Add Utility And Phone Payments To Your Credit Report

Typically, payments such as utility and cellphone bills wont be reported to the credit bureaus, unless you default on them. However, Experian offers a free online tool called Experian Boost, aimed at helping those with low credit scores or thin credit files build credit history. With it, you may be able to get credit for paying your utilities and phone bill even your Netflix subscription on time.

Note that using Experian Boost will improve your credit score generated from Experian data. However, if a lender is looking at your score generated from Equifax or TransUnion data, the additional sources of payment history wont be taken into account.

There are also services that allow rent payments to be reported to one or more of the credit bureaus, but they may charge a fee. For example, RentReporters feeds your rental history to TransUnion and Equifax however, theres a $94.95 setup fee and a $9.95 monthly fee.

How much will this action impact your credit score?

The average consumer saw their FICO Score 8 increase by 12 points using Experian Boost, according to Experian.

When it comes to getting your rent reported, some RentReporters customers have seen their credit scores improve by 35 to 50 points in as few as 10 days, according to the company.

If I Pay Off My Credit Card In Full Will My Credit Go Up

Yes.

Here’s a short chart showing different methods of paying off credit card debt and how they usually impact your credit score.

| Method used to pay off credit cards | Usual impact on credit score |

|---|---|

| Cash or check | |

| Personal loan, debt consolidation loan | Boost in score |

| Balance transfer credit card | No change |

Note: Depending on your circumstances, you may not see these effects on your credit score. We’ll explain more about how your credit score is calculated below so you can take all factors into account.

How Can I Use My Credit Card To Improve My Credit Score

When opening a new credit card you will have to consider a good strategic plan of use. It helps build credit and build an excellent financial profile.

Be smart, plan your spending ahead of time. Only spend what you can pay back.

Return payments for your credit card accounts on time and you have a winning method for bolstering or rebuilding a good credit score.

Also Check: How Long Do Hard Inquiries Stay On Your Credit Report

Build And Monitor Your Credit

Whether you’re starting with a credit card or using a loan to build credit, you can monitor your progress by tracking your credit report and score online. While there are many credit myths, Experian offers free access to your credit report and a FICO® Score for free, as well as ongoing if there’s any suspicious activity so that you know what is going on with your credit. You can see which information gets reported, how your score changes over time and receive personalized suggestions for how to improve your credit.

How To Build Credit Without A Credit Card

While opening and using credit cards can be a good way to build credit, they’re not the only option. Loans and other types of accounts can also help if they’re reported to the credit bureaus.

When you’re starting out, you could look into , which are designed specifically for this purpose. Other common loans, such as student, auto and mortgage loans can also help you build credit.

As with credit cards, making payments on time with loans is the most important factor in building credit. Your remaining balance can also impact your scores, but it’s not as important as utilization rates on credit cards.

Other types of accounts, such as utility and phone plans, often don’t get reported to the bureaus or impact your credit. However, Experian Boost is a free service that allows you to add your phone and utility accounts to your Experian credit report so they can help you build credit. There are also rent reporting services that you may be able to use to add your rent payments to your credit reports. As mentioned, there are several other ways to build credit, with no credit history.

Also Check: How To Get Accounts Removed From Credit Report

Ask For A Credit Limit Increase

A higher credit limit is another way to help reduce your credit utilization ratio, which can help raise your credit scores. Keep in mind though that some credit issuers do a hard credit check when you request a credit limit increase, and that can cause your credit to dip. Read up on how to ask for a credit limit increase.

How Long Does It Take To Raise Your Credit Score After Getting A New Card

Building credit takes patience and persistence, so you shouldn’t expect immediate benefits after getting a new credit card. However, as soon as your credit card company starts reporting to credit bureaus, it’ll start impacting your report. Credit card companies typically report information at least once a month, so you can expect to see your credit utilization ratio drop and your on-time payments increase after a month or two.

Recommended Reading: A Credit Report Is Used To Help Measure A Borrower’s

Why Did My Credit Score Go Down When I Paid Off My Credit Card

In general, the only time you should see a decrease in your credit score when you pay off credit card debt is if you also close your account. Why? Once again, it mostly comes down to utilization.

As we saw, your credit utilization decreases when you pay off credit card balances. But this only works if your total available credit stays the same.

When you close a credit card, you lose access to that credit line. This means your total available credit decreases. If you have balances on your remaining credit cards, a decrease in your total available credit can cause your utilization rate to rise.

To avoid this, you may want to pay off credit card balances without closing your accounts. Of course, if you have problems using your card responsibly or the card has an annual fee, it may be worthwhile to close the account despite the potential impact to your utilization. In this case, try to pay off all of your credit card balances to keep your overall utilization low.

Key Points About: How Opening A Credit Card Affects Your Credit Score

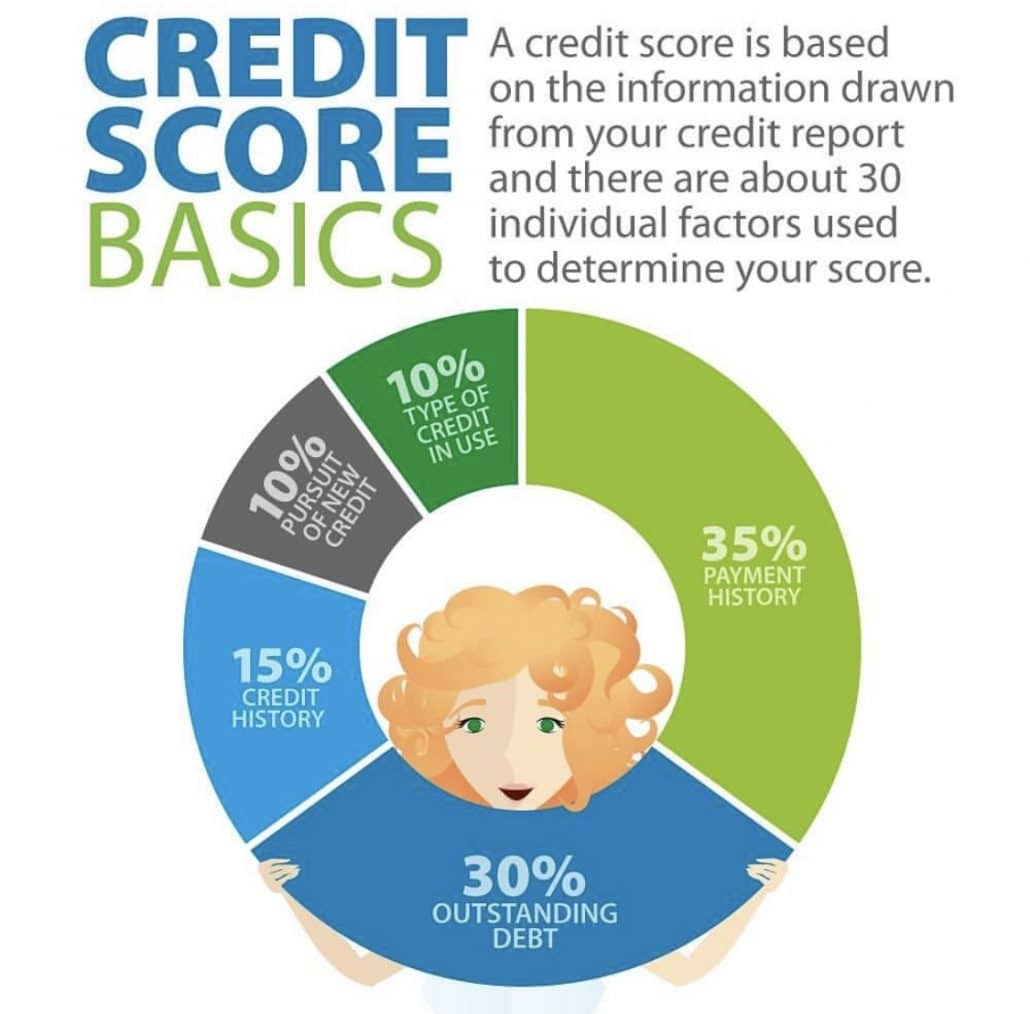

Length of credit history and credit utilization ratio are determining factors in a persons credit score.

Impacts to your credit score from opening a new card are less severe than missing payments or closing a longstanding credit card account.

Per FICO, opening a new credit card account can impact your in two primary ways. First, the card issuer will likely pull your credit report as part of their review process. That inquiry on your credit report can lower your score but generally has a small impact on your FICO® Scores1 . In addition, the issuer will report the newly opened account to the credit bureaus, which impacts length of credit history characteristics. The exact impact depends on the applicants unique credit history. Over time, though, getting a credit card can help build a better if you pay it on time and carry minimal debt . As you build up a history of responsible behavior, and its reported to the major credit bureaus, you can be on your way to a better financial future.

Those are far from the only ways that opening a credit card can potentially impact your credit score see below for more details.

Recommended Reading: Does Monroe And Main Report To Credit Bureaus

Increase Your Spending Limit To Lower Your Credit Utilization Ratio

What’s the spending limit on your credit card? $5,000? $15,000? Maybe it’s somewhere in between.

When it comes to building credit, this spending limit can be much more powerful than you’d think. If you have a high spending limit and low balance, your credit utilization ratio will be lower than if you have a low limit and a low balance. For example, if you have a balance of $1,000 on a card with a $6,000 limit, your utilization ratio is 16.6%. A balance of $1,000 on a card with a $12,000 limit comes to a ratio of 8.3%.

How do you increase your spending limit? You should be able to call the credit card company customer service number to request the change. When I made this call, it took less than 10 minutes. You can’t guarantee that they’ll say yes, but they won’t penalize you for asking.

If you think raising your spending limit will tempt you to overspend, you should refrain from increasing the limit. Not only will this make you accumulate debt, but your credit score could also drop if you can’t afford to make payments to keep the balance low.

Why Is My Credit Score Low After Getting A Credit Card

There are two ways that getting a new credit card may negatively impact your credit score. When you apply for a new card, the credit company may perform a hard pull of your credit report for review as part of the approval process. The inquiry on your credit history may lower your score, but generally the impact is low on the FICO scale .

When you receive a new card, a card issuer will report a recently opened account, which will affect the length of credit history you might have. The exact change to your FICO score depends on your overall credit history. A new card will, however, build a better credit history as long as you use all your accounts responsibly by paying on time and minimizing your overall debt as it relates to your overall available credit.

Recommended Reading: How Often Does Experian Update Your Credit Score

Make The Most Of A Thin Credit File

Having a thin credit file means that you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isnt normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO Score. Its free to use and designed for people with limited or no credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO Score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, several services allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO Score. Some rent-reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it

Don’t Miss: How To Run A Credit Report On Myself

Blue From American Express

Borrowers with a poor or fair score may qualify for a Blue from American Express card. There’s no annual fee, and you can earn 1 Amex Membership Rewards point per dollar spent. You can use these points to pay for things like travel, hotels, and gift cards. The main downside is that the interest rate is pretty high it’s a 24.99% variable rate. If you struggle to keep your balance low, this high rate could quickly rack up the amount you owe.

You’ll Have Access To More Credit

The percentage of the total credit you’re using, also known as amounts owed or , is the second-most important factor of your credit score.

For every new card you open, you’ll receive a new credit limit which increases your available credit. This can be a great way to improve your credit utilization rate and credit score, but only if you maintain the same or similar amount of spending as before you opened a new card.

If you use the additional line of credit to overspend, you risk raising your utilization and therefore hurting your credit score. The best approach with opening multiple credit cards is to maintain a consistent amount of spending that’s 10% of your total credit limit or lower.

You May Like: How Long Can Credit Inquiries Stay On Your Report

How Opening A Credit Card Can Help Your Credit Score

Responsible handling of your finances, potentially with the opening and use of a credit card, can help build a good credit history over time. For example, while FICO® Scores are made up of several components, one important category is amounts owed, which typically makes up 30 percent of your overall score. This component addresses your debt-to-credit ratio, or credit utilization rate. Essentially, it measures how much of the credit extended to you, also known as your credit limit, is being used and paid off. Per FICO, a low credit utilization rate will more positively affect your FICO® Scores than not using your available credit at all because it shows that you are capable of handling credit responsibly.

How many credit cards do you need to build credit? The answer depends on your credit utilization and how much credit you need, so consider the ratio of how much you spend compared to how much credit is available to you on your card, or cards. For example, opening a credit card may lower your debt-to-credit ratio. Say that you double your total credit lines available from $5,000 to $10,000 by opening a second card, but you simply spread out your current spending of about $1,000 per month across those two credit cards. This would improve your utilization ratio, meaning that youre spending $1,000 out of $10,000 available to you, for a utilization of 10 percent instead of 20 percent when you had $5,000 available.

Sign Up For Free Credit Monitoring

Whether its with Credit Karma or someone else, keeping a close eye on your credit is essential. Signing up for credit monitoring can help alert you to important changes in your credit, so that you can check for suspicious activity. Fraudulent activity can weigh down what could be an otherwise good credit score, so its important to dispute any details you identify as inaccurate. If the credit bureau rules in your favor, the fraudulent activity will be removed from your credit report, which can help raise your credit scores.

You May Like: How To Find Out My Credit Rating Uk

What Are Credit Reference Agencies

On which platform can you track and boost your fico score faster? Does credit karma have a boost like experian? 09/06/2022 · credit karma is different from experian. In short yes, experian boost is safe.

21/10/2021 · credit karma generates a vantage score while experian issues the fico score. 09/06/2022 · credit karma is different from experian. While experian compiles your credit report and determines your credit score, credit karma simply shows you credit scores and report information from equifax and transunion. Experian is one of the three main credit bureaus used to generate credit reports.

Where To Access Your Free Credit Reports

Thanks to the Fair Credit Reporting Act, you can access a free credit report from Experian, TransUnion and Equifax once every 12 months. Free reports are available at AnnualCreditReport.com.

You may be entitled to additional free reports under any of the following circumstances as well:

- Youre unemployed and plan to apply for a job within 60 days.

- A company denies your application or offers you worse terms based on your credit when you apply for credit, insurance or employment. .

- You receive public assistance income.

- Youre a victim of identity theft or fraud.

Also Check: How Much Does Transunion Charge For Credit Report

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay off all of them. Then youll just have one payment to deal with, and if youre able to get a lower interest rate on the loan, youll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period when they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 3%5% of the amount of your transfer.

Get A Copy Of Your Credit Report And Remove Errors

Studies by the Federal Trade Commission have found that 5 percent of consumers have errors on one of their three major credit reports. That’s why it pays to get a copy of your credit report and dispute any errors. Federal law allows you to get a free copy of your credit report every 12 months from each credit reporting company.

You May Like: Can You Get Charge Offs Removed From Credit Report