Is Credit Karma Safe

As mentioned above, they dont ask for a credit card number, and you only have to enter the last four digits of your social security number to get started. Furthermore, even that information isnt stored permanently, so theres no risk of someone hacking in and stealing part of your social security number.

Myth #: Each Person Only Has One Credit Score

There are two credit bureaus in Canada: Equifax and TransUnion. Some creditors report to one bureau and not the other, so each bureau may have different information on any one individual. Each bureau also uses their own calculations and algorithms to calculate a credit score. As a result, the same individual may have a different credit score at each credit bureau.

Is Experian Worth Paying For

Experian offers both free and paid credit monitoring services. ⦠Experian free credit monitoring ranks as our runner-up for the best free credit monitoring service, while Experian IdentityWorks is the best paid service for families. If youâre considering credit monitoring, it may be hard to know if itâs worth the cost.

Donât Miss: Usaa Credit Monitoring Experian

Don’t Miss: Removing Inquiries From Transunion

Which Credit Report Is Most Accurate

The three major credit bureaus get their information from different sources. This means that your three credit reports from these bureaus may all be slightly different. Consider monitoring each of these reports on an annual basis to help make sure the information is correct.

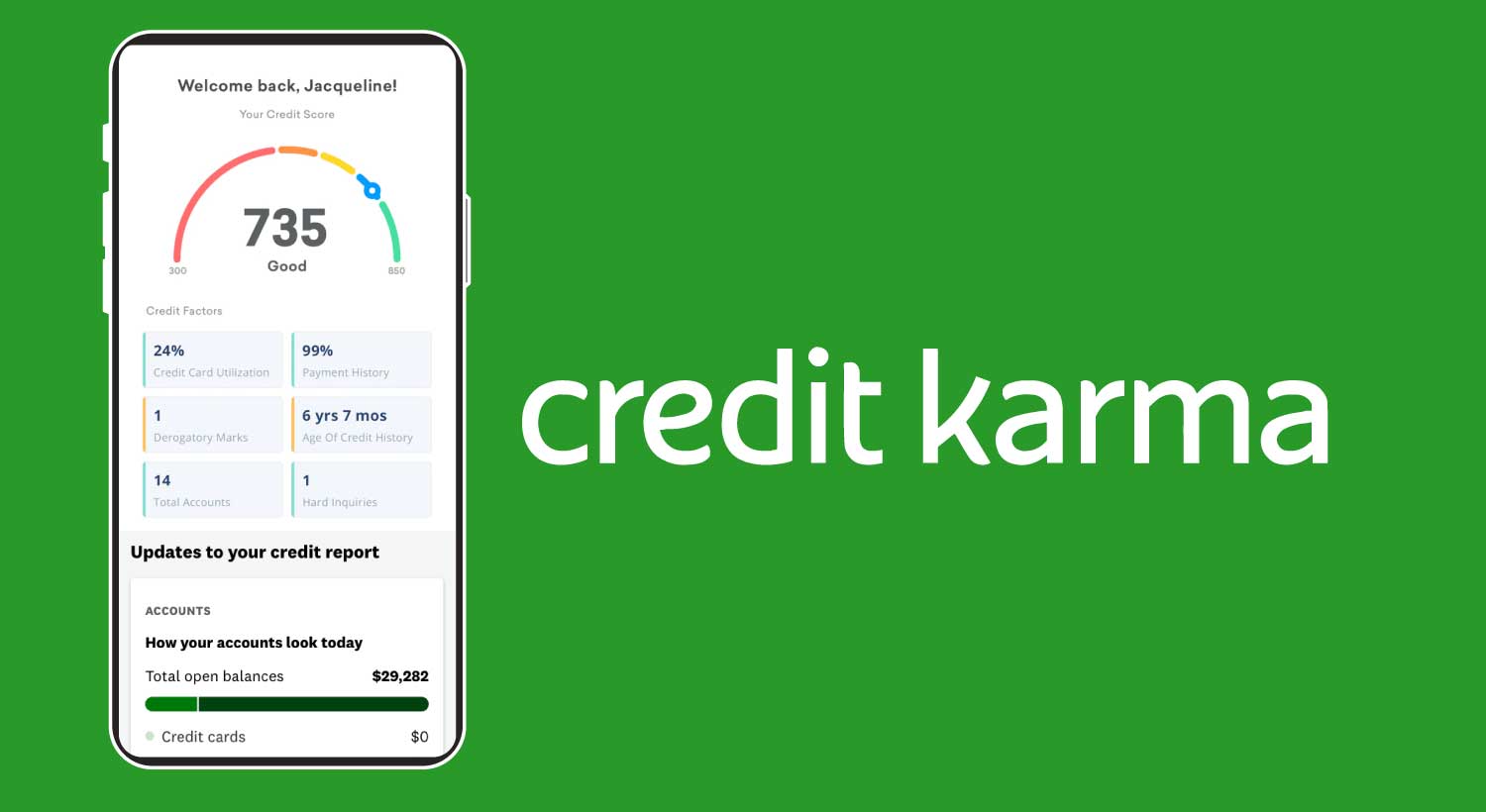

If youre using Credit Karma to check your credit scores and monitor your credit reports, keep in mind that we update your TransUnion credit scores on a daily basis, so you can follow your progress closely.

But as we mentioned, the most important credit report is the one your lender reviews when you apply for a new credit card, loan or mortgage. Because you may not know which report your lender might use, its more important to focus on the general principles of building credit than on memorizing whats in a particular report.

Why Is My Credit Karma Score Much Lower Than Fico Score

I signed up for that $1 promotional 3 Bureaus report from www.creditchecktotal.com, an Experian company. My scores are 850, 850 and 840 for Experian, Equifax and TransUnion, respectively. These are FICO 8 scores.

On Credit Karma, my score are 797 and 806 for TransUnion and Equifax, respectively.

My question is why is there a huge discrepancy between these two scores?

Edit:

I am preparing on a student loan refinance with my credit union. Their best rate requires an Equifax score of 825 but not really sure which score they use. Once of their customer service rep said they use Vantage , but not sure which version. I have 4 inquiries falling off in a month. I plan on refinancing then. Should I bbe confident with my FICO 8 score or Credit Karma Scoring?

Don’t Miss: 611 Credit Score Mortgage

When Does Checking My Credit Score Lower It

Hard inquiries, also called hard pulls, are the kind that can cost you points. They happen when someone pulls your credit for the purpose of deciding whether to extend credit to you. These hard inquiries should not happen without your knowledge or consent.

You can review your hard inquiries on NerdWallets free credit report summary, which updates weekly. You can also check your free credit reports at AnnualCreditReport.com to see who has looked at it in the past two years. Consumers currently have access to those reports weekly.

A hard inquiry might cost you up to five points according to FICO, the creator of the most widely used scoring formulas. With VantageScore, an increasingly popular credit scoring model, a hard inquiry is likely to cost even more.

In contrast, a soft inquiry or soft pull occurs when you or a creditor looking to preapprove you for a loan or credit card checks your score. A soft inquiry has no effect on your credit score.

So, if you apply for several credit cards close together, you might see a significant drop in your credit scores. Before you begin applying, take time to conduct research on the best credit cards for your specific financial needs, while keeping eligibility requirements in mind.

A hard inquiry stays on your credit report for two years, but any effect on your credit score fades sooner than that.

You May Like: Affirm Cricket

Faq About Credit Karma

Still have questions about Credit Karma? Keep reading.

Is Credit Karma really free?Does Credit Karma hurt your credit?

Checking your own credit score and credit report on Credit Karma will not hurt your credit. Your credit score may see a temporary dip when you apply for credit and the lender checks your credit report . Checking your own credit score is known as a soft inquiry, which does not affect your credit score.Credit Karma could boost your credit if its educational tools and credit monitoring services help you improve your credit score. On the other hand, if the site inspires you to take on excessive debt and you fall behind on the payments, your credit could suffer.

Can you get my FICO score from Credit Karma?

Credit Karma does not provide a FICO Score it provides your VantageScore 3.0. You can get a free FICO Score and free credit report from Experian. You may also be able to get your credit score from your bank or credit card company, but youll need to clarify whether it is the FICO Score or the VantageScore.

Is Credit Karma score lower than FICO?Is FICO the most accurate credit score?

You May Like: Aargon Com

How Accurate Is Credit Karma

The free credit score you receive from Credit Karma comes straight from TransUnion and Equifax, two of the three credit bureaus. It is not your FICO score, the scoring model used by the vast majority of lenders. In the credit industry, these credit scores are referred to as FAKOs.

If youre interested in getting your real FICO scores for free, check out our article, 13 Credit Cards Offering Free Credit Scores. Some of the credit card companies dont even require you to be a customer.

Why Is My Credit Score Important

Your credit score will play a large role in determining the answer to three crucial questions regarding your mortgage.

- Will the lender approve my mortgage?

- How much will they lend me?

- What will my interest rate be?

If your credit score is low, you might not be able to qualify for a loan large enough to purchase the home you want. Or, you might get the loan but at a rate so high that you will be wasting hundreds or even thousands of dollars each year just on interest payments.

Recommended Reading: Does Klarna Affect Your Credit Score

How Accurate Are Credit Karma Scores

- Banks Editorial Team

Curious about your credit score? Then you may be wondering about Credit Karma. The personal finance website promises to help you manage your finances and offers a free credit report and score to encourage you to register for a free account. But how accurate are Credit Karma scores? Keep reading to find out.

Vantagescore 30 Credit Score Ranges

vary by scoring model, and lenders can view ranges in different ways. VantageScore 3.0 credit scores range from 300 to 850. Think of them in terms of four basic categorizations: Excellent, Good, Fair and Poor. Heres how they break down.

Excellent :You may qualify for the best financial products available, and youll likely have several options when it comes to choosing repayment periods or other terms. But excellent credit scores arent the only factor in a lending decision a lender could still deny your application for another reason.

Good :Youre less likely to have an application denied based solely on your credit scores, compared to having scores in the fair or poor range, and youre more likely to be offered a low interest rate and favorable terms.

Fair :You may have several options when it comes to getting approved for a financial product, but you might not qualify for the best terms.

Poor :You may find it difficult to get approved for many loans or unsecured credit cards. And if youre approved, you might not qualify for the best terms or lowest interest rate.

Don’t Miss: Opensky Payment Due Date

Examples Of Hard Credit Inquiries And Soft Credit Inquiries

The difference between a hard and soft inquiry generally boils down to whether you gave the lender permission to check your credit. If you did, it may be reported as a hard inquiry. If you didnt, it should be reported as a soft inquiry.

Lets look at some examples of when a hard inquiry or a soft inquiry might be placed on your credit reports. Note: The following lists are not exhaustive and should be treated as a general guide.

Why Is My Experian Score So Low

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureauswhich is also unusual.

You May Like: Credit Score Care Credit

Does Checking My Credit Scores Hurt My Credit

Checking your free credit scores on Credit Karma doesnt hurt your credit. These credit score checks are known as soft inquiries, which dont affect your credit at all.

Hard inquiries generally happen when a lender checks your credit while reviewing your application for a financial product. This kind of check can negatively affect your credit.

Read more about the difference between hard and soft credit inquiries.

Why Is It Important To Track Your Credit Score

A high credit score can open your life to a world of opportunities. You will have an easier time getting access to large loans such as mortgages or car loans with better terms and rates that are available only for people with great credit scores.

Having a bad credit score makes it much harder for you to get a loan, and in the case, that one is granted to you they are often accompanied by higher rates. Paying higher rates on loans means more money towards debt and less money towards investing for your future self.

If you want to take out a loan to make a large purchase, youll need a strong credit score to do so. Using a lender to buy a house or car can be difficult If you have a bad credit score. A bad credit score can be due to poor care towards your credit or a mistake like a creditor accidentally reporting a defaulted loan on your credit report. This is why its highly important to monitor your credit score because a mistake like that will drop your credit score and lead to trouble trying to secure loans in the future.

Also Check: Syncb Ntwk Credit Card

Why Is Your Credit Score Lower Than Credit Karma Told You

February 23, 2021 by First Residential Mortgage

Did you recently try applying for a mortgage or another loan after you looked up your credit score using the free tool provided by Credit Karma?

Perhaps you faced an unwelcome surprise. The lender might have turned you down or offered you a lower rate than youd projected.

There is a specific explanation for why this happensand you are not the only borrower to have this experience.

Lets find out why the credit score that was pulled while processing your application for a mortgage was lower than the score Credit Karma pulled up online.

As CNBC explains, Consumers tweeted about going to apply for a credit card or loan thinking they have good or excellent credit, only to soon find that the credit score that the card issuer or lender pulled was lower than what they saw on Credit Karma.

Here is what is going on here. Credit Karma pulled up your VantageScore credit score. But the lender pulled up your FICO credit score.

Most customers know they have a FICO score, but many do not know they also have a VantageScore credit score as well as other credit scores.

Who Should Use Credit Karma

There are a lot of people who are too scared to use Credit Karma because they do not want to give their personal information. One of the pieces of information you need when signing up on Credit Karma is the Social Security Number. Not everyone is comfortable with giving these details.

However, its a necessary piece of information if you want to track your credit history and score. If you wish to find out your credit score and monitor it in order to know when you can buy a house or a car, then Credit Karma is the way to go.

Even if you dont give your information to Credit Karma, when you want to buy a new home, you will have to give the mortgage lender your Social Security Number. This will allow him/her to check your credit score. But when that happens, there will be a hard inquiry on your credit report, which will bring down your credit score by a bit.

On the other hand, Credit Karma doesnt end up in a hard inquiry on your report. It is only there to gather information and let you monitor your credit.

So, Credit Karma is a good alternative for first-time homebuyers or just anyone who wants to keep an eye on their credit before they borrow a loan or make a great purchase. You should consider this service and sign up in order to monitor your credit score. On top of allowing you to check your score, Credit Karma also lets you learn more about credit scores, what impacts them and how to improve them.

Read Also: Remove Syncb Ppc From Credit Report

How Does Credit Karma Make Money

For example, if you apply for one of the personalized credit card offers using their link, theyll get a kickback from that credit card company. So while you can easily opt-out of emails at signup, youll still get offers when you visit the website.

Some of the recommended credit cards Credit Karma offers include:

- Balance transfer credit cards

Each credit card recommended on their best credit cards list is based on your credit profile.

Option #: Purchase Your Credit Scores From Fico Or The Credit Bureaus

The first possibility for checking your credit scores is to buy them directly from FICO or one of the .

Usually, you get more than just a credit score with this option. For example, you might also get a copy of your credit report or access to ongoing credit monitoring. Remember, however, that you can get your credit score from each of the 3 credit bureaus for free once per year through AnnualCreditReport.com.

If youre interested in buying your credit scores, heres where you can get them:

- MyFICO: Choose between a one-time credit report and FICO Score or an ongoing monthly subscription, with prices starting at $19.95.

- Equifax Score Watch: Get your FICO Score and Equifax credit report 4 times a year for $14.95 per month.

- Experian: Get your FICO Scores and credit reports from all 3 bureaus for a one-time fee of $39.99.

- TransUnion: Get unlimited credit score tracking and credit reporting for $24.95 per month.

If you need more than just a credit score and report, you might consider the next option on the list.

You May Like: How To Get Repossession Off Credit

Why Is It Important To Check My Credit Score

Now that you know that you can check your credit score without negatively impacting your score, its time to make it a habit. A lower score may indicate errors or fraud on your credit report. The sooner you catch something, the faster you can address it.

Keeping tabs on your credit score can be motivational, too. People who checked their score 12 or more times a year were almost twice as likely to report an improved score, compared to those who only checked it once, according to a survey conducted by Discover. After all, to improve your credit score, you need to know your current number and track your progress.

How Often Does Credit Karma Update

The fact that there is an update every 7 days is great because you can keep a close eye on your credit at all times and know where youre standing. Not only will you see the credit score you have at the moment, but also the credit score from the past weeks, months, etc. If there are any problems that might drag your score down, then you will notice them before they get even worse.

Credit Karma will also let you know when the score was last updated. Moreover, if there are any problems with your credit score, the app will alert you.

You May Like: When Does Paypal Report To Credit Bureau

When Does A Credit Check Hurt Your Score

When you check your own credit score, it has no impact because it only counts as a soft inquiry. But when a lender or credit card company pulls your credit score, its a different story.

There are two ways a company can pull your credit information: a soft inquiry and a hard inquiry. A soft inquiry is most often used when a lender wants to preapprove you for a loan or credit card and has no visible impact on your score. Employer credit checks also show up as soft inquiries.

A hard inquiry occurs when youre directly applying for a loan or credit card and will impact your credit score. Landlord credit checks are often considered hard inquiries, too. A hard inquiry will officially stay on your credit report for two years but will only affect your score for one yeartypically between one and five points.