How To Establish Your Credit History

The big catch-22 of growing your FICO Score is that you need credit to get credit, and it’s difficult to open lines of credit to build your FICO Score if you don’t have a good FICO Score. Fear not. You can absolutely do some things to help grow the length of your credit history. Here are a few to get you started.

First, apply for a secured credit card. A secured card is a card where you provide cash collateral for the line of credit. FICO Scores look at secured cards the same as any credit card. Most banks and lending institutions not only offer secured cards, but most also report secured card activity to the credit bureaus.

Second, see if you can get a friend or family member with good credit to be a co-applicant with you – this will help you establish your credit history. Or, see if they are willing to authorize you on their card. It’s a lot to ask, but if they’re willing, it’s a good way to start growing your credit history.

Finally, adopt a mindset where you see the length of your credit history as part of your greater long-term credit strategy. Use your card, but keep the balances low and pay on time. If you do, you’ll find yourself well on the road to building a strong credit history that you can put to work when you need credit.

Boosting Your Credit Score

Now that you know what goes into your credit score, you can take steps to tackle your shortcomings. Let’s start with payment history. Simply put, if you want to beef up your payment history, you’ll need to make a habit of paying your bills on time, every time — no exceptions. If that’s not a feat you can pull off directly — say you’re really strapped for cash and have many bills coming due — your next best bet is to get added as an authorized user on someone else’s account. This way, when that person pays the bills on time, you’ll get to piggyback on his or her good habits.

If your goal is to boost your credit score as quickly as possible, tackling your credit utilization can help. The easiest way to bring down this ratio is to pay off a chunk of your existing debt, but if you don’t have the cash, you might try calling your lenders and requesting an increase in your credit limit. If you have a decent history of paying on time , there’s a good chance your lender will comply.

If neither of the aforementioned tactics work, you can try applying for a new credit card with a higher limit. While that step will result in a hard inquiry on your record, thus taking your new accounts rating down a notch, if it causes a steep drop in your utilization, you’re likely to come out ahead. Becoming an authorized user on another card also helps with utilization, as that card’s credit limit will get added to yours, thereby bringing your ratio down.

Question: Does Checking Your Own Credit Hurt Your Credit Scores

According to TransUnions July 2017 , a lot of people think so. Of the 1,002 U.S. consumers included in the survey, nearly half thought that checking your own credit scores has the same effect as when a lender checks them.

Fortunately, this isnt the case. As many of our members know, checking your credit scores on Credit Karma is reported as a soft inquiry and it wont negatively impact them.

But that got us thinking: What other questions or misconceptions do people have about credit? The factors that actually make up a credit score may be a lot different from what you think.

Lets dig a bit deeper.

Read Also: What Is Cbna Bby

What Factors Affect Your Credit Scores

Checking your credit rating is the best way of getting an insight into your credit capabilities when looking for a loan. Also, credit scoring companies have their ways of figuring out the factors that determine your credit score. The main factors that affect your credit score include credit utilization, history of payments, and amounts owed.

The founder and CEO of AdvanceSOS, Nick Wilson, shares his insight into the aspects determining your credit scores. With his experience in financials, combined with this guide on the main credit score determining factors, you get to understand how loans work a bit better.

AdvanceSOS is a loan service founded by Nick Wilson, an experienced loan officer. Using its fast application that connects borrowers with licensed lenders, you can easily get payday loans with same day deposit withAdvanceSOS, even with bad credit for your emergency needs.

The Two Most Important Factors That Determine Your Credit Score

When trying to improve your credit score, it can be tricky to know where to start. There are dozens of different types of credit scores out there, and each has its own unique formula to rate a borrower’s “creditworthiness.”

When trying to improve your credit score, it can be tricky to know where to start. There are dozens of different types of credit scores out there, and each has its own unique formula to rate a borrowers “creditworthiness.”

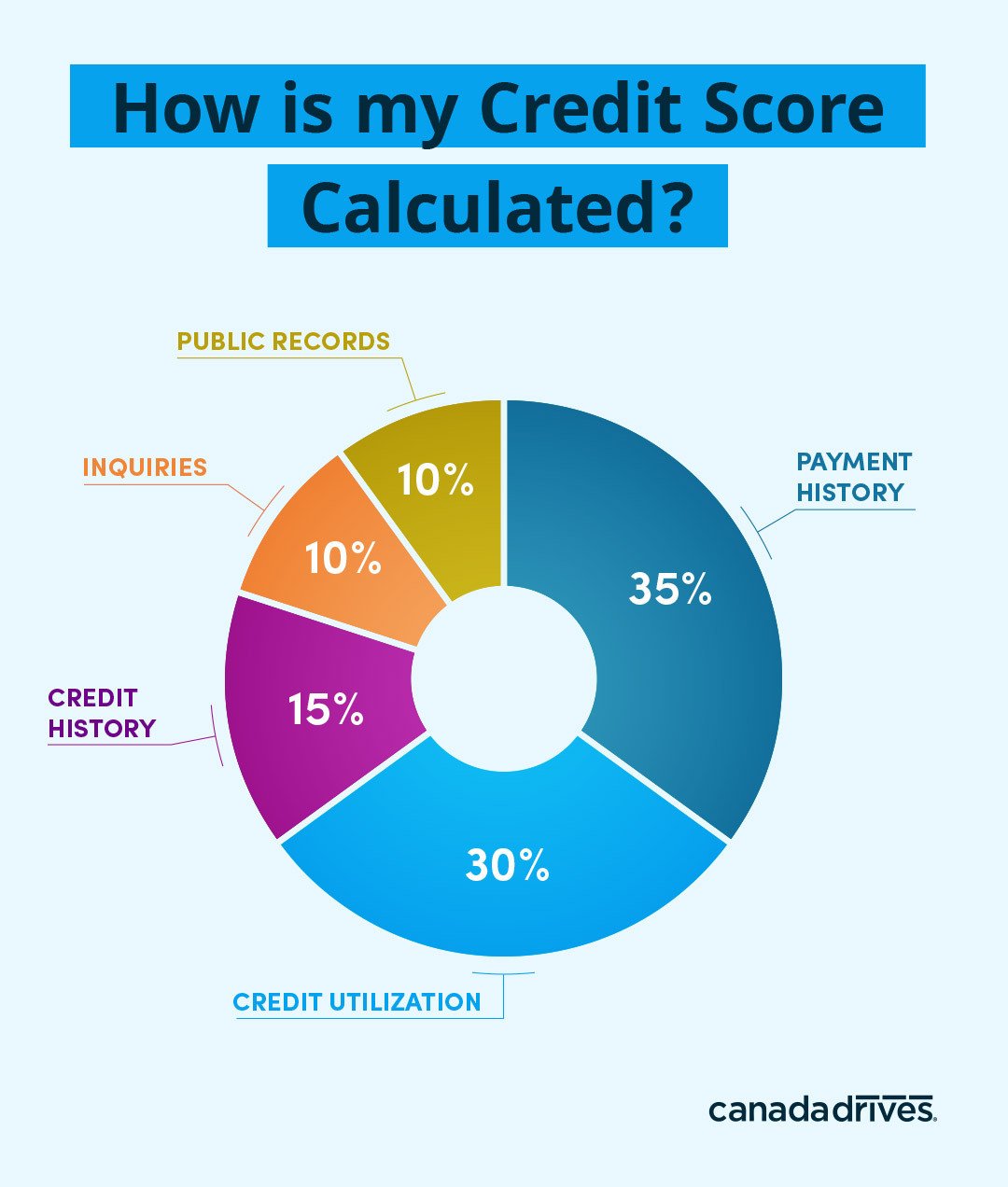

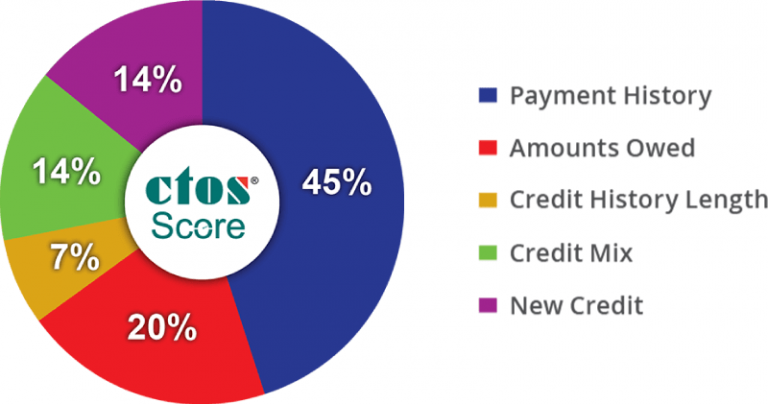

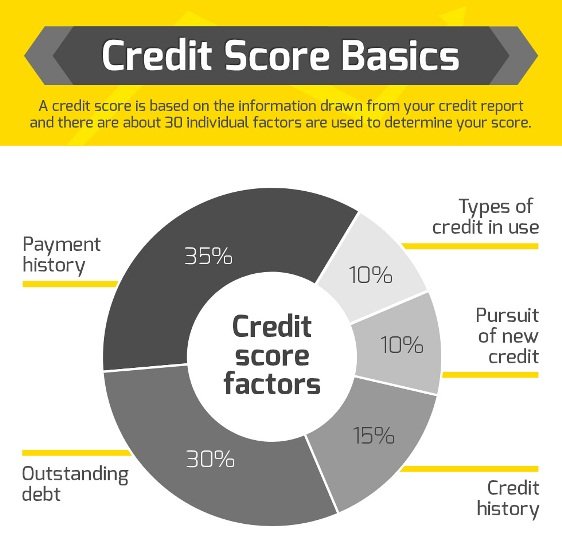

We know that there are five main factors that contribute to your FICO score, one of the most popular scores used by lenders today: payment history, utilization rate, age of credit history, recent credit inquiries, and types of credit used.

Of these factors, if you are trying to improve your credit, there are two you should really focus on:

Your payment history Your utilization rate

Payment history makes up 35% of your credit score.

Your history of on-time or missed payments is the single most powerful factor in determining your credit score. Any lender will want to know whether or not youve paid others who loaned you money on time in the past.

Youll be rewarded for making consistent, on-time payments. A single late payment can take 60 to 110 points off your score.

Your utilization rate makes up 30% of your credit score.

Your utilization rate is simply how much debt you are using versus how much debt you have available. The lower your utilization rate is, the better your score will be.

Other Important Factors

More Videos

Recommended Reading: Usaa Free Credit Score

How Credit Scores Work In 2021

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit this page.

Editors note: This is a recurring post, regularly updated with new information and offers.

Want more credit card news and advice from TPG?

Why Are My Fico Score And Vantagescore Different

A score is a snapshot, and the number can vary each time you check it.

Your score can vary depending on which credit bureau supplied the credit report data used to generate it. Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique.

Each company has several different versions of its scoring formula, too. The scoring models used most often are VantageScore 3.0 and FICO 8.

Also, FICO and VantageScore weight scoring factors slightly differently.

Also Check: Serious Delinquency On Credit Report

Getting Your Credit Score Has Never Been Easier

Developed by Fair, Isaac, and Company in 1956, the FICO scoring system initially flopped. Credit bureaus didnt adopt FICO until 1991, and consumers didnt gain on-demand access to bona fide FICO scores until much later than that. Now, thanks to the internet, you can see your FICO score in minutes. Lets explore two ways to get your score right now.

Worrying Too Much About Your Oldest Account

While your average account age is a minor factor in your credit score, Ive heard many people proclaim that you must never-ever close your oldest account. Thats nonsense, since the closed account will continue to appear on your credit history and be factored into your average account age especially for a period of time. While its not a bad idea to keep your oldest account, if there is a compelling reason to close it, its not the end of the world.

Whenever someone tells you that theres some way to improve your credit by keeping an account open, or closing it, just keep in mind that an account doesnt disappear from your credit history just because you closed it.

Don’t Miss: Does Ashley Furniture Repossession

How Can You Improve Your Credit Score

Unhappy with the credit score range you fall in? Fortunately, there are many ways you can raise your credit score. Typically, building good credit will take time and its not something you can just accomplish overnight. But there are a couple of ways you can quickly boost your credit score.

If you implement these good credit habits now and remain consistent, you should see your credit score start to improve over the course of several months:

Building good credit habits now can only benefit you in the long run.

Your Bill Payment History

Payment history determines 35% of your credit score. In fact, how timely you pay your bills affects your credit score more than any other factor. Serious payment issues, like charge-offs, collections, bankruptcy, repossession, tax liens, or foreclosure can devastate your credit score, making it almost impossible to get approved for anything that requires good credit.

The best thing you can do for your credit score is to make your payments on time each month.

You May Like: Can Landlord Report To Credit Bureau

Fewer Credit Cards Are Better

Like many award-travel enthusiasts, I have numerous credit card accounts. In response to hearing that, some conclude that my credit must be terrible. They might be surprised to learn that I have excellent credit not despite my numerous accounts, but because of them.

Each account, when managed responsibly, adds positive information to my credit history and helps me to maintain my high credit scores. So if you have little-used accounts with no annual fee, theres really little reason to close them.

Look at it from the lenders perspective: Would you rather offer a new line of credit to someone with a very limited record of paying back loans, or someone with a very extensive history of managing multiple credit lines responsibly?

Donât Miss: Business Cards That Donât Report To Personal Credit

Types Of Accounts That Impact Credit Scores

Typically, credit files contain information about two types of debt: installment loans and revolving credit. Because revolving and installment accounts keep a record of your debt and payment history, they are important for calculating your credit scores.

- Installment credit usually comprises loans where you borrow a fixed amount and agree to make a monthly payment toward the overall balance until the loan is paid off. Student loans, personal loans, and mortgages are examples of installment accounts.

- Revolving credit is typically associated with credit cards but can also include some types of home equity loans. With revolving credit accounts, you have a credit limit and make at least minimum monthly payments according to how much credit you use. Revolving credit can fluctuate and doesn’t typically have a fixed term.

Also Check: How To Get A Repossession Off My Credit

How To Check Your Credit Score

Checking your credit score helps you predict how borrowers will view your applications for credit cards or loans. If you see that your credit score is lower than you want, you have an opportunity to improve your score before you take major financial steps, such as applying for a mortgage.

Avoid sites that claim to provide a free credit score if they mention a trial subscription or ask for your credit card information. You may be charged within a few days if you donât take some action to stop the trial.

You can check your own credit score, and you should, through any of a variety of services. There are online sites that offer free credit scores. If you have a checking account, many banks will also offer customers a chance to monitor their credit scores through their online accounts.

How To Use Your Newfound Knowledge

Credit scoring companies review your credit reports to see how youre doing on all these factors. Then they build your scores from that data. You can see the same things they do by checking your credit reports.

Focus your credit-building efforts on on-time payments and keeping balances low relative to credit limits, because those factors have the biggest effect on your scores. You can track your score and get personalized tips with NerdWallets free credit score dashboard.

Don’t Miss: Aargon Agency Settlement

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: What Credit Bureau Does Paypal Credit Use

Fico Models Explained: Which Differences Matter Most

Advertiser Disclosure

Advertiser Disclosure: ValuePenguin is an advertising-supported comparison service which receives compensation from some of the financial providers whose offers appear on our site. This compensation from our advertising partners may impact how and where products appear on our site . To provide more complete comparisons, the site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

FICO has created the algorithmof the same namethat most lenders in the United States use to find your credit score when you apply for a loan. The company releases an updated version of the algorithm to lenders every few years. Since lenders are not required to use the latest version of FICO, its important to understand how the algorithms differ as your score will be altered. In this guide, well give you an in-depth look at the most commonly used versions of the FICO scoring model.

| Used by mortgage lenders. Built on data from TransUnion. | |

| FICO 2 | Used by mortgage lenders. Built on data from Experian. |

Also Check: Syncb/ppc Credit Card Login

What Is The Credit Score Scale For Fico

Your FICO score is based on the information in your credit report and it tells lenders how likely you are to repay borrowed money. Most lenders will look at your FICO score to determine whether or not to loan you money. Your FICO score measures:

- How long youve had credit

- How much of your available credit is being used

- If you make payments on time

- If you have a mix of different types of credit open

- How many new lines of credit you have

The credit score scale for FICO looks like:

- Poor: < 580

- Excellent: 781 to 850

What Are The Main Factors That Affect Your Credit Scores

Besides the mentioned points based on which credit scoring companies determine your rating, there are also other points of interest. Although a credit check conducted by the lenders only takes a few hours, all the valuable info fits right in.

These are the most prominent aspects that determine your credit score when you apply for a quick cash advance or a title loan:

- Payment history

- Current credit account

As you can see, theres a list of different factors that are considered to determine your credit rating. Not all the factors count towards your credit score equally, but they are all important when forming the final rating. Ill lead you through the specifics so you can know all the details the next time you apply for a payday loan or installment loan.

Besides the main factors mentioned, it also has to do with the credit amount owed. The lenders will often consider your current monthly income and the amount that you wish to borrow. The requested loan amount should be according to your income for having a positive credit score.

Yet another important factor besides utilization rate and payment history is your credit mix. Also known as credit portfolio, this factor contributes about 10% to your . It includes a diverse portfolio of different credit accounts and how well you can manage the repayments of each.

Read Also: Cbna Inquiry

What Is New Credit

New credit makes up 10% of a FICO® Score. When you apply for new credit, inquiries remain on your credit report for two years. FICO Scores only consider inquiries from the last 12 months.

People tend to have more credit today and shop for new credit more frequently than ever. FICO Scores reflect this reality. However, research shows that opening several new credit accounts in a short period of time represents greater risk – especially for people who don’t have a long credit history. Your FICO Scores take into account several factors when looking at new credit.

Whats The Meaning Of Your Credit Score

As a borrower, youll want to get a cash advance with the most convenient interest rate, and your credit score mostly determines your ability to do so. Its expressed as a value between 300 to 850, while you should be able to get payday loans or installment loans up to the score of 600.

Its also based on the lenders, as you can sometimes arrange specific terms. The mentioned value is calculated as your FICO score based on the mentioned factors including utilization rate, history, amount of credit accounts, and others.

Lenders could perform a hard credit check which could stay on your credit history or a soft check that leaves no trace. Also, if you check your credit rating you wont reduce the FICO score value, while you get valuable info in return.

Read Also: Free Karmascore