How Long Does It Take To Repair Or Rebuild Your Credit

Its often possible to earn a higher credit score in 30 days or less, says Grant, but dont expect your credit score to move from fair to excellent during that time. If youve had a major setback, it usually takes about one to two years to repair your credit, according to Weaver.

But that depends on your individual situation. For example, FICO research shows that it takes about five to ten years to recover from bankruptcy, depending on your credit score. If youre 30 days late on a mortgage payment, you can repair your credit in about 9 months to three years. The higher your score was initially, the longer it will take to fully recover from the setback.

You should start the credit repair process as soon as you can so youll be prepared the next time you need to apply for new credit. If youre coming up to a house purchase, a new car, starting a business, six months to a year out, start reviewing your score and your report, says Weaver.

Is There Anything Else I Can Do To Improve My Credit

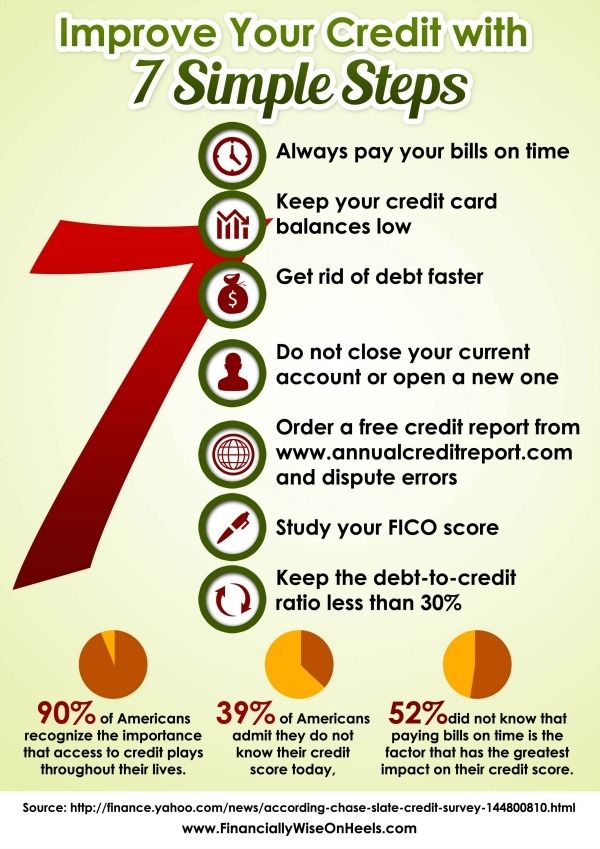

It takes time, but you can improve your credit by paying your bills by the due date, paying off debt especially on your credit cards and not taking on new debt. Paying bills on time and having low balances can help you build a solid credit history. If youre in debt and need help, a reputable credit counseling organization might be able to help. Good credit counselors spend time discussing your entire financial situation with you before coming up with a personalized plan to solve your money problems. They wont promise to fix all your problems or ask you to pay a lot of money before doing anything.

You often can find non-profit credit counseling programs offered through

Impact Of Identity Theft On Your Credit Report

Identity theft when someone steals your personal information and uses it to open new financial accounts can wreak havoc on your credit. These new accounts show up on your credit record and hurt your score, especially if theyre delinquent or if the identity thief applied for several in a short amount of time.

Cleaning up your credit after identity theft can take anywhere from several months to years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. This is why keeping a close eye on your report and learning how to protect yourself from identity theft will help you to keep your information safe.

How to remove negative items related to identity theft

If you believe youve been a victim of identity fraud, file a dispute with the Federal Trade Commission online at IdentityTheft.gov or by phone at 1-877-438-4338. You should also file a police report.

To prevent further damage to your credit history, these are the steps you should take:

- Notify the incident to Transunion, Experian and Equifax through phone or mail

- Place a security freeze and fraud alert on your credit report

- Request a copy of your credit report through AnnualCreditReport.com

- Look out for unauthorized transactions or new accounts that dont belong to you

- Contact creditors to close compromised accounts

- Consider subscribing to an identity theft protection or credit monitoring service

Read Also: Comenity Bank Credit Score

An Improved Score Will Lead To Financial Opportunities

Keeping your credit report in positive and accurate shape is something anyone can and should do. Your credit scores speak for you, and you want them to be your numerical cheerleaders! The higher they are, the better the interest rates will be on credit cards and loans.

Odds are, youll be eligible for higher credit limits, a greater variety of rental properties, and wont have to pay extra fees to start up a cellphone or utility contract. They can even result in lower car and life insurance rates. In fact, when your reports are reflecting what they should and your credit scores are in the right place, you can be sure that a business or financial institution will identify you as the attractive credit risk you really are.

Know Your Credit Utilization Ratio

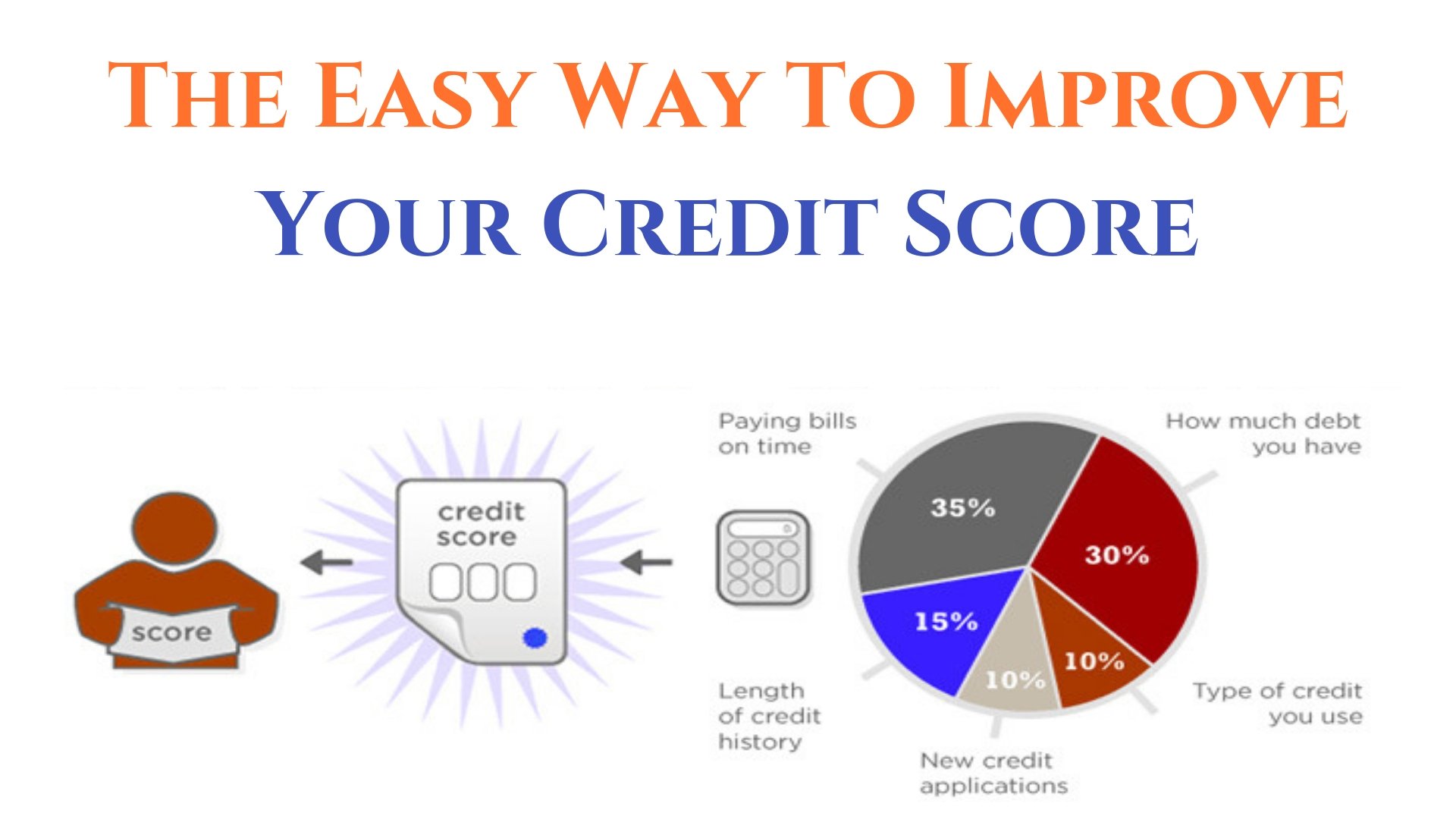

Credit scoring models usually take into account your , which is how much you owe compared with how much credit you have available.

Basically, it’s the sum of all of your revolving debt divided by the total credit that is available to you multiplied by 100 to get a percentage. For example, if you have $6,000 in credit card balances and $60,000 in total available credit across all of your credit card accounts, your utilization ratio is 10%.

High credit utilization can negatively impact your credit scores. Generally, it’s a good idea to keep your credit utilization ratio below 30%, but there’s no hard-and-fast rulethe lower it is, the better.

There are a few different ways you can reduce your credit utilization rate:

- Start paying down your account balances.

- Increase your total available credit by opening a new credit card account or requesting a credit limit increase on an existing card.

- Consolidate your credit card debt with a personal loan, which isn’t included in your credit utilization rate calculation.

That said, while increasing your credit limit may seem like an appealing option, it can be a risky move. If increasing your credit limit tempts you to spend more, you could fall deeper into debt. Additionally, if you try to open a new credit card, a hard inquiry will appear on your credit report and could temporarily reduce your credit score by a few points.

Don’t Miss: Syncb/ppc Credit Card Login

Recognize The Signs Of A Repair Scam

Always thoroughly vet a service provider before you sign up or pay any fees! The following tips can help you avoid getting scammed:

- Make sure the company has an attorney licensed to make disputes in your state.

- Be cautious of any guarantees to improve your credit score by a certain amount this is not something any company can guarantee!

- Never take advice that sounds illegal, such as using a fake Social Security number or using an Employer Identification Number to start a new profile.

- Be wary of any upfront fees that dont come with a money-back guarantee.

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your record.

The NFCC can provide financial counseling, help review your credit history, help you create a budget and even a debt management plan free of charge. It also offers counseling for homeownership, bankruptcy and foreclosure prevention.

As always, be wary of companies that overpromise, make claims that are too good to be true and ask for payment before rendering services.

When looking for a legitimate credit counselor, the FTC advises consumers to check if they have any complaints with:

- Your states Attorney General

- Local consumer protection agencies

- The United States Trustee program

Don’t Miss: Can I Buy A House With A 588 Credit Score

Signs That A Credit Repair Company Is A Scam

- It promises to remove negative information from your credit report.FACT:No one can legally remove negative information from a credit report that is accurate. Most negative information generally stays on your report for seven years while bankruptcy information can remain on the report for ten years.TIP: You’re entitled to one free credit report each year from each of the nationwide consumer credit reporting companies, so visit www.annualcreditreport.com to get yours today and review it to ensure the information is accurate and up to date. The copy of your credit report will include information about how to dispute inaccurate or incomplete information.

- It requires an upfront fee before any type of credit repair is performed.FACT: Under federal law, credit repair companies cant require you to pay until theyve completed the services theyve promised.TIP: To get free help with improving your credit, visit the City’s Financial Empowerment Center

- It offers to create a new ‘credit identity’ for you with different identification .FACT: It is illegal to commit identity fraud or misrepresent Social Security or business tax ID numbers under false pretenses.TIP: To report this credit repair company scam, file a complaint with the Federal Trade Commission

Assess The Damage And What Needs Repairing

You cant know whats hurting your credit without reading over your most recent credit reports, so you want to pull them all.

There are three major credit reporting agencies in the U.S.: TransUnion, Equifax, and Experian.

Although you can get copies from the companies that produce them, the easiest way is to access all three at once from annualcreditreport.com. You are entitled to a copy of your credit report once a year from each of the agencies at no cost.

Occasionally, a creditor will report to only one or two of the agencies, so youll want one from each agency to be certain that you have your complete credit picture.

After accessing the credit reports online, print them out. As youll see, they are divided into four sections, so read through each and look for areas of concern:

In the next step, youll find common examples of inaccurate and/or erroneous information to look for and dispute.

Read Also: Letter To Remove Repossession From Credit Report

What Can Credit Repair Services Do

Legitimate credit repair services check your credit reports for information that shouldn’t be there and dispute it on your behalf. Many of them also check to be sure the information doesn’t reappear.

When information on your credit reports is disputed, credit bureaus have 30 days to investigate. However, they don’t have to investigate disputes they deem frivolous.

Among the errors that can be addressed:

-

Accounts that don’t belong to you.

-

Bankruptcy or other legal actions that aren’t yours.

-

Misspellings, which may mix in negative entries that belong to someone with a similar name or may mean positive entries aren’t showing up when they should.

-

Negative marks that are too old to be included.

-

Debts that can’t be validated and verified.

Figure Out Where You Stand

Before you begin do-it-yourself credit repair, youll want to get copies of your full credit reports from all three bureaus .

You can get your reports truly free, once a year, at www.annualcreditreport.com or by calling 1-877-322-8228. Other websites may claim to offer free reports, but the Federal Trade Commission warns that these offers are often deceptive.

You can also try free credit score tracking apps like to get a sense of where you stand.

Credit scores range from 300 to 850. A score of between 700 and 740, depending on the scoring method used, is considered good credit and usually enough to qualify you for the best credit cards and lowest mortgage rates.

Also Check: How To Report Death To Credit Bureaus

Wait For Negative Items To Fall Off Your Credit Reports

Its natural to want to improve your credit score fast, but some things take time. Many negative items can stay on your credit reports for seven years or more. But eventually, theyll fall off your reports and wont hurt your credit score anymore. Heres how long it takes certain types of negative marks to disappear:

- Chapter 7 bankruptcy: 10 years

- Chapter 13 bankruptcy: 7 years

- Collection account: 7 years

- Hard inquiries: 2 years

Tips To Overcome Derogatory Credit

Your credit score benefits from having positive information, so your score may start improving long before the derogatory items are removed from your credit report if you’re paying other accounts on time.

Your recent credit history affects your credit more than old derogatory credit items, so having open accounts with on-time payments will help improve your credit score.

You may not be able to have excellent credit until the derogatory items are completely removed from your credit report, but with good credit, youll still be able to qualify for many credit cards and loans.

You May Like: What Does Thd Cbna Stand For

Can You Pay To Have Your Credit Fixed

If your credit file has information you feel is incorrect, credit repair companies may offer to dispute the information with the credit reporting agencies on your behalf. Credit repair companies typically charge a monthly fee for work performed in the previous month or a flat fee for each item they get removed from your reports. However, Experian does not charge consumers or require any special form to dispute information, so this is something you can do on your own at no cost.

If you’re on a monthly subscription, the cost is typically around $75 per month but can vary by company. The same goes for paying a fee for each deletion, but that option typically runs $50 each or more.

That said, it’s important to keep in mind that credit repair isn’t a cure-alland in many cases it crosses the line into unethical or even illegal measures by attempting to remove information that’s been accurately reported to the credit bureaus. While these companies may try to dispute every piece of negative information on your reports, it’s unlikely that information reported accurately by your lenders will be removed.

And again, credit repair companies can’t do anything that you can’t do on your own for free. As a result, it’s a good idea to consider working to fix your credit first before you pay for a credit repair service to do it for you.

How Do I Know If Im Dealing With A Credit Repair Scam

Heres how to know if youre dealing with a scammy credit repair scam company:

- Scammers insist you pay them before they help you.

- Scammers tell you not to contact the credit bureaus directly.

- Scammers tell you to dispute information in your credit report you know is accurate.

- Scammers tell you to lie on your applications for credit or a loan.

- Scammers dont explain your legal rights when they tell you what they can do for you.

These are not just bad ideas, theyre also scams and theyll hurt your credit if you buy into the scam. If a company promises to create a new credit identity or hide your bad credit history or bankruptcy, thats also a scam. These companies often use stolen Social Security numbers, or they get people to apply for Employer Identifications Numbers from the IRS under false pretenses. They do that to create new credit reports. If you use a number other than your own to apply for credit, you wont get it. And you could face fines or prison.

Also Check: Opensky Payment Due Date

Can I Make Disputes Online Or By Phone

You can make disputes online. All three credit bureaus provide online portals on their websites where you can make disputes. Some people choose to do this because it easier than sending letters .

However, we recommend making disputes by certified letter with return receipt requested. Its easier to keep track of correspondence. You also now when the dispute was received. And some statistics show that letter-based disputes have a higher chance of success.

You cannot make disputes by phone, although you can request hard copies of your credit report by phone.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

Also Check: Does Seventh Avenue Report To Credit Bureaus

Assess Your Credit History For Free

You are entitled to receive one free credit report from each of the three major credit reporting bureaus every year. These credit reporting agencies keep detailed records of your credit history. Assessing your credit involves three simple steps:

What Is Considered A Good Credit Score

Once you know your score and the steps youre willing to take to repair it, you can then decide on a plan to see how aggressively you should try to improve your score. Though a higher score is always better, most consumers aim to get their credit score into the good threshold or above.

While ranges will vary slightly between the FICO® and VantageScore 3.0 score models, 850 is the highest possible credit score for both. The credit score ranges for FICO® impact may include:

- Exceptional: Applicants with exceptional credit get access to the best interest rates, most beneficial offers and can even secure special individualized perks and offers from lenders.

- Very Good: Applicants with very good credit will have a variety of options to choose from when it comes to products and pricing.

- Good: According to data from Experian, borrowers in the good range have only an 8% chance of becoming seriously delinquent in the future. Most borrowers are in the good range of credit.

- Fair : Fair borrowers may see higher interest rates and lower ranges of credit than their peers with good or higher scores.

- Poor : Lenders see borrowers with poor credit scores as very high risk. Borrowers with poor credit may pay a fee or deposit in exchange for credit or a loan or they may be flat-out refused by lenders. If you have poor credit, you may want to create and carry out a credit repair plan immediately.

Don’t Miss: What Does Syncb Ppc Stand For