Hard Credit Inquiry Removal Letter Sample

Jay Smith

New York City, NY 20009

RE: Hard Credit Inquiry Removal Request

Dear :

I am writing to request several credit inquiries that were unauthorized be removed from my credit report. On April 18, 2021, I received a copy of my credit report and became aware of five inquiries that I did not authorize. They are as follows:

1. Name of the Inquiring Company2. Name of the Inquiring Company3. Name of the Inquiring Company4. Name of the Inquiring Company5. Name of the Inquiring Company

Each company has received a letter sent by certified mail stating that the inquiries were not authorized, and I have requested them to be stopped. In addition, I have asked for their removal from my credit report.

In keeping with the Fair Credit Reporting Act, I am asking that my claim is investigated and any and all unauthorized inquiries removed from my credit report. I would appreciate a copy of my credit report once the inaccuracies are removed.

Sincerely,

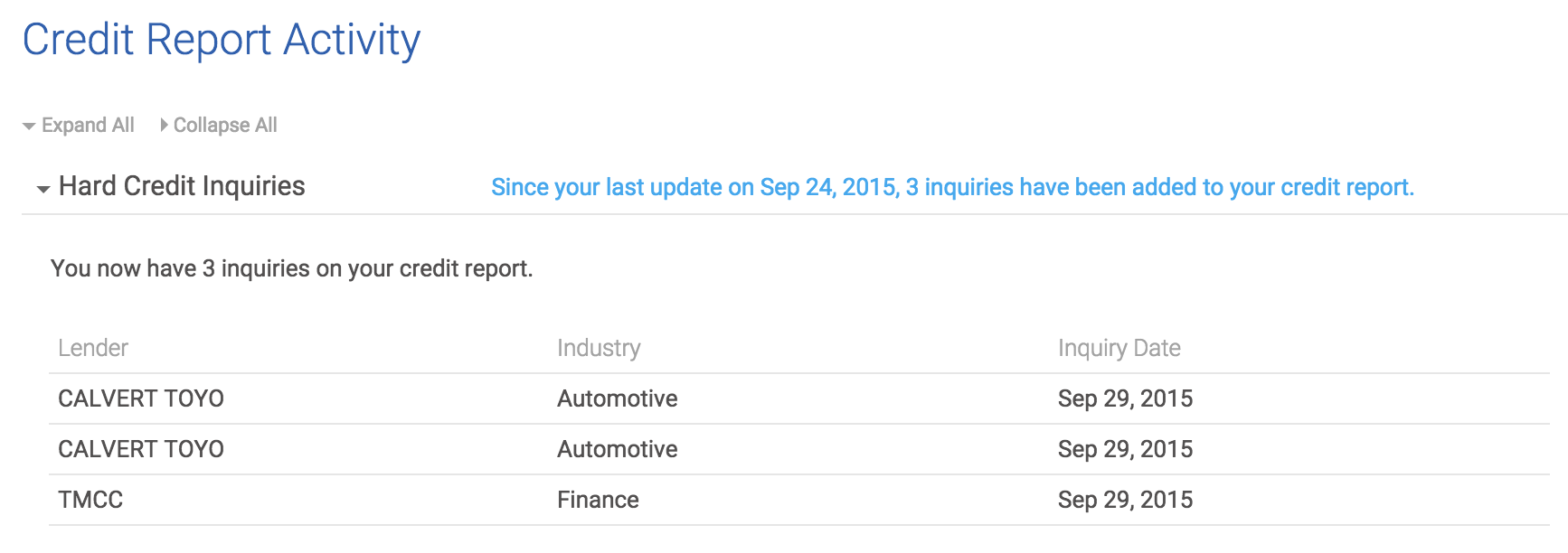

How To Find And Evaluate Inquiries

You’re entitled to free credit reports direct from the three major credit bureaus at least once every 12 months. Request them by using AnnualCreditReport.com.

Look over the section labeled inquiries. Youre concerned with hard inquiries, the kind that happen when you apply for credit. Those can cause a small, temporary drop in your score. Soft inquiries, such as when you check your own credit or a marketer screens you for a pre-approved offer, dont affect your score.

Each credit bureau or website presents information in its own way, but all will label any inquiries that might affect your score. If you dont recognize something, its worth investigating. Reasons you might not recognize the entry range from benign to worrisome:

-

A store credit card you applied for may be issued through a financial institution with a different name.

-

Your car loan application may have gone to multiple lenders .

-

Debt collectors are allowed to check credit under the Fair Credit Reporting Act, although most often these are soft inquiries.

-

You may have fallen victim to identity theft and someone is opening fraudulent accounts in your name.

Write A Letter To The Creditors

Armed with the addresses of each creditor, write a letter notifying them of the disputed inquiries. The letter should include any documentation that supports your claims. These can be payment records that contradict the items in dispute. Request them to contact the reporting bureau that they gave the information to and have them remove the items from your records.

Read Also: Afni Subrogation Department Bloomington Il

Hard Inquiries Should Be Removed After 2 Years

The only way that a dispute will work is if the inquiry appears in error on your credit report. Fortunately, hard inquiries only appear for two years on your credit report. Most other negative information will remain for seven years. A Chapter 7 bankruptcy remains for up to 10 years, though its effects on your credit score are much more short-lived.

Gather Documents To Back Up Your Claim

If you are going to dispute a hard inquiry, you will need to provide supporting documentation so that a creditor or credit bureau can adequately investigate your claim. The required documentation will depend on the nature of the error you want to dispute. If you think a creditor got your name or identity mixed up with someone elseâs, youâll need to provide official proof of your personal information. This proof could be a driver’s licence, birth certificate or even a utility bill to show proof of address. If you believe youâve been a victim of identity theft, youâll need supporting evidence like bank or police statements or letters from creditors supporting your claim.

Don’t Miss: How Often Does Capital One Report To The Bureaus

How Long Do Credit Inquiries Affect Your Credit Score

Each hard inquiry on your credit report can hurt your credit score by up to 5 points each. Soft inquiries dont affect your credit at all. Having too many hard inquiries on your credit report at once can indicate to a creditor that you are desperate for money and may be in trouble financially.

Lenders may also assume that youve recently opened up a bunch of new accounts and could deny you credit because new lines of credit often take time to show up on your credit report.

Plus, while 5 points may not seem like a lot, it can quickly add up if you have applied for many loans or credit cards over the last two years.

What To Remember When You Are Rate Shopping

If you need a loan, do your rate shopping within a focused period such as 30 days. FICO Scores distinguish between a search for a single loan and a search for many new credit lines, in part by the length of time over which the inquiries occur.

When you look for new credit, only apply for and open new credit accounts as needed. And before you apply, it’s good practice to review your credit report and FICO Scores to know where you stand. Viewing our own information will not affect your FICO Scores.

As a general rule, it is OK to apply for credit when needed. Be mindful of this information so you can start the credit-seeking process with more confidence.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Don’t Miss: Free Paydex Score

Write A Letter To The Credit Bureau

Write a letter to the credit bureau whose report you dispute. Clearly identify and circle the items in a copy of the credit report. The reporting bureau will carry out investigations to ascertain your claims. They will do so by collaborating with the information provider to weed out the errors. This should be completed within 30 days, after which they are supposed to remove the items in question. The removal will depend on whether your claims are found to be true, if not the items will remain in your report.

The above steps give you a 2-pronged approach to having hard inquiries removed from your credit report. One is by requesting the company whose inquiry you dispute, to contact the credit reporting agencies and notify them of the mistake. The other is by writing to the credit bureaus and having them investigate the inquiries in question both of which are within your rights.

For assistance with removing hard inquiries and other negative items from your credit report to increase your credit score quickly, contact Credit Absolute for a free consultation.

What Is A Soft Inquiry

Soft inquiries typically occur when a person or company checks your credit as part of a background check. This may occur, for example, when a credit card issuer checks your credit without your permission to see if you qualify for certain credit card offers. Your employer might also run a soft inquiry before hiring you.

Unlike hard inquiries, soft inquiries wont affect your credit scores. Since soft inquiries arent connected to a specific application for new credit, theyre only visible to you when you view your credit reports.

Read Also: What Fico Score Does Carmax Use

You Are A Victim Of Fraud Or Identity Theft

Can you remove hard inquiries from your credit report if you are a victim of fraud or identity theft? The answer is YES.

If you are positive that you did not recently apply for a new credit, you might have been a victim of fraud or identity theft. This means someone used your personal information to get a loan. It is very important that you take the necessary actions not only to remove the hard inquiry entry from your credit report but also check and secure your other accounts.

Next Stepscheck Your Credit Score & Report Regularly

Its a good idea to check your credit score at least once per quarter and your credit report once per year to check for errors. Free credit report websites can be a handy source to notify you about any new inquiries on your report. Signing up with one of these sites can help you receive any new updates about your credit reports in real-time.

Read Also: Does Cancelling A Loan Affect Credit Rating

How To Remove Inquiries From Your Credit Report

Because inquiries on your credit report can cause your credit score to drop a bit, you might be inclined to remove them. However, hard inquiriesthose that are made because you applied for more creditcan not be removed unless they are inaccurate or fraudulent.

Since hard inquiries have only a small effect on your credit score and they go away after two years, you shouldn’t waste your time trying to get them taken off your report. The wiser action is to limit the number of credit applications you make over a short period of time.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: What’s My Credit Score Chase

Dispute An Unauthorized Or Inaccurate Hard Inquiry

Remember, if you did request the credit inquiry because you were applying for a loan, then you cant dispute it with the agencies.

But if something looks suspicious, then lets take action.

If you find you could have a case of identity theft youre dealing with, then you will need to file a police report.

You would need the information from your police report to help you dispute the unauthorized inquiry.

If you think this is a case of a mistake in reporting, then you can work directly with each bureau.

File A Dispute with Each Credit Bureau

Since you receive three different credit reports, youll need to dispute the inquiry with each corresponding bureau.

Hard Inquiries Sometimes Appear In Error

There are several reasons that inaccurate hard inquiries might appear. All of them impact whether you receive credit and loans, and the interest rates that you receive for these loans. One cause of error is identity theft. When you receive a fraud alert, itâs sometimes because someone is using your personal information that they gained through identity theft to apply for credit or a loan in your name.

A hard credit inquiry carried out through identity theft will hurt your credit score, so the inquiry itself is worth disputing. If the fraud threatens immediate harm, you can put a on your record, to prevent anyone from accessing it until the issue is resolved.

Hard inquiries are supposed to last for only two years on a credit report. If one is older than two years, itâs in error. The mistake still hurts your credit score, so you should contest it. Additionally, a hard inquiry from a single application could mistakenly appear on your credit report multiple times. This is an innocent slip up, but you should still dispute it.

Sometimes retailers or lenders run unauthorized hard inquiries, where they look up a credit report by mistake and/or without permission. This can also happen if a merchant sends out multiple inquiries to try to get you the best financing for a loan. In situations like this, as long as the inquiries are all within 14 days of each other, they will only count as one inquiry against your credit score.

You May Like: Syncb Ppc Closed

How Much Does A Hard Inquiry On Your Credit Report Hurt

For people with extensive credit histories, a single credit application and hard inquiry has no effect or a fairly minimal one.

If youve lost points because you applied for a lot of credit in a short time span, take heart. Credit applications are not a major factor in calculating your credit scores.

VantageScore describes recent credit behavior and inquiries as less influential. Applications for new credit account for 10% of FICO scores.

But people who have short credit histories or few accounts may see a bigger change.

If youre trying to build credit, every point counts, and pulling back on new applications for a few months should restore lost points. Particularly if you are taking out a mortgage, wait until after closing to apply for new credit.

Multiple hard inquiries can put a serious dent in your credit, particularly if you are new to credit, and its an easy mistake to make. Say youve just rented an apartment. The leasing agent may check your credit. And then you may apply for financing for furniture. Then you decide you want a card with travel rewards, so you apply for a couple of those. That could be four credit inquiries within a short period, and it could result in a lower score.

Statistics cited by FICO show that people with six or more recent inquiries are eight times as likely to file for bankruptcy as those with none, and scoring formulas reflect that.

In the meantime, focus on the two things that have the most powerful effect on your scores:

The Type Of Credit Inquiry That Matters Most

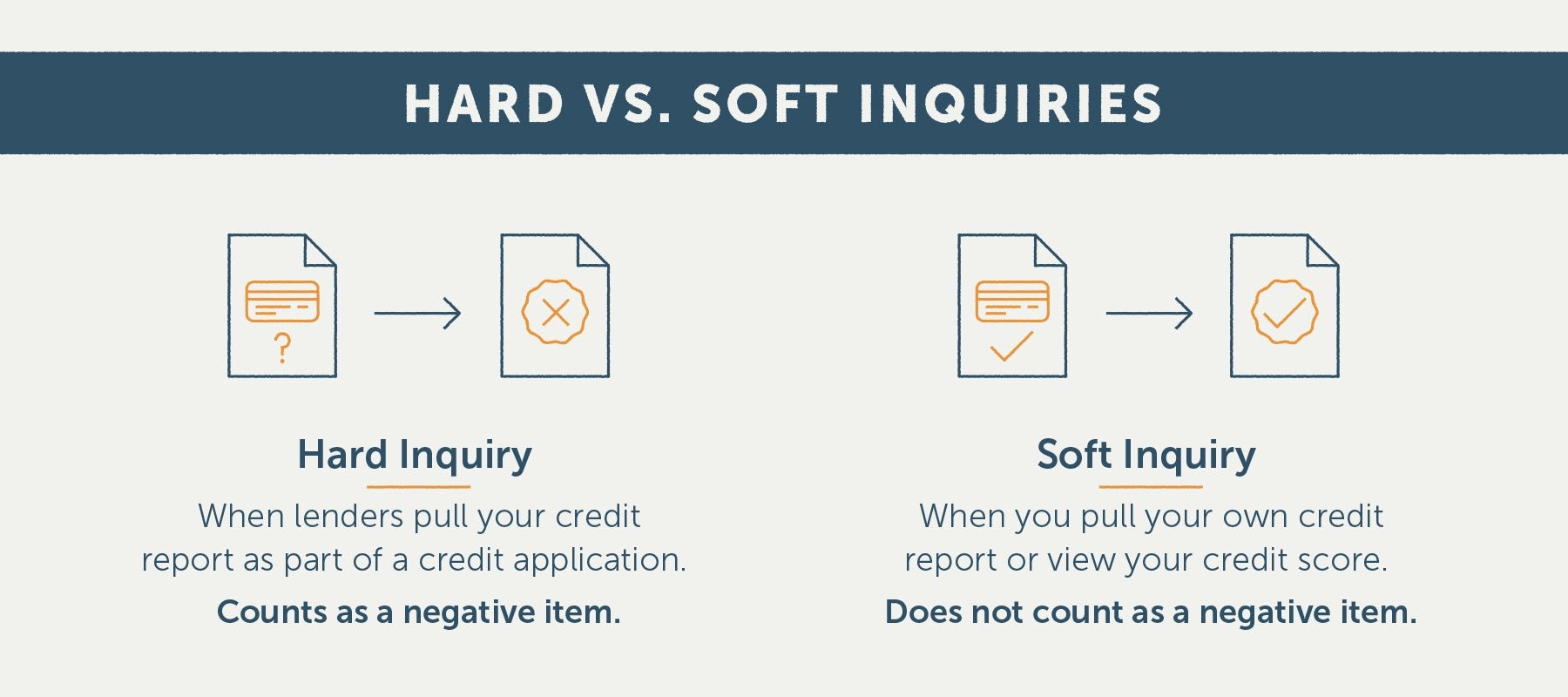

There are two different types of inquiries, with differing effects on a consumers : hard inquiries and soft inquiries.

If someone authorizes a hard inquiry of your credit report, then your credit score will drop anywhere from 5 to 10 points for a year for each hard inquiry. A soft inquiry wont impact your credit score at all. Well go into how these two inquiries differ.

Don’t Miss: Does Affirm Show Up On Credit Karma

Hard And Soft Credit Inquiries

While creditors can pull your credit reports and report to determine whether you are in good standing, they have key differences. A hard credit inquiry may contain different information than a soft credit inquiry. A creditor or another entity conducting a soft credit inquiry for marketing or promotional purposes may only have access to a portion of your report. A hard credit inquiry is required to obtain your complete credit file.

Hard credit inquiries may also have negative effects on credit scores by decreasing your score. Soft inquiries can still be noted on credit reports, but they do not lower credit scores or show up on credit reports. A lender or creditor must have your permission before they can conduct hard inquiries. You can usually dispute a hard credit inquiry that was done without you knowing or consenting.

Whats The Difference Between Hard Inquiries And Soft Inquiries

Each time a bank, lender, credit card issuer, or insurance company receives an application from you, an inquiry is made on your credit report. They have been authorized by you and are called hard inquiries.

Unsolicited credit card offers that come in the mail are called soft inquiries. Credit card issuers, insurance companies, and lenders make those inquiries. You did not make them, so they dont impact your credit score, even though they appear on your credit report.

Pre-approvals and pre-qualifications initiated on your own usually also only constitute a soft inquiry. To be sure, however, check with the creditor before agreeing to one.

See also:Hard vs. Soft Inquiries: How They Affect Your Credit Score

Don’t Miss: Care Credit Credit Score Approval

What Are Inquiries On Your Credit Report

Anytime you seek credit from a lender or credit card issuer, that organization will want to see your track record as a borrower. You can check your credit report before applying for new credit to get an understanding of what they’ll see on your report. Your past and current financial behavior, such as payment history and balances on loans and credit cards, helps lenders decide whether to work with you.

Lenders could interpret several missed bill payments, for instance, as a sign that you’re likely to miss a payment again in the future. That could lead to you getting denied for a loan or being charged higher interest rates. To get the information it needs, the lender must request your credit file from the credit bureaus, and that results in a hard inquiry. That inquiry, in turn, will appear on your credit report.

In contrast, a soft inquiry occurs when you check your own credit, for instance, or when a company wishes to prequalify you for a loan offer, but you haven’t yet submitted a full application. Soft inquiries do not impact your credit score.

What To Do If You Dont Recognize An Inquiry On Your Credit Report

If you see an inquiry you dont recognize, first check what kind of inquiry it is hard or soft. Soft inquiries dont affect your credit score and only you can see them. Hard inquiries typically happen when a lender or company accesses your credit report with the intention to extend you credit or apply for a new financial obligation.

Lenders can only access your credit report if they have a permissible purpose. That is, they must have a specific, allowable reason under the Fair Credit Reporting Act. If a hard inquiry is a result of fraud, it can be removed from your report. But just because an inquiry on your credit report doesnt look familiar, that doesnt mean its unauthorized or inaccurate.

Store credit cards are a great example. Sometimes, the name of the bank on the credit report isnt the same as the company the card is for. If you request to increase your credit line on a credit card you already have, that will often cause a hard inquiry too. These are easy to miss or forget about when reading through a credit report.

One quick way to double check if you applied for new credit is to search your email for the name of the creditor on your credit report. If you find an application, check the terms and conditions, which will say if you gave the creditor permission to access your report.

If you still think a hard inquiry on your credit report is unauthorized, run through this checklist for suggested steps to take and further protect your credit health:

Don’t Miss: Will Paypal Credit Report To Credit Bureaus