Dispute Inaccurate Information On Your Credit Reports

Sometimes, your credit score might suffer because something wound up on your credit reports that shouldnt have been there. Of course, you wont know unless you check them.

Under normal circumstances, consumers are entitled by federal law to one free credit report every year from each of the credit bureaus Equifax, Experian and TransUnion accessible through annualcreditreport.com. However, during the coronavirus pandemic, the bureaus are allowing consumers to access their reports weekly through April 2021.

If you spot legitimate, incorrect information while reviewing your reports, such as accounts that arent yours, a name mix-up with another person or incorrectly reported payments, you can file a dispute. The Consumer Financial Protection Bureau, a federal agency responsible for protecting consumers and offering financial education, provides dispute instructions for each bureau.

Its worth taking a look at your reports, even if you have no reason to suspect there might be a problem. According to a report from the Consumer Financial Protection Bureau, 68% of credit or consumer reporting complaints received by the bureau in 2020 dealt with incorrect information on peoples credit reports.

How much will this action impact your credit score?

Whether your credit score changes and how much it changes depends on what you are disputing.

Can You Improve Your Credit By 100 Points

If youre struggling with a low score, youre better positioned to quickly make gains than someone with a strong credit history.

Is a 100-point increase realistic? Rod Griffin, director of public education for credit bureau Experian, says yes. The lower a persons score, the more likely they are to achieve a 100-point increase, he says. Thats simply because there is much more upside, and small changes can result in greater score increases.

And if youre starting from a higher score, you likely dont need a full 100 points to make a big difference in the credit products you can get. Simply continuing to polish your credit can make life easier, giving you a better chance of qualifying for the best terms on loans or credit cards.

Here are some strategies to quickly improve or rebuild your profile:

Set Up Automatic Bill Payment

If you have the money but keep forgetting to pay on time, put your bills on autopilot. Most companies are happy to help you set up automatic payments online. Your bills will be paid before the due date, and you won’t have to go out and buy stamps.

Your credit score won’t automatically improve once you set up autopay, and if it’s low because of something serious such as defaulting on a loan, it could take years to reap the benefits. If the main problem is forgetting the car payment, however, automatic bill payment can help your credit score start rising again. Your on-time payment record accounts for 35 percent of a FICO score.

Join today and get instant access to discounts, programs, services, and the information you need to benefit every area of your life.;

Recommended Reading: Paypal Credit Hard Pull

How Long Does It Take To Get A 700 Credit Score From 500

The Best Starter Credit Cards. ] The good news is that when your score is low, every positive change you make is likely to have a significant impact. For example, going from a poor credit score of about 500 to a fair credit score takes about 12 to 18 months of responsible credit use.

How long does it take to build credit from 500 to 700? It will take about six months of credit activity to establish a sufficient history for a FICO credit score, which is used in 90% of lending decisions. 1 FICO credit scores range from 300 to 850, and a score of more than 700 is considered a good credit score. Scores above 800 are considered excellent.

Get A Handle On Bill Payments

More than 90% of top lenders use FICO credit scores, and theyre determined by five distinct factors:

- Payment history

- Age of credit accounts

- New credit inquiries

As you can see, payment history has the biggest impact on your credit score. That is why, for example, its better to have paid-off debts, such as your old student loans, remain on your record. If you paid your debts responsibly and on time, it works in your favor.

So a simple way to improve your credit score is to avoid late payments at all costs. Some tips for doing that include:

- Creating a filing system, either paper or digital, for keeping track of monthly bills

- Setting due-date alerts, so you know when a bill is coming up

- Automating bill payments from your bank account

Another option is charging all of your monthly bill payments to a credit card. This strategy assumes that youll pay the balance in full each month to avoid interest charges. Going this route could simplify bill payments and improve your credit score if it results in a history of on-time payments.

Use Your Credit Card to Improve Your Credit Score

Read Also: Does Paypal Credit Report To Credit Bureaus

Become An Authorized User

If you have a relative or friend with a long record of responsible credit card use and a high credit limit, consider asking if you can be added on one of those accounts as an . The account holder doesnt have to let you use the card or even tell you the account number for your credit to improve.

This works best for if you have a thin credit file,;and the impact can be significant.;It can fatten up your credit file, give you a longer credit history and lower your credit utilization.

Factors That Affect Your Credit Scores

As we mentioned above, there are several factors that go into determining your credit scores.

Recommended Reading: Is 779 A Good Credit Score

Pay Off Cards With The Highest Balances First

In addition to limiting your future spending, work on paying off your credit cards. If you have several cards with a balance, focus on the highest card balance to reduce your credit utilization ratio.

Paying down your outstanding debt can also improve your debt-to-income ratio, which is not a factor in your credits core but is used by many lenders.

These Two Things Hurt Your Credit Score The Most

One of the most useful features of a credit card is the convenience of paying as well as getting the security. Thanks to these two factors, we have been witnessing a massive growth of credit cards. However, even though credit cards come with the convenience of buy now pay later, you have to make sure to be particular the repayments. A bad repayment history takes a toll on your credit score in a big way. Letâs understand how is your credit score calculated:

⢠35% – Payment History

⢠15% – Age of Credit History

⢠10% – Type of Credit

⢠10% – Credit Inquiries

All the aforementioned factors affect your credit score but the payment history and credit utilisation hamper your credit score the most. Let us now understand how credit cards impact these two factors.

It must be noted that improving your credit score take time and patience and it cannot happen overnight. You have to follow certain discipline and work towards your financial goals to achieve the desired credit score.

Also Check: Is 524 A Good Credit Score

How To Improve Your Credit Score By 100 Points In 30 Days

As a member, I frequently check in to see how my credit is doing and make sure theres nothing suspicious going on there.

I really like Credit Karma because its free and provides detailed information about changes to your credit score. Also, you can link all your accounts to monitor your debt to savings ratio, and the site provides suggestions for financial products to apply for and why.

Another great feature I like to play around with is my spending. When I connect my bank account, I can categorize each transaction and see where all my money is going, which gives me a clear view of my spending habits.

One day when I logged in to my account, I was very excited to see that my credit score had increased by almost 100 points! I had managed to raise my credit score by 92 points in just one month.

In this article, Im going to share with you the steps I took to improve my credit.

Get Late Payments Removed

Before disputing late payments you should contact your creditors and tell them you have a late payment on your credit report on your account and you believe its inaccurate. They may remove it as an act of goodwill for customers who have been with them for awhile.

I had a creditor remove a late payment from my credit report by calling and coming up with an excuse for why it was late. They removed it as an act of goodwill because I had been a customer for several years. If that doesnt work, you can start disputing it with the three major credit reporting companies.

I had four late payments with two different creditors at one point. I contacted the creditors and got one removed and disputed the other 3 with the Credit Bureaus. I was able to get another one removed, and my credit score jumped up by 84 points.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Option 1 Request A Credit Limit Increase

Another way to reduce your credit utilization ratio if youre carrying high balances is to bump up your credit limits.

For example, if youre carrying $700 in debt on a card with a $1,000 credit limit, your credit utilization is 70%. If youre successful in increasing your credit limit to $2,000, then your utilization rate drops to 35%.

Some issuers make it easy to request a credit limit increase via your online account. For example, Citi allows cardholders to make such a request on the Credit Card Services page:

You can also call the number on the back of your card to make the request. Know that some issuers may conduct a hard pull on your credit before granting you a higher credit line, which can ding your credit score a few points. Your score will recover, but inquire exactly how your request will be handled before you allow them to proceed so you know what to expect.

Note: If youve only had the card a few months, have a history of late payments or are carrying really high balances, your request may be denied until youre seen as a less risky customer.

How much will this action impact your credit score?

The impact a credit line increase could have on your credit score depends on much of an increase you get. If its enough to bring your utilization under 30%, you should see a reasonable increase in your score. However, it wont improve your score as much as paying off your balance and bringing your utilization to or near zero.

You May Like: Why Is There Aargon Agency On My Credit Report

Negotiate A Lower Interest Rate

A lower rate can help you pay off your balance faster, because more of your payment can be applied to your principal balance than interest. Lower balances can mean a lower credit utilization ratio . Learn more about how to negotiate a lower interest rate.

Pay Attention To Credit Utilization

Your credit utilization rate is the amount of revolving credit youre using divided by the amount of revolving credit you have available. It makes up 30% of your credit score and is often the most overlooked method of improving your score. ;For most people, revolving credit just means credit cards, but it includes personal and home equity lines of credit as well. A good credit utilization rate never exceeds 30%. So, if you have a credit limit of $5,000, you should never use more than $1,500.

Read Also: Is Creditwise From Capital One Accurate

Find Out When Your Issuer Reports Payment History

Theres something called a credit utilization ratio. Its the amount of credit youve used compared to the amount of credit you have available. You have a ratio for your overall credit card use as well as for each credit card.

Its best to have a ratio overall and on individual cards of less than 30%. But heres an insider tip: To boost your score more quickly, keep your credit utilization ratio under 10%.

Heres an example of how the utilization ratio is calculated:

Lets say you have two credit cards. Card A has a $6,000 credit limit and a $2,500 balance. Card B has a $10,000 limit and you have a $1,000 balance on it.

This is your utilization ratio per card:

Card A = 42% , which is too high.

Card B = 10% , which is awesome.

This is your overall credit utilization ratio: 22% , which is very good.

But heres the problem: Even if you pay your balance off every month , if your payment is received after the reporting date, your reported balance could be high. And that negatively impacts your score because your ratio appears inflated.

So pay your bill just before the closing date. That way, your reported balance will be low or even zero. This lowers your utilization ratio and boosts your score.

Verify Your Credit Score Rating

One of many first issues you need to do is examine your credit score rating. How will you have the ability to enhance it if you dont even know what it appears to be like like? Due to expertise, there are easy methods youll be able to examine your credit score rating. Its as simple as downloading an app in your smartphone, which is able to stroll you thru the required steps to offer you an in depth account of your rating and credit score historical past. That is important with the intention to work in the direction of enhancing it.;

Recommended Reading: How To Get Credit Report Without Social Security Number

Limit Loan Applications To A Short Time Period

Lots of hard inquiries in a short time could be an indication to lenders that you’re searching for lines of credit you won’t be able to pay. Smart borrowers, though, will apply for a few loans of the same type to compare rates. For that reason, credit scorers tend to treat multiple hard inquiries of the same loan type made around the same time as one, so submit applications within a short time frame. That will prevent your credit score from suffering.

Become An Authorized User On Someone Elses Account

If youre new to credit and cant qualify for your own credit card, becoming an on someone elses account can be a great way to get started. But its a double-edged sword: If the person who owns the account has healthy credit, it can help you establish a positive credit history over the long run. On the other hand, if they miss payments or carry high credit card balances, that could also reflect poorly on you. Thats why its important to pick someone you trust who has a longer credit history and higher credit scores than you do, and who overall has a positive credit history.

Also Check: Opensky Billing Cycle

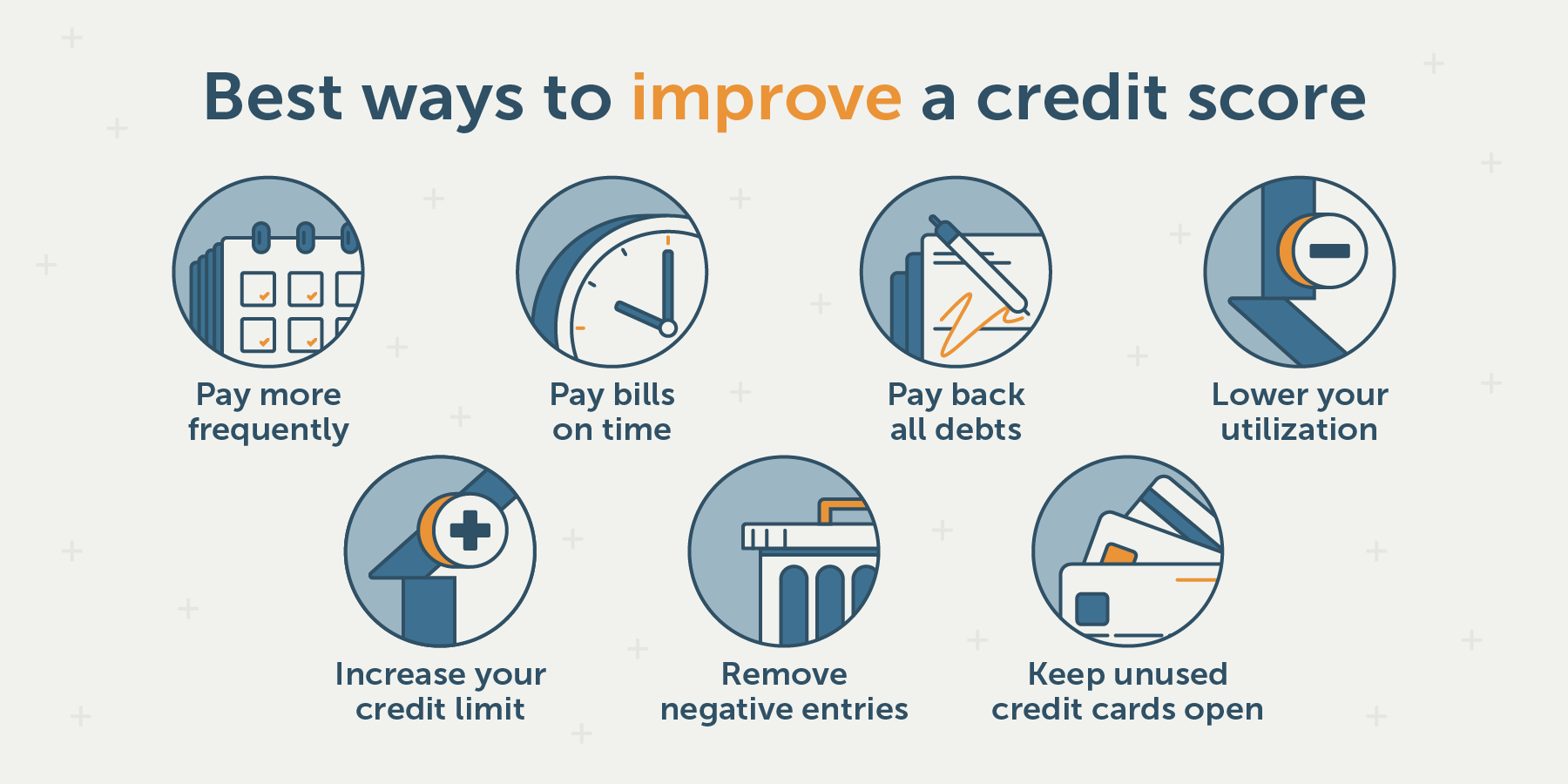

Top Ways To Raise Your Credit Score

There are several things you can do in the short-term to try and better your credit score.

Improving your credit utilization will likely have the quickest impact. This could be through paying down debt, upping your credit limit or opening a new credit account. Keep in mind, applying for new credit could hurt your score, so its best to prepare beforehand to find the right card for you and increase your chances of a successful application.

Additionally, there are a couple other things you can do to start your journey to an increased score:

- Make credit card payments on time. This is especially helpful for those with no credit history because you have the chance to prove yourself by being consistent right off the bat.

- Remove incorrect or negative information from your credit reports. Often times, you can challenge old information or errors on your report to attempt to get the event removed.

- Hold old credit accounts. Keeping accounts open that improve your length of credit will help your score as you better your habits.

As it is with many of lifes problems, theres no better time to address the issue than now. Through Bankrate, you can get a free credit score each month so take the time to assess where you stand, consider your financial habits and find your path towards better credit.