Very Poor Credit Score: 0 549

This score spells rookie. Clearly, youre a newbie in the credit bidness and dont have enough credit history, to begin with. Not to panic though, everybody starts somewhere. This can easily be fixed, apply for a loan and credit card and set up a repayment schedule, this will ensure a good record and aid in maintaining a future credit history. Although if your score falls to this range, you might need to take some drastic measures to bring it back up.

Perfection is overrated but aiming for it isnt. Our score doesnt be perfect to get the best terms but our effort should be to achieve an excellent credit score. But if your credit is bad, how do you get there?

Auto Loans For Excellent Credit

Having excellent credit can mean that youre more likely to get approved for car loans with the best rates, but its still not a guarantee.

Thats why its important to shop around and compare offers to find the best loan terms and rates available to you. Even with excellent credit, the rates you may be offered at dealerships could be higher than rates you might find at a bank, credit union or online lender.

You can figure out what these different rates and terms might mean for your monthly auto loan payment with our auto loan calculator.

And when you decide on an auto loan, consider getting preapproved. A preapproval letter from a lender can be helpful when youre negotiating the price of your vehicle at a dealership, but be aware that it might involve a hard inquiry.

If you have excellent credit, it could also be worth crunching the numbers on refinancing an existing auto loan you might be able to find a better rate if your credit has improved since you first financed the car.

Compare car loans on Credit Karma to explore your options.

What Is A Good Credit Score For A Loan

If you need a car loan or a mortgage, it’s another story. Lower credit scores are often able to borrow money for these purchases. However, they’ll be at a major disadvantage when it comes to the interest rate they get.

The minimum FICO score required for conventional mortgage approval is 620. You can get a mortgage with this credit score, but you might have to pay more in interest. For example, as of this writing:

- The average borrower with a score of 620 can expect an APR of 5.084% for a 30-year loan

- The average borrower with a score between 700 and 759 can expect a much lower APR of 3.717% for the same 30-year loan

To put this into perspective, with a $200,000 mortgage, the lower-credit borrower would pay an additional $58,120 in interest over the term of the loan.

Because of these factors, it’s important to pay attention to your credit score. Even though it’s hard to get a perfect credit score, if you work towards the best credit score you can get, your wallet will thank you.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Keep Your Credit Score In Tip

Should you stress if your credit score doesn’t hit the 800 range? Absolutely not. Many borrowers can get loans and adequate interest rates when in the lower credit ranges.

However, you may want to consider boosting your credit if you fall into the “poor” or “fair” categories to make sure you get the absolute best credit offers possible when you want to buy a car, buy a home or utilize credit in other ways.

Keep Unused Credit Cards Open

Keeping old credit cards open as long as theyre not costing you money in annual fees is a smart strategy, as closing an account may increase your credit utilization ratio. Owing the same amount but having fewer open accounts may lower your credit score.

However, credit card issuers may close old, unused accounts, so you should periodically make a small purchase on old accounts you want to keep open just remember to pay them off to avoid interest.

Also Check: How To Get Rid Of Repossession On Credit Report

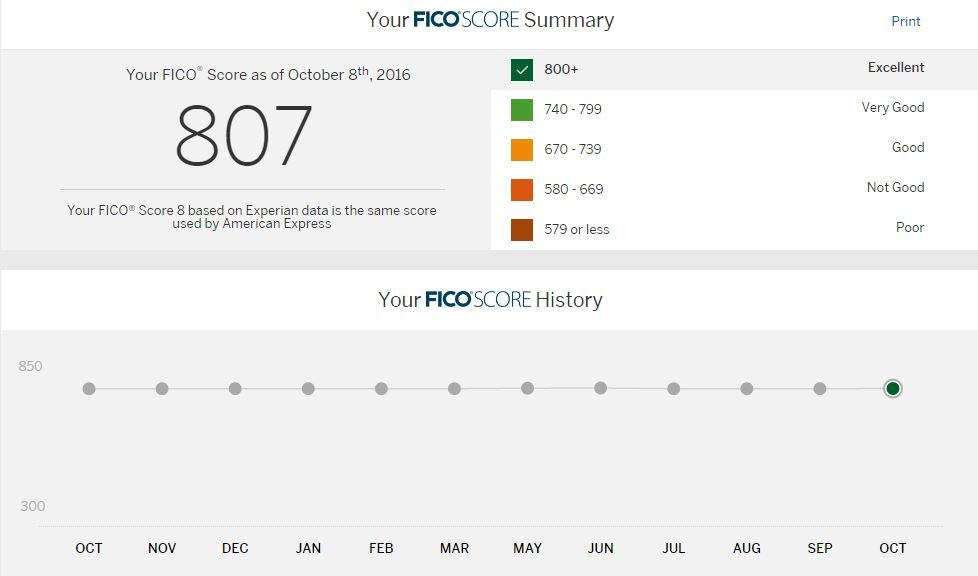

Improving Your 807 Credit Score

A Credit Repair company like Credit Glory can:

An industry leader like Credit Glory can guide you through this process. Give them a call @ , or chat with them, today â

What’s Great About An Exceptional Credit Score

Your 827 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates. Credit card issuers are also likely to offer you their most deluxe rewards cards and loyalty programs.

Late payments 30 days past due are rare among individuals with Exceptional credit scores. They appear on just 1.0% of the credit reports of people with FICO® Scores of 827.

An Exceptional credit score can mean opportunities to refinance older loans at more attractive interest, and excellent odds of approval for premium credit cards, auto loans and mortgages.

Read Also: How To Get Repos Off Your Credit

How To Get An 807 Credit Score

If youre not yet a member of the 800+ credit score club, you can learn how to join by checking your free personalized credit analysis on WalletHub. Well tell you exactly what you need to change and exactly how to do it. Paying your bills on time every month and keeping your below 15% are the keys to success in most cases. But you cant beat a customized credit improvement plan.

But good advice can be priceless when it comes to your credit, so we asked a selection of WalletHub users with 800+ credit scores to share the secrets of their success. You can check out their tips below.

Monitor Your Credit Score

Make sure to check your credit score regularly. Many popular provide you with an updated credit score every week, along with an analysis of why your score might have changed. Learn what is likely to raise your score and what is likely to lower it, and avoid anything that might bring your credit score down.

You May Like: Does Paypal Credit Report To Credit Bureaus

What Credit Score Do You Need For The Best Mortgage Rate

A credit score of 700-plus will usually land a borrower a lower interest rate, and while mortgage industry experts say you can still qualify for certain loans with a score under 680, the 700s are where you can expect to pay the lowest rates.

Creditors set their own standards for what constitutes an acceptable score, but these are general guidelines:

-

A score of 740or higher is generally considered excellent credit.

-

A score between 700 and 739 is considered good credit.

-

Scores between 630 and 699 are fair credit.

-

And scores of 629 and below are poor credit.

The lending industry carves up the credit score scale into 20-point increments and adjusts the rates it offers borrowers each time a credit score moves up or down by about 20 points. For instance, if your score drops to 740 from 760, youre likely to see a small bump up in the rate youll be offered.

Can I Get A Mortgage & Home Loan W/ A 807 Credit Score

Getting a mortgage and home loan with a 807 credit score should be extremely easy. Your current score is the highest credit rating that exists. You’ll have no issues getting a mortgage or home loan.

The #1 way to get a home loan with a 807 score is just to apply for that loan and wait for approval!

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

Recommended Reading: Report Death To Credit Bureaus

The Benefits Of An 800 Credit Score

So what exactly do you gain by having an 800 credit score? Is this something you should strive for? Here are three benefits of having an 800 credit score:

- You’re more likely to have your applications approved. Remember that credit scores indicate your creditworthiness. Along with your other financial information, your credit score helps lenders predict whether you’ll repay the money you borrow. With a high credit score, lenders see you as a less risky borrower, increasing the chances that they will approve your credit.

- You’re more likely to qualify for lower interest rates. Your credit score is a major determining factor in the interest rate on loans. Having an 800 credit score will help you qualify for lower interest rates and save you thousands of dollars over the life of your loan. You’ll see the biggest impact with larger loans that you repay over a longer period of time, such as mortgage and auto loans.

- You’ll receive better credit card offers and pay less in interest. Regardless of credit score, everyone can avoid paying credit card interest by paying their credit card balance in full each month. An 800 credit score can help you qualify for credit cards that offer a 0% promotional rate on purchases and balance transfers. Having one of these credit cards in your wallet gives you the flexibility to carry a credit card balance and pay it off over time while avoiding finance charges on your balance.

Can You Pay Off Your Balance Each Month

Never apply for a loan or credit if you dont first believe that you can afford to pay off the balance at the end of each month. This may sound obvious, but youd be surprised at how many people apply for credit or loans without asking themselves this question.

Ask yourself how you will use the credit card. Will you carry a balance, or can you indeed pay it off each month? Will you pay it off some months and not in others?

Roughly three fifths of all Americans who possess a credit card have a balance on that card. Despite this, you may want to pay off your balance at the end of each month so you can definitively avoid additional interest charges.

Don’t Miss: What Is Syncb Ntwk On Credit Report

What Happens If Your 807 Score Goes Up Or Down

If your score moves, then you have to plan accordingly and fix it accordingly. Sometimes when it moves it is only slightly, while other times it might be a drastic change that happens on your credit score. Either way, it is important to monitor your score for these changes.

If your score goes up, which it is able too a bit, then you do not want to do anything to fix it. This is a great thing. Whether you are lower or higher, having a score that gets higher is never a bad thing or something to worry about.

If the 807 score gets lower then the individual will want to look into many factors that might have caused a negative impact on the score such as just opening a new account, defaulting on a loan, being late with payments or using too much of the available credit that they have. When either of these is a problem, you can fix it according to the issue. Paying down your credit usage, making on time payments, catching up with the defaulted loan or waiting out new accounts until they become older are all fixes. Hard credit checks can also negatively impact your score, so it is important to note that these will go away with time.

As a general rule of thumb, you always want your score to go up and never down. When it goes down, it is important to note why it is and then change the issues that the score is having so that it goes back to where it was or higher.

Perks Of Having An 800 Credit Score

In addition to receiving all of the perks that come with having good credit, there are some additional 800 credit score benefits that you should be aware of. In many cases, these are the same benefits that people with very good or excellent credit scores receivebut they might be a little bit better due to your exceptional credit score.

You May Like: Does Affirm Show Up On Credit Karma

Do You Need An 800 Credit Score

Have you always been insatiably curious about your credit score? I am. In my mind, my credit score is kind of like a report card, like a race toward personal best.

Despite widespread media reports of Americans’ debt challenges, most consumers have credit scores that fall between 600 and 750. More good news: In 2020, the average FICO Score in the U.S. reached a record high 710, according to Experian.

So, speaking of an 800 credit score what is it and should you work toward achieving it? Let’s dive in.

How Long Does It Take To Get A 807 Credit Score

It depends where you started out.

If you had very good credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Read Also: Syncb Ppc Credit Card

Whats Impacting Your Score

Below are the aspects of your credit profile and history that are important to your Equifax credit score. They are listed in order of impact to your scorethe first has the largest impact, and the last has the least.

- Ratio of satisfactory trades to total trades in last 24 months.

- Number of personal finance trades with high utilization in the last 3 months.

- Worst rating for installment trades in the last 12 months.

What Does A 807 Credit Score Mean Pros And Cons Of Having This Credit Score

Those that have this credit score do not really have any cons, as this is one of the highest scores they can get. Though they are not at the very top of the ladder, they have a couple ways they can improve the score to get it to the top such as paying their payments on time, using the right amount of credit and never defaulting on their loans.

In terms of pros, a 807 credit score shows that you are a trustworthy, reliable borrower and that you would be ideal to loan money too for mortgage loans, vehicle loans, credit cards, lines of credit and a wealth of other money loaning services offered through various financial institutions.

Read Also: How To Fix A Repo On Your Credit

Recognize That Your Rates Can Increase

Currently, credit card companies cannot raise your credit rate for at least one year after you have opened your account, unless any of the following circumstances apply:

- A six month introductory rate exists

- You are late paying your bill by sixty days

- You have a card with a variable rate that is tied to an index and that index increases

You need to recognize that your credit rates will increase in the future, at least after the initial twelve months, and you need to establish with your potential creditor exactly when your rates will increase, by how much, and if there is anything you can do to lower your rates.

Credit Score Mortgage Rate: What Kind Of Rates Can You Get

An 800 credit score usually comes with low mortgage rates and can help you save thousands of dollars over the life of your loan.

Kim PorterUpdated April 28, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If youve managed to earn a credit score of 800 or higher, congratulations! Youve achieved one of the highest scores out there. Credit scores stretch from 300 to 850, and the average Americans score sits at 711 as of October 2020.

Generally, a high credit score shows youve managed debt responsibly in the past and it comes with benefits. Aside from bragging rights, an exceptional credit score makes you an attractive borrower for mortgage lenders and puts the best interest rates within your reach.

Heres what you need to know about credit scores of 800 or higher:

Recommended Reading: Is Creditwise Good

Whats Considered A Good Credit Score

If youre trying to build or maintain healthy credit, knowing whats considered a good score can be helpful. As you know, a good credit score can help you get approved and get better rates for loans and other credit.

Higher is generally better, but its hard to say specifically what a good score is. Whats considered a good score can differ by lender and based on the credit youre applying for. There are also different scoring models, so a good score may vary depending on what product or services you use to see your scores. That said, read on to learn what a good credit score range is when you check your score with TransUnion.