What Are The Risks

Before you start giving yourself a digital makeover, like filling out your LinkedIn profile to show your professional or academic accomplishments, keep in mind these changes to how your credit score is calculated are still speculative at this point.

Your Orwellian objections may have some merit. What about privacy and security concerns? The IMF research acknowledges there would be an efficiency-privacy trade-off.

The increasing use of private data for financial services also raises a myriad of consumer protection and privacy issues that require the government to set standards for data collection and use, the working paper says.

The paper points to fair lending rules in the U.S. that prohibit using gender or race information for lending decisions. So how much of your digital footprint is fair game when it comes to evaluating what kind of borrower youll be? And how will your information be kept safe from data breaches?

The researchers say new regulations will need to be set by governments so that Big Tech faces the same data privacy requirements as banks do. Big Tech innovations move at such a fast pace, it may take a while for governments to catch up with the necessary policy. When it comes to regulation, it is a slow-moving process.

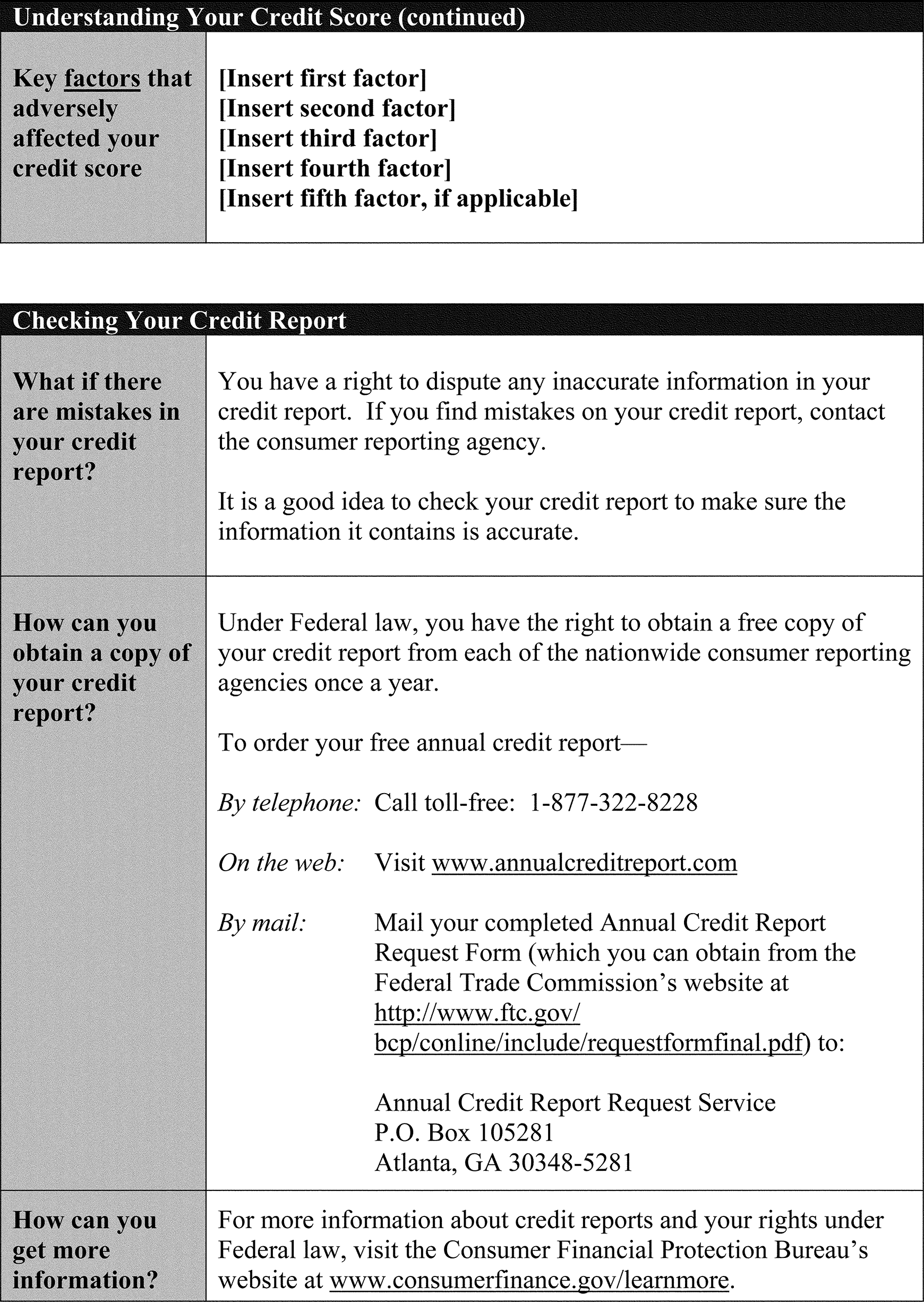

What Is A Fico Credit Score

The most widely used credit scoring model is the FICO Score, or the credit score created by Fair Isaac Corporation. More than 90% of lenders use your FICO score to help in their billions of decisions relating to credit every year. Your FICO score is a 3-digit number, ranging from 300 to 850, that is calculated using the information contained in your consumer credit report. By comparing the information contained in your credit report to patterns from a large number of past credit reports, your FICO Score quickly and accurately estimates your level of future credit risk as a borrower.

But how is your credit score calculated? Lets look at the factors that contribute to your credit score, as well as their respective weights for each bureau.

Scoring model calculation factors by bureauDescription: Credit Sesame wanted to provide the calculation that comprises a credit score by credit bureau.

| Experian |

|---|

| 10% |

What you may notice that is different, however, is the weight each credit bureau assigns to each of these 5 factors. While each bureau looks at the same factors to calculate your credit score Score, they may choose to weigh each factor differently or assign it a different importance. For instance, your payment history contributes to 35% of your total credit score for Experian and Equifax but this number jumps to 40% for TransUnion. In other words, if you have a stellar payment history, it is likely that your credit score from TransUnion may be higher than your other scores.

Secured Line Of Credit

With a secured line of credit, you use an asset as collateral for the line of credit. For example, the asset could be your car or your home. If you don’t pay back what you owe, the lender can take possession of that asset. The advantage is that you can get a lower interest rate than with an unsecured line of credit.

Recommended Reading: Syncb/ppc On Credit Report

Key Variables In A Mortgage Credit Assessment

During the credit evaluation process, credit originators scrutinize several key variables. These are:

- FICO: A score that provides a quick way of assessing the applicants creditworthiness.

- DTI: Debt-to-income ratio is used to qualify mortgage payment and other monthly debt payments versus income.

$$ \text=\cfrac } } $$

- LTV: This is the ratio of a loan to the value of an asset purchased i.e., the loan-to-value ratio. A higher ratio generally indicates a higher level of credit risk.

- Payment type : indicates the type of mortgage, e.g., adjustable rate, fixed, etc.

Mortgage products also differ according to the type of information the lender demands before approval:

- Full doc: The loan requires proof of income and assets. Debt-to-income ratios must be calculated.

- Stated income: The mortgage lender verifies employment but not income.

- No income/No asset: The mortgage allows the applicant to state their income and assets that can be used as security on the loan application document. Although the source of the income is verified, the lender makes no attempt to verify whether this information is true .

- No ratio: The DTI is not calculated because income is not listed on the application. Only employment information is requested.

- No doc: The applicant does not have to provide income or asset information documentation. Application forms may have fields for such information, but the fields are left blank.

How Credit Scoring Works

Credit scoring models may differ slightly in how they score credit. Fair Isaac Corporations credit scoring system, known as a FICO score, is the most widely used credit scoring system in the financial industry, employed by more than 90% of top lenders. However, another popular credit scoring model is VantageScore, which was created by the top three credit-reporting agencies: TransUnion, Experian, and Equifax.

A persons credit score is a number between 300 and 850, with 850 being the highest score possible. Credit scores for small businesses, such as the FICO Small Business Scoring Service , range from zero to 300.

An individuals credit score is influenced by five categories:

- Payment history

- Public filings

- Payment history and collections

- Number of accounts reporting and details

Lenders use credit scoring in risk-based pricing in which the terms of a loan, including the interest rate, offered to borrowers are based on the probability of repayment. In general, the higher the credit score, the better the rate offered by the financial institution.

The higher your credit score, the better your interest rate will be.

You May Like: What Is Syncb Ppc On My Credit Report

Having Your Credit Checked For A Job In Canada

Categories

Youve definitely heard of creditors and lenders checking your credit report, but did you know that potential employers sometimes check credit reports too? Usually checking a credit report is a part of a full employment background check which includes things such as a criminal record check as well. Because this may be new information to you, its important to understand what a potential employer will see through a credit check and why they might want to look at the credit report of a potential employee.

These 7 people can check your credit.

What Is Credit Scoring

Credit scoring is a statistical analysis performed by lenders and financial institutions to determine the of a person or a small, owner-operated business. Credit scoring is used by lenders to help decide whether to extend or deny credit. A can impact many financial transactions, including mortgages, auto loans, credit cards, and private loans.

Don’t Miss: Syncb Ppc

What Impacts Your Credit Score

Your credit score reflects the way youve managed your debts and bills in the past. So if youve borrowed money in the past and always kept up with repayments, this will have had a positive impact on your score. But a history of missing or making late payments would have had a negative impact.

If youve never borrowed money before, it’s difficult for lenders to assess the risk of lending to you and your credit score will reflect that.

Your credit score is based on your credit report, also known as a credit file.

Whats included in your credit report:

-

all your credit agreements such as loans and credit cards, including any held jointly with other people

-

your history of credit repayment, including payments you’ve missed over the last six years

-

public records, including County Court Judgments and the electoral roll

Your credit report doesnt include things such as your medical history or salary.

Measurement And Monitoring The Performance Of A Scorecard

Lenders use a credit scoring model to help them predict with reasonable accuracy which applications will be good or bad in the future. To achieve this, the scorecard must be able to differentiate between good and bad by assigning high scores to good credits and low scores to poor ones. A good model minimizes the overlapping area of the distribution of the good and bad credits, as we saw above in The Distribution of Good and Bad Accounts Based on a Cutoff Score.

For this reason, it is important to come up with tools that can be used to measure the performance of a scorecard. The most popular tools today are the cumulative accuracy profile and the accuracy ratio.

The figure below illustrates how the CAP works.

The horizontal axis shows the percentiles of the predicted default scores in the data set. The vertical axis, on the other hand, shows the actual defaults in percentage terms obtained from the banks records.

For illustration purposes lets assume that according to the banks scoring model, 20 percent of the accounts will default in the next 12 months. If the model were perfect, the actual number of defaults recorded over that time period would correspond to the second decile of the score distribution the perfect model line in the figure.

The observed cumulative default line represents the actual defaults observed by the bank. A lender would aim to develop a model whose results are relatively close to the perfect model line.

Don’t Miss: What Is Syncb Ntwk On Credit Report

What It Means When You Apply For A Loan

Following the guidelines below will help you maintain a good score or improve your credit score:

- Watch your . Keep below 15%25% of your total available credit.

- Pay your accounts on time and if you have to be late, don’t be more than 30 days late.

- Don’t open lots of new accounts all at once or even within a 12-month period.

- Check your credit score about six months in advance if you plan to make a major purchase, like buying a house or a car, that will require you to take out a loan. This will give you time to correct any possible errors and, if necessary, improve your score.

- If you have a bad credit score and flaws in your credit history, don’t despair. Just start making better choices and you’ll see gradual improvements in your score as the negative items in your history become older.

Pros Of A Line Of Credit

- You’ll usually pay a lower interest rate for a line of credit than for a credit card or a personal loan

- Depending on the product and financial institution, you may not be charged set-up fees or annual administration fees

- To avoid unnecessary fees, if you bank with the same financial institution where you got a your line of credit, you may be able to have any overdraft on your chequing account transferred to your line of credit

Also Check: Is 611 A Good Credit Score

Can Service Accounts Impact My Credit Score

Service accounts, such as utility and phone bills, are not automatically included in your credit file. Historically, the only way a utility account could impact a credit score was if you didn’t make payments and the account was referred to a collection agency.

But this is changing. A revolutionary new product called Experian Boost now allows users to get credit for on-time payments made on utility and telecom accounts.

Experian Boost works instantly, allowing users with eligible payment history see their FICO® Score increase in a matter of minutes. Currently, it is the only way you can get credit for your utility and telecom payments.

Through the new platform, users can connect their bank accounts to identify utility and phone bills. After the user verifies the data and confirms they want it added to their credit file, they will receive an updated FICO® Score instantly. Late utility and telecom payments do not affect your Boost scorebut remember, if your account goes to collections due to nonpayment, that will stay on your credit report for seven years.

Example Of Why Lenders Look At Your Debt

When you apply for a mortgage, for example, the lender will look at your total existing monthly debt obligations as part of determining how much mortgage you can afford. If you have recently opened several new credit card accounts, this might indicate that you are planning to go on a spending spree in the near future, meaning that you might not be able to afford the monthly mortgage payment the lender has estimated you are capable of making.

Lenders can’t determine what to lend you based on something you might do, but they can use your credit score to gauge how much of a credit risk you might be.

FICO scores only take into account your history of hard inquiries and new lines of credit for the past 12 months, so try to minimize how many times you apply for and open new lines of credit within a year. However, rate-shopping and multiple inquiries related to auto and mortgage lenders will generally be counted as a single inquiry since the assumption is that consumers are rate-shoppingnot planning to buy multiple cars or homes. Even so, keeping the search under 30 days can help you avoid dings to your score.

Don’t Miss: Removing A Repossession From Credit Report

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

A Walkthrough Of Statistical Credit Risk Modeling Probability Of Default Prediction And Credit Scorecard Development With Python

We are all aware of, and keep track of, our credit scores, dont we? That all-important number that has been around since the 1950s and determines our creditworthiness. I suppose we all also have a basic intuition of how a credit score is calculated, or which factors affect it. Refer to my previous article for some further details on what a credit score is.

In this article, we will go through detailed steps to develop a data-driven credit risk model in Python to predict the probabilities of default and assign credit scores to existing or potential borrowers. We will determine credit scores using a highly interpretable, easy to understand and implement scorecard that makes calculating the credit score a breeze.

I will assume a working Python knowledge and a basic understanding of certain statistical and credit risk concepts while working through this case study.

We have a lot to cover, so lets get started.

Don’t Miss: How Accurate Is Creditwise Credit Score

Why Is Your Personal Credit Score Part Of A Business Loan Decision

For most small business owners, the need to build and maintain a good personal credit score never goes away. Although its true that some lenders tend to weight the value of your personal score higher than others when they evaluate your business loan application, most lenders include a review of your personal credit score to determine your business creditworthiness.

This can be true for businesses with a few years under their belts as well as for those early-stage businesses looking for their first business loan. Nevertheless, in addition to a good personal credit score, small business owners also need to focus on building a strong business credit profile.

Your personal credit score is really a reflection of how you handle your personal credit obligations, and there are those who suggest it isnt relevant to how your business handles its business credit obligations. Nevertheless, many lenders consider your personal credit score as one of the data points they consider when they review your business loan application, so its important to understand how your score is created, how it is considered when you apply for a loan, and what you can do to improve your score.

Improving Your Credit Can Help Lower Your Premiums

If you live in a state that does allow insurance companies to consider your credit standing, improving your credit can help you lower your rates. By and large, credit-based insurance scores are based on similar factors that influence your credit scores, which means doing things like paying bills on time and keeping credit card balances low can help you improve both types of scores. Learn ways to improve your credit scores to save on your insurance premiums. Monitoring your credit with Experian can help you keep an eye on your credit report and address any issues as quickly as they arise.

Recommended Reading: 586 Credit Score

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.