How To Remove Late Payments From A Credit Report

Posted onMay 24, 2021

Have you missed some credit payments? Have late payments noted on your credit report? Want them removed? What are your options? Can you request they are removed once youre back on track? These are all questions our Glen Morris auto loan team have fielded over the past few months and we thought the subject of how to remove late payments from a credit report would make for an interesting blog post.

What Is A Goodwill Letter

A goodwill letter is sent to the creditor that reported your late payments with the goal of having them remove the derogatory information.

Since negative reporting can stay on your credit report for seven years, its not difficult to understand how impactful a successful goodwill letter could be. If you were able to send a goodwill letter that results in late payments being completely removed from your credit reports, you could potentially enjoy a healthier credit score for years to come.

Note that goodwill letters are sent as a way of apologizing for your late payment, but also explaining your intentions to pay all your bills on time going forward. If a late payment is incorrectly reported on your credit report, you should instead take steps to dispute incorrect information with the three credit bureaus Experian, Equifax and TransUnion. To help in that respect, check out Bankrates .

When you send a goodwill letter, youre not asking the credit bureaus to do anything. Instead, youre asking a creditor like a credit card company, your auto loan provider or even your mortgage company to erase the late payment and give you a second chance. Theres no guarantee that a goodwill letter will work, but you have nothing to lose by asking for some relief.

Filing A Small Claims Lawsuit Against The Creditor

Finally, if the first three steps do not yield results, I often help my clients file a small claims suit.

Heres whats great about this I have seen many judges rule in a consumers favor if they can prove wrongdoing by the creditors. Research your states civil code to see what violations were committed pertaining to credit reporting. Also check for breach of contract, or unfair business practices.

Thats not allSmall claims court also requires consumers to show monetary damages. Proof of monetary damages could include documentation that a consumer was turned down for credit. It could also be that they received unfavorable financing terms due to the specific late payment.

Something to remember when trying to remove remarks from credit reports via legal action

But make no mistake, simply filing a suit will not make the creditor buckle. The case has to be strong and well documented. What you may find surprising is, even in the event the creditor does not show up to court, the judge will still look at the merits of the case and rule accordingly.

I normally recommend hiring an experienced professional if you are going to go down this path. This is due to the complexities involved with filing and winning a small claims case to erase your late payment,

Also Check: Which Credit Bureau Does Usaa Use

Change Due Dates Or Consolidate If Helpful

Most credit card issuers such as Capital One and Discover will let you change your due date to avoid payment conflicts with other bills such as your rent or auto loan payment.

Sometimes a simple change like this can create the relief you need to keep your credit score on the up and up.

You could also consider consolidating several smaller credit card balances into one larger credit card or personal loan.

Youd have fewer due dates to remember, and you could probably pay less in interest charges, too.

Why Do I Have A Late Payment On My Credit Report

Generally speaking, there are two main reasons why late payments appear on credit reports. The first is that you were late making a payment or missed the payment entirely, and the second is that a creditor mistakenly reported a missed payment.

If a missed payment was mistakenly reported, the error can be relatively easy to fix. If you missed a payment and are at fault, itll be a lot more difficult to have that late payment removed from your credit report.

You May Like: What Credit Score Does Les Schwab Require

How Late Payments Can Affect Your Credit Scores

As your payment history is one of the most important credit scoring factors, even a single late payment can have a big impact on your credit scores. The number of points your score will drop will depend on your overall credit profile.

If you had excellent credit, you might see a big drop in your scores after a single late payment. Your score may continue to drop as you fall 60, 90, 120, etc. days behind.

But those who already have poor credit might not see as much of an impact from one additional late payment because its not necessarily a major change in their behavior. The previously low credit score may have already calculated in that they were likely to fall behind on a payment in the future.

Catching Missed Payments Early

If you do miss a payment, its important that you catch it early. Most issuers only report credit activity approximately every 30 days. This means if you catch the late payment early and rectify your account, the issuer may not report it to the credit agency. While youll likely still get hit with a late payment fee and possible penalty APRs, in this case your credit score wouldnt suffer.

If you do notice a late bill, its still worth a call to your issuer to make sure it wont end up on your account. I know Ive certainly flubbed on a due date this year because I got due dates mixed up on a new credit card.

Related: How to check your credit score

Don’t Miss: 686 Fico Score

Get The Mortgage Late Removed From Your Credit Report

- If you can get the mortgage late removed from your credit history

- Your credit scores may surge higher as a result

- And you wont have to worry about underwriting restrictions

- Most mortgage lenders wont extended financing with prior late mortgage payments present on your credit report

Youll likely need to get those late mortgage payments removed from your credit report if you plan on financing any new lines of credit, especially if you plan on buying a new home, or refinancing your current mortgage.

Assuming you still qualify for a mortgage with the late payments, youll be stuck paying a premium in the form of a higher mortgage rate.

So its a problem either way. Now about getting those lates removed. If your mortgage late is substantiated, there is little you can do about removing it from your credit history.

You got the late for a reason that was nobodys fault but your own, and you have to pay the price.

But if for any reason that mortgage late was the fault of the bank or lender, the loan servicer, or another third party, you can successfully get it removed from your credit report.

In reality, you can *attempt* to get the late removed either way, though youll probably see a higher rate of success if it wasnt really your fault.

Analyze Your Late Payments

In addition to keeping track of your daily charges and overall balance, you should analyze your credit history at least once a year. Each of the allows one free credit report copy every year. By requesting your free report from one of the credit bureaus every few months, you can ensure your credit is in good standing throughout the entire year without spending a penny.

When analyzing your report, any late payment you come across should be under seven years old. Although its rare, sometimes older delinquencies can remain on your report after their expiration period. If you do find an older late payment on your report, make sure to call the bureau and file a claim to get it removed.

You May Like: Raise Credit Score 50 Points

File A Dispute Directly With The Creditor

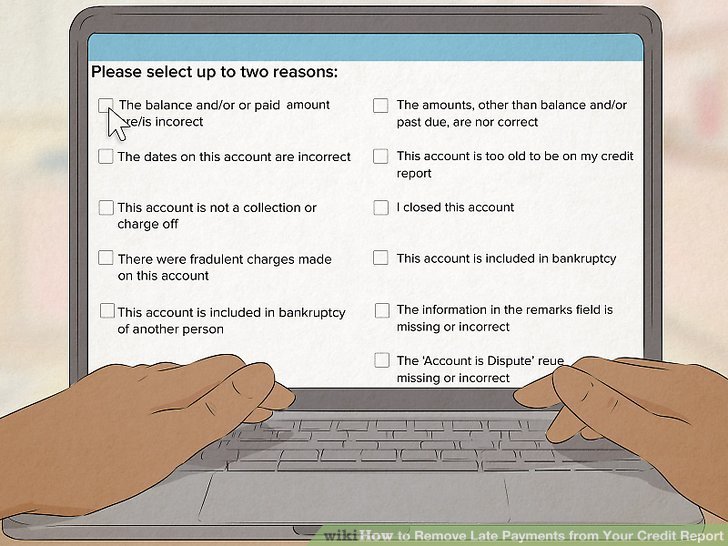

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. It’s also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

How To Get Navient To Remove Late Student Loan Payments

The best way to remove an unverified late payment from your credit report is by disputing it. First, you need to have Navient verify the claim’s details, and if they can’t, you can dispute it. The best way to dispute an unverified late payment on your credit report is with help from a credit expert like Credit Glory.

Also Check: How Often Does Capital One Report To The Bureaus

Late Payments With Fico Score 9 System

FICO revises its scoring model every few years, but lenders are not required to update their credit scoring systems. FICO Score 9 has been available since 2016 and is currently being used by hundreds of lenders. While late payments continue to have a detrimental impact on credit scores under FICO 9, paid collection accounts are handled differently.

- Paid collections. Collections accounts that have been paid in full are disregarded in score calculations.

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your record.

The NFCC can provide financial counseling, help review your credit history, help you create a budget and even a debt management plan free of charge. It also offers counseling for homeownership, bankruptcy and foreclosure prevention.

As always, be wary of companies that overpromise, make claims that are too good to be true and ask for payment before rendering services.

When looking for a legitimate credit counselor, the FTC advises consumers to check if they have any complaints with:

- Your states Attorney General

- Local consumer protection agencies

- The United States Trustee program

You May Like: When Do Closed Accounts Fall Off Credit Report

Borrowing With Poor Credit

Your scores will be lower if late payments remain on your credit reports, but that doesnt mean you cant borrow money. The key is to avoid predatory lenders who charge high fees and interest rates.

A cosigner may be able to help you get approved for certain types of loans. Your co-signer applies for a loan with you and promises to make the payments if you stop paying on time. Lenders evaluate their credit scores and income to determine their ability to repay the loan. That may be enough to help you qualify, but its risky for the co-signer, because their credit could take a hit if you make late payments.

Do Late Payments Always Show Up On Credit Reports

No, late payments wont always show up on your credit reports.

When a lender reports a late payment, they also classify the account as delinquent. Lenders are not allowed to report an account as delinquent to the credit bureaus until a payment is a minimum of 30 days past due. Even then, they may not choose to report the late payment until some more time has passed, basically as a favor to the cardholder.

There is some flexibility in when a payment might be reported as late. However, you should expect to be charged a late fee if your payment is not delivered on time, even if youre only one day late. Card issuers may waive this fee if you call and ask nicely, explaining that the late payment was a fluke . This late fee is separate from the issue of having late payments on your credit reports.

On credit reports, late payments are broken down into several categories. The later a payment is, within these categories, the worse the impact on your credit.

- 30 days late

- 120 days late

- 180 days late

Once your credit card is a full 90 days past due, the lender will often decide to sell the account to a collection agency and mark it as a charge-off. This means that the creditor has declared that the card debt is unlikely to be repaid, and its extremely bad for your credit.

Recommended Reading: How To Get A 900 Credit Score

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

Why Do Late Payments Show Up On Credit Reports

There are two basic reasons why a late payment might be shown on your credit reports:

In the first case, it may be possible to remove the late payment from your credit reports by filing a dispute. The credit bureaus dont want inaccurate information on their reports, so if your claim can be verified, theyll take steps to fix the problem.

In the second case, you may be able to have the late payment removed from your credit reports. This process basically consists of asking nicely, explaining your situation, and promising to be more responsible in the future. Theres absolutely no guarantee that this will work, and youll have better success if you have a positive payment history other than this blemish.

No matter how the late payment got on your credit reports, it usually will be worth your time to attempt to remove it.

In this article well discuss when late payments will show up on your credit reports, and why you should remove them if you can. Then well go over the actual steps of how to dispute an inaccurate late payment, and how to ask lenders to remove legitimate late payments from your reports.

MoneyHackAvoid Scams

Many credit repair companies offer to fix your credit fast for a price. They claim miraculous results. The truth is, they have no special privileges or access.

Recommended Reading: Carmax Installment

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

What If Its Not A Mistake

If you made a late payment and it shows up correctly on your credit reports, your chances of getting it removed are slim.

According to a TransUnion spokesperson, If late payment information is indeed accurate and properly reported by a lender, then it cannot be removed from a consumers report by the credit-reporting agency.

You may hear about ways to get an accurately reported late payment removed from your credit reports, but you should know that these methods are probably a scam.

Ultimately, you can avoid late payments on your credit reports by making sure you pay your bills on time and in full. One tip is to set up automatic payments for your credit accounts.

If you do pay late and a late payment ends up on your credit reports, you may be stuck for seven years until the late payment falls off. But its likely that the longer its been, the less impact a late payment can have on your credit, especially if youve since been working on building your credit with responsible use.

You May Like: What Is A Factual Data Credit Inquiry

Faqs On How To Remove Late Payment Records Of Credit Card From Credit Report

Yes, late payment records lower your credit score making it harder to get approvals for loans.

A late payment record will remain for seven years on your credit report from the date it was reported.

A late payment is reported if you fail to pay your outstanding balance within 30 days after the due date.

Your credit score can reduce by up to 100 points due to a late payment record.

If an incorrect late payment has been reported even if you made the payment on time, you will have to file a dispute with the credit bureau. The credit bureau, after investigation, will remove the late payment record if your dispute has been proved right.