What Is A Good Credit Score Range For Buying A Home

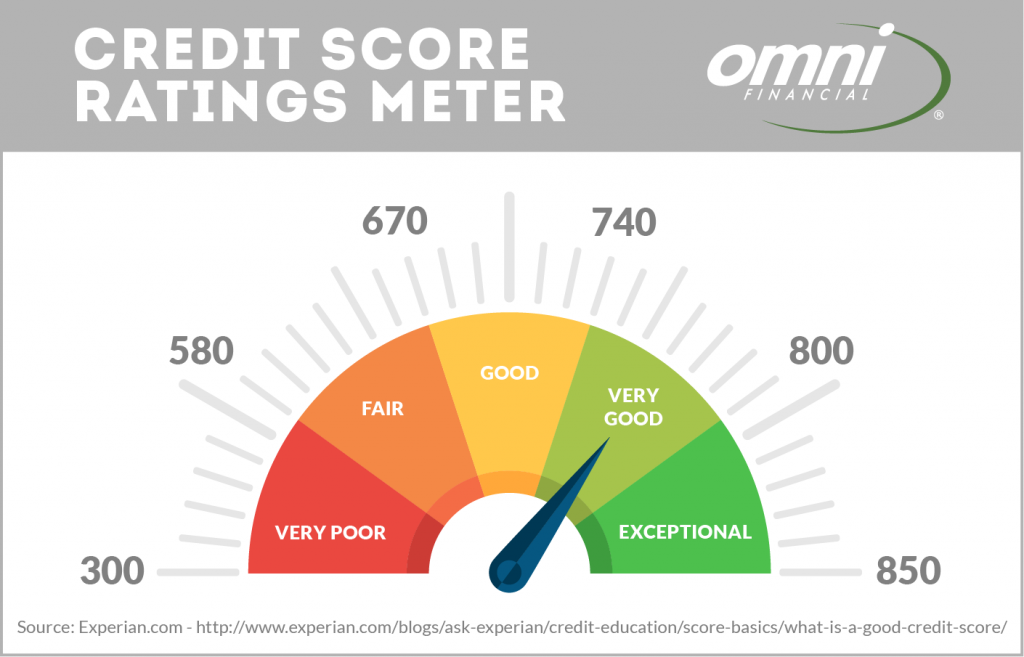

If your credit score range is between 740 and 850, you are likely to have the widest range of choices and the most attractive interest rates for your mortgage loan. Most lenders determine mortgage rates by credit score, making it less likely to achieve low interest rates if your FICO® scores are below 740.

You might still be offered a mortgage loan with lower scores, but the terms may not be as favorable. You could also be approved for a lower mortgage amount than the sum for which you originally applied.

The Federal Housing Administration may also be an alternative for first-time home buyers who meet certain criteria. If you are wondering how to buy a home with bad credit, an FHA loan may be the answer for you. Some of the primary requirements for an FHA mortgage include the following:

- You must provide a down payment of at least 3.5 percent of the homes value.

- You must be a legal resident of the U.S. with a valid Social Security number.

- Your debt-to-income ratio, including all outstanding loans and your new mortgage, must usually be 43 percent or less.

- You must have worked for the same employer for at least two years or have a generally stable employment history to qualify.

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

How Credit Scores Are Calculated

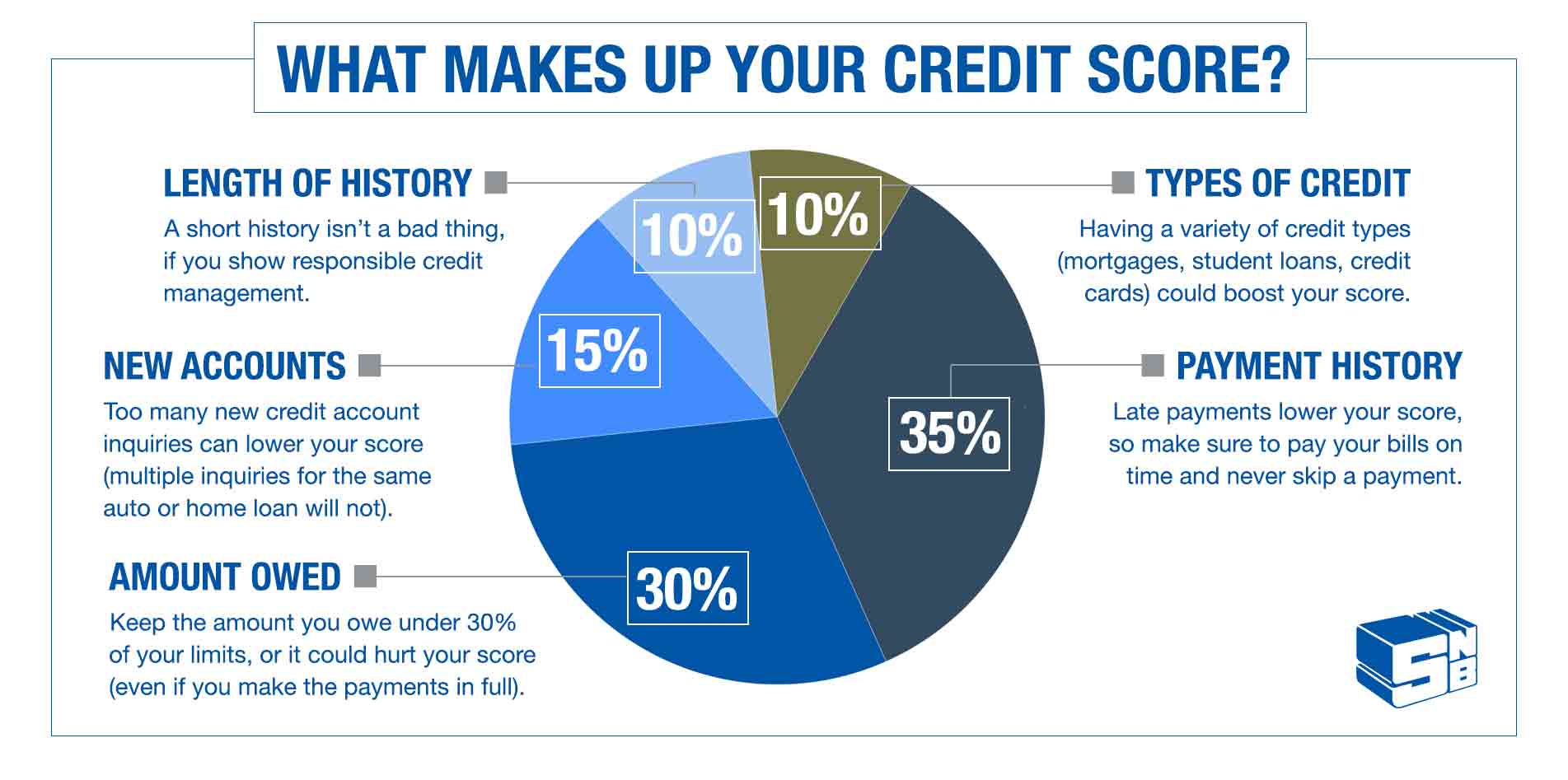

There are several factors that each credit bureau uses to calculate your credit score, and understanding them can help you maintain or improve your credit. These factors are:

Of those five categories, payment history and credit utilization carry the most weight. Length of credit history, new credit, and credit mix all play a smaller role. They’re still important, but not as important as the top two.

Also Check: How Long Does A Derogatory Stay On Your Credit Report

Why Your Credit Score Is Important

Your is important because lenders use this three-digit number to determine how risky of a borrower you may be. The higher your credit score is, the greater your chances are of qualifying for a loan and securing the best interest rate. Typically, the best rates and loan terms are reserved for people who have good credit .

During your lifetime, a good credit score can help you save a ton of money in interest. It can also help you avoid some fees. For example, if you took out a personal loan, a high credit score could help you avoid personal loan origination feesfees charged to process the loan.

However, If you have a bad credit score or minimal credit history, you might not meet a lenders minimum credit scoring requirements. This can prevent you from getting access to the cash you need. You most likely would need to apply for a loan with a co-signer or co-borrower to qualify, or you can explore bad credit personal loans.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Read Also: How To Get Annual Free Credit Report

Vantagescore Credit Score Ranges

Launched in 2003, VantageScore is a joint venture between the three major credit reporting agenciesEquifax, TransUnion and Experian. Although FICO Scores are the most popular choice among lenders, VantageScore credit scores deserve your attention too.

VantageScores use a 300 to 850 credit score range. Just like FICO Scores, the higher your credit score on the VantageScore scale, the lower the risk you represent to lenders.

More Interest Rate Hikes

The Federal Reserve has already started a measured series of interest rate increases designed to tame increasing inflation, which reached 40-year highs in 2022. This series of hikes will cascade through the financial system, increasing the borrowing rates for credit cards, personal loans and mortgages by varying degrees.

Rate increases, in turn, have the potential to slow the rise of housing prices. The Fed increases are already impacting mortgage rates: The average conventional 30-year mortgage rate exceeded 5% in April 2022, the highest it’s been since 2010. And even though housing supply is still limited, prospective new homebuyers won’t be able to qualify for homes they otherwise might at lower rates. This could slow down the double-digit home price increases in some markets as more buyers are priced out of the market.

Recommended Reading: Why Did My Credit Score Go Up

Having A High Credit Score Could Give You Access To More Favorable Loans Credit Cards And More

Good credit. You mayâve heard the term more times than you can count. Thereâs a reason for that.

Itâs because credit can touch many parts of your life. For example, it may impact where you live, how much money you can borrow and how certain employers may view your job application. Read on to take a closer look at the benefits of good credit and how you could work on improving your own.

How Can I Maintain My High Credit Score

Paying your bills on time is one of the most important steps in achieving and keeping a high credit score. If you don’t make on-time payments, you may incur a late payment fee, a penalty interest rate and ultimately risk damage to your credit score.

“The same is true for overutilization of available credit, even at times when payments are being made as agreed,” McClary says. “The best way to preserve a top credit rating is to be aware of the practices that could cause a score to drop and be especially careful to avoid them.”

Some steps you can take to prevent late payments include automating them, setting reminders or changing to a due date that works best for you.

And when it comes to just keeping your overall credit score healthy and you happy, McClary recommends maintaining balances below 30% of the assigned and avoiding the urge to apply for too much credit all at once.

Once you learn how to maintain an excellent credit score, you can enjoy qualifying for the best reward cards, like the Blue Cash Preferred® Card from American Express, which earns cardmembers 6% cash back at U.S. supermarkets on up to $6,000 per year in purchases , 6% on select U.S. streaming services, 3% cash back at U.S. gas stations and on transit and 1% cash back on other purchases. Terms apply. That’s a lot of money back in your wallet just for having a healthy credit.

Editorial Note:

Also Check: Is 583 A Good Credit Score

How To Earn A Good Credit Score:

If you currently have a credit score below the “good” rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

You May Like: Will Applying For A Credit Card Hurt My Credit Score

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

What Is A Good Credit Score For A Mortgage

Your credit score arguably matters more on a mortgage application than with any other type of personal financing. With a mortgage, a good credit score might save you thousands of dollars in interest every year.

For example, say you have a FICO credit score around 640 when you apply for a $350,000 mortgage. FICOs Loan Savings Calculator estimated that in June 2020, your APR would be around 3.957% on a 30-year, fixed-rate loan. Your monthly payment would be $1,662, and youd pay $248,424 in interest over the life of your loan.

Now, imagine you work to improve your FICO Score to 680. With the higher score, you might qualify for an APR of 3.313%. Based on the lower rate, your monthly payment would be $1,535 for the same home. You would pay $202,726 in interest over your 30-year loan term. Because you improved your credit score from fair to good, you would save:

- $127 per month

- $1,524 per year

- $45,698 over the life of the loan

If youre aiming to qualify for a mortgage lenders lowest rates, that generally falls under a FICO Score of 760 or higher. Of course, getting a great mortgage rate requires more than just a brag-worthy credit score. But the three-digit numbers sold alongside your credit reports are a key factor that mortgage lenders consider when you apply for financing.

Read More:How Your Credit Score Affects Your Mortgage Rates

Also Check: How Long Do Inquiries Last On Your Credit Report

Avoid Security Deposits On Utilities

Security deposits are sometimes $100 to $200 and a huge inconvenience when youre relocating. You may not be planning to move soon, but a natural disaster or an unforeseen circumstance could change your plans. A good credit score means you wont have to pay a security deposit when you establish utility service in your name or transfer service to another location.

How A Good Credit Score Can Help You

A credit score is a numeric representation, based on the information in your , of how risky you are as a borrower. In other words, it tells lenders how likely you are to pay back the amount you take on as debt.

In general, the higher your scores, the better your chances of getting approved for loans with more-favorable terms, including lower interest rates and fees. And this can mean significant savings over the life of the loan.

Having a good score doesnt necessarily mean youll be approved for credit or get the lowest interest rates though, as lenders consider other factors, too. But understanding your credit scores could help you decide which offers to apply for or how to work on your credit before applying.

Recommended Reading: Will Paying Off Derogatory Accounts Raise Credit Score

What Is A Credit Score Anyway This Number Really Does Matter

We’ll break down the basics, from defining a good score to why it’s important.

Dori Zinn

Contributing Writer

Dori Zinn loves helping people learn and understand money. She’s been covering personal finance for a decade and her writing has appeared in Wirecutter, Credit Karma, Huffington Post and more.

Grades aren’t only for the classroom. You have a grownup grade that’s foundational to your financial life: It’s your credit score. And just like grades, having a better credit score can help you get you ahead in life.

Whether you need to score a mortgage, buy a car, qualify for a , refinance student loans or rent an apartment, it’s all based on your credit score. If you aren’t familiar with credit scores and how they impact nearly every facet of your financial life, here’s a primer.

Read more: The best credit monitoring services

What A Good Credit Score Can Get You

Having good credit matters because it determines whether you can borrow money and how much you’ll pay in interest to do so.

Among the things a good credit score can help you get:

-

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

-

A desirable car loan or lease.

-

A mortgage with a favorable interest rate.

-

The ability to open new credit to cover expenses in a crisis if you don’t have an emergency fund or it runs out.

A good credit score helps in other ways: In many states, people with higher credit scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

So having a good credit score is helpful whether you plan to apply for credit or not.

If your credit score is below about 700, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate. Read about what rates to expect with your score.

You dont need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you wont repay as agreed, so lenders do reward higher scores with lower interest rates. Read about your mortgage options by credit score tier.

Landlords or property managers generally aren’t looking for immaculate scores, they are interested in your credit record. Learn more about what landlords really look for in a credit check.

Read Also: How To Get Transunion Credit Report

What Is An Excellent Credit Score

You probably already know that your credit score is a three-digit number based on the information in your credit report, which includes items like your loan payment history and credit card balances. Multiple companies have models that calculate credit scoresFICO and VantageScore, for example, which both operate on a scale from 300 to 850.

Generally speaking, a higher credit score can translate to cost savings, perks and more. Your credit score is a key factor considered by lenders, so a better score can help you get more credit at attractive interest rates . Landlords and employers can also check your credit score as part of their due diligence process. And some of the best reward credit cards are only available to those with the highest scores.

So how high should you aim? Getting a perfect score is extremely difficult, so many credit overachievers strive for a score in the high 700s or 800+. That puts you squarely in the highest range for most credit scoring models .

If youre nowhere close, dont worrythe tips below will still help you improve your credit score over time. You can actually reap many of the benefits listed above with a score thats considered good. But if good doesnt cut it, read on for your roadmap to excellent credit.

Check Your Credit Reports

The three credit reporting agencies, active in many countries, are Experian, Equifax, and TransUnion. Theyre the companies that keep detailed records of your credit and make it available to people that request it.

Thanks to the Fair and Accurate Credit Transactions Act, all three companies are required to provide U.S. residents with a copy of their credit report if requested, once per 12 months.

They do so through the website AnnualCreditReport.com thats the only source for free credit reports authorized by this Act. They dont show you the scores for free, but they show you their records of your payment history, so you can check to make sure there are no mistakes. The website lets you check your detailed report one time from each of the three credit rating agencies per year.

If youre planning on making a big purchase, or if you are fixing severely bad credit or found some mistakes in one report, then you might want to check all three at once. On the other hand, if youre more in maintenance mode and just want to check your credit regularly for errors, then the optimal strategy is to check your report from one of the agencies every 4 months. That way, you can spread your three free reports out evenly over the year for the most up-to-date info.

You can also pay a fee to receive more information on that site, like the actual score, but there are better free ways to do that:

Read Also: Is 779 A Good Credit Score