction type, you can take out a purchase loan, a rate and term refinance, or a cash out refinance to pay off things like student loans or credit card debt.

They also have some less conventional stuff like their YOURgage that sets you pick the length of your mortgage term.

So ultimately, no matter what type of mortgage youre looking for, Quicken Loans should have available options.

How Does Rocket Mortgage Compare To Traditional Loans

Rocket Mortgage is tailored toward borrowers who prefer the convenience of getting a loan from their home or even their local coffee shop. However, the actual process of applying for and closing on a loan are actually quite similar to that of your neighborhood bank. With Rocket Mortgage, you have the option to apply for a loan completely online. For those who do not prefer to apply online, they also have the option to work with a Rocket Mortgage Home Loan Expert. Rocket Mortgage then uses your financial information and employment status to determine the loan options and rates for which you qualify.

Before you close the loan, the company has to check your , as well as verify that your income and employment information are correct and that you have adequate homeowners insurance. It also has to order a home appraisal from a third party.

These steps cost money, which is why Rocket Mortgage requires that borrowers make a good faith deposit of $400 to $750. The good news is that the company deducts the deposit from your other closing costs, so in the end, you may not pay more for these fees than you would with other lenders.

You can use the platform to see whether youre approved and to ask questions about your loan . You can also log in to the Rocket Mortgage website or app to manage your account and update payment information once you close on the loan.

Investopedia / Sabrina Jiang

Applying For A Mortgage With Quicken Loans

One of the nice things about Quicken Loans is the convenience of applying for a mortgage.

They allow you to apply online or via smartphone, or you can answer some questions and have a Home Loan Expert contact you.

You can also apply online and work with a human, and use their chat feature to talk to someone in real-time.

Those who are savvy can do nearly everything online, including importing financial documents to speed up the process.

Once you fill out the loan application, you can see several loan options and choose the one thats right for you.

If you are purchasing a home can take advantage of the companys RateShield Approval, which locks your interest rate for up to 90 days.

If rates go up during that time, your rate doesnt, but if rates fall during that period, your rate goes down too.

You also get a RateShield Approval Letter that can be shared with real estate agents to show them you mean business if home buying in a competitive market.

Its based on verified credit, income and asset information collected from you upfront, so its a legit pre-approval letter.

Quicken Loans also offers the MyQL Mobile app , which allows you to apply for a mortgage, see customized loan solutions, upload documents, e-sign on your phone, message the company, and even make mortgage payments.

Read Also: How To Keep A Good Credit Score

What Credit Score Do You Need To Buy A House

Your credit score is a very important consideration when youre buying a house, because it shows your history of how youve handled debt. And having a good credit score to buy a house makes the entire process easier and more affordable the higher your credit score, the lower mortgage interest rate youll qualify for.

Lets dive in and look at the credit score youll need to buy a house, which loan types are best for certain credit ranges and how to boost your credit.

What Documents Do I Need For An Fha Loan

If youre applying for an FHA loan, youll need documentation. These documents include a state-issued identification, proof of a Social Security number and 2 years worth of pay stubs, W-2 forms or tax returns. FHA lenders can provide you with a specific list of what youll need, and they can walk you through the process.

Read Also: How To Get A Detailed Credit Report

Fha Credit Score Requirements May Vary

The credit scores and qualifying ratios weve mentioned in this article so far are either the minimums required by Rocket Mortgage or the FHA itself. Other lenders may have their own requirements, such as a higher FICO® Score or a larger down payment.

Read More: Mortgage Payment Breakdown: Whats Included In Your Payments

What Is A Credit Score

It’s true that having a good will give you better mortgage rates and save you money, but do you know the minimum and credit score you need to qualify for a mortgage and buy a house? Even more basic, what is a credit score?

We’ll explore the ins and outs of credit scores in this article, including credit score ranges, what constitutes a good credit score, why it’s important to have a good credit score, how credit scores are determined and how to improve yours.

Don’t Miss: How To Repair Your Credit Report

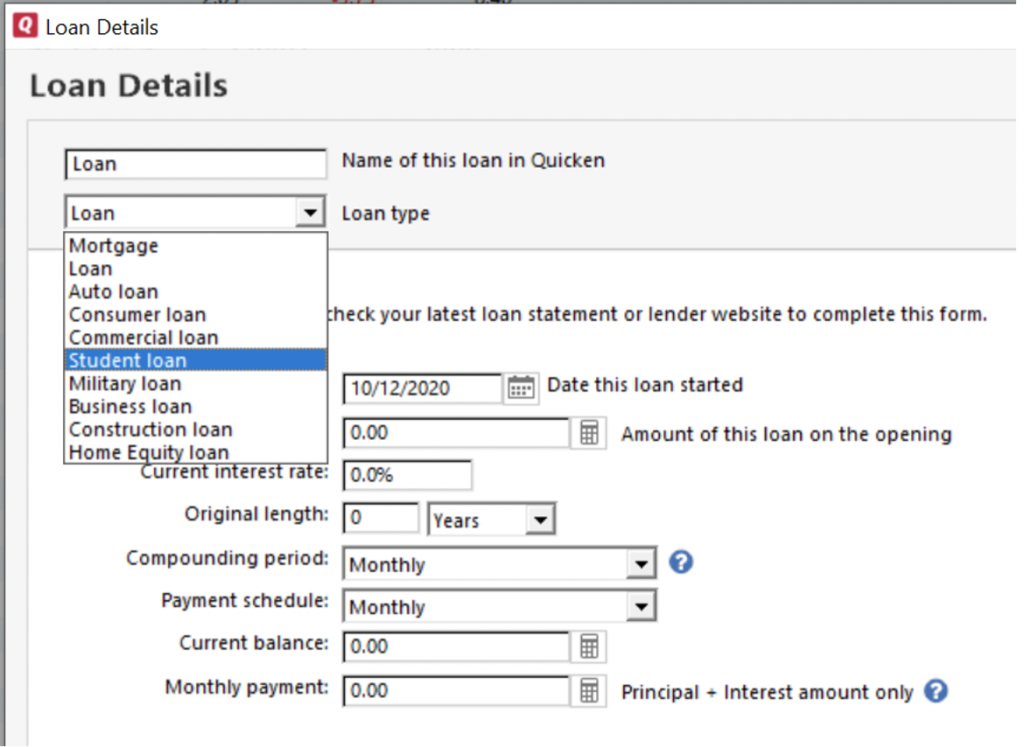

Eligibility & Application Requirements

Eligibility requirements for a Quicken Loans mortgages varies depending on the mortgage youre applying for. Generally, its best to have:

- A minimum credit score of 580 on FHA and VA loans

- A minimum credit score of 620 on other loans

- A debt-to-income ratio of no more than 43%

- Verified, consistent income

Working With Quicken Loans

Quicken Loans was one of the first companies to offer web-based mortgage borrowing at the turn of the century. And its largely maintained its lead ever since.

If you enjoy technology, Quickens Rocket Mortgage offering will be particularly appealing.

Rocket lets you carry out even more tasks online including e-signing your loan documents. And its back-office functionality can automatically verify much of the information you provide in your online application. That speeds up the process and takes some of the administrative burden off your shoulders.

But technophobes arent excluded. Quicken Loans will let you apply and manage the loan process using the phone, email, fax, and snail mail. You just wont get to look a loan officer in the eye.

Finally, the companys RateShield Approval offering lets you get pre-approved for a loan and fix your interest rate for 90 days while you find the home you want.

Actually, fix isnt the right word. Your rate will stay the same if mortgage rates rise but can still move down if they fall.

You May Like: What Is Revolving Debt On My Credit Report

What Else Do Mortgage Lenders Consider

Your credit score is a key factor in determining whether you qualify for a mortgage. But its not the only one lenders consider.

- Income: Lenders will also look at your income. They want to make sure you make enough money each month to afford your payments.

- Debt-to-income ratio: Lenders also look at your monthly debts. Lenders vary, but they generally want your total monthly debts, including your estimated new mortgage payment, to consume no more than 43% of your gross monthly income. If your debt-to-income ratio is higher, you might struggle to qualify for a mortgage.

- Down payment: The bigger your down payment, the more likely it is that youll qualify for a mortgage with a lower interest rate. Thats because lenders think youre less likely to stop making your payments if youve already invested a significant amount of your money into your loan. A higher down payment makes your loan less risky for lenders.

- Savings: Lenders want to make sure that you have funds available to make your mortgage payment if your income should unexpectedly dry up. Because of this, most will want to see that you have enough money saved to cover at least 2 monthsof mortgage payments.

- Employment history: Lenders vary, but they usually like to see that youve worked at the same job, or in the same industry, for at least 2 years. They believe youre less likely to lose that job, and that stream of income, if youve built up a longer work history.

Where To Get A Personal Loan

You don’t have to step into a brick-and-mortar bank to apply for a personal loan there are many online lenders offering competitive terms and rates.

In addition to traditional banks, the two main types of lenders likely to offer a personal loan are credit unions and online lenders. Whether you’re applying for a loan online or in person, each lender has its pros and cons, and looks for something different in the application process.

You May Like: What Credit Score Do You Need To Buy A House

What Kind Of Homes Can I Use Rocket Mortgage To Get A Loan For

Most people use Rocket Mortgage® to buy or refinance:

- A condo

We dont provide mortgages for manufactured or mobile homes. We encourage you to see if you can get approved for a single-family home.

We do provide mortgages for other less common property types. If you want to buy or refinance something not mentioned above, reach out to a Home Loan Expert.

What If Theres An Inaccuracy In The Credit Summary That I Wish To Dispute

Because Quicken does not control the content of the credit report, you must contact Equifax if you have a dispute. You can contact Equifax directly by clicking the link at the bottom of the credit score page. When you click the “Contact Equifax” link, a pop-up appears with information on how to contact Equifax by mail or via their online dispute form, or you can use the information below:

Read Also: How Much Does A Hard Credit Pull Affect Your Score

What To Do If You Get Turned Down

While the company has long been a technological innovator, it mainly offers inside-the-box financing. Thereâs a good chance youâll need to take steps to improve your credit score, reduce your debt or increase your income to qualify with Rocket Mortgage if your application is denied. The more you can accomplish in these areas, the more likely you are to not only get approved but get a better rate. Donât forget to look into the Fresh Start Program.

If youâre in a hurry, however, you may be able to get approved with a different lender that has looser criteria. A lender that offers non-QM loans may be able to meet your needs if youâre willing to pay a higher interest rate.

Getting a co-signer or co-borrower may be an option, but asking someone to take on a mortgage with you is no small commitment, especially if this person is not residing in the home. To get an idea of what you can afford without help, use our mortgage calculator.

Before you figure out your next steps, itâs a good idea to apply with several mortgage lenders to see where you stand. Donât worry about hurting your credit score: Submitting multiple applications within 45 days will have the same impact on your score as submitting a single application, according to the Consumer Financial Protection Bureau .

Your Credit Utilization Has Changed

Your credit utilization ratio is the amount you owe on your credit card relative to your credit limit. It influences your credit score, so a change in either of the two can cause your score to adjust.

Have you charged more on your credit card lately? If so, your credit utilization may have increased, which can negatively impact your score. Typically, having less than a 30% credit utilization can keep your credit in top shape.

Check to see if your credit card company has increased or decreased your total limit. Often credit card companies will tell you if youre eligible for a change in credit limit, but they could alter it without you knowing. If your spending habits remained the same, an increase in your credit limit would decrease your credit utilization ratio, which can positively impact your score. A decrease in your credit limit would increase your utilization ratio thus, your score could go down.

Read Also: Who Is Factual Data On My Credit Report

Compare To These Lenders

Whats The Process For Getting A Mortgage With Quicken Loans

You can apply for a mortgage with Quicken Loans online or over the phone. Youll be matched with a Home Loan Expert who will guide you through the mortgage process. After your credit score is pulled, youll get a loan estimate via the sites loan portal, MyQL.

To continue the mortgage process, youll need to submit a deposit which covers costs incurred to process your credit report, appraisal and title work. When you close on a house, this deposit is credited against your total closing costs. Quicken Loans says that the amount of this deposit varies between $400 and $750. Your Quicken Loans Home Loan Expert will let you know what you owe. You can use credit, debit, pre-paid Visa or MasterCard gift cards to pay the deposit, but not checks, money orders or cash.

You can also get a credit toward your closing cost by opting for a higher interest rate when you get a mortgage from Quicken Loans. Quicken Loans calls this option the Closing Cost Cutter. If a lack of ready cash is your problem and you want to reduce your closing costs, the Closing Cost Cutter may be an appealing option. However, its important to understand that opting for a higher interest rates means youll have a higher monthly payment and pay more interest over the term of the mortgage.

Don’t Miss: Does American Web Loan Report To Credit Bureaus

Is Rocket Mortgage Trustworthy

Rocket Mortgage ranked as the top lender for customer satisfaction from J.D. Power for 11 consecutive years, and it ranked as No. 2 in 2021. It also has an A+ rating from the Better Business Bureau. The BBB measures trustworthiness based on response to customer complaints, honesty in advertising, and transparency about business practices.

In 2019, the US Justice Department required Rocket Mortgage’s parent company Quicken Loans to pay $32.5 million for alleged mortgage fraud. The Justice Department claimed Quicken Loans approved mortgage applications it shouldn’t have. Although Quicken Loans paid the settlement, the company never admitted to mortgage fraud.

If the mortgage fraud scandal makes you nervous, you may decide to go with another lender. But considering its great customer satisfaction and trustworthiness scores, you might still feel comfortable using Rocket Mortgage.

How Do Credit Scores Affect Va Loan Approval

have an impact on determining whether youll qualify for a mortgage because they can show your history of paying back debt. With that in mind, its necessary to understand that while a low credit score won’t always prevent you from getting a VA loan, if you have a higher score, you can get better interest rates and loan terms.

You should also be aware that, when borrowing money, your score can change. A lender may deny you a loan if your score drops during the application process. To prevent this, we recommend you avoid taking on new debt until the application process is finalized. This will help to avoid any drops in your credit score.

Don’t Miss: How To Get Paid Collections Off Of Credit Report

Mortgage Loan Products At Quicken Loans

You dont get to be the biggest lender with a small portfolio of products. So its no surprise Quicken Loans has a good selection, including:

Quicken Loans also offers reverse mortgages to those 62 years and older.

These let you access the equity in your home without selling. And you dont have to make any monthly payments. But the cumulative borrowing costs may mean you wont have much equity to leave your heirs.

No second mortgages with Quicken

Quicken does not offer home equity loans or home equity lines of credit . But homeowners can access their equity with a cash-out refinance.

Cash-out refinancing pays off your current mortgage and replaces it with a larger loan, paying you the difference in cash at closing. This loan type works best when homeowners can get a lower rate or shorter loan term in the process.