Medical Information Bureau Report

The Medical Information Bureau, or MIB for short, collects and reports information about any past insurance applications for coverage that have been applied for. It will include whether your application was approved or denied and what information was found.

Life insurance companies use this information to look for inconsistencies and possible fraud. For example, if you were denied a policy in the past because of a health condition and did not mention it on your current application, your MIB would disclose this information to the underwriter.

Your MIB report is always pulled when you apply for life insurance and other forms of insurance.

Should I Freeze My Lexisnexis Report

LexisNexis compiles multiple data sources about consumers, including public records information, as well as reports with insurance claim and policy data. Your information might be pulled if you’re applying for insurance, and requesting a report freeze could prevent a criminal from getting a policy in your name.

Request And Receive A Report Online

You can request and receive reports from LexisNexis Risk Solutions online. After your request is submitted, you will receive a letter via U.S. Mail with details explaining how to access your report online.

If you prefer to mail in your requests, you can choose to download a and send it to us via U.S. Mail. If it is more convenient to call us, feel free to give us a call and we will submit your requests for you.

Also Check: Does It Affect Your Credit Rating To Apply For Cards

Why Can’t Insurance Companies Just Use The Information On Your Application

Insurance companies are required to verify the information you provide to prevent fraud. It might seem like a lot of information asked for on the application and the medical exam for the insurance company to verify it with reports, but its necessary.

Life insurance benefits are large amounts of money, ranging from $100,000 to several million dollars. Life insurance companies need to pay out that money to a beneficiary if a policyholder dies, so they need to make sure they have a complete and accurate picture of every applicant.

How This Site Works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure it’s right for your specific circumstances and remember we focus on rates not service.

- We don’t as a general policy investigate the solvency of companies mentioned , but there is a risk any company can struggle and it’s rarely made public until it’s too late .

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We often link to other websites, but we can’t be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the MoneySuperMarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-binding MSE Editorial Code.

Read Also: Is 632 A Good Credit Score

What Is Lexisnexis On My Credit Report Jobs

Proven experience as a Full Stack Developer or similar roleExperience developing desktop and mobile applicationsFamiliarity with common stacksKnowledge of multiple front-end languages and libraries Knowledge of multiple back-end languages and JavaScript frameworks Familiarity with databases , web servers and UI/UX designExcellent communication and teamwork skills

Premise is a global research company mapping life for organizations working to improve your community. We pay people in specific countries to download our app and reporton their daily life.For this particular project, we are looking for freelancers who can visit Royal van Kempen & Begeer cookware stores and report from the locations. We will pay USD 15 per task completed/successful visit.Send us a message for more details!

How Long Does It Take For Lexisnexis To Freeze Your Account

Thanks for your curiosity about LexisNexis information suppression program. Your request to have your personal information suppressed from our public records products has been received and is in process. Please be aware that it might take as much as 72 hours to suppress your info from LexisNexis services and products.

Read Also: Does Applying For A Credit Card Lower Your Credit Score

Lexisnexis And Accelerated Underwriting

Until recently, it was standard for life insurance decisions to take a few weeks up to a month to complete. You would need to complete an application, take a medical exam, and wait on the company underwriters to provide a decision.

Today, LexisNexis allows companies to offer policies without the need for a long and involved process. The information LexisNexis provides means companies can often make a coverage decision without the need for a medical exam if its an option offered by the insurance company.

Instead, they can use LexisNexiss information to get a complete picture of the applicant applying for coverage very quickly.

LexisNexis also helps companies detect errors like incorrect birthdays or social security numbers. Those sorts of errors could add days to the processing of a life insurance exam in the past.

Now, they can be resolved in minutes. Essentially, LexisNexis streamlines insurance underwriting, making no exam and other accelerated policies possible through running a simple report on an applicant.

How Does My Lexisnexis/ins/p& c Inquiry Affect My Credit Score

How your LexisNexis/INS/P& C inquiry affects your credit score depends on what type of inquiry it is. There are two types of inquiries that can appear on your credit report:

- Hard inquiry: Youll see a hard inquiry on your credit report if you applied for new credit, such as a car loan or mortgage.

- Soft inquiry: Youll see a soft inquiry on your report if someone checked your credit for reasons unrelated to credit applications, such as for employment screening or to prequalify you for an installment loan or other type of credit.

The main difference between hard and soft inquiries is that hard inquiries will bring your credit score down by a few points, whereas soft inquiries dont affect your credit score.

Its not always easy to tell whether the credit bureaus will class an inquiry as hard or soft. For example, landlord credit checks can trigger either soft or hard inquiries. However, applications for credit pretty much always trigger hard inquiries, and screening for employment or insurance generally only triggers a soft inquiry. 23

How much a hard credit pull actually affects your score depends on your credit history and how recent the inquiry was. Hard inquiries usually cause a small drop in your FICO or VantageScore credit score, but the effect shouldnt last more than a year.4 Whats more, they wont stay on your credit report for more than two years.

Recommended Reading: What Credit Score Does Navy Federal Require For Auto Loans

Do All Insurance Companies Use Lexisnexis

Not all insurers use the service, but most do, says a LexisNexis spokesperson. When you apply for auto or homeowners insurance, you authorize insurers to check your records at consumer reporting agencies. That includes reporting agencies and services like LexisNexis, which will provide your C.L.U.E. report.

How Does Lexisnexis Tie Into The Credit Repair Process

There are many things that credit repair companies claim to be able to help you with. How many times have you come across an ad or website claiming that a company can help you with a million different things like collections, charge-offs, late-pays, judgments, tax liens, bankruptcy, foreclosures, student loans, and more?

There are many things that credit repair companies claim to be able to help you with. How many times have you come across an ad or website claiming that a company can help you with a million different things like collections, charge-offs, late-pays, judgments, tax liens, bankruptcy, foreclosures, student loans, and more?

Sounds nice, doesnt it?

However, this vague idea of help doesnt necessarily address what will or can be accomplished.

So how can a credit repair company help with the other items they claim to be able to? Well, if they are a general dispute company, they cant. If they are a true credit repair company that knows what theyre doing, they can probably help you out.

Lets go over how the credit repair process works and what exactly a company can assist you with legally.

How Does the Credit Repair Process Work?

Typically, credit repair done by most companies would entail an online dispute with the three major Credit Bureaus but there is more than this that can be done.

Many times, they are not actually associated with a physical credit report. To see public records, you would have to access this information from LexisNexis.

Whats Next?

Read Also: How Often Does Your Credit Score Change

Lexisnexis Risk Solutions Services

Two LexisNexis reporting services that we commonly hear complaints about are LexisNexis Accurint and LexisNexis C.L.U.E.

LexisNexis Accurint provides consumer reports to collections, government, healthcare, insurance, law enforcement, legal, and private investigators.

LexisNexis C.L.U.E. auto and property reports include auto and property information of consumers for insurance companies. These reports include loss and claims information, transaction information, ownership, liens, judgments, addresses and more.

What Is A Hard Inquiry

A hard inquiry occurs any time you apply for new credit and the lender or creditor runs a credit check. It can be for a mortgage, apartment, car loan, credit card, insurance policy, cell phone, and sometimes even a job application.

Hard inquiries will typically only drop your credit score by a few points. However, if you have too many, especially in a short period of time, they can really start to add up and do some damage.

Recommended Reading: How To Check Credit Score Bank Of America

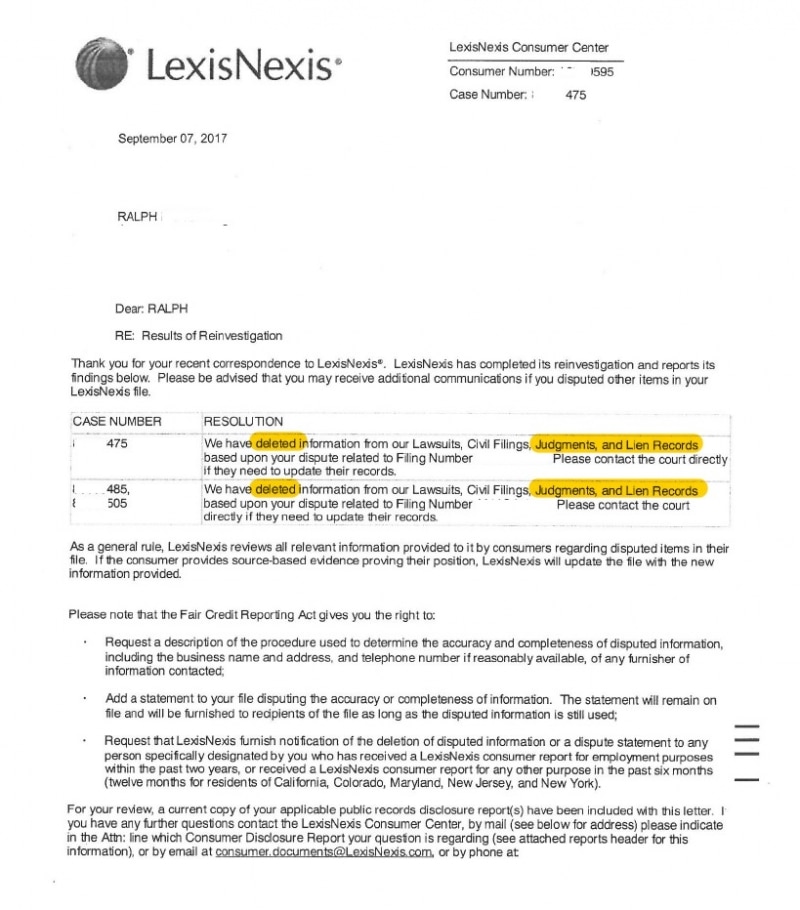

Can You Dispute Lexisnexis

Dispute LexisNexis Accurint Errors If your Accurint report contains errors, contact them and dispute the information. LexisNexis will then have 30 days to investigate your dispute and correct the information. If your LexisNexis dispute is ignored or unresolved after 30 days, you have the right to sue.

Does Lexisnexis Make Underwriting Faster

Yes. LexisNexis allows companies to get the information they need for underwriting much faster. Before LexisNexis, companies needed to pull multiple reports from multiple sources and wait for the results. Plus, companies had to pay for each one of these results.

LexisNexis streamlines the process. It also gives much more detailed information than companies were able to get in the past. This allows them to decide on offering your coverage quickly.

You May Like: What Is A Fico Credit Score

How Do I Contact The Cras And Lexisnexis

If you would like to query or dispute the search on your credit file, have any questions, or wish to make a subject access request to see the credit file information that the CRAs hold on you, you should contact the CRAs directly, using the contact details set out below:

TransUnion

Email:

To raise a dispute please visit:

To find out which insurers/brokers are behind your LexisNexis / IIL search footprint please contact TransUnion by email at:

For other information and ways to contact TransUnion please visit their website at:

Experian

LexisNexis acts as a processor of the credit file information and therefore this information will not appear in LexisNexis subject access request report.

If you need any further information from LexisNexis, please do not hesitate to contact us:

Industries

Why Does Insurance Rely On Lexisnexis

When you apply for an insurance policy, your insurer wants to know how much of a risk you are to cover. The more likely you are to die, the higher your monthly premiums will be this compensates for the higher financial risk the company takes on by insuring you. Statistically, people with lower credit scores and financial standings are likely to die earlier. This is why insurance companies will check your credit score when you apply for life insurance. There are some states that have laws prohibiting insurers from checking your credit during the underwriting process. However, they may still look at LexisNexis reports for other information about your background.

You May Like: Can You Dispute Credit Report

What Is Lexisnexis Risk View Score

The RiskView Short-Term Lending Risk Score is designed to provide predictive insight on the creditworthiness of potential loans provided by short-term loan providers, using alternative credit data. … This score helps drive critical credit decisions for short-term lenders at acceptable levels of risk.

Lexisnexis/ins/p& c On My Credit Report

LexisNexis is a company that provides businesses with data-driven research and risk management services.

The corporation partners with insurance agents and providers, including those that sell property and casualty insurance.

As such, they may access your credit reports and other records on behalf of an insurer when you submit an application.

With its National Credit File program, LexisNexis may access data from all three of your credit reports.

This would result in a hard inquiry on one or more of your reports.

If you are overwhelmed by dealing with negative entries on your credit report,we suggest you ask a professional credit repair company for help.

Its important to understand the difference between hard and soft credit pulls.

Don’t Miss: How To Get 850 Credit Score

How Is Your Credit Report Used

Lenders use your credit reports as part of their evaluation process when deciding whether to extend you credit and at what terms. Additionally, the information on your credit report is used to calculate your credit scores.

Prospective employers and landlords may also access your credit reports to help them decide whether to offer you a job or a lease. Your credit reports may also be reviewed if youre trying to secure insurance coverage or if youre applying for services such as utilities or a mobile phone contract.

Ways To Get Your Lexisnexis Report

Everyone is entitled to one free copy of their LexisNexis report each year, thanks to the Fair Credit Reporting Act and the Fair and Accurate Credit Transactions Act . LexisNexis customer representatives say that consumers do not need to pay for additional copies of their own report, either.

Requesting a LexisNexis report online is the easiest option for most people. But if you want to get a copy in the mail, send the printable request form to this address:

LexisNexis Risk Solutions Consumer Center

P.O. Box 105108

Atlanta, GA 30348-5108

Also Check: How To Improve Credit Rating Nz

Who Can Access Lexisnexis

Examples of LexisNexis customers include law enforcement agencies, federal homeland security departments, banking and financial services companies and insurance carriers, legal professionals, and state and local governments. Certain products, such as Peoplewise and Vitalcheck, are sold to the general public.

Dispute Lexisnexis Risk Solutions Consumer Report

Under the Fair Credit Reporting Act you have the right to dispute inaccurate information on your report. If a LexisNexis Risk Solutions report is used against you, you must be notified. The notification you receive is generally and adverse action letter. To learn more about about the report and to dispute information you can contact the LexisNexis Consumer Center at 1-800-456-6004.

Read Also: How To Dispute An Eviction On Credit Report

How Often Does Lexisnexis Update

We update our 50-state online code offering with new legislation virtually every day throughout the year. LexisNexis analysts and editors process tens of thousands of updates to our code collection each month, especially during the times of year when many states are in session and are actively generating legislation.

How Long Do It Take To Opt Out Of Lexisnexis

Thank you for your interest in the LexisNexis information suppression program. Your request to have information suppressed from publicly facing public records products has been received and is in process. Please note that it may take up to 30 days to suppress your information from LexisNexis products and services.

Read Also: How To Get Charged Off Accounts Off Credit Report

Should I Opt Out Of Lexisnexis

Removing your information minimizes your risk of identity theft, scams, and other online privacy issues. Because of its use of analytics, however, LexisNexis gathers and uses info on a range of people. Not everyone seems to be comfy with the usage of this info, which is why theres a LexisNexis opt-out process.

Does Transunion Use Lexisnexis

TransUnion does the matching of bankruptcy information to consumer credit files LexisNexis does not determine the impact, if any, that bankruptcy information will have on a consumers credit score.Can I dispute LexisNexis online?You can request a Description of Process Letter from LexisNexis with the status of your disputes in our system, and you will receive the Description of Process Letter via US Mail. Request and Receive a Description of Our Dispute Process Online.

If LexisNexis triggered a hard inquiry, then it will likely result in a small, temporary drop in your credit score. Soft inquiries dont hurt your credit score. If you see LexisNexis/INS/P& C on your credit report, it means that an individual or company used LexisNexis services to run a background check on you.How can I get Chapter 7 off my credit report?There are only two ways to get a bankruptcy removed from your credit report: file a dispute with the credit bureaus or wait for the bankruptcy to leave the report after seven to 10 years.How to rebuild your credit after bankruptcy

Recommended Reading: What Is A Positive Entry On Your Credit Report