Active Military Fraud Alert

The active duty alert is designed for members of the military who have been stationed overseas for an extended period of time. Deployed service members are can place this type of credit alert on their credit to help reduce the risk of identity theft.

To get an active duty alert on your credit report, you will need to follow the same steps as with getting an initial or extended fraud alert but ask for the active duty alert instead.

Active military fraud alerts last for 1 year until re-instated. However, this fraud alert also removes your name from prescreened credit card marketing offers for 2 years.

Place One Of Three Fraud Alerts On Your Credit Report

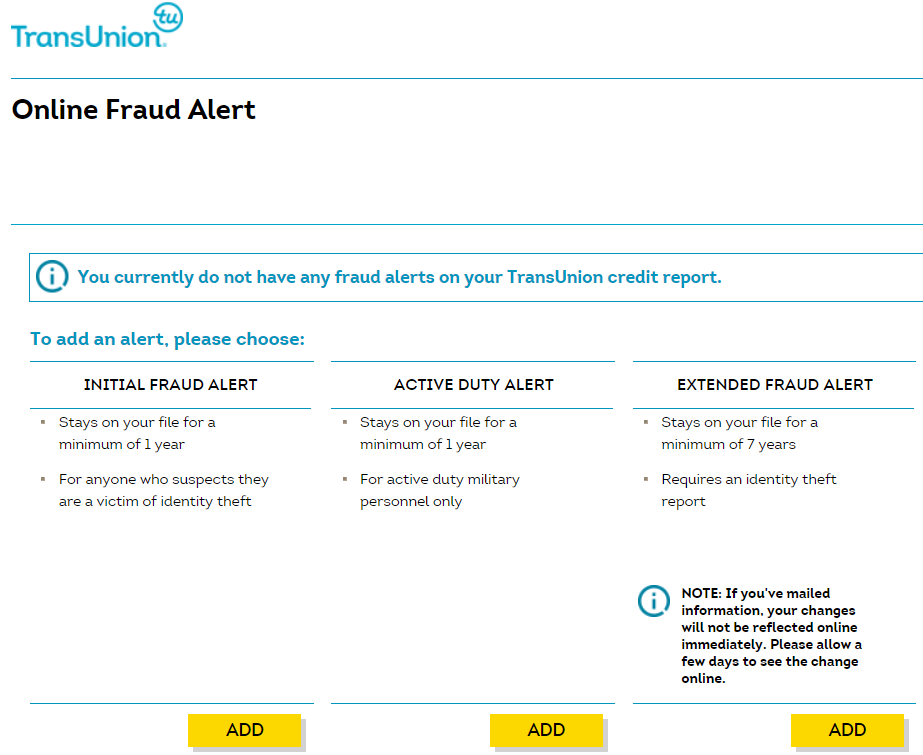

These are the three types of fraud alerts that you can implement on your credit reports:

- Initial fraud alert

- Extended fraud alert

Initial fraud alert

If you suspect your wallet, financial information or credit card number has been lost or stolen, you can ask for an initial fraud alert to be placed on your credit file.

An initial fraud alert lasts 90 days. During that time, it should be more difficult for an identity thief to open accounts in your name because the alert requires a business to verify your identity before a new line of credit is approved.

You can apply for an initial fraud alert by phone, mail, or online, using the contact information above.

The CRA websites noted above will take you to where you can submit your request online or mail a written fraud alert letter.

Remember, initial fraud alerts last only 90 days, but they can be renewed. Youll have to remind yourself to do so. Otherwise, theyll expire. ;Also, requesting such an alert also entitles you to order one free credit report from each credit reporting agency.

Active duty alert

If youre a service member and about to be deployed, you can place an active duty alert on your credit report that lasts for one year and can be renewed for the length of your deployment.

This can be very helpful in protecting your identity while deployed, because a business will have to take extra steps before giving credit in your name.

Extended fraud alert

Consider A Credit Freeze

The strongest protection against new accounts being opened in your name is a credit freeze, also called a security freeze. A freeze means that your file cannot be shared with potential creditors, insurers, employers, or residential landlords without your permission. For more information, see our CIS 10: How to Freeze Your Credit Files.

Don’t Miss: How Long Do Credit Inquiries Stay On Your Credit Report

If You Are Wrongly Accused Of A Crime Committed By An Identity Thief

“Criminal identity theft” is a label given to a particular type of identity theft. Criminal identity theft occurs when a suspect in a criminal investigation identifies himself or herself using the identity of another, innocent person. A special database in the California Department of Justice can help victims of this kind of identity theft. See our Consumer Information Sheet 8: How to Use the California Identity Theft Registry- A Guide for Victims of “Criminal” Identity Theft.

Tips To Monitor Your Identity

When you place a fraud alert with one of the three credit reporting companies, you will receive information about ordering one free credit report from each of;

Place a free fraud alert on your credit report, by contacting any of the major credit reporting agencies. A fraud alert will alert businesses to verify identity;

Place a fraud alert on your credit reports. The alert tells creditors to follow certain procedures before they open new accounts in your name or make certain;

You May Like: How Much Does A Hard Inquiry Affect Credit Score

Fraud Alert Vs Credit Freeze

Fraud alerts and credit freezes are two options consumers have when they suspect fraud, and both are free to place and remove on your credit report. While a fraud alert advises creditors and lenders to use caution when opening new credit lines, a restricts access to your file. Lenders and other companies cannot view your credit, and new accounts cannot be opened.

If your credit report has incorrect information on it after a case of identity theft, you have rights protecting you and enabling you to fix the errors. The consumer protection attorneys at Francis Mailman Soumilas, P.C. are here to help. Get free legal help today and file a free case review, or call us at 1-877-735-8600.

Report The Fraud To Your Local Police Department As Soon As Possible

Indiana law requires the law enforcement agency where you live to take an official report and provide you with a copy. When you file the report, provide as much documentation as possible, including copies of debt collection letters, credit reports, and your notarized Identity Theft Affidavit. The police report and complaint number may be needed when contacting creditors. Consumer reporting companies should automatically block fraudulent accounts and bad debts from appearing on your credit report if you provide a copy of the police report.

Recommended Reading: Does Having A Mortgage Help Credit Score

Fraud Alert Vs Credit Freeze Which Should I Choose

NerdWallet recommends a;credit freeze;for most consumers, because it’s the best protection available. Unlike a fraud alert, it won’t expire, so you won’t have to remember to extend it. But you will need to unfreeze your credit if you decide to apply for credit.

If you don’t want to have to bother with freezing and unfreezing your credit every time you apply, then a fraud alert is a good choice.

Social Security Combats Fraud

Social Security has zero tolerance for fraud. We aggressively investigate and prosecute those who commit fraud against our programs. Social Security is diligently working at national, regional, and local levels to combat the fraud that undermines our mission to serve the American public. OIG conducts investigations of allegations of SSA fraud. They refer cases to U.S. attorneys within the Department of Justice, among other state and local prosecuting authorities, for prosecution as a Federal Crime.

Read our Legal Enforcement and Financial Penalties publication to learn more about our efforts. Visit our OIGs Investigations page to view a list of recent fraud investigations.

Recommended Reading: Is 666 A Good Credit Score

Measures You Can Take To Prevent Fraud

- Do not routinely carry your Social Security card

- Never say your SSN aloud in public

- Beware of phishing scams to trick you into revealing personal information

- Create a account to help you keep track of your records and identify any suspicious activity

- Consider adding these blocks to your account with us:

- The eServices block It prevents anyone, including you, from seeing or changing your personal information on the internet. Once we add the block, you or your representative will need to visit your local field office to request removal of the block.

- The Direct Deposit Fraud Prevention block This prevents anyone, including you, from enrolling in direct deposit or changing your address or direct deposit information through or a financial institution . Once we add the block, you or your representative will need to visit your local field office to request removal of the block or make any future changes to direct deposit or contact information.

Consider Taking The Following Actions

-

Contact any of the three credit reporting agencies and ask that a free fraud alert be placed on your credit report. Also ask for a free credit report. You only need to contact one of the three agencies because the law requires the agency you call to contact the other two.;

-

TransUnion; 1-888-909-8872

Once you have a fraud alert on your credit report place, a business must verify your identity before it issues new credit in your name.; The alert remains active for;a year;and can be renewed by you;for up to seven years.

-

Change the passwords, pin numbers, and log in information for all of your potentially affected accounts, including your email accounts, and any accounts that use the same password, pin, or log in information.;

-

Contact your police department, report the crime and obtain a police report.;

-

Go to the webpage of the Federal Trade Commission, report the ID theft and create an;identity theft recovery plan:;;

Texas law;provides victims of identity theft the option of seeking a court order declaring that you are a victim of identity theft.; If you are granted this type of court order, you may submit it to private businesses and to governmental entities to help correct any records that contain inaccurate or false information which resulted from the identity theft.

ALWAYS: REMAIN VIGILANT

Read Also: Is 643 A Good Credit Score

Place A Fraud Alert With A Credit Bureau

Contact one of the nationwide credit reporting bureaus and place a fraud alert in your credit report:

- Equifax, 800-525-6285

- Experian, 888-397-3742

- TransUnion, 800-680-7289

When you place a fraud alert on one credit report with a credit bureau, it must notify the others. A fraud alert requires creditors who check your credit report to take steps to verify your identity before opening a new account, issuing an additional card, or increasing the credit limit on an existing account based on a consumers request.

Want to be proactive? Monitor your credit reports using a or enroll in a paid ID theft insurance plan.

Place Fraud Alerts On Your Credit Reports

Fraud alerts can help prevent an identity thief from doing further damage to your credit. Contact the toll-free fraud number of any of the three consumer reporting companies below to place a fraud alert on your credit report. You only need to contact one of the three agencies to place an alert. The company you call is required to contact the other two, which will place an alert on their versions of your report. Ask the company that you contact to confirm this action. Credit reports from all three consumer reporting companies should be sent to you free of charge.

TransUnion: 1.800.680.7289; ; Fraud Victim Assistance Department, P.O. Box 2000, Chester, PA;;19016-2000

Equifax: 1.800.525.6285; ; P.O. Box 740241, Atlanta, GA 30374-0241

Experian: 1.888.EXPERIAN ; ; P.O. Box 9554, Allen, TX 75013

Also Check: How To Print Out My Credit Report

Request Information On Fraudulent Accounts

When you file your police report of identity theft, the officer may give you forms to use to request account information from credit grantors, utilities or cell phone service companies. If the officer does not do this, you can use the form in our Consumer Information Sheet 3A: Requesting Information on Fraudulent Accounts. When you write to creditors where the thief opened or applied for accounts, send copies of the forms, along with copies of the police report. Give the information you receive from creditors to the officer investigating your case.

How To Put A Flag On Your Social Security Number Or Credit Report

There are a few ways you can flag your social security number. The primary way to do this is to through a fraud alert, which will put extra protections in place for people trying to access or use your social security number or other private account details associated with your credit.

To get a credit flag or fraud alert placed with any of the three credit bureaus, do the following:

You can contact the credit reporting agencies using the following information:

| Agency |

|---|

| P.O. Box 105069Atlanta, GA 30348-5069 |

As stated earlier, youll only need to contact one credit reporting agency. By law, each of the agencies must contact the other agencies after you set up a fraud alert. This makes your life easier, as youll only need to do this once.

Read Also: What Credit Score Do You Need For An Fha Loan

Why Check Your Credit Report

Your credit report is a record of how well you manage credit. Errors on your credit report can give lenders the wrong impression. If there’s an error on your credit report, a lender may turn you down for credit cards or loans, or charge you a higher interest rate. You may also not be able to rent a house or apartment or get a job.

Errors can also be a sign that someone is trying to steal your identity. They may be trying to open credit cards, mortgages or other loans under your name.

Take a close look at your credit report at least once a year to see if there are any errors.

Remove The Fraud Alert From Your Credit Report

Once you place any of these three fraud alerts on your credit file, you can simply allow them to expire or remove them. If you choose to remove a fraud alert before its expiration, youll need to submit a request to the appropriate credit reporting agency.

The Experian letter referenced above can also be used to remove a fraud alert. You can remove a fraud alert with Equifaxs fraud center by written request with certain forms of documentation sent to the address in the table above. However, if youve activated the credit bureaus automatic fraud alert as part of an Equifax product subscription and wish to deactivate earlier, youll have to contact Equifax in writing.

For TransUnion, you can remove a fraud alert at any time online.

The real key when dealing with the exposure of your personal information or theft of your identity is to act quickly. If you can react before the identity thieves do, itll help you stay a step ahead of the bad guys.

Get LifeLock Identity Theft Protection 30 DAYS FREE*

Criminals can open new accounts, get payday loans, and even file tax returns in your name. There was a victim of identity theft every 3 seconds in 2019°, so dont wait to get identity theft protection.

Start your protection now. It only takes minutes to enroll.

Read Also: Does Having A Overdraft Affect Credit Rating

Report The Fraud To The Three Major Credit Bureaus

You can report the identity theft to all three of the major credit bureaus by calling any one of the toll-free fraud numbers below. You will reach an automated telephone system and you will not be able to speak to anyone at this time. The system will ask you to enter your Social Security number and other information to identify yourself. The automated system allows you to flag your file with a fraud alert at all three bureaus. This helps stop a thief from opening new accounts in your name. The alert stays on for 90 days. Each of the credit bureaus will send you a letter confirming your fraud alert and giving instructions on how to get a copy of your credit report. As a victim of identity theft, you will not be charged for these reports. Each report you receive will contain a telephone number you can call to speak to someone in the credit bureaus fraud department.

Experian 1-888-397-3742

How To Place A Fraud Alert On Your Credit Reports

Placing a;fraud alert;on your three;credit reports;is simple and free.

Fraud alerts are referred to as one-call alerts in the credit world. Even though the three major credit bureaus are entirely separate credit reporting companies, you only need to request a fraud alert from one of them to get the job done. Once you contact any one of the credit bureaus to request a fraud alert, its legally required to contact the other two on your behalf.

Initial alerts and active duty alerts can be placed easily online. But to place an extended fraud alert youll need to fill out a form, print it, and mail it to a credit bureau.;Since each type of alert mentioned above lasts for a specified period of time, you should mark your calendar to remind you when the alert expires.

You can add a;fraud alert;to your three;credit reports;through any of the three methods below.

Read Also: Does Requesting A Credit Report Hurt Score

Review Your Credit Report For Free

Filing a fraud alert gives you access to an additional free credit report from each bureau. Its important that you take advantage of this and request a copy of your report.

Youre filing because youre a victim of identity theft, or you suspect you are. Your credit report will list all your open accounts so you can identify any that dont belong to you.;

How Does Identity Theft Happen

Identity theft is a serious crime. Identity thieves steal information in several ways, such as:

- Digging through trash cans and other places to find documents that contain credit card numbers, account numbers, Social Security Numbers and other personal information

- Retrieving information from lost or discarded computer equipment, mobile phones and PDAs, or wallets

- Using rogue Radio-Frequency Identification readers; stealing checks, credit cards, debit cards, passports, driver’s licenses, Social Security cards; or skimming the information from card readers to create new cards

- Stealing information from personal computers using malware or spyware

- Hacking into computer networks and databases to steal large amounts of personal information or infiltrating organizations that store large amounts of valuable information

- Acting as a trusted organization to obtain personal information and/or financial information through the mail, telephone, text messaging and email

Read Also: How To Unlock My Experian Credit Report