Hold Off On Applying For New Lines Of Credit

When you apply for a line of credit, something called an inquiry gets put on your credit report. Too many of those in a short amount of time shows lenders that youâre probably living beyond your means which makes them not want to loan you money. After all, they want to make sure theyâre going to get the money they give you back.

When you know you have a big purchase like a car or house coming up, donât apply for any new lines of credit for at least 6 months before when you hope to make the purchase. Not only will this help your credit score stay stable, but it will put potential lenders at ease.

Average Credit Score By Age

Millennials have an average credit score of 680, while baby boomers have an average credit score of 736.

The average FICO Score tends to improve with age.

The average credit scores coincide with the financial situations facing younger generations. Its usually around the millennial age range that major expenses and debt begin to rack up such as weddings and first mortgages, among others. Despite their ages, millennials hold an average of $4,322 in .

The other age group whose average credit score skews lower is Generation Z . A contributing factor to this is the limited access to credit this age group faces. Following the 2009 CARD Act, it became significantly harder for 18- to 21-year-olds to open new credit card accounts. As a result, many young adults dont begin building a credit file until later in life driving averages down.

Americans of all ages owe debt. In fact, U.S. household debt spiked to $14.35 trillion in the third quarter of 2020 the latest available data amid the coronavirus pandemic, according to the Federal Reserve Bank of New York. And that debt is growing while more people remain out of work. The federal unemployment rate was 3.5% in February 2020 before spiking to 14.8% in April 2020.

Factors That Affect Credit Scores

So, you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.

Here are a few factors the CFPB says âmake up a typical credit scoreâ:

- Payment history: How well youâve done making payments on time.

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans and what kinds they are, such as revolving credit accounts and installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect on your scores might be minor, but a lot of new hard credit inquiries could still give a negative impression to lenders.

How Does FICO View Those Credit Factors?

FICO is pretty specific about what it views as the most important credit factors: Payment history makes up about 35% of its scoring. About 30% is based on the total debt. The other primary factors are credit history , credit mix and new credit .

How Does VantageScore View Those Credit Factors?

You May Like: How Accurate Is Creditwise

Get A Household Utility In Your Name

Some utility accounts are now being reported on your credit file and having one in your name is a very good way to improve your credit score. This means that your payment history on your gas, electric and telephone service will affect your credit score.

If you live in a shared accommodation be sure to avoid any disputes and get payment for utilities well in advance so as to avoid any of your house mates holding you hostage and ruining your credit file.

Do you live with your parents? Ask them to put your name, date of birth and address on the utility bill. This will open a new account on your credit file and ensure you begin to get credited for the regular payments being made on the account.

If payments are missed on the account this could negatively affect your credit score so you must ensure payments are not missed.

You can also simply get a cheap phone on contract. A £5/month contract will be achievable with little or no credit history as the risk of default is very low and making regular repayments to your phone contract will boost your credit file.

You should avoid applying for more expensive phones with no credit file or score as this could damage your credit score even further even though you dont have one.

Not all utility providers report your payment history to the credit bureaus so you may want to inquire with the utility provider before opening an account.

Average Car Loan Interest Rate By Credit Score

Thereâs a big difference in those interest rates if you have bad or poor credit , compared to average credit , compared to excellent credit .

Still not convinced? Two people, one with a subprime credit score and one with a prime credit score both want to get a loan for a $10,000 used car. Both of them get a 60 month loan term. The prime borrower is offered a 6.05% interest rate. The subprime borrower? A 17.78% interest rate.

Over the 60 months, the subprime borrower is going to pay $5,164 in interest or $15,164 total for the car. The prime borrower will pay $1,614 in interest or $11,614 total for the car.. Thatâs a $3,550 difference in interest paid all because of their credit score.

We all want to be the prime borrower in this situation. But, if youâre not and you know your credit score could use some work, then you know the drill, keep reading.

Also Check: What Is Cbcinnovis On My Credit Report

Fico Vs Experian Vs Equifax: An Overview

Three major compile information about consumers’ borrowing habits and use that information to create detailed credit reports for lenders. Another organization, Fair Isaac Corporation , developed a proprietary algorithm that scores borrowers numerically from 300 to 850 on their creditworthiness. Some lenders make credit decisions strictly based on a borrower’s FICO score, while others examine the data contained in one or more of the borrower’s credit bureau reports.

When seeking a loan, it is helpful for borrowers to know their FICO score, as well as what is on their credit bureau reports, such as those from Experian, Equifax, and TransUnion. A borrower who appears stronger under a particular scoring or reporting model should seek out lenders that use that model. Given the crucial role a good credit score and credit reports play in securing a loan, one of the best credit monitoring services could be a worthy investment to ensure this information stays safe.

I Have A Low Credit Score Why Does It Matter

If you have a very low credit score, you may find it difficult to qualify for credit cards and loans, or you may be required to pay a higher annual percentage rate or additional fees.

When you apply for a loan or credit card, lenders want to know if you will be a responsible borrower who stays on top of payments. Credit scores are an important way businesses can get a sense of how good you are at repaying your debts.

Read Also: Jefferson Capital Systems Verizon

Understanding Your Credit Scores

First off, you have more than one credit score, and there are a few reasons for that.

There are different scores for specific products. For example, there are special auto and home insurance credit scores. There are also different credit-scoring models, like FICO and VantageScore, which means you could have scores according to each model. Even the same model could give a different score depending on whether it uses data from your Equifax, Experian or TransUnion credit report.

Lastly, there are multiple consumer credit bureaus that provide on which scores are based. So depending on what information each bureau gets from individual lenders and that can differ the data used to compile your reports and build your scores could vary from bureau to bureau.

When you put it all together, that means that each individual could have multiple scores, and sometimes they dont match. Its difficult to pinpoint exactly how many scores you may have, but it could be hundreds.

Even though there are many different credit scores out there, its worth knowing the general range that your scores fall into especially since they can determine your access to certain financial products and the terms youll get.

FICO and VantageScore Solutions create the most widely used consumer credit scores, and these companies update their scoring models from time to time.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Read Also: Paypal Credit Credit Bureau

Get A Credit Builder Loan

Another way to improve your credit score is by using a credit builder loan.

As you make these loan repayments on time your credit file records this and your credit score improves. At the end of the loan term you get all your loan repayments and whatever interest you have gained.

Loqbox is a credit builder loan provider in the UK.

What Factors Matter For A Credit Score

The FICO credit scoring model looks at these five key factors and weighs each differently:

Don’t Miss: How To Remove Child Support From Credit Report

Pay Off Existing Debts

We know it sounds obvious, but paying off existing debts is one of the most effective ways to wipe the slate clean on your credit score. If youve got outstanding loans no matter how small they may be then try to pay them off as quickly as you can. Every loan thats outstanding on your account is a black mark against your name as far as future lenders are concerned. Take a look through your bank account and ask yourself if theres anything you could be making more regular repayments on, no matter how small or inconsequential it might seem.

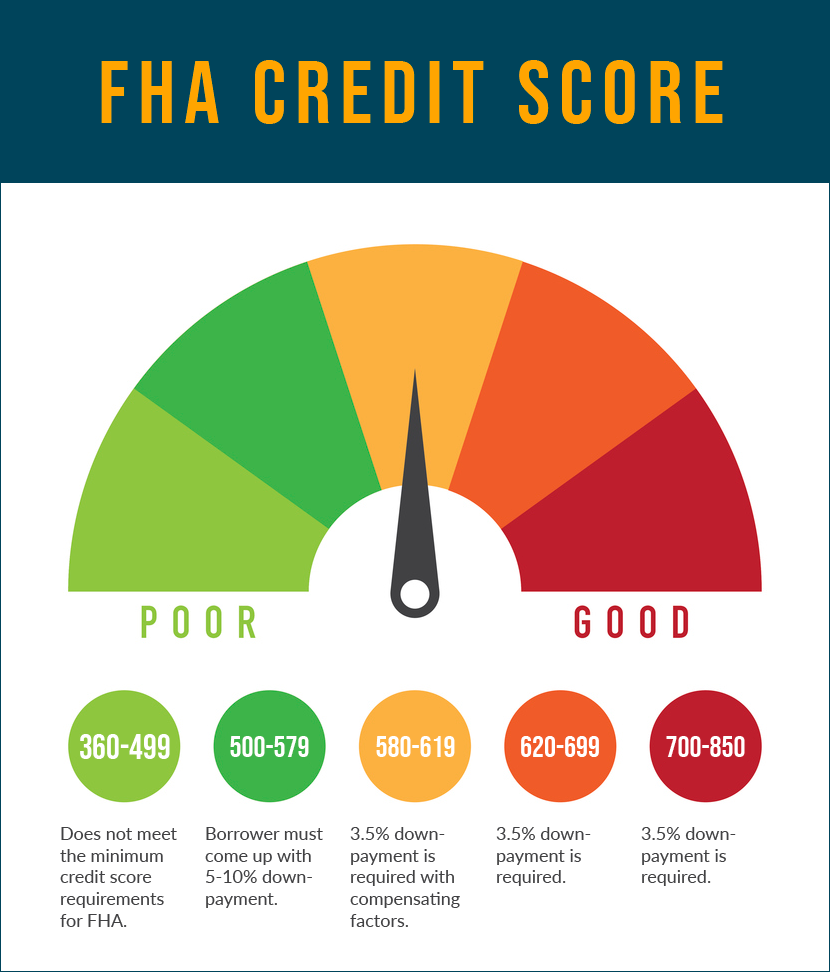

How Low Can Fico Go

One of the scoring options used for evaluating personal credit, FICO , is used in over 90% of credit decisions, and it ranges from 300 to 850 . But just because youre hanging out well above the 300 mark, doesnt make your credit good. In fact, most lenders consider anything below 600 in the poor range, and youll find it hard to qualify for the best credit, mortgage, and loan offers available.

Read Also: Does Paypal Credit Report To Credit Bureaus

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often

Pay Your Bills On Time

The most important credit score factor is payment historyit accounts for 35% of your credit score. If you make a late payment or your debt ends up going into collections, this negative information can stay on your credit report for up to seven years. Paying all of your bills on time can help you avoid damaging your credit score.

Don’t Miss: Which Business Credit Cards Do Not Report Personal Credit

Open A Bank Account Or Credit Account

The simplest thing you can do to establish or improve your credit score is to open a bank account or any other credit account.

The longer you have this account open for the longer you will have a credit history. It usually takes 3 years from you opening an account which gets reported on your credit file before you will have any credit history which can be seen by others.

Opening a bank account also allows you to have an account on your credit file with a verified home address. This means it will be easier for you to access credit products in the future.

A bank account might also be the easiest way to a credit card as banks are more willing to offer credit cards to account holders as they can view your account history and see how credit worthy you are even if you have a low credit score.

So Back To The Question: Does A Fico Score Of 300 Mean You Can’t Get Credit

It all depends on the individual lenders and insurance companies and what they consider an acceptable level of risk. They may take someone with a low score, approve them for credit but charge a very high-interest rate on unpaid balances. They might also approve someone with a low score but only for a minimal amount – reducing their risk while also giving you the opportunity to prove yourself a good borrower. Check out this loan savings calculator to see how much a high FICO Score can save you money.

That really means that the credit score number itself only means what the lender decides it means. What is considered bad credit by one lender may be acceptable to another. If you’re looking to improve your credit score and want to prove you’re a good credit risk, don’t give up… no matter how low your score.

If you’d like to take a look at your FICO Score range for FREE, just click or taphere.

Rob Kaufman

Rob is a writer… of blogs, books and business. His financial investment experience combined with a long background in marketing credit protection services provides a source of information that helps fill the gaps on one’s journey toward financial well-being. His goal is simple: The more people he can help, the better.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Recommended Reading: Can You Remove Hard Inquiries Off Your Credit Report

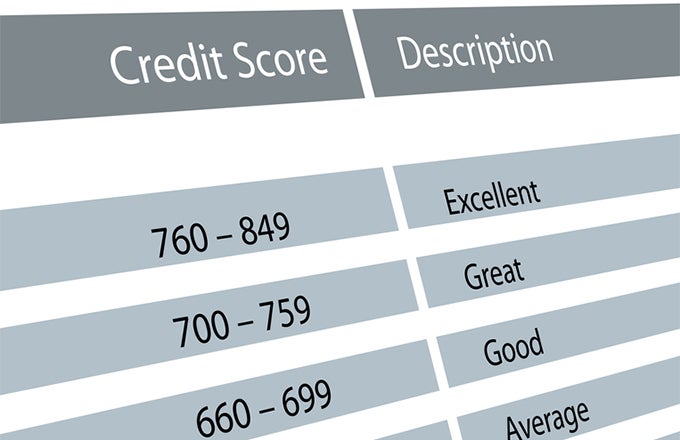

Learn About Credit Score Ranges From Fico And Vantagescore And How They Classify Excellent Good Or Poor Credit Scores

By Allan Halcrow | American Express Freelance Contributor

7 Min Read | January 31, 2020 in

Figuring out what a credit score of 640 means isnt really as tough as cracking the Da Vinci Code. But by the time youve considered the various credit score scales , it can certainly feel that way.

Fortunately, you dont need to be the hero of the Da Vinci Code to make sense of your . Thats because the different scales are more similar than different, and the scales are divided into credit score ranges whose names are simple and easy to remember .

Although cracking the credit code wont help you save the world, knowing the credit score range where your score lands can help you understand how lenders may view you in terms of credit risk. That could help you plan various aspects of your life, including the likely success of credit card, loan and rental applications, and whether you can expect to be offered favorable interest rates. And if you dont like the implications of your credit score range, you can take actions that could change it.

The two most commonly used credit scoring models, FICO and VantageScore, both rank credit scores on a scale from 300 to 850 and divide the scale into five credit score ranges. The ranges differ somewhat between the two models, and also have different names. If youve heard of higher scores, its either based on old information or industry-specific scoring models.

- Superprime

- Subprime

Equifax Credit Score Rangesand Others