How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What Credit Card Can I Get With A 697 Credit Score

As someone with fair credit, you may have access to a number of unsecured credit cards. Unlike secured cards, an unsecured card doesnt require you to put down a security deposit.

Thats a plus, but there are other factors to consider. For example, many unsecured cards available to applicants with fair credit may charge an annual fee. These cards may also come with a high variable APR on purchases, which can translate to high interest charges if you carry a balance instead of paying off at least your statement balance each month.

With fair credit, you might be approved for a credit card with a relatively low credit limit though some issuers will automatically review your credit limit after several months of on-time payments. Your credit limit is important, because its directly correlated with your credit utilization rate.

Dealing With Negative Information Which Impacts Your 697 Credit Score

Whether you have too many hard inquiries or have late payments listed on your report, knowing how to deal with negative information on your credit report is crucial in attempting to boost your credit score. Fortunately, this information will be removed with time. Some information on your credit report can even be removed sooner from the original date, if applicable.

Bankruptcies

If you filed a Chapter 13 bankruptcy, your bankruptcy will be cleared from your credit report after seven years. For a Chapter 7 bankruptcy, it will be cleared in ten years. One can try to clear a bankruptcy from their report early however, it can be a difficult process.

Hard inquiries

One can expect hard inquiries to remain on their report for two years. Initially, they can drop your 697 credit score 5 to 10 points. Fortunately, as time goes on, they affect credit less and less. To potentially remove a hard inquiry earlier, one can dispute the inquiry with the creditor or credit bureau. The latter technique is useful for those who have been a victim of identity theft.

Late payments

Late payments will be taken off your credit report after seven years from the delinquency date. There are ways that one can attempt to remove late payments earlier: requesting a goodwill adjustment from the creditor, volunteering to the creditor to sign up for automatic payments as an exchange for removal of the late payment, or disputing any information in regard to the late payment as inaccurate .

Debt Collections

Also Check: When Will Chapter 7 Be Removed From Credit Report

What Do Credit Score Mean

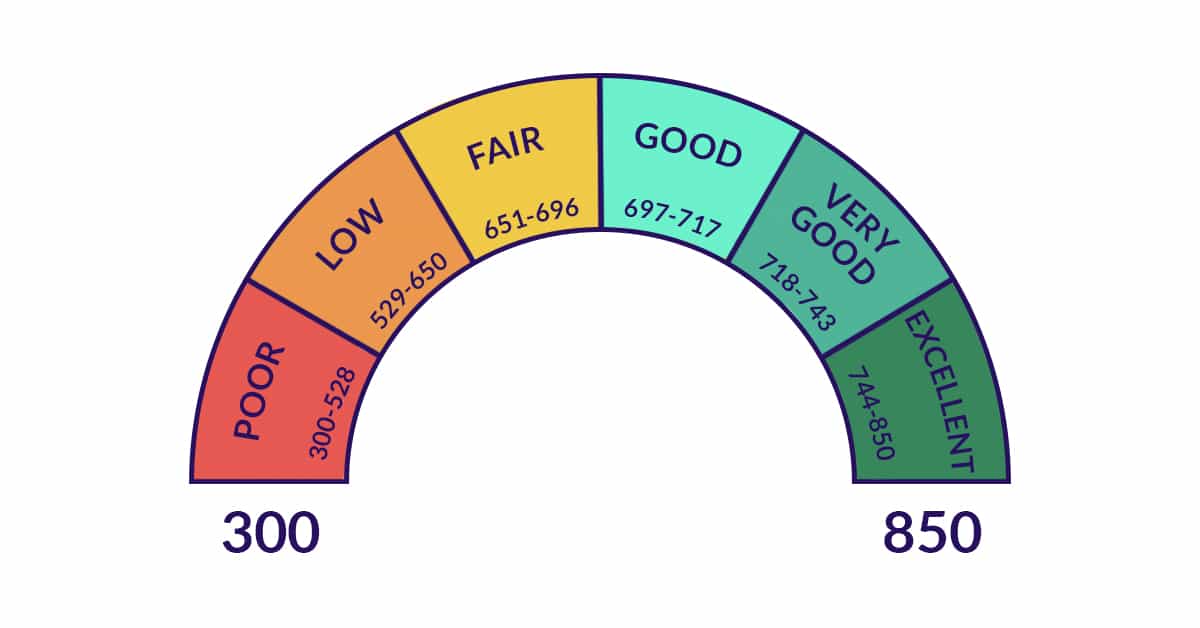

Category: Credit 1. Credit Score Ranges: What Do They Mean? Investopedia A credit score is a number between 300850 that depicts a consumers creditworthiness. The higher the score, the better a borrower looks to potential lenders.Credit Score Basics · Exceptional Credit Score: 800 to 850 For a score with

Average Credit Score By Age

The average credit score looks very different between age groups. As credit scores are calculated on credit and borrowing history, older people have higher credit scores on average due to a more extensive borrowing history. Here’s how it breaks down by age group, according to data from Experian:

| Generation | Average credit score in 2021 |

| Generation Z | |

| 760 |

You May Like: Do Lending Club Loans Go On Your Credit Report

What Is A Good Credit Score In Australia

A good credit score is generally one above 625, but this depends on which credit bureau you’re using:

- Equifax: 622+ is a good score

- Experian: 625+ is a good score

- Illion: 500+ is a good score

- Average credit score in Australia: 695.6

Experian, Illion and Equifax are the leading credit score providers in Australia, but you can also get your score through a bunch of other providers .

Each bureau uses a different scoring system, so what is considered a “good” credit score will be different with each. As a rule of thumb, an Experian or Illion credit score over 700 is “very good” and an Equifax credit score over 726 is “very good”.

Your score can vary between 0 and 1,000 or 1,200, depending on the credit bureau, but no matter which bureau you use, the higher the score, the better it is.

A Quick Guide Explaining Credit Scores Including How They Work What Range Is Considered Good And Why Theyre Valuable

- FICO says good credit scores fall between 670 and 739. Thatâs on a scoring range from 300 to 850.

- VantageScoreâs good scores are reported to fall between 661 and 780. And like FICO, VantageScore also uses a scoring range of 300 to 850.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them and what you can do to monitor and improve yours.

Also Check: What Does Charge Off Mean On Credit Report

What Interest Rate Can I Get With My Credit Score

While a specific credit score doesnt guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, lets assume that you meet the highest standards for all other criteria in your loan application. Youre putting down at least 20% of the home value, you have additional savings in case of an emergency and your income is at least three times your total payment. If all of that is true, heres how your interest rate might affect your credit score.

- Excellent Your credit score will have no impact on your interest rate. You will likely be offered the lowest rate available.

- Very good Your credit score may have a minimal impact on your interest rate. You could be offered interest rates 0.25% higher than the lowest available.

- Good Your credit score may have a small impact on your interest rate. This means rates up to .5% higher than the lowest available are possible.

- Moderate Your credit score will affect your interest rate. Be prepared for rates up to 1.5% higher than the lowest available.

- Poor Your credit score is going to seriously affect your interest rates. You may be hit with rates 2-4% higher than the lowest available.

- Very Poor This is trouble. If you are offered a mortgage, youll be paying some very high rates.

More from SmartAsset

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Also Check: How To Increase Mortgage Credit Score

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

How To Improve A 697 Credit Score

Work on removing all negative accounts such as collections, charge-offs, medical bills, bankruptcies, et al.

Remove as many excess hard inquiries as you can. Get your revolving utilization as low as you can . Ensure you have a good credit mix of installment loans and revolving accounts.

Last but not least, make sure you have at least two revolving accounts older than 2 years

We recommend taking a look at Credit Glory. Give them a call

It’s generally much faster if you worked with Credit Glory, and they happen to have incredible customer service.

Read Also: How Long Do Accounts Stay On Credit Report

Pay All Of Your Bills On Time

Your payment history is the most important credit score factorit accounts for 40% of your VantageScore and 35% of your FICO score. Repaying your debt on time can improve your score. However, payments that are 30 days past due can cause major damage.

To avoid late payments, enroll in autopay or use a bill management app or spreadsheet to keep track of your due dates.

What Does A 697 Credit Score Mean

A credit score of 697 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that youre a low-risk borrower. In FICO and VantageScore, the main scoring models used by US credit bureaus, 697 is classed as a good credit score.

Although a 697 credit score is much higher than the lowest credit score of 300, its still far from the highest credit score of 850, and its below the current nationwide average.

Heres how your score of 697 compares with the average for different generations.

Recommended Reading: How To Analyze A Credit Report

How Is A Credit Score Calculated

In Canada, there are two main credit bureaus Equifax and TransUnion that are responsible for calculating individuals credit scores. These companies collect data about your financial activity and then distil that information into a credit score based on five key factors, as outlined below.

» MORE:What is a credit report?

What Affects Your Credit Score

Overall, there are five main factors that affect your credit score:

Payment history

Lenders like to see you making regular payments on time and for at least the minimum amount required. Late or missed payments, and payments for less than the amount required, would likely lower your credit score.

Your credit utilization ratio is how much credit you’re using relative to how much total credit you have access to. Generally speaking, you’ll want to keep it under 35%.

Types of credit

Different credit types, such as credit cards, a mortgage, and a line of credit, could affect your credit score.

New loans

Applying for a new loan could lower your credit score since a hard check is performed.

While the above factors determine your overall credit score, it’s worth noting that whenever a lender does a hard check on your credit history, your credit score will decrease by a few points. A hard check is usually only performed when lenders need to see a detailed look at your credit history. This would include a formal application for credit like a mortgage, credit card, or auto loan.

Lenders can also perform a soft check that doesn’t affect your credit score. These are done when lenders want to quickly see your credit score or report.

Read Also: When Are Bankruptcies Removed From Credit Report

Length Of Credit History

The longer you’ve been using credit and the longer your average age of accounts the better it tends to be for your score. Remember, credit scores are meant to estimate your risk as a customer, and a longer history gives more data to estimate with.

Avoid closing credit cards unless there’s a pressing reason, like a high annual fee. You can also look into doing a product switch to a more suitable card from the same issuer.

Getting A Credit Account With A 697 Credit Score

With a credit score of 697, youll have plenty of options when looking for a new credit card. However, you might not qualify for the top rates that card issuers reserve for people in higher credit score ranges.

The types of credit cards you can get with a credit score of 697 generally fall into two categories:

- Secured credit cards: These cards require a security deposit, which your lender will use as collateral. The amount you put down will usually be your credit limit. Secured cards are a low-risk option if you want to build credit while ensuring that you dont spend beyond your means.

- Unsecured credit cards: These cards dont require a deposit. Your card issuer will set your credit limit according to how creditworthy they perceive you to be. In many cases, these cards offer cash back on certain purchases and other rewards.

Which type of credit card is best ultimately depends on your financial situation and your reason for opening a new credit account. If youre good at controlling your spending, then its a good idea to use your good credit score to take advantage of the potential rewards and higher credit limit that come with an unsecured card.

On the other hand, if your main goal is to build credit and youre worried about overspending, then a secured credit card may be your best bet.

Takeaway: 697 is a good credit score, but its not in the top scoring range.

Read Also: How To Freeze Your Credit Report

How To Improve Your 697 Credit Score

A FICO® Score of 697 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 697 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

40% of consumers have FICO® Scores lower than 697.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

Don’t Miss: Do Inquiries Affect Your Credit Score

Staying The Course With Your Good Credit History

Having a Good FICO® Score makes you pretty typical among American consumers. That’s certainly not a bad thing, but with some time and effort, you can increase your score into the Very Good range or even the Exceptional range . Moving in that direction will require understanding of the behaviors that help grow your score, and those that hinder growth:

Late and missed payments are among the most significant influences on your credit scoreand they aren’t good influences. Lenders want borrowers who pay their bills on time, and statisticians predict that people who have missed payments likelier to default on debt than those who pay promptly. If you have a history of making late payments , you’ll do your credit score a big solid by kicking that habit. More than one-third of your score is influenced by the presence of late or missed payments.

Utilization rate, or usage rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure utilization on an account-by-account basis by dividing each outstanding balance by the card’s spending limit, and then multiplying by 100 to get a percentage. Find your total utilization rate by adding up all the balances and dividing by the sum of all the spending limits:

| Balance | |

|---|---|

| $20,000 | 26% |

42% Individuals with a 697 FICO® Score have credit portfolios that include auto loan and 29% have a mortgage loan.

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine . That means what FICO, VantageScore or anyone else considers good may not all be the same.

However, there are some general guidelines for how being within a score range can impact your choices:

- A poor to fair score means you may find it difficult to qualify for many credit cards or loans. You might need to start with a secured credit card or credit-builder loan to build or rebuild your credit. And if you do qualify for an account, you may have to pay high fees and interest rates if you don’t pay your balance in full each month.

- A fair to good score means you may be able to qualify for more options, but you wonât necessarily receive the best rates or terms. You also might find you can qualify for a traditional unsecured but have a harder time qualifying for a premium card.

- A very good or excellent score means you may be able to qualify for the best products with the lowest-advertised rates. While creditors consider other factors too when determining your eligibility and rates, your credit score probably wonât be holding you back.

Hereâs a closer look at how FICO and VantageScore define their score ranges.

Whatâs a Good FICO Credit Score Range?

Whatâs a Good VantageScore Credit Score Range?

You May Like: What Is An Inquiry On A Credit Report