Do Title Loans Report To Credit Bureau

Yes, title loan companies in general, will report to the credit bureau, they will report the positive and the negative payments.

In this resource article, we will be explaining to you how title loans can help improve your credit immensely and, also, how they might potentially damage your credit if you do not handle the loan carefully.

How Applying For An Auto Title Loan In Texas Will Affect My Credit Score

When applying for any kind of loan, sometimes lenders will perform credit checks. A credit check can either be a hard inquirywhich may lower the applicants credit score by up to five pointsor a soft inquirywhich will not impact the applicants credit score.

For auto title loans, although lenders do not base eligibility on credit history alone, in most cases they will do some kind of credit check. When comparing several lenders and applying for lending, keep in mind that each hard credit check may impact the credit score.

You Dont Have To Risk Losing Your Vehicle For A Loan

Automobile loan services such as Auto Credit Express connect you with dealers who can arrange a cash-out refinance of your current loan. You also can apply for a personal loan as an alternative to title loans. Lending networks such as MoneyMutual cater to consumers with bad credit, and you may be able to get a personal loan without putting up collateral.

We also pointed out how credit cards like the Total Visa® Card accept bad-credit applicants and offer cash advances that are fee-free during the first year. Of course, interest rate charges apply from the date of the cash advance.

So, before you apply for a title loan, ask yourself what youll do if the repo person takes your car away.

Read Also: How Can Personal Responsibility Affect Your Credit Report

What Types Of Liens Are Seen As Good And Which Are Bad For My Credit

Creditors that allow purchases to be made through financing often require property to be pledged against a credit account. This property is known as collateral. Through the use of collateral, creditors establish a priority interest in the asset used to back the loan or line of credit. If you default on your repayment obligation, the creditor can place a lien on your property. Liens come in a number of forms under three broad categories: consensual, statutory, and judgment liens. But does having a lien affect your credit? The answer is it depends on which types of liens.

Are Credit Card Cash Advances Added To Your Credit Report

The answer to this question is: kinda. Anytime you add from your credit card balance, that change is noted on your credit report. So a credit card cash advance will show up on your report as an addition to your credit card balance, but it wont be noted any differently than a regular transaction would be.

So can a credit card cash advance negatively affect your credit? It can, but its not likely to. When it comes to your credit card balances, its a good idea to keep them pretty low relative to your total credit limiteven if you pay off your balances in full every month. Keeping your debt utilization ratio beneath 30% will mostly keep those balances from negatively affecting your credit.

In order for a credit card cash advance to negatively affect your credit score, it would have to either push your balances above 30% or it would have to be such a massive increase to your balances that it would reflect a major change to your total amounts owed. Unless you are right beneath that 30% ratio or are taking out thousands of dollars worth of cash advances in a short period of time, your score will be unaffected.

Also Check: Credit Report With Itin Number

Liens Are Different From Levies

Some people use the words “lien” and “levy” interchangeably, but they’re two quite different collection measures.

A tax lien is a document that the IRS files with your local government to ensure its ability to collect the money owed. It prevents you from selling the property without the lien being paid from the proceeds, and the government can force the sale in order to be paid.

A levy is the forced collection of taxes due, typically by garnishing your wages, salary, or bank accounts.

Forbearance Process: Credit Cards

Every credit card company has different options and eligibility requirements for forbearance or payment deferrals on your credit card debt. Some may allow you to defer payments while interest continues to accrue over a set period of time, while others may offer to reduce your interest rate or principal payments temporarily. Go to your credit card issuer’s website to learn what options are available and what you have to do to get help. Even if your credit card company isn’t offering a plan that works for you today, it might add new options in the near future, so check back frequently for updates.

Read Also: How To Remove Car Repossession From Credit Report

Do Title Loans Check Your Credit

Not all title loans check your credit, but it all depends on the location and state. We have some partners that will do a no-credit-check title loan. But most partners will check your credit.

How Your Credit Score Works With Title Loans

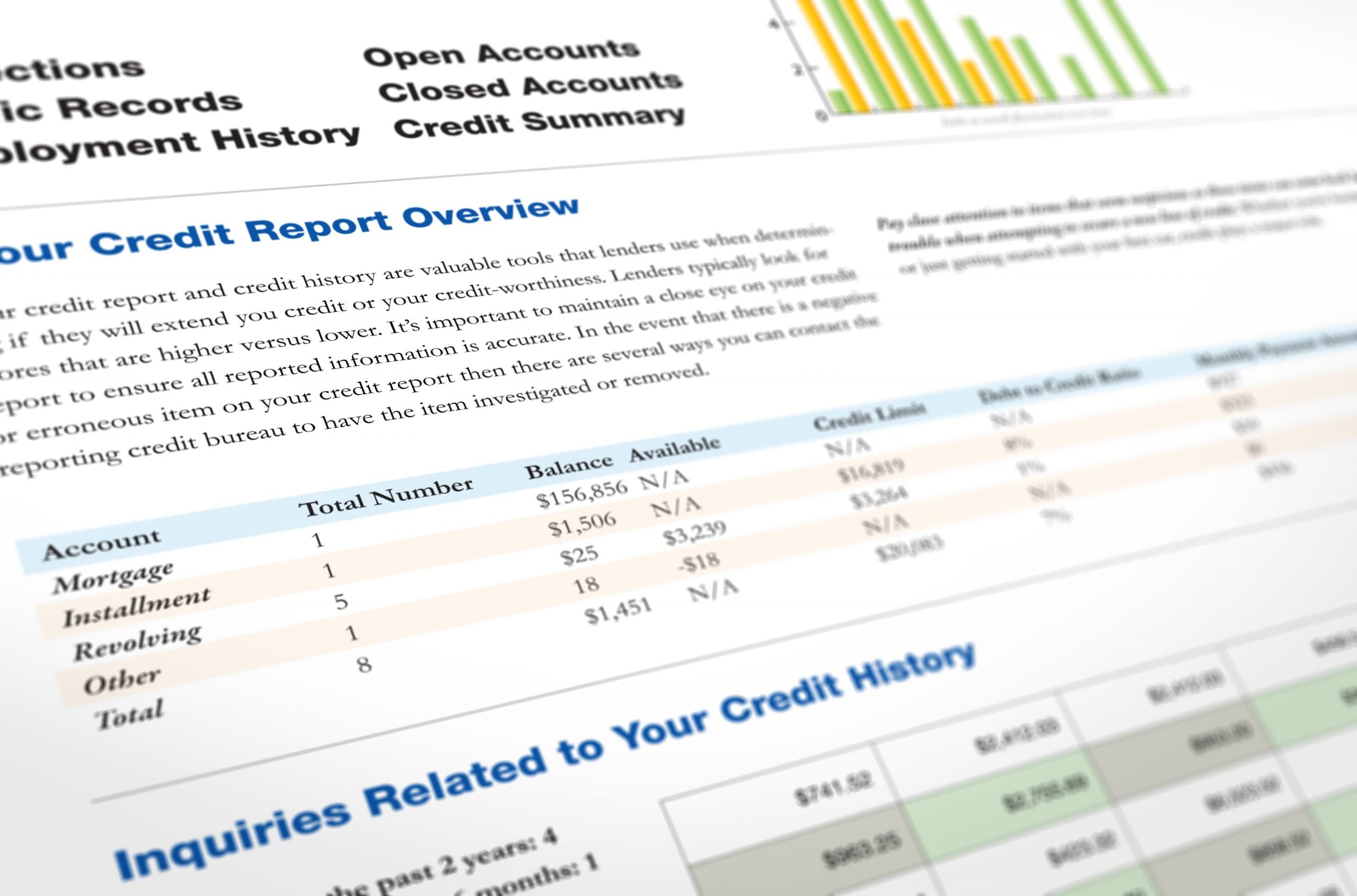

Thirty-five percent of your credit score is made up of your payment history.

Thirty percent is your credit utilization. 15% is the length of your credit history while your credit mix and your new credit make up 10% each.

Getting a title loan would have the greatest impact on the payment history percentage of your credit score.

Unsecured loans, tend to make a much larger impact on your credit score. However, loans that are secured, meaning they are based on collateral, like Car Title Loans still have the potential to greatly affect your credit score.

Title Loans Affect Your Credit

A title loan can both improve your credit score but also has the capability of damaging you. If you make all of your monthly payments on time, then your credit score will improve.

If you are late with your payments and fall behind, this will damage your credit. A title loan is like any other line of credit, as long as you make the monthly payments on time, just like other bills, then you will improve your credit score.

Title Loans Can Improve Your Score

If you pay off or refinance your title loan every month and on time, according to the terms set up by the lender at the beginning of the loan, then your payment history will start to look significantly better.

Get Help From Advantage Finance Llc

Advantage Finance could be the help you need to avert a financial emergency. Title loans are not always the answer, but they can be a valuable source of money when you need it. And, these are significantly better than a payday loan with an automatically debited payment. With a title loan, you have more control.

Email us your questions,, or use the convenient contact form to apply for the money you need, today.

You May Like: Does Paypal Credit Report To Credit Bureaus

Flexible Line Of Credit

When emergency expenses arise, its not always clear from the beginning exactly how much theyll cost. In some situations, you find yourself facing a string of smaller expenses rather than one big one. If this happens to you, youll be glad to know that our line of credit loans can help you get access to the funds you need without a lot of paperwork or waiting around. To find out more about our flexible line of credit loans, check out our Flexible Line of Credit FAQ page, where weve tried to answer all of the questions you might have before you apply. Of course, youre always welcome to contact us if you dont see the information youre looking for.

Title Loans Can Lead To A Cycle Of Debt

If youre not able to make the full loan payment at the end of the loan term, the lender may offer to renew or roll over the loan into a new loan. This new loan again adds more fees and interest to the amount you already owe.

Lets say you borrowed $1,000 with a 25% fee, but at the end of 30 days you could only pay back $250 rather than the full amount of $1,250. If your lender offers you a rollover loan, the $1,000 that you still owe would be rolled into a new loan with additional interest and fees.

Assuming the same rate, at the end of the next 30 days youd owe $1,250. If you pay back the loan in full at the end of this loan, you will have paid $500 to borrow $1,000 for 60 days.

Unfortunately, borrowers on average pay more in interest and fees than the amount they borrow. The average title loan is $1,000, and the average fees paid per customer per year are $1,200, according to a 2015 report from the Pew Charitable Trusts.

With costs piling up each month, borrowers who cant afford to pay the loan in full could face another challenge.

Also Check: Speedy Cash Extension

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Will An Unpaid Payday Loan Go On My Credit Report

January 26, 2013 by National Debt Relief

If youre not familiar with payday loans, these are those small, short term, unsecured loans that are linked to your payday. They are sometimes called cash advances. Payday loans dont require a credit check. If you are employed and can prove you get a regular paycheck, you could get a payday loan. The way it works is that you write a check for the amount of cash you want, plus the loan companys fee. You date the check to fall on your next payday at which time the loan company cashes it.

The good and bad of a payday loan

The good of a payday loan is that its an easy way to get fast cash. If you were to find yourself in an emergency situation like you suddenly needed to repair your car, a payday loan could be an easy way to get the money you need. The bad of a payday loan is how much they cost. For example, many of the payday loan companies will charge $20 to loan you $100 for two weeks. This is the equivalent to charging more than 400% APR .

What happens if the money isnt there?

If you lose your job or close your account

While a payday loan might seem different than a standard personal loan or , they work the same way if you cant pay back the money your borrowed. If for some reason the payday loan company couldnt get its money, the first thing it would probably do is turn your account over to a collection agency just as if you had defaulted on a personal loan.

On your credit report

Other options

Recommended Reading: Why Is There Aargon Agency On My Credit Report

How To Get A Car Title Loan

Regardless of what credit bureaus may report about you, getting car title loans with LoanMart is simple1! LoanMart offers secured loans where you use your car title as collateral. With LoanMart, the value of your car, your ability to repay the loan, and applicable laws in your state on loan limits will determine the amount you are eligible for.

Are Auto Title Payments Reported

So youve decided that securing an auto title loan to access funds quickly is the route you want to go. Many questions may enter your mind and one of those is whether or not your monthly loan payments will be reported to the major credit bureaus. The short answer is that it depends on the lender however, if you reach out to Transunion or Experian they state that these types of loans will not typically have any effect on your credit rating. Although Equifax has not made any formal updates if this will occur.

Theres two ways you can look at this. For one, if the auto title lending company isnt going to review your credit score, you dont have to worry about having your score affected by a credit inquiry. Thats really good news if youre getting many quotes from multiple lenders. On the other hands, if youre looking at improving your FICO score you have to consider that the monthly payments youre making to pay back your loan is not being reported, so you lose out on the opportunity to improve your credit score.

So what does an car title loan lender look for if they arent looking at your credit score? First and foremost is they look at the value of your car, are you employed and your bank details. The vast majority of lenders will not check your credit rating, but before you get a quote from them you should verify.

Also Check: Why Is There Aargon Agency On My Credit Report

Top Recommendations For Auto Loans

Regardless of whether youre financing a car or using one as collateral, its important to compare options to make sure youre getting the best rate. Its wise to always read the terms of each loan and check for potential penalties. You can also take advantage of the online prequalification many financial institutions offer.

Do Title Loans Go On Your Credit Report If You Apply For Another Loan

Any loan you get from Wisconsin Auto Title Loans Inc. is fully separated and has nothing to do with any other loan you might take out while paying the title loan off.

The only loan that concerns Wisconsin Auto Title Loans Inc. is their own and the information of that loan will be kept separate from any other loan you get from other sources.

You May Like: What Is Syncb Ntwk On Credit Report

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Less Than Perfect Credit Title Loans

Car title loans are one of the only loan options out there for individuals with a less than perfect credit score.

Title loans will use the equity that you have in your vehicle and not your credit score, and do this by basing the loan application approval on the current equity in your car and based on your ability to repay the loan according to monthly payments.

Also Check: Does Removing Authorized User Affect Their Credit

What Are The Pros & Cons Of Car Title Loans

If youre thinking about taking out a car title loan to handle unexpected expenses, you should consider the pros and cons:

| Car Title Loan Pros | |

|---|---|

| Monthly payments can turn into long-term debt | |

| You have access to quick cash | Your car could be repossessed |

| Late payments dont impact your credit score | Interest rates are high compared to other options |

Car title loans can be attractive to borrowers with poor credit since most title lenders dont perform credit checks. Additionally, your credit score wont take a hit if youre late on a payment. That said, getting quick access to cash with a car title loan rarely justifies the high interest rates and potential to lose a valuable asset.

Will Adding My Name To My Husband’s Mortgage Help My Credit Score

Will adding my name to a mortgage help my credit score?

IN THIS ARTICLE:

- Refinancing is the only way to add a person to a mortgage.

- You may not want to add a person to a mortgage for three reasons.

Having a mortgage in good standing appear on your credit report will probably increase your credit score. You may not want to do so for reasons I will get to later, but first let us talk about the steps needed to “get your name on the mortgage.”

Also Check: What Credit Score For Care Credit

Mortgage And Mortgage Refinance

A mortgage is a contract between the creditor and the debtor . Home loans in approximately half of the US are actually “deeds of trust,” and the other half are mortgages. There are important legal distinctions between a mortgage and a deed of trust that are outside of the scope of your question. For the sake of this high-level discussion we can consider deeds of trust and mortgages identical, and for the sake of simplicity we will refer to both as a “mortgage.”

Because a mortgage is a legal contract between the debtor and the creditor, neither party can change the terms or conditions of the loan without the other’s permission. For example, if the mortgage is a 30-year, fixed-rate loan at 6%, the creditor cannot arbitrarily and unilaterally reset the interest rate at 10% and require the debtor to repay the loan in 20 years. Similarly, the debtor cannot decide to stop making the monthly payment and not expect foreclosure and eviction from the property.

If a mortgage contract is between Spouse A and a bank, Spouse B cannot just be added to the contract, as simple as that may sound. Mortgages are not designed for easy addition or subtraction of parties. Therefore, to add a debtor from a mortgage the customary means for doing so is to refinance the loan. A mortgage refinance creates a whole new contract, and may include new terms such as changed debtors, a different interest rate, a new creditor, and a different pay-off date.