The Average Length Of Your Credit History Will Decrease

While new card accounts often lower your credit score about five points, it typically rebounds in a few months. However, if you frequently open new cards, the negative effect can add up.

For example, if you opened the;Chase Freedom® in 2010 and then the Citi® Double Cash Card today, the average length of your credit history would decrease from 10 years to 5 years.;That’s a significant difference and may cause your credit score to drop, especially if you open several accounts within a short time period.

You should also aim to keep your oldest credit card open since it increases the average length of time you have credit. If you don’t frequently use your oldest card, it may become inactive. The easiest fix for this is to maintain an active account by putting a small recurring charge on your card and setting up autopay.

What About Lock Periods

Once youre preapproved, youll begin a lock period. A lock period is the number of days that a rate will be guaranteed by your mortgage lender, typically from 45 to 60 days. It helps you lock in your interest rate when you close within the lock period, even if mortgage rates nationwide go up.

Many mortgage loan officers still recommend that you avoid opening any new loans or credit cards. The lock period is only good for your preapproved loan amount and property type. If you decide you want to make a change or if your closing date is after your lock period, your rate may change.

Focus On The Big Picture And Your Credit Score Will Take Care Of Itself

FICO rewards good credit behavior. That mean making your payments on time and staying well below your credit limits. As long as opening a new account with a credit card company doesn’t negatively impact either of those behaviors, your credit score shouldn’t be much of a problem for any loans or credit applications in the future.

In fact, opening a new credit card now can help improve your credit score to the point where it needs to be when you want to get the best interest rate possible on a mortgage or auto loan.

Opening a new account of any kind can produce a small ding on your credit report, but the more important factors simply outweigh the potential negative impact from getting a new credit card.

More From The Motley Fool

You May Like: What Credit Report Does Comenity Bank Pull

Does Opening A New Credit Card Hurt Your Credit Score

Learn what affects your credit score when opening a new card. Boost Your Credit Score

From unsolicited offers in the mail to the cashier offering you a 15 percent discount if you open a store card, people are constantly being bombarded by new credit card offers. As tempting as it might be to open a new credit card each time youre offered one, you need to consider the impact itll have on your credit score.

Keep reading to see if opening a new credit card will mess up your credit score.

Should You Close Old Credit Cards

If you have an old credit card that you rarely use, you might think the best option is to get rid of it. After all, why keep an account you never touch?

Reality is a little more complicated, though. When you close a credit card, you lose access to that credit line and your credit utilization can increase . The overall age of your credit also drops, since that account no longer factors into your score. The result is that your score could actually decline in the months following your account closure. Because of that, you may want to keep your old accounts open if you plan to apply for new financing soona mortgage or car loan, for example.

However, there are circumstances in which it may be best to close the account, particularly if you aren’t applying for a new loan or card anytime soon. If your card has a high annual fee or high interest rate, you may want to close it in favor of getting a more competitive card down the road. You might also want to close the account if you find that you’re overspending on it and racking up more debt than you can afford.

Read Also: What Credit Score Does Carmax Use

Can A Credit Card Be Closed Due To Inactivity

The short answer here is yes. And, as you know, closing an account can have an adverse effect on your credit score. Before you run out to charge something just to keep your account active, you should know that it usually takes a year or more of inactivity for the issuer to close the card. But you should also know that you might not get any warning that it is going to happen. Credit card companies are not required to notify customers of account closures if they are being closed due to inactivity.

If you do find that an account has been closed and you want to reopen it, you will need to contact the issuer. They may be able to reinstate the account if you contact them soon enough. Issuers have different policies, so it is not a given that you will be able to do so. But it wont hurt to ask.

I have a favorite card that goes way back to when I was just starting a business but that I havent used in a long time. Its just sentiment, but when it was about to be closed I asked for it to stay open and the issuer was happy to keep me on. This is understandable since they pay big money to acquire and keep a customer and I was offering to stay for free.

You’ll Have Access To More Credit

The percentage of the total credit you’re using, also known as amounts owed or , is the second-most important factor of your credit score.

For every new card you open, you’ll receive a new credit limit which;increases your available credit. This can be a great way to improve your credit utilization rate and credit score, but only if you maintain the same or similar amount of spending as before you opened a new card.

If you use the additional line of credit to overspend, you risk raising your utilization and therefore hurting your credit score. The best approach with opening multiple credit cards is to maintain a consistent amount of spending that’s 10% of your total credit limit or lower.

You May Like: Jefferson Capital Systems Verizon

How Many Is Too Many

A good credit score is something you can leverage to your advantage. If you put your score behind a glass display case and never tap your available credit, youre leaving valuable rewards on the table. I currently have nine inquiries on my TransUnion and Equifax reports, yet my scores are both excellent because I keep my utilization ratio low, pay every bill on time and have never missed a payment. Even though my hard inquiries category is in the red zone according to Credit Karma, my overall credit health is great.

One area where youll start to run into trouble is with card issuers that are inquiry-sensitive. This is not an official policy, but certain banks, including Citi and Capital One, will often reject applicants with excellent credit scores because they have too many recent inquiries on their credit reports. I applied for the CitiBusiness® / AAdvantage® Platinum Select® Mastercard® to take advantage of a past sign-up bonus, and I was rejected partly because of the large number of recent inquiries on my credit report.

The information for the CitiBusiness AAdvantage Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Negative Credit Score Impact: Repeatedly Opening Cards And Transferring Balances

Balance transfers will hurt your credit score if you make a habit of opening new credit cards and repeatedly transferring balances between them.

This approach seems enticing: why not just avoid paying interest for as long as you can by transferring your balances again and again?

But cycling through new cards is bad for your long-term financial health. Constantly opening new credit cards results in many hard inquiries and reduces your average account ageand could hurt your credit.

If you continue to roll your balances into new cards, your credit score could eventually be lowered to the point that you won’t qualify for any new credit . Not only that, your balance transfer fees could add up over time, minimizing the savings you get by reducing your interest rates.

Also Check: What Credit Score Does Carmax Use

When Using A Company Card Hurts Your Credit Score

There are a few scenarios in which using a company card can have a direct impact on your personal credit score, which many people don’t realize.

Business owners who take out small business credit cards in their name could be putting their own credit score at risk since the lender most likely reviewed your history and score before issuing you this line of credit for your business.

Because of this, “whatever happens on that credit card will be reported to the credit bureaus,” Harrison says. A small business credit card acts the same as a personal credit card in this way.

For example, if you are a small business owner who likes earning cash back with the Capital One® Spark® Cash for Business;but one busy month you miss a bill payment, this shows up on your personal credit report. Or if you charged work travel expenses on your;Ink Business Preferred® Credit Card;and need to carry a balance, it’s your personal credit that will reflect the higher;.

The same goes for employees of a company who have been added as an ;on their employer’s small business credit card. The impact on your credit is similar to being an authorized user on someone else’s personal credit card.

However, the damage will likely be minimal. According to the credit bureau;Experian, “Some credit reporting agencies, including Experian, do not include negative payment history in an authorized user’s credit report. But others may.”

Factors That Affect Your Credit Score

Even if youve done your research and decided which card you want to start with, you should not apply for it until you understand how your credit score is calculated.

Heres a breakdown of the factors involved:

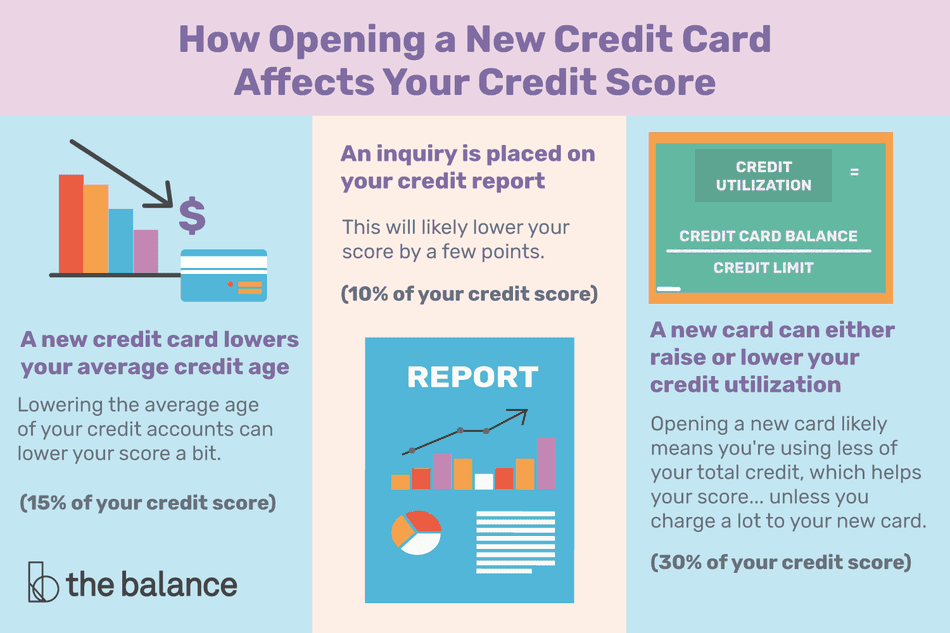

- 35% payment history:;Its no surprise that the category that carries the most weight is your on-time payment history.

- 30% amounts owed:;Also referred to as utilization rate, this is the total balance on all your credit cards divided by your total credit limit.

- 15% length of credit history: Also known as the average age of accounts. The longer your credit history, the higher your score will be.

- 10% credit mix:;This refers to the various lines of credit you may have, including credit cards, student loans, a car loan, a mortgage, etc.

- 10% new credit: New inquiries on your credit report account for 10% of your score.

Related:How credit scores work

Don’t Miss: Is 524 A Good Credit Score

How Does Applying For A New Credit Card Affect My Credit Score

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit this page.

Editors note:;This is a recurring post, regularly updated with new information.

The idea of earning free flights and hotel stays just by signing up for the right credit cards seems too good to be true, and there are plenty of myths about how it all works. When youre trying to introduce someone to the world of reward travel, you might have to dispel some of those misconceptions.

One of the most common things people believe when they start applying for new credit cards is that those actions will negatively and permanently impact their credit scores. While it is true that recklessly opening new lines of credit and abusing them can hurt your credit score, there is no long-term impact on your score from simply opening new accounts.

Since credit card sign-up bonuses are the foundation of travel rewards, today well take a look at how your credit score is affected when you open a new credit card.

New to The Points Guy? Want to learn more about credit card points and miles? Sign up for;our daily newsletter.

How New Credit Can Lower Fico Scores

When applying for new credit, an inquiry is placed on your credit report. That means, for instance, if you’re trying to get a new credit card, the lender will “inquire” into your credit report from one of the three major credit agencies. Depending on the other factors in your report, this inquiry can lower your score by a few points.

A new credit card or line of credit will also affect your length of credit history. This part of your score is made up of your “oldest” account and the average of all your accounts. Opening new credit lowers the average age of your total accounts. This, in effect, lowers your length of credit history and subsequently, your credit score.

New credit, once used, will increase the “amounts owed” factor of your credit score. Amounts owed is composed of credit utilization the ratio of your credit balances to your credit limits. Very often, the lower your credit utilization , the higher your credit score. When you open and use a new credit card or line of credit, you’re getting closer to your credit limit, which could mean a lower score.

Don’t Miss: Minimum Credit Score For Carmax

Common Credit Card Transactions That Impact Your Credit Score

Chances are you have at least one credit cardnearly 80%;of American adults doand you already know that credit cards impact your credit score. But in what ways? What happens to your credit score when you open a new card, close an old one, or transfer a balance?1

Lets dive into four common credit card scenarios, and see how they can potentially help or hurt your credit score.

Opening A Credit Card To Increase Your Available Credit

Responsible handling of your finances, potentially with the opening and use of a credit card, can help build a good credit history over time. For example, while FICO® Scores are made up of several components, one important category is amounts owed, which typically makes up 30 percent of your overall score. This component addresses your debt-to-credit ratio, or utilization rate. Essentially, it measures how much of the credit extended to you is being used and paid off. Per FICO, a low credit utilization rate will more positively affect your FICO® Scores than not using your available credit at all because it shows that you are capable of handling credit responsibly.

How many credit cards do you need to build credit? The answer depends on your;credit utilization;and how much credit you need, so consider the ratio of how much you spend compared to how much credit is available to you on your card, or cards. For example, opening a credit card may lower your debt to credit ratio. Say that you double your total credit lines available from $5,000 to $10,000 by opening a second card, but you simply spread out your current spending of about $1,000 per month across those two credit cards. This would improve your utilization ratio, meaning that youre spending $1,000 out of $10,000 available to you, for a utilization of 10 percent instead of 20 percent when you had $5,000 available.

You May Like: Is Paypal Credit Reported To The Credit Bureaus

How Many Credit Cards Is Too Many

So is it good to have multiple credit cards? Well, we can safely say its not bad. Using more than one credit card for your everyday spending has its benefits: For instance, using cards with different rewards programs can help you maximize how much you earn.

- 0% intro on purchases for 12 months

- Highlights

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Travel when you want with no blackout dates and fly any airline, stay at any hotel, anytime

- Miles wont expire for the life of the account and theres no limit to how many you can earn

- Transfer your miles to over 15+ travel loyalty programs

- Enjoy 0% intro APR on purchases for 12 months; 15.49% 25.49% variable APR after that

Whats more, some credit cards offer benefits that other cards dont, and having more than one in your wallet can ensure that you can take advantage of all the benefits you want.

Theres no universal answer to the question of how many credit cards is too many, because everyone is different. If you have good organizational skills and can easily stay on top of your card management, youll likely know when one more is too much.

If you want help with managing multiple credit cards, here are a few tips:

How Balance Transfers Affect Your Credit Score

Balance transfers can lead to big savings in interest, but opening new cards for the purpose of transferring a balance can affect your credit score either positively or negatively: so take care to know the advantages and disadvantages of balance transfers before you move your open balance. Find out what your credit score is today to establish a baseline, and be responsible when applying for new credit to keep your score headed in the right direction.

You May Like: Does Klarna Report To Credit