Why Is It Important To Check My Credit Report

Its important to check your credit report because credit reporting mistakes happen. They can be the result of a creditor reporting inaccurate information or a sign of identity theft. If the error lowers your , it can decrease your approval odds when applying for a loan and it could prevent you from securing the best rate.

Here’s Where To Check Your Fico Score

FICO Scores are generally the most widely used scoring models used by 90% of the top lenders in the U.S., its website says. In other words, when you go to apply for a new credit card or take out a loan, you can almost be sure that the card issuer or lender will look at your FICO Score to determine your creditworthiness.

Here’s where to check your FICO Score:

-

13 points, though results vary

How to sign up for Experian Boost:

How To Check Your Credit Report

Its best practice to frequently check your credit reports, which serve as a kind of financial resume outlining all of your money matters. Credit reports can help you keep track of your debts and check for signs of identity theft.

Thanks to the Fair Credit Reporting Act , you can always request one free credit report a year from each of the three big credit bureaus Experian, Equifax and TransUnion online at AnnualCreditReport.com. The three credit bureaus typically charge for each additional report beyond the free annual one, but because of the pandemic, youre now allowed to pull a credit report for free each week until April 20, 2022.

Heres everything you need to know about getting your credit reports.

Recommended Reading: 877-392-2016

Can I Buy A House With A 684 Credit Score

As mentioned above, a 680 credit score is high enough to qualify for most major home loan programs. That gives you some flexibility when choosing a home loan. You can decide which program will work best for you based on your down payment, monthly budget, and longterm goals not just your credit score.

Check And Monitor Your Credit Reports And Credit Scores

Now that you know why your credit is so important, you can see why itâs a good idea to check and monitor your credit. But how do you do it?

How to Request Free Copies of Your Credit Reports

You can get a free copy of your credit report from each of the three major credit bureausâEquifax, Experian and TransUnionâby visiting AnnualCreditReport.com. Youâll need to provide your:

- Legal name.

- Social Security number.

- Current address.

If youâve moved in the past two years, you may need to include your previous address as well. There may be a limit on how often you can obtain your reportâcheck the site for details.

Once youâve provided the information above, youâll pick which credit reports you want before answering a few additional questions that help verify itâs really you. âThese questions are meant to be hard,â according to AnnualCreditReport.com. âYou may even need your records to answer them. They are used to ensure that nobody but you can get your credit information.â

How to Check Your Credit Scores for FreeâWithout Hurting Your Credit

Keep in mind that your credit scores donât actually appear on your credit reports. So what do you do if you want to check your scores?

Depending on your lender, you may be able to find your scores by checking your statement or by logging in to your account online. You can also get your scores directly from the credit bureaus and credit-scoring companiesâbut you might have to pay for them.

Related Content

Also Check: Chase Sapphire Required Credit Score

Full Credit Report Services

Remember

You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Recommended Reading: What Does Leasing Desk Score Mean

Indias Cut In Credit Rating

Indias credit rating has moved one step closer to junk after Moodys Investors Service had downgraded the country to a low investment grade level and had also surprised the economists.

Moodys had reduced the long-term foreign-currency credit rating to Baa3 from Baa2, and this implies that it can get cut further. This action brings it in par with the BBB- assessment from Fitch Ratings Ltd and S& P Global Ratings. The economy is now facing a huge contraction in over four decades.

4 June 2020

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

Don’t Miss: Does Affirm Report To Credit Agencies

American Express Mycredit Guide

Available even if you are not an American Express customer. All for free.

Not a Card Member?

Why MyCredit Guide?

We believe everyone should know their credit score and have the tools to understand it better. That’s why we’re giving you VantageScore® 3.0 by TransUnion, and the key factors that affect your score.

Using MyCredit Guide won’t hurt your credit score.

Use it as often as you like, it wont affect your credit score.

There is no cost to using MyCredit Guide.

We provide a secure login that helps keep your information safe.

MyCredit Guide offers you tools and information to help you take charge of your credit.

In addition to your credit score, get a detailed TransUnion credit report that helps you stay informed.

Alerts

We will let you know if there are any changes to your TransUnion credit report to help detect identity theft. Alerts include address updates, new inquires on your credit report, new accounts opened, and more.

See how different actions like paying down debt or opening a new account, could affect your score.

Can I See My Credit Report

You can get a free copy of your credit report every year. That means one copy from each of the three companies that writes your reports.

The law says you can get your free credit reports if you:

- go to AnnualCreditReport.com

Someone might say you can get a free report at another website. They probably are not telling the truth.

You May Like: Syncb Ppc Account

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Don’t Miss: Does Speedy Cash Check Your Credit

What Your Credit Report Will Tell You

Your credit report contains identifying information, credit history information and public records. For example, your report may include:

- Identifying information Including your name, date of birth, current and previous addresses and telephone numbers, social insurance number, and employment information.

- Listing of your credit accounts and transactions, debt sent to collections, banking information, and a list of parties requesting your credit information.

- Public records Listing of items that could affect your ability to obtain credit, such as filing for bankruptcy and court judgements.

Learn more about what is included in your credit report.

How To Sign Up For Infoalerts

Your TransUnion Credit Score is provided by TransUnion Interactive, Inc. and is brought to you by Scotiabank at no additional charge. Accessing your TransUnion Credit Score will not impact your Credit Score. Scotiabank is not responsible for the TransUnion Credit Score or any of the information provided to you through TransUnion’s Credit Score services.

To access your TransUnion Credit Score, Scotiabank will share your personal information such as name, address and date of birth with TransUnion so that TransUnion can identify you and provide your Credit Score. Your information will not be used or disclosed by TransUnion for any other purposes.

The TransUnion Credit Score service is subject to certain terms and conditions that can be viewed here Terms of Use.

Read Also: Is 775 A Good Credit Score

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Difference Between Credit Reports And Credit Scores

While your credit score and credit report are related, they’re not the same thing. Your credit score is a single three-digit number that signals your credit health to lenders and creditors. Your credit report doesn’t include your credit score. The report, which includes credit activity, is used to calculate your credit score.

Recommended Reading: How Long Does Car Repo Stay On Credit

How Do I Establish A Good Credit Rating

The easiest way to establish a good credit rating is to pay your bills on time. If you don’t have a credit card, apply for one, and use it responsibly. If you make your minimum payments, you can develop a good credit history. This will have a positive impact on your ability to borrow in the future.

To find out more about establishing credit, talk to a CIBC advisor.

What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

Read Also: How Long Does Repo Stay On Credit Report

Coronavirus Credit Score Survey & Tips To Protect Your Score

The coronavirus pandemic may be disastrous for Americans credit for years to come. The unprecedented level of unemployment has left many people struggling to pay essential bills and charging more to their credit cards, which is concerning because total U.S. credit card debt already stood at over $1 trillion at the beginning of the year. As peoples credit utilization rises and they miss payments, its unsurprising that 87 million Americans are worried about their credit scores due to the coronavirus, according to a recent nationally representative WalletHub survey.Below are more highlights from the survey, along with tips to protect your score during the crisis.Key Stats

- Many Americans fear credit score damage: 87 million Americans are worried about their credit scores due to the coronavirus. Some of the most worried groups include middle-income people, the 30-44 age bracket and people with fair credit.

- Americans want missed payment forgiveness: 86% of Americans agree that credit scores should ignore any missed payments during the coronavirus pandemic.

- Housing payments take precedence: 58 million Americans are most worried about paying their mortgage or rent during the coronavirus pandemic, followed by 46 million most worried about paying their credit card bill.

- Women anticipate more debt: Women are 21% more likely than men to expect to get into more debt during the coronavirus pandemic.

How to Protect Your Credit Score During the Coronavirus PandemicSurvey Methodology

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free credit report if

- you get a notice saying that your application for credit, employment, insurance, or other benefit has been denied or another unfavorable action has been taken against you, based on information in your credit report. Thats known as an adverse action notice. You must ask for your report within 60 days of getting the notice. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

If you fall into one of these categories, contact a credit bureau by using the below.

Also Check: Does Paypal Credit Show On Credit Report

Summary Of Moneys Guide On How To Get Your Credit Report

- AnnualCreditReport.com is the best place to start to get your free credit reports from Equifax, Experian and TransUnion all in one spot.

- Because of the pandemic, Equifax, Experian and TransUnion are all offering free weekly credit reports also available through AnnualCreditReport.com until April 20, 2022.

- If you have exhausted all of your free credit reports from the major bureaus, you may contact them directly to purchase additional reports. They legally cant charge you more than $13 per report.

- While Equifax, Experian and TransUnion are the most popular credit bureaus, theyre not the only places to provide credit reports. According to the CFPB, you are also eligible for free annual credit reports from dozens of other credit-reporting agencies, most of which specialize in a niche credit topic.

Chris Huntley contributed to this article.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Recommended Reading: Credit Score To Qualify For Care Credit

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

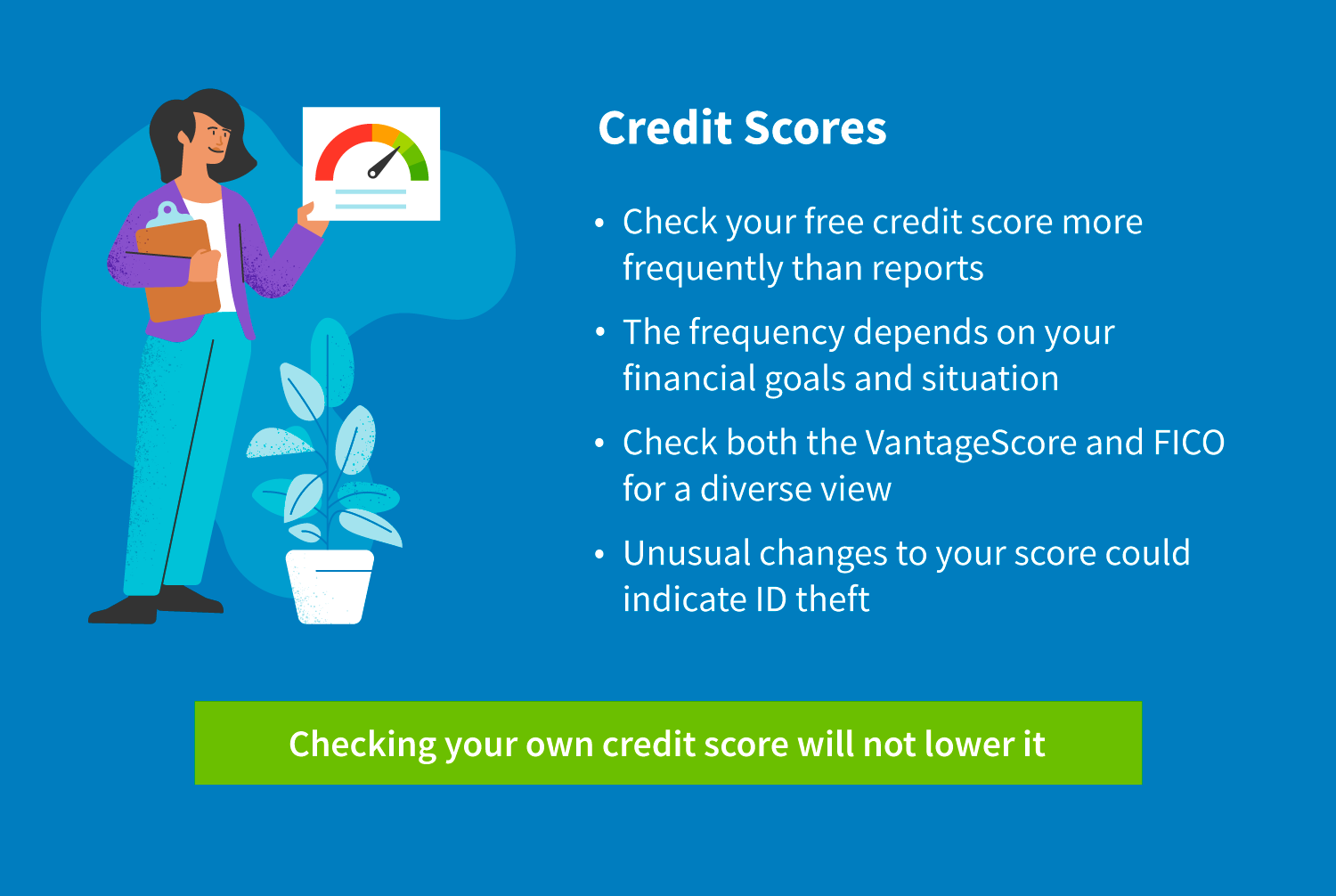

How Often Can You Check Your Credit Score Without Hurting It

How Often Can You Check Your Credit Score? You can check your credit score as often as you want without hurting your credit, and it’s a good idea to do so regularly. At the very minimum, it’s a good idea to check before applying for credit, whether it’s a home loan, auto loan, credit card or something else.

Read Also: Aargon Com

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.