How To Fix Your Payment History On Your Credit Report

Watching your credit score drop after a late payment can be frustrating. Thankfully, the effects of negative marks always diminish over time if you address them and work toward reestablishing a good payment history. Take the following steps to improve your credit score after late payments:

- Bring your accounts current

- Seek assistance from your creditor or a credit counselor

What Credit Report Information Is Included

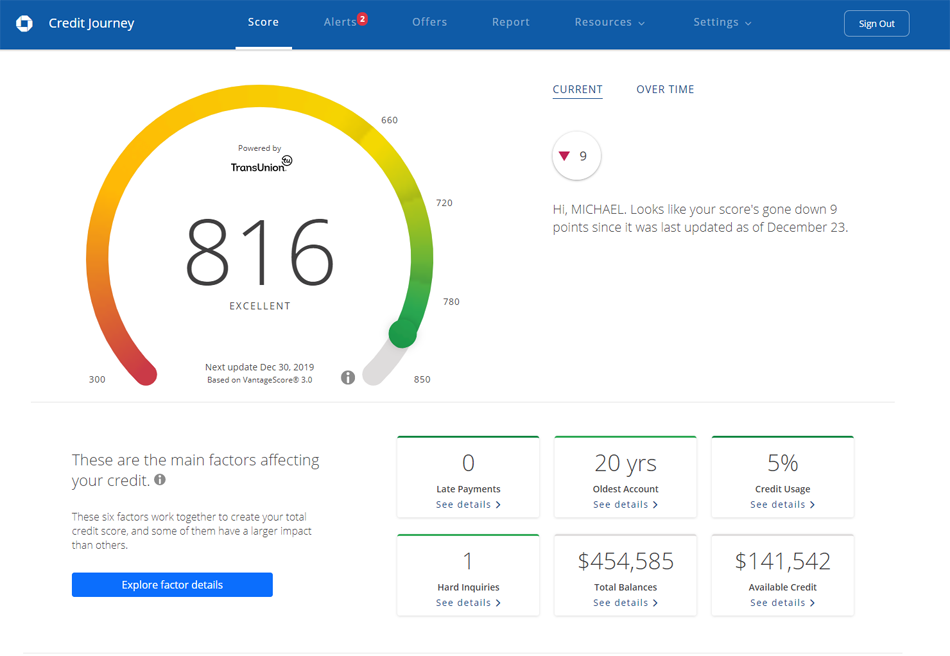

Aside from your credit score, Chase Credit Journey also offers a credit report. This report lists out key information that affects your score, including:

- Total balances owed

- # of public records

You can view a listing of all your accounts, their balances and their monthly payments.

That listing includes open and closed accounts, as well as loan and credit card accounts. You can see all of your credit accounts here, not just the ones you have with Chase.

Now:

This report is based only on whats in your TransUnion credit record.

If you want to see your credit report from Equifax or Experian, you can do that by heading to AnnualCreditReport.com.

This site lets you pull your credit report for free once a year from each of the three major credit bureaus. You can get all three at once or space them out over the year.

To get your report, you fill out a form with your name, address, Social Security number and date of birth. Youll also be asked for your previous address if you havent lived at your current address for at least two years.

You decide which credit reports you want to receive, answer a couple of verification questions and you can see your report. AnnualCreditReport.com doesnt, however, offer free credit scores.

A good idea:

Compare the information on your credit reports regularly.

That way, you can see whats being reported to different bureaus and whats not. Its also a way to check for signs of identity theft or credit reporting errors.

How Often Can You Check Your Credit

Check your credit reports at least once a year, according to the Consumer Financial Protection Bureau, and once a month, according to credit expert John Ulzheimer. Until the end of April 2022, you can get your reports for free every week from the three major credit bureaus by using AnnualCreditReport.com.

You May Like: Paypal Credit Report To Credit Bureaus

Tracking Changes Through A Non

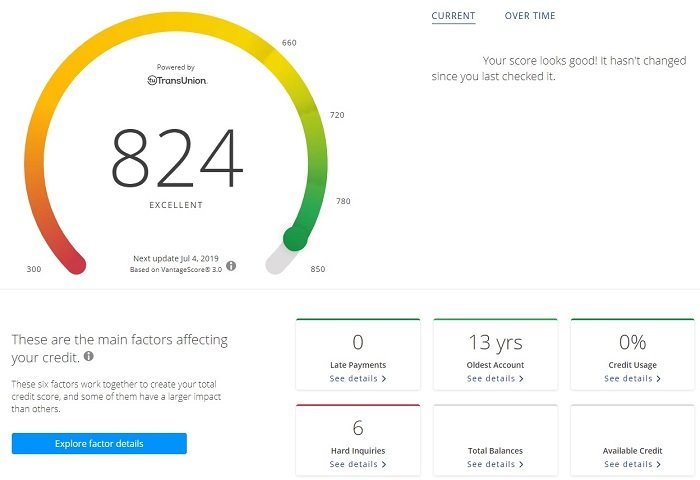

Unlike other bank-sponsored products, Chase Credit Journey does not track your actual credit score. Instead, it tracks your score on using the VantageScore 3.0 model, a competing credit score used by a number of banks and insurance companies, including the Amalgamated Bank of Chicago .

With a score ranging from 350 to 850, VantageScore 3.0 is designed to be a better predictor of credit responsibility, while opening up doors for those with thin or rebuilding credit files to get access to loans and other financial products. According to their website, VantageScore opens credit markets to an additional 35 million Americans, while providing additional stability.

Although VantageScore is not a true FICO score, it provides a good preview of where your credit stands, and how likely you are to get approved for new credit lines. Generally speaking, VantageScore scores tend to run between 25 to 50 points lower than your FICO score.

Using Chase Credit Journey To Check Your Credit Score

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Chase Credit Journey is a free online tool available to both Chase customers and noncustomers that provides access to your credit score and credit report from the credit bureau Experian.

For those looking for an interactive credit-monitoring tool to help keep track of your credit standing, well walk you through the features offered by Chase Credit Journey.

Recommended Reading: How To Remove Repossession From Credit Report

Our Experts Set The Record Straight About What Helps And What Hurts Your All

Tags:,,,Payments

Your credit score may not be something you think about every day, but when you go to apply for a loan, rent an apartment, or lease a car it suddenly becomes top-of-mind. During crucial moments like these, you may not know what that number is or what has shaped it up to this point.

It isnt just about buying a house or getting approved for a car loan anymore, says U.S. Bank Branch Manager Nancy Smock. Even cable companies and cell providers are starting to tune in to your credit score. Its true that more businesses are looking into that all-consuming number in order to get an understanding of your financial health. And even if you get approved for a loan or a car with your credit score, Smock says you might still be hit with a higher interest rate if your score is on the lower side.

Your credit score plays a greater role than it ever has in determining how much freedom you have to make purchases and build wealth, agrees Personal Banker Anthony Marengo. Unfortunately, there are still plenty of mixed messages out there about what actions actually affect that score.

Thats why, with the help of our experts, weve created a list to help separate the rumors from the reality. What really affects your credit score and whats plain fiction? Lets take a look.

Types Of Credit Accounts That Form Your Payment History

There are three types of credit accounts, all of which can show up in your payment history:

- Installment loans: These are lump sums that you borrow and repay in installments over a fixed period. Examples include mortgages, auto loans, and student loans.

- Revolving credit: This is money that you can continually access from a single line of credit up to a certain limit. If you dont pay off your balance in full at the end of the month, your remaining debt carries over into the next month. Credit cards are the most common form of revolving credit. Other types include personal lines of credit, home equity lines of credit , and retail accounts.

- Open credit: This consists of money or services that you receive upfront and must pay for in full at specified intervals . The most common examples of open credit are utility, internet, cable, and cell phone accounts.

Also Check: Who Is Syncb/ppc

Alternative Free Credit Score Services

Chase Credit Journey isnt the only free credit score service out there. In fact, Chase was late to the game. There are plenty of ways you can get free credit scores today, including free FICO scores.

- Discovers free scorecard offers your FICO Score 8 from TransUnion

- Capital One CreditWise offers a TransUnion VantageScore 3.0. Learn more in our Capital One CreditWise review.

- Credit Sesame offers a free TransUnion VantageScore 3.0 credit score. Read our for more details.

- Self Lender offers a free Experian VantageScore 3.0 credit score

In addition to free credit score services, many credit cards now give you a free credit score, too. In fact, many free credit scores offered by your credit cards are FICO scores.

View Your Credit Report For Free

In addition to your free credit score, you also get access to your TransUnion credit report for free. Like with your credit score, your credit report can update as often as once per week.

Keep in mind, it sometimes takes a while for an action to reflect on your credit report. CreditWise only shows what TransUnion reports to them.

Even if youve made a change, such as paying off a loan, it wont show up on your free TransUnion credit report in Credit Wise if it hasnt been reported to TransUnion yet.

While this is a great way to monitor your credit report for errors and potential fraud, you still need to check your credit reports from the other major bureaus every once in a while.

You can do this for free once per year for each major credit bureau at AnnualCreditReport.com.

Read Also: Can You Remove Hard Inquiries Off Your Credit Report

You May Like: Does Speedy Cash Report To Credit Bureaus

Can Credit Score Increase In A Month

For most people, increasing a credit score by 100 points in a month isnt going to happen. But if you pay your bills on time, eliminate your consumer debt, dont run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Does Checking Your Credit Score Lower It

There’s a common misconception that you checking your will lower it, but that’s actually not the case. Regularly checking your credit score and credit report helps make sure all of your information is correct, can detect potential fraud or identity theft and shows where you stand from a financial health perspective.

You May Like: Paypal Credit Score Requirement

What Is Credit Utilization

Credit utilization refers to the ratio between your total credit card balance and your total credit limit.

Say you have two credit cards, each with a limit of $5,000, making your total credit limit $10,000.

If you have a balance of $2,500 on one card and a $0 balance on the other, your total balance is $2,500 and your credit utilization ratio is 25%. Or, put another way, youre using 25% of your total available credit.

multiple credit cards can improve your utilization percentage

How Do These Get Affected When I Get New Credit Cards

Now that we understand how your credit score is determined, its important to look at how getting more and more credit cards could either hurt or improve your credit score.

Hey, Want some free cash?

- Rakuten: Get a free $30 Gift Card: Simply use Rakuten to find the best deals on items you were going to buy online anyway and get a free $20 gift card!All you have to do is sign up and make qualifying purchases totaling at least twenty dollars within ninety days of becoming a Member.Not only will you save money, but you’ll get paid too! Super easy!

Read Also: Does Capital One Report Authorized Users

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the very poor credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this very poor credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A very poor credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

It’s Easy To Be In Control

Sign up for MyCredit Guide at no charge to see your detailed TransUnion credit report, updated weekly upon log in, get alerts, and use the credit score simulator.

Already enrolled to MyCredit Guide? Log In Here

Articles about Credit

Here is how to check your credit score for free and get the most accurate picture of your credit.

Enroll with MyCredit Guide to get a free credit report that you can access at anytime or you can request a copy of your credit report 3 credit bureaus once a year.

Learn about credit score ranges from FICO and VantageScore, and how they classify Excellent, Good, or Poor credit score.

Tips to Improve Your Credit Score

The better your credit score, the better chance you may have to secure a mortgage for a house or get approved for that premium credit card. Watch this short video from American Express to learn how to improve your credit score.

You May Like: Does Paypal Credit Report To Credit Bureaus

Dont Fall For Credit Repair Scams

Now that you know how to read your credit report, youll naturally ask what comes next. Specifically, you may be wondering if you should get help from a credit repair company to improve any problem areas you found.

If so, Id strongly suggest that you dont bother. Credit repair companies usually offer next to nothing of value and are one of my bigger pet peeves in the financial service industry. Anything they can do, you can do better .

Do you want to protect yourself against the many scam artists out there looking to take advantage of people in tough financial spots? Read our guide: How to Spot Debt Relief and Credit Repair Scams.

If you still have some questions about how to read a credit report, let us know in the comments below.

Chase Credit Journey Features:

- Each time you log into your dashboard, youll see your updated credit score instantly. Chase Credit Journey updates your score weekly, but you can check the dashboard as often as you want.

- Identity Protection: Chase is available 365 days a year and 24-hours a day to help you with any identity theft issues. Whether you have a lost/stolen wallet or youve been a victim of identity theft, Chase professionals will help you around the clock.

- Real-Time Alerts: Chase Credit Journey provides instant alerts should anything change on your credit report. This helps you stop fraudulent activity before it gets out of hand.

- Tailored Insights: Chase Credit Journey provides tailored suggestions based on your credit history to help improve your personal financial situation.

- Lost Wallet Services: Whether youre at home or halfway around the world if your wallet is lost or stolen, Chase professionals will help you through the process.

- $1M Identity Theft Insurance: If your identity is stolen, Chase Credit Journey provides up to $1 million in identity theft insurance to cover the cost of lost wages and costs incurred to fix the issues caused.

Read Also: How Accurate Is Creditwise Credit Score

Do Business Cards Count Toward Credit Utilization

When you apply for a business credit card, the issuer will likely check your personal credit history and ask for a personal guarantee. Unless youre applying for a corporate credit card, a personal guarantee on a business card is nearly impossible to avoid.

Your business credit card activities, however, wont usually go on your personal credit reports, unless you miss a payment. That also means and credit scores. There are some exceptions, though, like Capital Ones business cards. See this table to learn which credit card companies report business credit cards on personal credit reports.

You may even be able to use balance transfers to move credit card debt over to business cards. This might reduce your personal credit utilization and improve your credit scores. However, keep in mind that moving personal debt to a business card could potentially trigger bookkeeping and other challenges for your business. When you move debt from a personal card to a business card, you also no longer enjoy the protections of the CARD Act since that law only applies to personal credit cards.

Transfer Balances To Business Cards

Since business credit cards dont normally show up on your personal credit reports, their balances may not affect your credit utilization. If you transfer a balance from a personal card to a business card that isnt on your personal credit report, the debt will no longer increase your utilization ratio. But watch out for balance transfer fees. We also recommend using a card with a 0% intro rate, if you can find one.

Like we said earlier, this strategy involves other potential risks. For example, it might complicate bookkeeping and possibly bring up other legal issues for your business. Youll also give up CARD Act protections when you transfer consumer debt to a business credit card account.

Recommended Reading: Is A 500 Credit Score Bad

Using A High Percentage Of Available Credit Hurts Your Score: Truth

Okay, so using credit is important . Lenders need a record of how well you manage your credit, so they know youre worth the risk. But at the same time, using a high percentage of that available credit sends up a red flag.

A good rule of thumb is 30 percent credit utilization, which leaves 70 percent always available to you, says Smock. That ratio shows your good habits, and gives them something to go on. But it also shows you have some restraint.

Important: Dont take that 30 percent credit utilization rule as an open invitation to apply for more credit just to artificially lower your ratio. Remember that applying for a credit card in the first place also brings down your score.

The bottom line: Keep the majority of your available credit untouched, to show youre using it as a smart wealth management tool instead of a financial crutch.

Chase Credit Journey Pros

![[CAUTION] Chase Credit Journey Free Credit Score May Be ...](https://www.knowyourcreditscore.net/wp-content/uploads/caution-chase-credit-journey-free-credit-score-may-be.png)

- Its completely free to use. Chase Credit Score does not cost a single cent to use. You dont have to put in any card info, and you dont even have to be a Chase bank customer to sign up for the service.

- The simulation tool is one of the best features of the service and can help you figure out what changes can maximize your score. You can change different parameters to see what effects they have on your score.

- Resource library. Chase credit Journey also features a large, comprehensive library of useful educational resources. They have articles on pretty much every aspect of credit, including tips to increase your score, common credit myths, and in-depth explanations of how, exactly, credit reporting works.

- Recommended offers. In addition to your credit score reports, Credit Journey will generate some recommended financial products that mesh well with your current score. To be completely honest, most people who use the service probably wont even actually apply for these offers, but they are still nice to have nonetheless.

Recommended Reading: What Credit Report Does Comenity Bank Pull

Recommended Reading: Can A Repossession Be Removed From Credit Report