How To Successfully Dispute Problems On Your Credit Report

and credit reporting agencies sometimes make mistakes. Those mistakes can result in costly errors on your , unfairly lowering your credit score and making it difficult for you to get the best loan terms. Thats why it is important to monitor your credit reports. When something on them is wrong, you need to file a dispute.

Reasons to Dispute a Credit Report

It is a that you can just dispute problems on the report because you dont like that theyre there. You have to have a valid reason to file a dispute. Valid reasons include:

Note that it can take as long as 90 days for your dispute to be properly handled so its best to take this action as soon as you realize that a dispute may need to be filed.

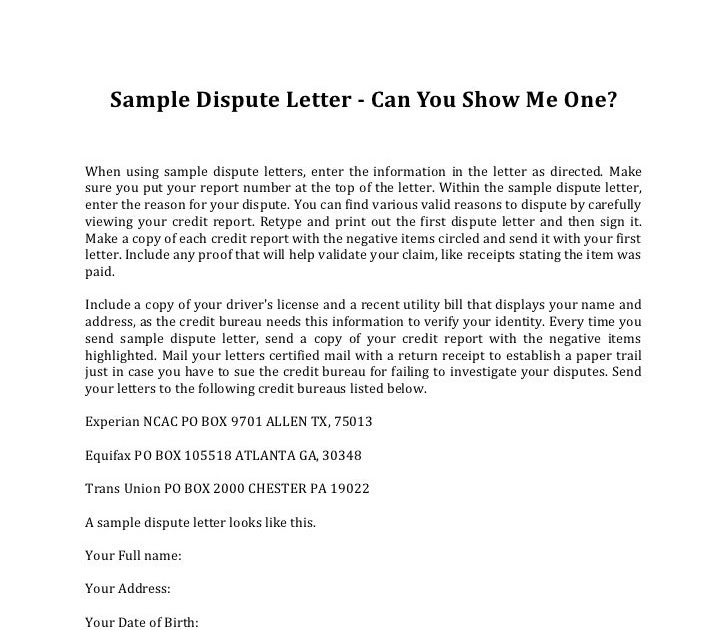

How to File a Dispute with the Credit Reporting Bureaus

Typically when you file a dispute you will do so with one or more of the three major credit reporting bureaus . In many cases it makes sense to file the report with all three reporting bureaus because they may all have the same mistaken information. However, in less common instances the problem is only with one bureau and there is no need to contact the others. Continue to monitor the others closely in the months following, though, to make sure that the problem doesnt crop up with them as well.

If youre ready to file a dispute with a credit reporting bureau then you need to do the following:

Filing a Dispute with the Credit Card Company

Disputing Your Credit Report For Inaccurate Information

Inaccurate information on your credit report can lead to a drop to your credit score and your reputation. It is important that you check your credit report occasionally so nothing false appears on your credit report.

If anything suspicious or damaging appear on your credit report, you can dispute items to fix or remove them. If you would like to talk to an experienced , call . The consultation is free!

How To Dispute An Account In Collections

If you identify what you believe to be inaccurate collection account information, you can contact the credit reporting company that is reporting the collection and formally log your dispute.

Use the following links to file a dispute with the appropriate credit bureau or bureaus:

You also have the option of contacting the collection agency directly and filing a dispute with them. This is formally referred to as a “direct” dispute because you are contacting the source of the allegedly incorrect information directly. If the collection agency concludes through their investigation that the collection account is, in fact, being reported incorrectly, they must either remove it from all of your credit reports or correct any erroneous information. In this case, keep an eye on your credit reports to ensure the company had the account removed.

Also Check: Is 784 A Good Credit Score

What Should I Expect After Filing A Dispute

Investigation of your dispute

When reviewing your dispute, if we are able to make changes to your credit report based on the information you provided, we will do so. Otherwise, we will contact the company that reported the information to us to verify the accuracy of the information you’re disputing.

Your dispute will be processed in approximately 10-15 days for electronic submission and 15-20 days for postal mail

After our investigation is complete, a confirmation letter or email will be sent to you with the results and outcome of the investigation. If we require additional information in order to complete our investigation, we will notify you. If you submitted your dispute electronically, we will notify you by email. If you mailed in your completed form and documents, we will send you a letter. Due to COVID-19, we are experiencing longer than normal processing times. We appreciate your patience.

How To Dispute Credit Report Errors

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Errors on your credit reports can cause your credit scores to be lower than they should be, which can affect your chances of getting a loan or credit card and how much interest you pay. Disputing credit report errors and getting those negative items removed can be a quick route to a better score.

Here’s how to dispute credit report errors and have them removed in four steps.

Also Check: How To Get Collections Off Your Credit Report

Should I Pay Debt Collectors Or The Original Creditor

If the debt is legitimately yours, knowing whom to pay can be confusing. Debt collection agency? Original creditor? Debt that has slipped into arrears often changes hands, sometimes more than once.

There are, essentially, three scenarios when a debt is unpaid and the consumer could be confused about who is being dealt with and who is getting paid.

The Credit Report Dispute And Resolution Process

Whether you dispute a charge-off on your own or hire someone to dispute it for you, the process is roughly the same. The Fair Credit Reporting Act requires the credit bureaus to complete the investigative process within 30 days under most circumstances, although the process almost always takes considerably less time.

Once a credit reporting agency receives your dispute, it notifies the data furnisher that you disagree with information on your credit report. The data furnisher must then investigate your claim.

Verify the creditors name, dates, balance, account number, names of relevant parties, and payment history before disputing a charge-off. Image courtesy of LexingtonLaw.com

Typically, the data furnisher will check its records and review all relevant data to ensure that what it is reporting to the credit bureaus is correct. If it discovers a mistake, the data furnisher may direct the credit bureau to update your account accordingly or delete the item from your credit reports altogether.

If a data furnisher doesnt respond to a credit bureau within the 30-day time frame, the account will be deleted from your reports because it is unverifiable.

Don’t Miss: How To Unlock My Transunion Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Closing A Line Of Credit That Is Already Behind On Payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Also Check: How To Unfreeze Your Credit Report

Correcting Errors In Your Reports

If you spot an error in a credit report, you should file a formal dispute with the credit reporting company. The dispute process is completely free. Under the provisions of the Fair Credit Reporting Act, the credit bureau must investigate the error and update you with the results of its investigation within 30 days .

MoneyFactSubmit Separate Requests

Keep in mind that if the error is on all three of your credit reports, youll need to submit a separate request to each credit bureau involved.

Its worth noting that there are a few cases where a credit bureau may take up to 45 days to investigate your dispute instead of 30 days. Your dispute investigation might last up to 45 days if:

- You send a dispute after claiming your free annual credit report.

- You send a credit bureau additional information about an ongoing dispute in the middle of the 30-day investigation period.

While the item on your credit report is being investigated, the information thats in dispute will be treated differently by scoring models like FICO®. Basically, the payment history and balance on the account will be temporarily ignored, so that the potentially incorrect information cant hurt your credit scores until the credit bureau determines whether or not the item needs to be deleted from your report.

MoneyHackAn Alternative Approach

P.O. Box 2000Chester, PA 19016

A Guide To Credit Report Disputes

Reading time: 4 minutes

- Regularly checking your credit reports can help ensure information is accurate and complete

- If you believe information on your credit reports is inaccurate or incomplete, contact the lender

- You can also file a free dispute with the three nationwide credit bureaus

When reviewing your credit reports, its important to make sure all of the information is complete and accurate. This includes everything from the account information to the other personal information thats on your credit report such as your home address, name, and Social Security number.

Here are some steps you can take to address information you believe is inaccurate or incomplete:

What information can I dispute on my credit reports?

What should I expect after filing a dispute?

You May Like: How To Remove Fraud Alert From Credit Report

How To Remove Negative Items From Your Credit Report

First, it’s important to know your rights when it comes to the information in your credit history.

Under the Fair Credit Reporting Act , credit bureaus and lenders must ensure that the information they report is accurate and truthful.

This means that, if you find mistakes in your credit report, you have the legal right to dispute them. And, if the information disputed is found to be incomplete or erroneous, the bureaus are obligated to remove it from your record.

Some common credit report errors include payments wrongly labeled as late or closed accounts still listed as open. It’s also possible for your report to include information from someone else, possibly someone with a similar name, Social Security number, or identifying information.

Bear in mind that correct information cannot be removed from your credit report. So, if your score is being dragged down by accurate negative information, youll need to repair your credit over time by ensuring you make payments on time and decrease your overall amount of debt.

Here are some tips to help you repair your credit history:

Will The Wording Consumer Disputes After Resolution Hurt My Credit Score

The wording Consumer Disputes After Resolution on your credit report will impact your credit score at all. With that said it might effect your ability to get approved for loans, credit cards, or rentals.

Banks and lenders like to see a clean credit report that shows the consumer in a financially responsible light. If you have any negative items on your credit report, lenders might deny you.

Read Also: How To Put Fraud Alert On Credit Report

Checking Up On Your Credit Reports

You have three credit reports, one from each of the consumer credit bureaus Experian, Equifax® and TransUnion®. Under federal law, you can check free credit reports from all three major bureaus once every 12 months from AnnualCreditReport.com.

Some credit report errors to look out for include:

- Name misspellings

- Duplicate accounts

- Fraudulent accounts

- Information or accounts from an ex-spouse

- Incorrect payment statuses

- Outdated information

- Incorrect date of first delinquency on a collection account

If you find any fraudulent activity on your credit reports, you should probably place credit freezes and/or fraud alerts on your three reports. You can also place credit locks on your three reports, but this is different from a credit freeze, which the government requires the bureaus to offer free of charge.

Print Out Your Credit Report And Notate The Errors

In step two you printed out your original credit report. Now, youll want to notate the errors you noticed on your report by circling the items you wish to have changed. Its important that the credit bureau knows exactly what your request is about, so be extra careful here and make sure the information youre citing here matches the description on your credit report dispute form.

Also Check: Is Your Credit Score On Your Credit Report

Check Credit Reports Regularly

As Attorney Rheingold noted above, most disputes with debt collection agencies are the result of debts consumers dont even own. Collection agencies often rely on second- or even third-hand information that is unreliable and unverified.

If a judgment goes against you, find a lawyer, Rheingold adds. If you do so within 30 days and your lawyer files a motion to reconsider, you have a chance to get it overturned. The crucial thing is to make sure the debt collector has the information necessary to bring the case to court. A lot of times, he is working off a line of data that says the amount owed, but with no real proof that you are the one who owes the debt.

If you cant find a way to stop the phone from ringing , stop trying to go it alone. Instead, contact a nonprofit credit counseling agency, such as InCharge Debt Solutions.

As illustrated above, disputing a debt against collectors whose only goal is to squeeze money from each consumer on its list can be a painstaking, time-consuming, and downright exasperating endeavor. Having InCharge Debt Solutions expert, certified counselors on your side can help deal with collectors and credit problems, steering you today toward solutions you hadnt imagined.

15 MINUTE READ

Disputing Late Payment Errors

If a late payment mark appears on your credit report, you dont have to just accept it and move on, most especially if its there in error. There are three steps youll need to take toward disputing a late payment error on your credit report:

Identifying The Credit Report With Late Payments

If youve been monitoring your credit score and report using a third-party service, youll likely be very aware of which report has the issue. If you havent already been monitoring your credit score, its advised you do so in the future so you can quickly spot issues when they appear. When you reach out to your creditor to present your case, it helps if you have accurate information about where the wrong payment information is listed.

Contacting Your Creditor

The next step is to reach out to your creditor about fixing the error. Keep in mind that its never in their best interest to misreport a late payment as having good standing relationships with clients is very important. Once you contact the creditor, theyll investigate your claim to see if an error was made and if thats the case, theyll inform the credit bureau, and it will be removed from your report.

Contact The Credit Bureau

If you end up taking this route, youll want to make sure you have all the necessary paperwork ready to send in by mail should they be requested. Be sure to only send photocopies and never an original document.

Using Equifax® To Dispute The Late Payment

Using TransUnion® To Dispute The Late Payment

Read Also: How To Unlock Credit Report

Whats On Your Experian Credit Report

Understanding the contents of your personal credit report makes it easier to spot errors so youll know which items to dispute. Your Experian credit report contains:

- Personal information, including your name, date of birth, address Social Security number and employer data. This information is updated as you supply new information to lenders and creditors. However, it does not affect your credit scores.

- Account information, including the credit limit or total amount of the loan and the outstanding balance, and information about the account status. In this section, you will also find the initial date the account was opened.

- Public records and collection accounts, along with tax liens, suits, bankruptcies, foreclosure, or wage garnishments.