Social Credit System Pros And Cons A Look At Chinas System

In 2020, China announced that it would be implementing a social credit system whereby individuals and companies throughout the country could increase their social credit score. This score aims to keep track of the good and bad deeds of citizens, rewarding those who do good in their communities and punishing those who dont.

As a new idea, one must wonder: what are the social credit system pros and cons? Will this really excel at promoting good moral behavior?

Below, well explain how Chinas social credit system is set up, examples of good deeds and bad deeds, and how each is rewarded or disciplined.

Consolidate Cards To Have Fewer Balances

Having a number of small balances spread out over several different cards may seem smart, but this approach can actually backfire if you overuse it.

Instead, John Ulzheimer of Credit Sesame says youre better off paying these amounts down. A good way to improve your credit score is to eliminate nuisance balances, he says. This is because having multiple cards with balances can lower your score rather than boost it.

If youre looking to pay off credit card debt quickly, consider a balance transfer card to consolidate all your monthly payments onto one card.

Auto Loans Require Good Credit

Most people do not have the money to fund a vehicle and cover living expenses at the same time. Many will apply for an auto loan. Your credit rating affects whether you are qualified, the amount you can receive, and the interest rate of the loan. Generally, loan applicants with a higher credit rating can qualify for larger loan amounts with lower interest rates.

A low credit rating will limit your choices. Few lenders will work with you if you have low creditthose that do will charge a much higher interest rate on your auto loan. A higher interest rate will significantly raise the amount you pay monthly on the car, which raises the total amount you pay over time.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

Helpful Tips For Maintaining A Good Credit Score

Modified date: Nov. 3, 2020

There are plenty of things you can do to maintain the good credit score youve worked so hard to build, and one excellent reason why you should care: money.

A good credit score typically means lower interest rates, and that means more cash in the bank. Itll also be easier for you to get loans and credit.

With that said, here are my top 14 tips for keeping up your credit score.

Whats Ahead:

Use More Than One Credit Card

Big purchase coming up? Consider using multiple credit cards to cover it. We mentioned earlier that your credit utilization ratio is calculated based on your total utilization rate and that on individual accounts. So, if you have a big expense you plan to charge on credit, consider spreading the purchase over more than one credit card.

You could also consider a new card with an introductory 0% APR offer for purchases, balance transfers or both. That gives you some time to pay off the purchase without incurring interest. As a bonus,adding a new card to your repertoire will add more overall credit, which can help reduce your utilization ratio. If you’re in the market for a new card, check out Experian’s CreditMatch tool to find personalized card matches.

Don’t Miss: 672 Credit Score

How To Get And Keep A Good Credit Score

Posted by | Jun 19, 2019Jun 19, 2019

Usually, one of the first things you learn about when it comes to personal finance is credit.

By the time you start college, youre getting bombarded with credit card applications and marketing to start building your credit and getting your first credit card.

And for good reason building your credit is important. But there are some guidelines to follow. It can easily turn sour and follow you like a dark rain cloud over your head for many, many years if you dont use your credit responsibly.

So credit is a pretty big deal. And the reason is your credit score.

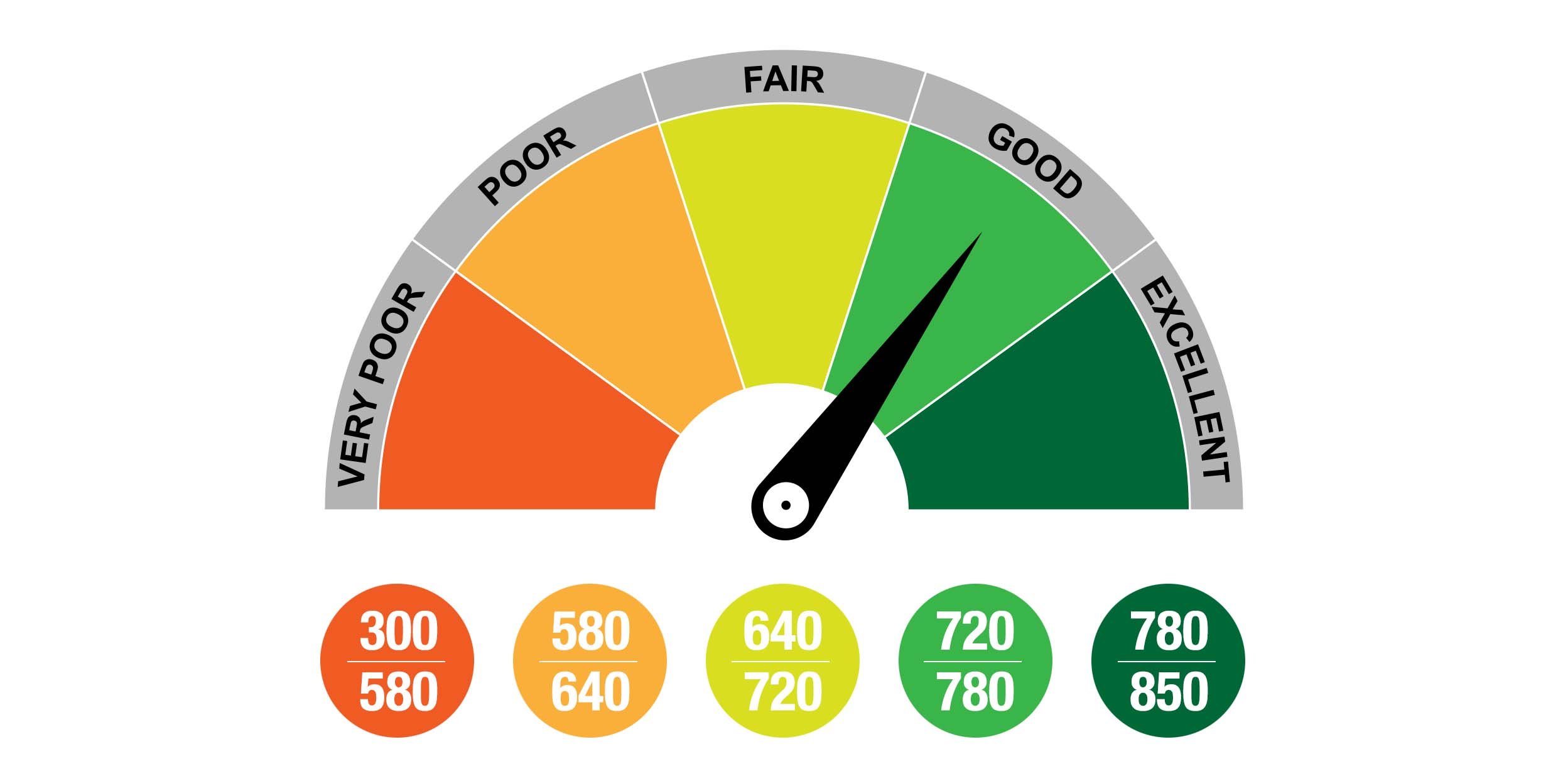

Your is a calculated 3-digit number that directly reflects what kind of borrower you are, and whether or not youre good at repaying your debt.

This intangible representation of your spending history follows you wherever you go, from buying a car, a home, or even renting an apartment.

Everything you do stays on your credit file for at least 7 years, and bankruptcy can stay on your file for at least 10 years.

Thats why its so important to stay on top of your credit score.

Keep An Eye On Your Credit Report And Make A Stink About Errors

Errors on your credit report are more common than you might think. Luckily, you can keep an eye on them by taking advantage of the free yearly credit reports youre entitled to from TransUnion, Experian, and Equifax.

When you get the reports, go over them carefully to look for errors, and get on the horn right away to dispute ones you find.

Recommended Reading: How To Get Repossession Off Credit Report

Monitor Your Credit Utilisation Ratio

Credit utilisation ratio is a calculation that measures credit usage against your credit limit. This ratio should always be 30% to ensure that your remains stable. To do this, you must ensure that you limit your spending. For example, don’t spend via your credit card up to its entire limit month after month.

Open Accounts With Collections

Once you stop paying your bills, its only a matter of time before theyre sent to collections. You should receive a couple of notices in the mail first before the billing company sends your past-due payments to collections. Youll then have an open collections account for any past-due payments.

Open accounts with collections will negatively affect your credit. The best thing you can do is start paying them back as soon as possible. In some cases, if you ignore your debts in collections, legal action can be taken against you.

You may even begin to have certain assets taken from you through this process.

Recommended Reading: When Does Capital One Report To Credit

How Are Good Deeds Rewarded

Good deeds arent rewarded directly. Instead, those citizens who have a high score indicating a larger number of good deeds than bad enjoy a variety of benefits.

Perks include decreased electric bills, access to universities and higher education, easier access to public housing, free gym access, and a higher chance of securing a loan. Some citizens with high scores also enjoy lower public transportation costs and tax breaks, as well as no requirement for a deposit when booking hotels or travel reservations.

China is ranked as one of the worlds most miserable countries, so putting these perks behind good deeds may increase overall positivity for citizens.

Your Technology Is Tracking You Take These Steps For Better Online Privacy

Never get too close to your credit card spending limit

Let’s say your credit card company tells you you can have a credit card with a $100 spending limit. That’s how much money you can borrow and spend. But … you actually shouldn’t spend that full amount. You shouldn’t get even close to your $100 limit. You should spend much less. Just 30% of your spending limit, so $30. If your credit card limit is $1,000, you can spend $300. If you spend more than 30% of your limit, that hurts your credit.

So if you have a good credit score and you want to maintain it, spending 30% of your credit card limit is fine. If you have a $100 credit card limit and you only spend $30 each month, that keeps you at 30% utilization of your card, and the credit score people like that.

If you want to increase your credit score, though, you need to spend less than 30% of your spending limit. Only use $20 of your credit card limit. Or $15 . That shows the credit bureau that you don’t need all of their credit. And for some reason, that makes your credit score go up.

If you do need to use your full credit card limit, one way to get around this is to pay your balance before your statement date. Your statement date is different from your payment due date. The statement date is the day that credit card companies notify the credit bureaus of your card usage. If you can beat them to the punch and pay off the card before it’s reported, you can use more than 30% of your spending limit.

Read Also: What Is Syncb Ntwk On Credit Report

Make Your Payments On Time

This one may seem obvious, but you want to make your payments on time. One missed payment isnt the end of the world if it was an honest mistake however, if you have several missed payments, thats when it can be an issue for lenders.

If you cant make the full payment, make sure you make at least the minimum payment. If youre considering skipping your payment one month because cash flow is tight and getting caught up next month, dont do it. Make at least the minimum payment otherwise, it will be reported as a missed payment and hurt your credit score if you skip your payment, even if you get caught up next month.

Better Chance For Credit Card And Loan Approval

Borrowers with a poor credit history typically avoid applying for a new credit card or loan because they’ve been turned down previously. Having an excellent credit score doesnt guarantee approval, because lenders still consider other factors such as your income and debt. However, a good credit score increases your chances of being approved for new credit. In other words, you can apply for a loan or credit card with confidence.

Read Also: Syncb/ntwk

Tips To Build A Credit History If You Have Not Taken Loan Till Date

Featured in: Personal Loan

There are many misconceptions regarding credit, but developing a credit history for a home or auto purchase is vital even if you dont have cash on hand. Credit reports and scores are used by businesses to evaluate your creditworthiness and set your borrowing terms for everything from buying a new cell phone to securing a mortgage.

If you dont have much credit history or have unfavourable information on your credit report, such as late payments, you may have trouble getting accepted for a new account. If you do get accepted, the terms will almost certainly be less favourable.

It takes time to build a decent credit score, but the benefits are vast.Even if there is no need for you to apply for credit in the coming months, you must start working on it as soon as possible so your credit score is good when you need it.

Only Borrow What You Can Afford

A credit card isn’t a permission slip to buy things you can’t afford. This is the quickest way to get into debt and credit trouble.

The best way to build good credit is to create the habit of charging only what you can afford. This habit lets future lenders and creditors know you’re a responsible borrower. You’ll find it easier to borrow money and get new credit when you show that you have the discipline to borrow only what you can afford to repay. Not only that, only charging what you can afford helps you avoid excessive debt.

The same rules applies to loans. Regardless of what the lender says you qualify for, you should only borrow what you can pay back. Before you shop for a loan, review your budget to see what monthly payment you can afford. Make sure your loan payment doesn’t exceed the amount you’ve come up with.

Read Also: 728 Credit Score

Petal 2 Cash Back No Fees Visa Credit Card

Best for credit-building with cash back

- This card is best for: Anyone who could benefit from some extra incentive to start building a good credit score as they earn cash back.

- This card is not a great choice for: Established credit users. If you already have a good credit score and disciplined spending habits, you could find a card with a more rewarding cash back program pretty easily.

- What makes this card unique? You automatically earn 1 percent cash back on eligible purchases, but the rate rises to up to 1.25 percent after six on-time monthly payments and up to 1.5 percent on eligible purchases after 12 on-time monthly payments.

- Is Petal® 2 Cash Back, No Fees Visa® Credit Card worth it? For beginners, this cards credit-building capabilities and incentive-based cash back program could be a useful way to navigate an early stage of the personal finance journey.

Jump back to offer details.

Habits That Can Help You Maintain A Good Credit Score

Your credit score is a measure of how responsible you are with borrowed funds. A credit score of 750 and above is considered good, as it showcases financial fitness. This gives lenders a reason to view you as a worthy, reliable borrower. In turn, you can get a better interest rate on a loan or get a higher sanction. If you already have a credit score of above 700, here are 5 effective habits to follow to maintain your credit score.

Don’t Miss: What Is Syncb Ntwk On Credit Report

Keep Credit Accounts Open

You know that old credit card account you never use? Think twice before closing it. Unless you’re paying a lot in annual fees, it may be better for your finances to leave it open. Closing your account means removing some of your total available creditnot part of our recipe for a lower utilization rate.

To keep benefitting from old, unused cards, try charging a small amount to the card on a consistent basis to keep the account active. For example, you can pay for your favorite streaming service subscription on a rarely used credit card and set up automatic payments to cover the monthly charge.

Get A Secured Credit Card For Bad Credit

For many people, getting a secured credit card is the first step in either getting or improving their credit score.

For young adults who want to get their first credit card, it can be difficult to get accepted since theres no credit history associated to them yet.

Secured credit cards usually require a deposit which will often be equal to the amount of credit youre allowed to use.

And on the issuer side of things, its less of a risk for them since there is some collateral in case you dont make your payments.

Also Check: What Is Syncb Ntwk On Credit Report

How To Get A Good Credit Score

Maintaining a good credit score is more critical than ever. A goodcredit score enables you to obtain additional credit for important lifepurchases, such as a car or a home. You can often score better insurancerates with a high credit score, and forego deposits on your utilitiesthe next time you move into a new residence. Your credit score can evenaffect your job prospects.

However, despite its importance, a staggering number of Americanshave poor credit. Approximately one-third of Americans have a creditscore below 601, which falls between fair and poor credit. It doesnthave to be that way, though. Here are five tips you can use right now toimprove your credit score, and keep it that way.

After A Year Try Applying For An Unsecured Credit Card

It normally takes at least six months of consistent credit card usage to accumulate enough data for credit agencies to issue a credit report. Build a strong credit history for a year to ensure lenders give you a secured credit card to use, since this should be enough time to demonstrate that youre good with money. It is critical to switch from a secured to an unsecured credit card because the latter relieves you of any security or collateral obligations. An unsecured credit card also has a higher credit limit and more benefits.

Also Check: Does Capital One Report Authorized Users To Credit Bureaus

Pay Your Bills On Time

On-time payments are important for all your bills, not just your and loans. Even if youre not using one of the third-party services that can get your timely rent and utility bill payments reported to the credit bureaus, payment activity on those accounts could end up on your credit report if you fall behind. Continue to pay all your bills on time to maintain a good credit score.

How To Repair Your Credit And Improve Your Fico Scores

You can improve your FICO Scores by first fixing errors in your credit history and then following these guidelines to maintain a consistent and good credit history. Repairing bad credit or building credit for the first time takes patience and discipline. There is no quick way to fix a credit score. In fact, quick-fix efforts are the most likely to backfire, so beware of any advice that claims to improve your credit score fast.

The best advice for rebuilding credit is to manage it responsibly over time. If you haven’t done that, then you’ll need to repair your credit history before you see your credit score improve. The following steps will help you with that.

Read Also: Opensky Credit Card Delivery

You May Have Heard Someone Refer To A Score As A Quantity And Wondered What It Means

What does your credit score need to be to buy a house? In recent years it has become easier than ever t. Although people don’t use the term much anymore, you can find examples of it in literature and history. National basketball association quarters last for 12 minutes, and there are four of them during every nba game. Compare the top options at wallethub to see which is best in your book. Just like keeping a close eye on your weight is a good idea if you want to maintain good health, monitoring your credit scores is also a smart move if you want to maintain your credit health. Not all credit score sites are created equal, whether in terms of cost or quality. We discuss the minimum credit score needed and what else you need to buy a house. If so, you’re probably wondering, what’s a good act s. It’s no secret that having good credit pays off, especially when you apply for financing like a credit card or loan. Best credit monitoring services how to get your free credit report how to read & understand your credit. Learn what a good 2021 act score for you will be and how to set your personal goal score. Predict the super bowl score for your chance to win a $50,000 cash prize from aptivada’s the big game score 2021 contest.