Terms And Conditions Related To Services

Your paid membership in credit monitoring is effective for the period covered by your membership fee and continues upon your payment of the monthly/annual renewal fee. Renewal fees for your membership will automatically be charged, at the then current rate, to the credit card or other billing source authorized by you, on the first day of each successive membership term, until you cancel your membership. Should you choose to discontinue your membership for any reason before expiration of the then applicable membership term for which you have paid, you may cancel your membership and terminate further billing by calling the toll-free number listed on this Website, by calling , or online, if that option is applicable and available to you. If you are an annual subscriber and choose to cancel within 180 days of when you were billed, you will be eligible to receive a prorated refund of your current year’s membership fee. If you are a monthly subscriber and choose to cancel after your free trial ends or anytime during your monthly billing term, your membership and monthly billing will terminate at the end of your monthly billing term and you will not be eligible for a prorated refund of any portion of your paid monthly membership fee. ECS reserves the right to change the membership fee for any renewal term to be effective upon the renewal of your membership.

Cancel Your Experian Membership Through The App

Experian has a smartphone app that provides most of the same services as the Experian website. Unfortunately, it is not possible to cancel your Experian subscription through the companys app. You will have to use one of the other methods to cancel your membership, including online, over the phone, or via email.

Some third-party services offer to cancel memberships on your behalf. If you decide to use such a service, it is extremely important to make sure it is reputable and trustworthy before you provide sensitive information that could easily be used to steal your identity.

Almost Free Credit Report

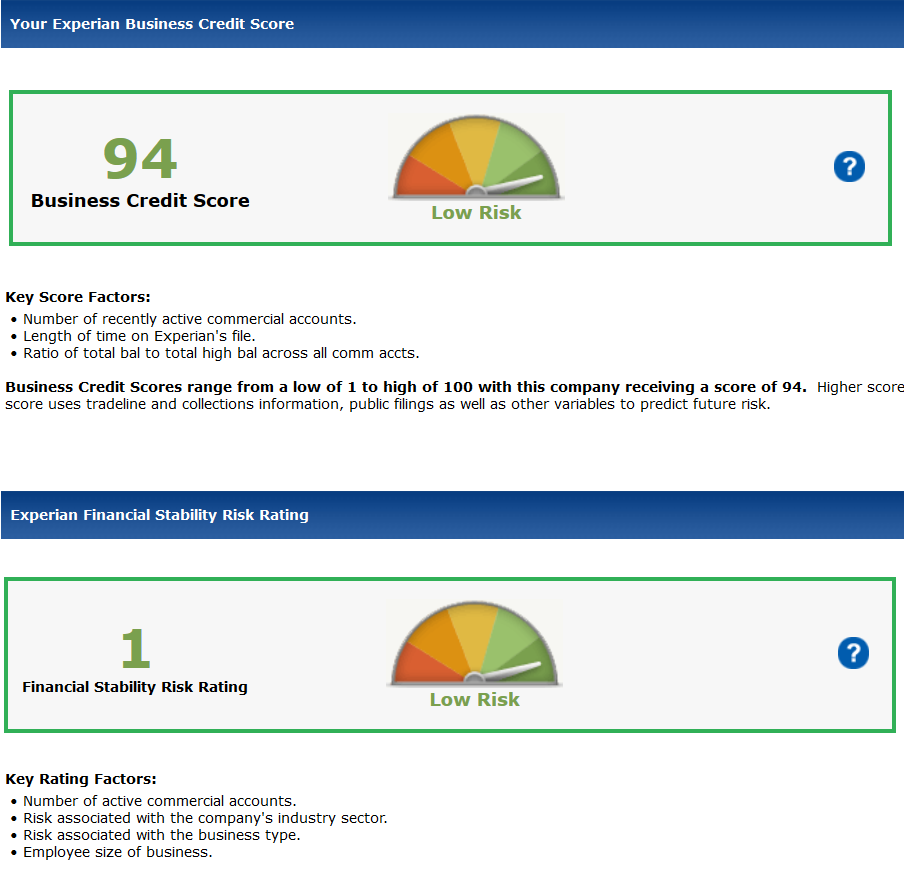

If you choose to get your credit report, including a FICO score from the site, freecreditreport.com will charge your credit card $1. Both the report and score come from your data reported to Experian, one of the three major credit bureaus.

The report has an easy-to-read layout, with each of the credit report sections on a separate tab. If you sign up for the site, review your credit report for accuracy, and check for anything out of the ordinary. Your FICO score will help you gauge your .

Also Check: What Is The Purpose Of A Credit Score

Will You Notify Me Of Every Change To My Credit Score

No. We will provide you an updated score monthly and a chart showing the history of your score during you membership. If you cancel your membership and later reactivate, the credit score history will be lost and your score will be charted over again. Slight fluctuations to your credit score are to be expected. When your score is updated monthly, we will send you an email alert.

Pay Off Your Balance In Full

Before canceling your credit card, pay your balance in full.

If your card has an annual fee, thereâs generally no reason to cancel early. Instead, wait until the annual fee posts to your cardâs account or just before. Most banks and credit card companies have a grace period of at least 30 days where you can cancel the card and still get the annual fee refunded. Operating this way, you have the option to call for a possible retention offer after your annual fee posts.

If you do have a zero balance on the card and end up getting your annual fee refunded, you may end up with a negative balance. If this happens, the credit card company will send you a check in the mail. Make sure to make a note of it and follow up to make sure you receive a refund check.

Also Check: What Is A Good Credit Score To Buy A Home

Compliance With Law And Notice Of Prosecution

Your access and use of the Services and Websites must comply with all applicable laws, rules and regulations. Unauthorized access and use of the Services and/or Websites is expressly prohibited. For online customers, access to and use of password protected and/or secure areas of the Websites are restricted to authorized users only. Unauthorized individuals attempting to access these areas of the Websites may be subject to prosecution.

Further, failure to comply with all applicable laws, including but not limited to the FCRA, can result in state or federal enforcement actions, as well as private lawsuits. In addition, any person who knowingly and willfully obtains a consumer credit report or disclosure under false pretenses may face criminal prosecution.

Cancelling Is A Minor Headache

To cancel the freecreditreport.com service, you have two options: contact the company by phone, or send your cancellation request by mail. The company’s website doesn’t offer the ability to cancel online. If you cancel over the phone, expect the customer service representative to read through some scripts in an attempt to convince you to continue your service.

You May Like: Is Credit Report Com Accurate

What Is A Credit Report And What Is It Used For

A credit report is a record of a consumers credit history and current credit standing. Your credit report will indicate how you have handled past credit obligations, how much credit is currently available to you and your current outstanding debt. Lenders review your credit report to help decide if you are a good credit risk. Prospective employers, insurers and landlords may also review your report to make decisions about you. Your credit report is also used to calculate your credit score.

Which Credit Bureaus Report Will I Receive

If you order a single bureau report, it will be from one of the three major credit bureaus determined at our sole discretion.

However, you have the option to purchase a 3-bureau report with 3 scores. A 3-bureau report contains your credit information from all three of the major credit reporting agencies in one easy-to-read report.

Recommended Reading: Will Disputing Items On Credit Report Lower My Score

Option : Update Your Membership Online

Sign in to update your membership from a paid monthly membership to a free membership with no monthly costs by simply selecting the type of membership you would like to change to. There may be several options available to you, including a no cost option.

After you sign in you will be automatically redirected to your membership settings.

Updating to a free account online includes the following benefits:

- Your Experian Credit Report and FICO® Score*

- Your report and score updated every 30 days on sign in

- Experian credit monitoring with alerts when key changes occur

- Customized alerts when your Experian FICO® Score or rating changes

- Access to Experian Online Disputes to review and correct inaccuracies

- Access to credit offers based on your credit profile

- The latest credit information and education delivered to your mailbox

- Upgrade and change your account anytime as your needs change

*Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more

I Forgot My Username And/or Password How Do I Log In To See My Report

Our one-step security procedure will help you gain access to your membership. From the , click the “Forgot Username or Password?” option. You will be prompted to enter your name, the last four digits of your Social Security number and your date of birth. If the information you enter matches our files, you will be given immediate access to your membership. If the information you enter during the security procedure does not match our files, you will be prompted to call our Customer Service Specialists.

Don’t Miss: Does Apartment Lease Show On Credit Report

Creating An Account With Ecs Registering For Any Service

To create an account or enroll or purchase any Service, you must have an address within the United States, provide a valid Social Security number, address, email address and date of birth and agree to be bound by these terms and conditions. In other limited circumstances, you may need to provide a valid telephone number so that ECS can process your order. You must provide valid credit card information to enroll in or purchase a paid Service, as explained in greater detail above. ECS will then evaluate your complete registration information.

In certain jurisdictions sales tax at state and local rates may apply, in which case you may be charged the applicable taxes in addition to the monthly fee and/or the price of the product.

For certain Services and/or channels where Services are sold, we reserve the right to accept or decline some forms of payment, including, but not limited to “pre-paid” or “re-loadable” credit/debit cards.

Online And/or Mobile Application Requirements

You must have an email address and provide the same to ECS, and have a Java-compatible browser to receive and/or access your Services online via a mobile application, if applicable. As an online customer, you are agreeing to receive all notifications via email at the email address on file with ECS. You are obligated to update the email address on file when your email address changes. In the event that ECS is unable to deliver email messages to you, you agree to accept Service notifications in an alternative method, such as direct mail or SMS messages. You may also opt-in to SMS messaging as a standard method of receiving notifications and alerts. We strongly encourage you to at least select SMS messaging as an alternative method of receiving notifications and alerts. You may select this method by accessing your Customer homepage online and changing your Alert Settings. Please note, mobile messaging rates may apply. All service alerts are also accessible online in your Alerts Center of your account.

In the event that you fail to or otherwise do not update your email address or mobile phone number on file with ECS, and thus ECS is unable to deliver email or SMS messages to you, you nonetheless understand and agree that any paid Service will be fulfilled at the price agreed upon at the time that you placed your order or enrolled in the Service.

Read Also: Is 628 A Good Credit Score

Not A Credit Repair Organization Or Contract

ECS offers access to your credit report, FICO ® Score, and other credit information. ECS is not a credit repair organization, and is not offering to sell, provide or perform any service to you for the express or implied purpose of either improving your credit record, credit history or credit rating or providing advice or assistance to you with regard to improving your credit record, credit history or credit rating. You acknowledge and agree that you are not seeking to purchase, use, or access any of the Service and Websites in order to do so.

Accurate adverse information on your credit report cannot be changed. If you believe that your credit report contains inaccurate, non-fraudulent information, it is your responsibility to contact the relevant credit reporting company, and follow the appropriate procedures for notifying the credit reporting company that you believe that your credit report contains an inaccuracy. Any information provided to you regarding the procedures followed by the various credit reporting companies related to the removal of inaccurate, non-fraudulent information is provided without charge to you and is available for free. Any such information is not included as part of your credit score monitoring product but is provided free of charge to all consumers, regardless of whether they are Customers of the credit score monitoring product.

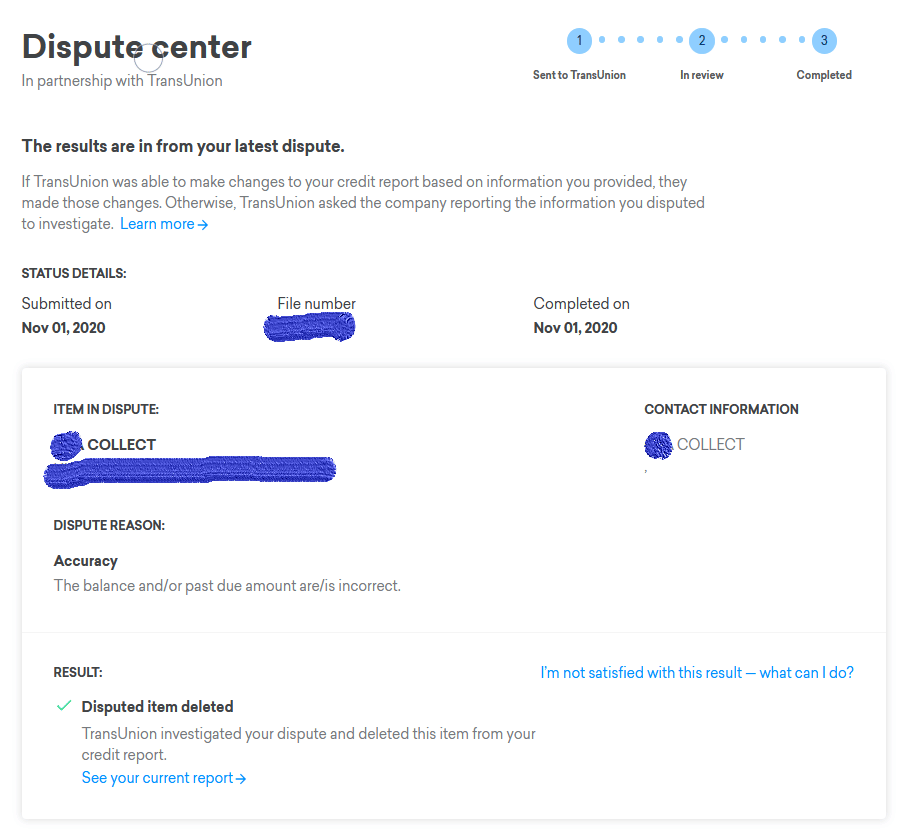

How Do You Dispute Information On Your Credit Report

The Fair Credit Reporting Act gives everyone in the U.S. the right to an accurate credit report. If there are mistakes on your report that you want to dispute, all you have to do is reach out to the credit bureaus. You can call, dispute the information online, or dispute it in writing with a mailed letter. Credit bureaus are legally required to investigate any disputes unless they are “frivolous,” but they won’t remove accurate information from your credit report.

Don’t Miss: Is 787 A Good Credit Score

After You Sign Up For A Free Trial

Your free trial offer has a time limit. Once the deadline to cancel passes, you may be on the hook for more products or services and more payments.

Monitor your credit and debit card statements. That way you’ll know right away if you’re being charged for something you didn’t order. See the section How To Stop a Subscription for more on how to dispute a charge you didnt authorize.

Terms Of Use Agreement

Revised July 28, 2022

OVERVIEW AND ACCEPTANCE OF TERMS

You agree that by creating an account with ECS , or accessing or using our Services , website ), or mobile applications , as well as any content provided or accessible in connection with the website or mobile application, including information, user interfaces, source code, reports, images, products, services, and data , you represent to ECS that you have read, understood, and expressly consent and agree to be bound by this Terms of Use Agreement, and the terms, conditions, and notices contained or referenced herein whether you are a “Visitor” , or a “Customer” .

You may not browse the Websites, or create an account or register with ECS, or use or enroll in any Services, and you may not accept this Agreement, if you are not of a legal age to form a binding contract with ECS. If you accept this Agreement, you represent that you have the capacity to be bound by it. Before you continue, you should print or save a local copy of this Agreement for your records.

Recommended Reading: How To Boost Credit Rating Uk

What Is An Experian Membership

Experian is a multinational credit reporting agency. It is based in Ireland but operates in 37 countries. The company offers a subscription service that compiles and sends a detailed credit report several times a year. This allows you to closely monitor your credit history and quickly understand any changes that happen over time by reducing how long it takes to get a credit score. Experian also offers services like identity theft protection, credit freezing, and several other subscription services.

Cancel Your Experian Membership Online

You can cancel your Experian membership by visiting the companys website using a web browser . The steps listed below will show you how to cancel Experian membership online:

Please note this option may not be available if you log in to your account from inside the U.S. You may only be able to change to the free version rather than cancel completely. If that is the case, you will have to cancel using one of the other options.

After you cancel your subscription, you will continue to have access to the service until the next billing date. Then, your subscription will change to the free version and you wont be charged.

Recommended Reading: How To Improve Credit Score With Credit Card

Free Trial Offers Can Cost You

Many subscription offers are tempting, especially if they offer a free trial period before you commit. But free trial offers can be tricky, and theres often a catch.

Here are three things to know about free trial offers:

1. If you dont cancel on time, youll be charged. Usually, you have to give your credit card number for a free trial. That way, the company can charge you if you dont cancel before the trial period ends. Dishonest businesses make it tough to cancel, and will keep charging you even if you dont want the product or subscription anymore.

Tip: Make sure youre clear on the terms of the trial period. If you sign up, make a note on your calendar to remind you to cancel. If you cant cancel, call your credit card company and ask them to stop the payments.

2. If you have to pay for shipping or fees to get your free trial, its not really free. The offer may say you can try a product free but you have to pay a small fee for shipping costs or something else. You may think those few dollars are no big deal, but after the trial ends, you might see higher charges than expected on your credit card or charges for products you didnt want or order.

Tip: Free means free. Be suspicious of companies that offer something free but say you have to pay to get it. You may be dealing with a scammer.

Tip: Remember that some ads may be designed to make you click, not tell you the truth about the offer. So think before you click on that online free trial offer.

Consent For Election Signatures Records And Disclosure

Please read this information carefully and print a copy and/or retain this information for future reference.

Introduction. In order to provide you with credit opportunities available through third party lending platforms, including prequalified credit and personal loan offers, such third party lending platforms may need your consent to use and accept electronic signatures, records, and disclosures . This form notifies you of your rights when receiving electronic disclosures, notices, and information. By clicking on a link assenting to this Terms of Use Agreement, you acknowledge that you received this E-Consent and that you consent to conduct transactions using electronic signatures, electronic disclosures, electronic records, and electronic contract documents .

Option for Paper or Non-Electronic Records. You may request any Disclosures in paper copy by contacting the third party lending platforms directly. The lending platforms will provide paper copies at no charge. The lending platforms will retain all Disclosures as applicable law requires.

Consenting to Do Business Electronically. Before you decide to do business electronically with the third party lenders, you should consider whether you have the required hardware and software capabilities described below.

Recommended Reading: What Does Closed Derogatory Mean On Credit Report