What To Do If You Disagree With The Outcome Of Your Dispute

If you don’t agree with the results of your dispute, here are some additional steps you can take:

- Contact the information source. Your best next step is to contact the entity that originally provided the disputed information to Experian and offer proof their information is incorrect. The source may be the lender or financial institution that issued you a loan or credit, but it could also be a collection agency or government office. Contact information for each source appears on your credit report, and you can use it to reach out to them.

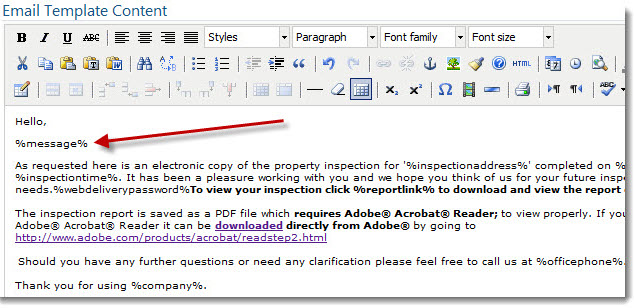

- Add a statement of dispute to your credit report. A statement of dispute lets you explain why you believe the information in your credit report is incomplete or inaccurate. Your statement will appear on your Experian credit report whenever it’s accessed or requested by a potential lender or creditor, so they may ask you for more details or documentation as part of their review or application process. To add a statement of dispute, go to the Dispute Center, choose the item in dispute, and select Add a Statement from the menu of dispute reasons.

- Dispute again with relevant information. If you have additional relevant information to substantiate your claim, you can submit a new dispute. If you’re filing the dispute online, follow the steps listed above for using the Dispute Center, and use the upload link to provide your supporting documentation.

Submit Your Request By Mail:

First, you’ll need to download and complete the;Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

Wait Up To 45 Days For The Credit Bureau Or Furnisher To Investigate And Respond

The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. The credit bureau must also report the results back to you within five days of completing its investigation.

If you dispute the error with the information furnisher, that company must also report the results of its investigation to you. It also typically has 30 days to investigate.

Also Check: How To Remove Items From Credit Report After 7 Years

How To Protect Yourself

Dont be the victim of a scam. If it sounds too good to be true, it probably is. These scams can result in:

- identity theft

- theft from your bank account or credit card and

- computer viruses

Remember:

- No one can guarantee you a job or a visa to Canada.

- Only immigration officers in Canada, at Canadian embassies, high commissions and consulates can decide to issue a visa.

- Processing fees are the same for all of our services in Canada and around the world.

- Fees in local currencies are based on official exchange rates.

- Theyre the same amount as fees in Canadian dollars.

Use The Direct Marketing Association’s Mail Preference Service

The Direct Marketing Association provides a Mail Preference Service, which costs only $1 and puts your name on a “do not mail” list to be provided to direct-mail marketers.

The catch is that not all direct-mail marketers subscribe to the DMA’s service; however, according to PrivacyRights.org, many mailing list compilers do subscribe to the DMA’s list, so you could see a significant drop not only in the number of credit card offers you receive but also in the amount of junk mail that crowds your mailbox. Your mail preference needs to be updated every three years, which can be done via mail or an online form.

Recommended Reading: Business Cards That Don’t Report To Personal Credit

How To Check Your Financial Associates

Checking who your financial associates are is as simple as checking your credit report.

For more information about how to obtain your credit report please see our guidance.

In the connections section of your report, youll be able to see the names of everyone you have financial links with and if any of them are incorrect, you can issue a notice of disassociation.

Generate Your Credit Report Online

You can save;reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a;request form;to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

Recommended Reading: Does Paypal Working Capital Report To Credit Bureaus

How To Get Your Annual Credit Report From Experian

Starting April 20, 2020, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports for the next year through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

Under federal law you are entitled to a copy of your credit report annually from all three credit reporting agencies – Experian®, Equifax® and TransUnion®– once every 12 months. Every consumer should check their credit reports from each of the 3 bureaus annually. Doing so will make sure your credit is up-to-date and accurate. Each reporting agency collects and records information in different ways and may not have the same information about your credit history.

*warnings When Ordering Online:

Misspelling the annualcreditreport.com site or using another site with similar words will take you to a site that will try to sell you something or collect your personal information. Even one mistyped letter could take you to a fraudulent website that looks and feels like a place to order credit reports but in fact has been set up by ID thieves to steal your information. Other sites with similar names exist and may try to sell you credit monitoring services.

Remember, only one website is authorized to fill orders for the free annual credit report you are entitled to under lawannualcreditreport.com. Other websites that claim to offer free credit report,, free credit scores, or free credit monitoring are not part of the legally mandated free annual credit report program.

Beware of emails, banner ads, pop-up ads, and telemarketing calls that promise to obtain your free annual credit report on your behalf. In particular, beware of email messages or internet ads claiming to be from annualcreditreport.com.

Also beware of any free offers for your credit score. One wrong click on an enticing ad for a free look at your credit score may have you signed up for costly or unnecessary credit monitoring or sharing your personal information with a thief.

Annualcreditreport.com will not send you an email asking for your personal information; do not reply or click on any link in the message. Its likely a scam, leading to potential ID theft. .

Recommended Reading: Does Paypal Working Capital Report To Credit Bureaus

About American Express Credit Guide

What information can I find on MyCredit Guide?

MyCredit Guide provides your VantageScore® credit score by TransUnion®, refreshed weekly upon login. MyCredit Guide also includes a range of information and tools to help you understand your credit score better and plan for the future. Some of the features include:

- Score Factors impacting your score

- Up to 12 months of score history

- Detailed TransUnion credit report

- Email alerts about critical changes to your TransUnion credit report information to help you identify potential fraud

- Score simulator to help you assess the possible impact of financial choices before you make them

How often is the credit score in MyCredit Guide updated?;;;

Your VantageScore credit score is updated weekly, upon login.;;

What are the “Score Factors” impacting my VantageScore credit score?

The “Score Factors” impacting your VantageScore;credit score tell you what information from your TransUnion credit report is impacting the calculation of your score. These are some key factors that could affect your credit score:

- Your history of making payments on time

- How old your credit accounts are

- How much credit you are using

- Recent inquiries for credit

- Recently opened new credit or loan accounts

- How much credit you have available

What is the Credit Score Simulator?

Please note the results of Credit Score Simulator are estimated and dont necessarily show the exact results a given behavior will have on your score.;;;

How accurate is the Credit Score Simulator?

How Can Other Peoples Credit Histories Affect Mine

Your financial associates are just one more contributing factor to the lenders decision whether or not to give you credit. Before youre accepted for a loan or a mortgage, lenders want to make sure you can afford to pay it back. This involves assessing your other financial ties and commitments.

For example, if you and your spouse share a mortgage and your spouse loses their job, youre likely to have to pick up their half of the payments. This could affect your ability to pay off other debts, and potential creditors will take that into account when deciding whether to give you credit.

You May Like: Does Paypal Report To The Credit Bureaus

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.;

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your credit report. The NFCC can provide debt counseling services, help review your credit reports, work with lenders, and help create a debt management plan free of charge.

As always, be wary of predatory credit organizations or companies. Make sure to find a reputable counseling agency and keep a lookout for any red flags, like hidden fees or lack of transparency.

When looking for a credit counselor, the Federal Trade Commission advises consumers to check out each potential agency with:

- The Attorney General of your state

- Local consumer protection agencies

- The United States Trustee program

Don’t Miss: What Credit Report Does Comenity Bank Pull

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and; include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.;

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.;

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Other Complications Of Online Disputes

One of the primary problems with disputing online, is that the credit bureaus only provided limited access to your dispute materials.; Most of the credit bureaus will only allow consumers to access and view their disputes and responses for a limited time, and after that time expires, the consumer cannot access that information on their own.; This makes it very difficult to ask an attorney to review your specific situation.; These same limitations also apply to your requests for credit file disclosures.; So, if you are expecting that the documents in your account with a major credit bureau will be accessible long after your dispute, think again and read the terms of service.; Chances are, you will not be able to access these documents indefinitely, even if those documents are still available to the credit bureaus.

In addition to the barriers put in place by the credit bureaus, many of the credit reporting agencies require consumers to navigate through a number of pop-up boxes before being able to access their credit file. These pop-up boxes often contain waivers of the consumer’s rights, including your right to sue in a court with a jury.

These popup boxes may not provide an opportunity to meaningfully review the agreements or allow consumers to keep copies of any waivers.; Because consumers cannot proceed with an electronic dispute without agreeing to these waivers, consumers should think twice about beginning this process.

You May Like: Aargon Collection Agency Address

Check Your Credit Reports For Updates

It may take some time for your credit reports to be updated. Creditors can take up to 45 days to send a credit bureau new information, according to TransUnion. If the information isnt updated after 45 days, contact the credit bureaus or data furnisher again to see why inaccurate information is still being reported.

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to;file a dispute with Equifax Canada. You will need to complete the;;enclosed with your package. You can also review;how to dispute information on your credit report;for additional details on the Equifax dispute process.

Read Also: How To Get Credit Report Without Social Security Number

Is Everyone Eligible To Get Their Free Statutory Annual Credit File Disclosure

Yes. As of Dec. 1, 2005 all consumers are eligible to request their statutory annual credit file disclosure once every twelve months.

Monitor your Experian credit report for free

No credit card required.

- Access to your free Experian credit report and FICO® Score

- Get real-time alerts to help you detect possible identity fraud sooner

- Monitor your spending and know when your account balances change

What Is The Fact Act

The Fair and Accurate Credit Transactions Act was signed into law in December 2003. The FACT Act, a revision of the Fair Credit Reporting Act, allows consumers to get one free comprehensive disclosure of all of the information in their credit file from each of the three national credit reporting companies once every 12 months through a Central Source.

Don’t Miss: Does Zzounds Report To Credit Bureau

Who Needs A Notice Of Disassociation

If you no longer have any joint financial arrangements with a third party, you should apply to have the association removed from your credit file. For instance, you may have separated from your partner with whom you had a joint mortgage, or you no longer share a joint account, but its still recorded on your credit report.

Its essential to regularly check your financial associates are correct. You can do this by checking your credit report.

Read our guide for more information about how to get your credit report.

Small Business Loan Disbursals Increased 40% In Fy21

The latest edition of the Sidbi TransUnion Cibil MSME Pulse Report has been published and it shows that loans worth Rs.9.5 trillion have been disbursed by the lenders to micro, small, and medium enterprises for the current financial year.

This number is 40% more than the previous years disbursal of Rs.6.8 trillion. The report suggests that the interventions from the government such as Emergency Credit Line Guarantee Scheme have played a major role in the surge of the credit disbursement to the MSMEs.

11 August 2021

Recommended Reading: When Do Companies Report To Credit Bureau

Fix Your Credit And Improve Your Credit Score

Here are some tips on how to fix your credit and improve your credit score:

If you need help fixing your credit, contact a non-profit credit counseling service that can help you for little or no cost. You can also check with your employer, credit union, or housing authority to see what no-cost credit counseling programs may be available.

It takes time to build up or fix your credit. Unfortunately, there are a lot of fraudsters preying on consumers who want to fix their credit. Avoid any credit counselor or company that promises quick-fix credit repairs, promises to hide your bad credit history, requires upfront payment, or tells you to dispute accurate credit report information or to give false information to creditors.

Here are some resources to help you find a reputable credit counselor:

- Federal Trade Commissions Choosing a Credit Counselor: How to choose a credit counseling service

- Federal Trade Commissions : How to avoid credit repair scams

- Department of Business Oversights : Common questions about credit counseling services