Experian Connect Tenant Screening

Does Experian Connect Tenant Screening offer additional features : No

How does Experian Connect Tenant Screening work?

The tenant is invited to fill out an online form to verify their identity. Applicants pay for their credit report and grant you access to it.

How much does Experian Connect Tenant Screening cost?

The applicant pays $14.95 for their credit report. Experian Connect does not include a criminal record search or dedicated eviction history reports.

Also Check: What Credit Score Do You Need For Paypal Credit

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the;Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

How To Get A Transunion Credit Report

You can request a free TransUnion credit report online. When you sign up to be a TransUnion member through the credit reporting companys website, you also sign up for a credit monitoring service. This service costs $24.95 per month and provides you with unlimited score and report requests.;

If you dont wish to sign up for this credit monitoring service through TransUnion and simply want to request your free annual credit report, follow these steps:

- Visit AnnualCreditReport.com and click Request your credit reports.

- Provide the information requested, including your Social Security number, date of birth, and address.

- Verify your identity.

- Select the TransUnion credit report, and any other credit reports youre eligible to receive as desired.

- Receive your credit report.

Once youve accessed your credit report, you may want to print the report if possible. This allows you to take your time reviewing the items on the report so you can identify errors, or to compare your different reports side by side.

Also Check: Does Credit Check Affect Credit Score

Free Annual Credit Report

To support you during the uncertainty caused by COVID-19, we offer a free credit report weekly at annualcreditreport.com through April 20, 2022.

Get your free weekly report online through April 20, 2022 at annualcreditreport.com. You can always get a free report every 12 months.

With this credit report youll get:

- Fast, free access to your credit report online

- Control of your credit data, with free reports available from all three credit reporting agencies in one place

- The option to buy a one-time VantageScore® 3.0 credit score

How To Check Your Crb Status Via Sms:

- Open a new SMS on your phone.

- Enter 21272 as the number to send to.

- Next, enter your name.

- Hit the send button.

- Once you have done this, you will receive an SMS from Transunion to register for an account by paying 50 Ksh to paybill number 212121

- Complete the registration and Pay amount by following these steps.

- Next, you will receive an SMS confirming you have made payment.

- You can now text CS to get your credit score or download the Transunion Nipashe.

- You will receive an SMS showing you credit status on CRB.

Also Check: How To Get An Eviction Removed From Your Credit Report

Transunion Score Report & Monitoring

A paid subscription to TransUnion Credit Monitoring can help you improve your credit health, manage your data identity and approach credit with confidence.

A paid subscription to TransUnion Credit Monitoring includes key information and tools you can use, all in one place.

Get key information and empowering tools in one place, including:

- VantageScore® 3.0 credit score & TransUnion credit report free refreshes available daily

- Alerts to critical changes to any of your 3-bureau reports

- Educational resources to help you understand your credit report and steps you can take to reach your score goals

- Identity protection, including 1-touch TransUnion & Equifax credit locks, ID theft insurance and instant inquiry alerts

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

Subscription price is $24.95 per month .

Fill Out One Online Submission Form

If you’re requesting through the website, you’ll have to fill out one submission form, regardless of whether you want one, two, or all three of your allotted credit reports. The form will ask for your name; your current address; your last address if you’ve lived at your current address for less than two years; and your Social Security number.;

Also Check: What Does Charged Off Account Mean On My Credit Report

Where To Get A Tenants Credit Report

Three credit bureaus have cornered the market on credit reports:

- Experian .

As linked above, each of these credit bureaus offers tenant screening services that include credit checks. You can order the reports online and receive them immediately. Fees for the services vary, but usually are no more than $40.

Another popular option is to have a service request a credit and screening report from your tenant. Doing so avoids your having to collect a credit check fee and potentially sensitive information . Most of the time, you simply register an account online with the service, and it will send the applicant instructions for how to order the report and allow you to receive it. The service notifies you when the report is complete and tells you how to access it. Many of the credit bureaus provide this option, as do other landlord-oriented websites such as Cozy and TurboTenant.

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.;

Request Your Free Credit Report:;

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:;

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Also Check: Why Does Credit Score Drop When You Pay Off Debt

Dont Settle For An Incomplete Picture

- See all there is to see with data from all four CRAs

- Get support and online dispute resolution from UK based Credit Analysts

Free 30-day trial, then just £14.99 a month cancel anytime. Checkmyfile is a trading name of Credit Reporting Agency Ltd. TransUnion receives a fee from Checkmyfile if you sign up.

How To Get A Free Transunion Credit Report

Once a month, you can order a free credit report from TransUnion Canada. The document is referred to as a Consumer Disclosure and you can order it online, by mail, phone, or in-person.

Online: Visit TransUnion and enter your information including name, address, date of birth, and social insurance number .

You may be required to answer a few random questions to confirm your identity, after which you can access your credit report.

Mail: Download and complete the request form and mail it to Consumer Relations Centre, 3115 Harvester Road, Suite 201, Burlington, Ontario L7N 3N8.

Attach a copy of your government-issued ID such as your drivers license, passport, or birth certificate. Also attach one copy of a document showing your address such as a recent utility bill, credit card statement, Notice of Assessment, or T4 slip for the current year.

Phone: You can contact TransUnion by phone at 1-800-663-9980 and follow the automated interactive voice response.

In Person: Visit one of their provincial offices in Newfoundland, Nova Scotia, Ontario, and Prince Edward Island.

A second option for obtaining your free TransUnion credit report is via Credit Karma Canada. Credit Karma is a financial technology company with operations in Canada and the United States.

They offer free access to free credit scores and reports from TransUnion. You can learn more about their service in this .

Read Also: What Is A Good Business Credit Score

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through the pandemic, everyone in the U.S. can get a free credit report each week from all three national credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

Recommended Reading: How Long Does Debt Settlement Stay On Your Credit Report

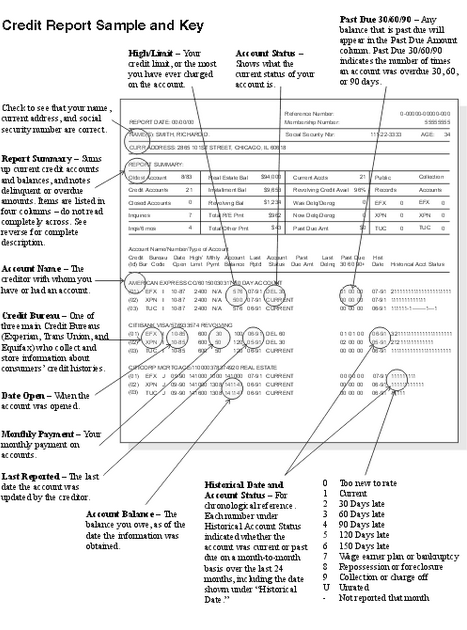

What Is A Credit Report

Your credit report is a record of your credit activity and history. It includes the names of companies that have extended you credit and/or loans, as well as the credit limits, loan amounts and your payment history. You can think of it as your financial resume; it tells the story of your financial health to potential lenders.

Experian Credit Report And Score For Tenant Screening

Request a;rental credit check;using only the applicants name and email address. Your applicants purchase their;tenant credit report;and grant you private access directly through Experian.

Shareable to trusted people like a;landlord, property manager or;real estate agent, for up to 30 days at no additional charge.

- , Credit Rating and Credit Score factors;

- Best Name,;AKAs, Addresses and Employers

- Public Record filings

Read Also: A Credit Score Tells A Lender How

Submit Your Request By Phone:

To request your credit report free of charge by phone, use our Interactive Voice Response system:;. Interactive Voice Response is an automated tool that gathers the required information to process your request through voice response or key pad selection. It is important to note that when requesting your free credit report by phone, you will be required to enter your Social Insurance Number . If you do not wish to provide your S.I.N., you will need to select a different option to submit your request such as mail or in person. If/when you complete the identity validation process, your credit report will be sent to your home address via Canada Post within 5-10 days.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Don’t Miss: How Much Does Transunion Charge For Credit Report

Get Started With Freeze For Free Through Our Transunion Service Center Where You Can:

- Control who can access your credit information with Credit FreezeAre you applying for credit or has a lender referred you here to lift a freeze on your TransUnion credit report? Youre in the right place.

- Manage or fix any inaccuracies on your credit report

- Place Fraud Alerts to protect your identity

- Add a note to your report around any COVID-19 or other financial considerations

What Can I Do If I Believe The Information In My Credit Report Is Inaccurate

Write to the credit bureau immediately and describe the error in as much detail as possible. The agency must investigate your request and correct the error if one is found. If a correction is necessary, the agency must inform every business that has recently received your report that a correction has been made. If the dispute is not resolved, you have the right to file a brief statement describing the nature of the dispute with the credit reporting agency. This statement, or an accurate summary of the statement, must be included in any future credit report concerning you. Since the reports from the three major credit bureaus may contain different information about you, it is a good idea to obtain a report from each of them. Additionally, you should contact the company that provided the incorrect information. It may verify the mistake and write a letter on your behalf requesting that the credit reporting agency fix the error.

Dont Miss: How To Check Credit Score For Free

Read Also: Does Capital One Report Credit Limit

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.;

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Which Credit Report Do Lenders Look At

It may be difficult to know which credit report and score a lender is using to evaluate your credit. You can ask, but the lender isnt obligated to tell you.

But if a lender denies your credit application, federal law requires the lender to

- Tell you the main reasons why you were denied.

- Tell you the numerical credit score it based its decision on.

- Give you the name, address and phone number of the credit-reporting agency that provided your credit report.

- Inform you of your right to get a free copy of that report from the credit-reporting company .

- Explain how you can fix mistakes on your report or add information to it.

The reporting agency is required to provide you with a copy of the report used for the decision to deny your credit application. If you spot any errors in your report, you can dispute them and the agency is required to investigate and correct any errors it finds.

Read Also: Is 611 A Good Credit Score

Transunion Credit Score Range

On the flip side, a poor or bad credit score means you will find it challenging to obtain credit.

TransUnion credit scores can be classified as follows:

- Excellent TransUnion credit score: 800-900

- Very Good TransUnion credit score: 720-799

- Good TransUnion credit score: 650-719

- Fair TransUnion credit score: 600-649

- Bad TransUnion credit score: 300-599

If you have a bad or good credit score, you can improve it by paying your bills on time, using a lower percentage of your available credit , limiting your credit applications and more.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Don’t Miss: What Is A Good Credit Score For My Age

Can I Buy A Copy Of My Report

Yes, if you dont qualify for a free report a credit bureau may charge you a reasonable amount for a copy of your report. To buy a copy of your report, contact:

- TransUnion: 1-800-916-8800; transunion.com

But before you buy, always check to see if you can get a copy for free from AnnualCreditReport.com.

Federal law says who can get your credit report. If youre applying for a loan, credit card, insurance, car lease, or an apartment, those businesses can order a copy of your report, which helps in making credit decisions. A current or prospective employer can get a copy of your credit report but only if you agree to it in writing.