Why Do Most Lenders Require A 640 Credit Score For Usda Loans

Lenders prefer to use the USDA Guaranteed Underwriting System for an efficient, streamlined underwriting process. GUS analyzes your risk and eligibility as a borrower using a scorecard.

Automatic GUS approval requires you to have a credit score of 640 or higher with no outstanding federal judgments or significant delinquencies.

Even if you dont have a 640 credit score, its still possible to apply and be approved for a USDA loan. USDA allows lenders to underwrite and approve USDA home loans manually at the lenders discretion. Once cleared by your lender, the USDA must review your loan for final loan approval before you can close.

Regardless of credit score, all USDA loan applications must receive final loan approval from the USDA once cleared by the lender.

Usda Minimum Credit Score Overlays

Often, minimum credit score will vary by lender due to an internal guideline called an overlay.

For example, some lenders set higher minimum credit scores like 640 or 620 FICO credit score.

Why do lenders set these higher standards? They may not have the resources to underwrite the loan or they concentrate on originating loans for borrowers that meet a specific credit profile.

Minimum Credit Requirements To Qualify For A Usda Mortgage

-

620 Credit Score

-

Borrowers without a credit score are not eligible.

-

At least 2 active credit accounts reporting to the credit bureau

-

Minimum 12 months of repayment history on at least one credit account

At this time, USDA Mortgage Credit Guidelines are more flexible thanmany other mortgage programs but there are some credit deficiencies that the USDA will not overlook no matter what the credit score.

Dont Miss: What Is A Loan Commitment Fee

You May Like: Does Checking Your Credit Score Make It Go Down

Usda Guaranteed Underwriting System

Ultimately, the USDA Guaranteed Underwriting System will determine the acceptable credit score to be used which depends on whether it is an Accept,Refer, or Refer with Caution underwriting recommendation.

These underwriting recommendations dictate the way lenders approve a USDA loan and what minimum required documentation is needed for loan closing.

An Accept recommendation provides for streamlined processing and simply means that GUS has accepted the credit as is with no further credit score validation required.

However, a GUS recommendation of a Refer, Refer with Caution, and for those Manually Underwritten loans, it requires a more stringent review of the loan file along with a validated credit score as follows:

One applicant whose income and/or assets is used to originate the loan must have a validated credit score. This applicant must have two tradelines on the credit report that have been/were/are open for 12 months based on the date the account was opened as stated on the credit report. A validated score does not indicate the applicant has an acceptable credit history. A validated score confirms that one applicant has an eligible minimum credit history.

This means that the applicant must have at least 2 credit tradelines that have existed on their credit report for a minimum of 12 months.

Additionally, USDA guidelines state that the following tradelines are eligible to validate the credit score and may be open, closed, and/or paid in full:

- loans

How Credit Scores Work

Many prospective homebuyers are caught by surprise when they apply for a mortgage and see scores that differ from what a free credit monitoring service shows.

First, it’s important to note that consumers don’t have just one credit score. Each of the nation’s three major credit reporting agencies Experian, Equifax and TransUnion receive different information from creditors and score that information dozens of different ways depending on the type of credit you’re seeking, such as a mortgage, car loan or credit card.

The majority of lenders utilize FICO scores to check a potential borrower’s credit.

There are five main factors that go into every FICO score:

- Payment history . Are you on time with your bills, or do you have a habit of being late? Anything over 30 days overdue can ding your credit.

- Amounts owed . That’s a number that shows how much debt you have, i.e. how much of your available credit you’re using. Over 30 percent utilization can be a red flag.

- Length of credit history . If you don’t have at least 12 to 14 months of credit history, that can lower your score. The longer the record, the better.

- The more kinds of credit you have, the better. For example, a credit card, a store card, and a loan like a mortgage or auto loan shows a good mix.

- New credit . How many credit lines do you have? Ideally, you have several, but opening a bunch of new accounts all at once can hurt your score, especially if you don’t have a long credit history.

You May Like: Is 766 A Good Credit Score

Alliance Catholic Credit Union

Category: Credit 1. Alliance Catholic Credit Union | LinkedIn Established by and for the Catholic Community, ACCU is uniquely qualified to provide financial products and services tailored to meet the needs of our Catholic With Alliance Catholic CU Mobile Banking: -Check Balances -View Transaction History -Schedule bill payments with our

Examples Of Alternative Credit To Use:

- Rent history

- Utilities

- Insurance not payroll deducted

- Cell phone

- Small store accounts furniture, gas station, heating oil companies

- Buy-here, pay-here car loans

- Consistent savings pattern depositing a set amount over a 12 month period

In cases where credit is limited, but everything else looks in line, proving extra alternative credit references can put a borrower over the top when it comes to USDA loan approval.

Recommended Reading: How Do You Get An 800 Credit Score

Usda Home Loans: Eligibility And Program Requirements

When you hear the acronym USDA, the first image that probably comes to mind is a juicy steak. As in, USDA Prime or Choice.

But the U.S. Department of Agriculture isnt just in the farming businessthey also run a pretty substantial home loan program that offers mortgage financing with zero money down.

About The Usda Rural Housing Mortgage

The Rural Development loans full name is the USDA Single Family Housing Guaranteed Loan Program. However, the program is more commonly known as a USDA loan.

The Rural Development loan is sometimes called a Section 502 loan, which refers to section 502 of the Housing Act of 1949, which makes the program possible.

This program is designed to help single-family home buyers and stimulate growth in less-populated, rural, and low-income areas.

That might sound restrictive. But in fact, 97% of the U.S. map is eligible for USDA loans, including many suburban areas near major cities. Any area with a population of 20,000 or less can be an eligible rural area.

Yet most U.S. home buyers, even those who have USDA loan eligibility, havent heard of this program or know little about it.

This is because the USDA loan program wasnt launched until the 1990s. Only recently has it been updated and adjusted to appeal to rural and suburban buyers nationwide.

Many USDA-approved lenders dont even list the USDA loan on their loan application menu. But many offer it.

So if you think youre eligible for a zero-down USDA loan, its worth asking your shortlist of lenders whether they offer this program.

Don’t Miss: How To Pull Credit Report

Find Additional Sources Of Cash For Down Payment And Closing Costs

If you dont have much savings but want to buy your home sooner than later, it cant hurt to consider other sources of cash. You can ask friends and family for gifts to assist with down payment or closing costs. The latter usually works out to 3-5% of your loan amount, on top of any required down payment.

You might also even sell something of value that you dont need and is just laying around the house to pad your down payment. A little creativity will go a long way, plus it could save you thousands if not tens of thousands of dollars as a homeowner. The bigger your down payment, the lower your loan amount and the less interest youll pay.

Usda Household Income Limits For Most Counties:

- 1-4 household members $82,700

- 5+ household members $109,150

Additionally, eligible properties include stick-built homes, townhomes, off-frame modular homes, and approved condos in USDA-eligible areas. Most of America, other than highly populated areas, is eligible.

Plus, USDA is not just for low priced homes in the country. Actually, buying a home up to 453,100 is possible based on 2018 loan limits. Plus, many mid-sized towns are eligible. Even many whole counties are USDA eligible. If a city is not eligible, then spread out the home search to consider USDA eligible properties.

If you find that you still have questions about eligibility, please reach out to one of our experienced, licensed loan officers.

Recommended Reading: Does Cashnetusa Report To Credit Bureaus

Usda Loan Program Faqs

Are USDA loans better than FHA loans?

USDA and FHA loans each have pros and cons. Generally, FHA loans work better for people with lower credit scores. However, FHA loans require at least 3.5% down while USDA loans can offer zero down payment. Unlike USDA loans, FHA does not set geographic or income limits.

Are USDA loans good for first-time home buyers?

Yes, USDA can lower the barriers to homeownership by offering no down payment loans and less stringent credit requirements compared to conventional loans all while still offering competitive loan rates.

Do all lenders issue USDA loans?

No, but many do. USDA like FHA and VA is a widely used mortgage program.

Does the USDA set loan limits?

No, but your mortgage underwriters will cap your loan size based on your credit profile and ability to make payments.

What credit score do I need for a USDA loan?

In most cases you need a FICO score of 640 or higher to get USDA loan approval. However, some lenders can make exceptions, especially if you have a low debt-to-income ratio . Be sure to check your credit report before applying so you can dispute inaccurate credit data which can pull down your score.

How can I get out of a USDA loan?

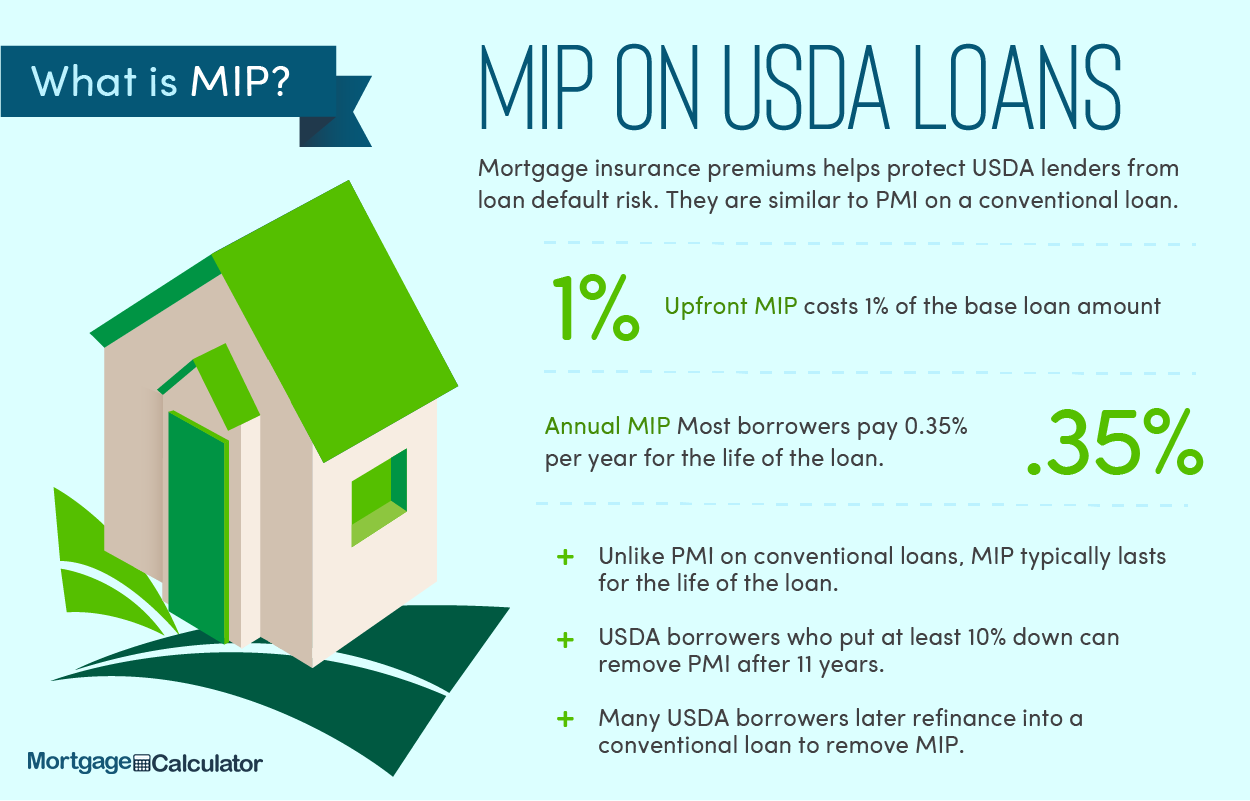

Youd need to pay off the loan or refinance it to a non-USDA mortgage. Refinancing into a conventional loan lets homeowners stop paying mortgage insurance premiums if they own at least 20% of the homes value as equity.

Can I use a USDA loan for a vacation home or investment property?

Does Usda Offer A Streamline Refinance Program

Yes. To qualify, the borrower must currently have a USDA loan currently and must live in the home. The new loan is subject to the standard funding fee and annual fee, just like purchase loans. Refinancing borrowers must qualify using current income but may qualify with higher ratios than generally accepted if the payment is dropping and they have made their current mortgage payments on time.

If the new funding fee is not being financed into the loan, the lender may not require a new appraisal.

Also Check: How To Read A Transunion Credit Report

Usda Loan Location Requirements

The USDA loan is designed to help those in rural areas purchase a residential home. Fortunately, the USDAs definition of rural is generous and many suburbs qualify.

According to the USDA, rural areas are defined as open country, which is not part of an urban area. There are also population requirements that can reach up to 35,000 depending on area designation.

The agency’s broad definition makes approximately 97% of the nation’s land eligible for a rural development loan, which includes an estimated 100 million people.*

Find USDA-eligible properties in the US.

How Usda Loans Work

Using a USDA loan, buyers can finance 100% of a home purchase price while getting access to better-than-average mortgage rates. This is because USDA mortgage rates are discounted as compared to other low-down payment loans.

Beyond that, USDA loans arent all that different from other home loan programs.

The repayment schedule doesnt feature a balloon or anything non-standard the closing costs are ordinary and, prepayment penalties never apply.

The two areas where USDA loans are different is with respect to the loan type and down payment amount.

- With a USDA loan, you dont have to make a down payment. This is one of only two major loan programs that allow zero-down financing

- The USDA loan program requires you to take a fixed-rate loan. Adjustable-rate mortgages are not available via the USDA rural loan program

Rural loans can be used by first-time home buyers and repeat home buyers alike. Homeowner counseling is not required to use the USDA program.

You May Like: How To Up Credit Score

Usda Loan Credit Requirements 2022

The main aspects of a credit report that is evaluated to determine borrower eligibility for USDA loans are credit scores and credit history. The credit history evaluation analyzes the depth of your credit , the payment history on all accounts, and any potential derogatory marks such as collections, tax liens, and judgements.

The minimum credit score required for an automated approval is a 640. If your credit score is below a 640, you may still get approved, but your application will have to be manually underwritten and approved. Also, if your credit score is a 660 or higher, you may be able to receive exceptions for certain disqualifying aspects of your application. Having higher credit scores is considered a compensating factor, which can help improve the overall strength of your USDA loan application.

Trade-lines The USDA recently implemented new rules related to trade-lines. An applicant must now have at least 3 trade-lines. Only 3 are required if one can provide proof of the last 12 months rental history . If rental history can not be furnished, 4 trade-lines will be required. The great news though is that non-traditional sources are allowed . This can include anything from health insurance, utilities , cell phones, cable, internet, and other monthly obligations which payments have been made on time.

Usda Loan Credit Score Minimum Steps

- Step 1: Visit the usda minimum credit score 2021 official website of the bank usda loans credit score needed

- Step 2: Log into usda loan credit score minimum internet banking portal with your user ID and password.

- Step 3: Select Card Activation

- Step 4: Type in your credit card number, your date of birth, and the expiry date.

- Step 5: Select Submit

Recommended Reading: Texas Fha Loan Limits 2020

Don’t Miss: How To Remove Multiple Late Payments From Credit Report

What Is A Usda Loan

Quick Answer

Through December 31, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

USDA loans are low-interest mortgage and home improvement loans that low-income suburban and rural homebuyers can get with no money down.

Issued through the U.S. Department of Agriculture , these single-family home loans are designed to help buyers with lower-than-average incomes and less-than-ideal credit get into homes of their own. They are also intended to help spur sales of properties with values considerably lower than those in their local markets. Even in today’s hot housing market, if you’re moving to a rural or suburban area, a USDA loan could help you get into a home of your own.

Type Of Usda Loan Program

There are two types of USDA loans: USDA guaranteed loans and direct loans. The difference between the two lies in how you obtain the loan and the income level requirements of each loan.

Loan Guarantees And Requirements

USDA guaranteed loans work in a similar fashion to other government-backed loans, such as FHA loans and VA loans: the USDA insures the loan, but the loan itself is obtained through a participating lender. The lender will typically relax their criteria for eligibility since the loan is backed by the USDA. This eliminates the risk of losing money if the borrower defaults on them.

Despite the USDAs backing, there are still a number of requirements that must be met. Besides proving that youre a U.S. citizen or permanent resident, the estimated monthly payment for your house cant cost more than 29 percent of your monthly income. Any other monthly debts you have to pay cant exceed 41 percent of your income. However, there is some flexibilityif your credit score is higher than 680, then they will consider higher debt ratios.

There are some income limits as well. Your base income limit must be less than 115 percent of the areas median income. There are also a few household income limits you must meet. For a household with four or fewer people, your household income cant be more than $82,700. For households with five to eight members, it cant be more than $109,150. Finally, the property must be your primary residence.

Direct Loans And Requirements

Don’t Miss: How Can You Remove A Collection From Your Credit Report

What Factors Determine Your Credit Score

Payment History 35%: How well you pay your bills on time has the biggest impact on your credit score. If you have multiple 30-day late payments or 60,90 or 120 late payments you will see a huge drop in your credit score. However, if youve made your payments on time for years, youll see a much higher credit score.

Utilization Rate 30%: The next largest factor is how much you are using your available credit. Are your credit cards maxed out? Do you run high balances on them? Once you keep a balance of 30% of your credit limit or higher on your cards, your score begins to decrease.

How long youve been making debt payments also has an effect on your credit score. This is why its never a good idea to close a credit card or other credit account if youve had it for a long time. Closing the account will lower your average age of accounts and negatively impact your credit.

Your credit mix is the types of credit you have. In order to get the most out of your credit score, youll want to have a mixture of revolving accounts, like credit cards, and installment loans, like car payments.

New Credit 10%: Finally you need to keep an eye on how much new credit you open at one time. If you go on a credit spree opening a bunch of new accounts, this can cause your scores to drop. Obtaining a lot of new credit can be a red flag to lenders that you may be desperate or unable to make ends meet.