Is A Fico Score The Same As A Credit Score

As with all credit risk scores, FICO® Scores predict the likelihood that someone will fall 90 days behind on a bill within the next 24 months. FICO® does this using complex algorithms based on information in your from each of the national credit bureaus: Experian, TransUnion and Equifax.

FICO® periodically releases new versions of its scores, and it creates different versions of its scores to work with each bureau’s databases, which is why there are many FICO® Scores. Other companies, including VantageScore®, also create credit risk scores that similarly analyze consumer credit reports to calculate scores.

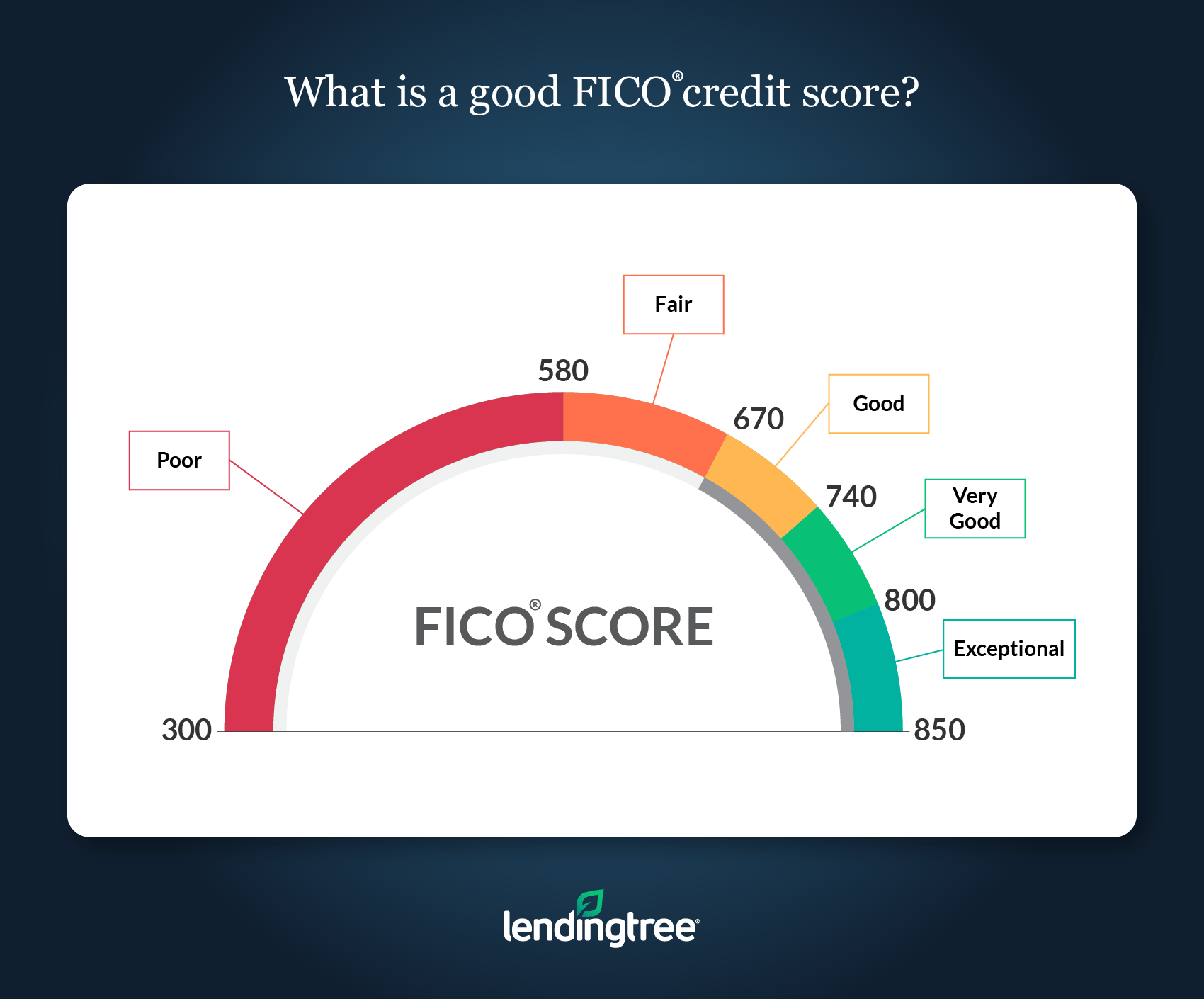

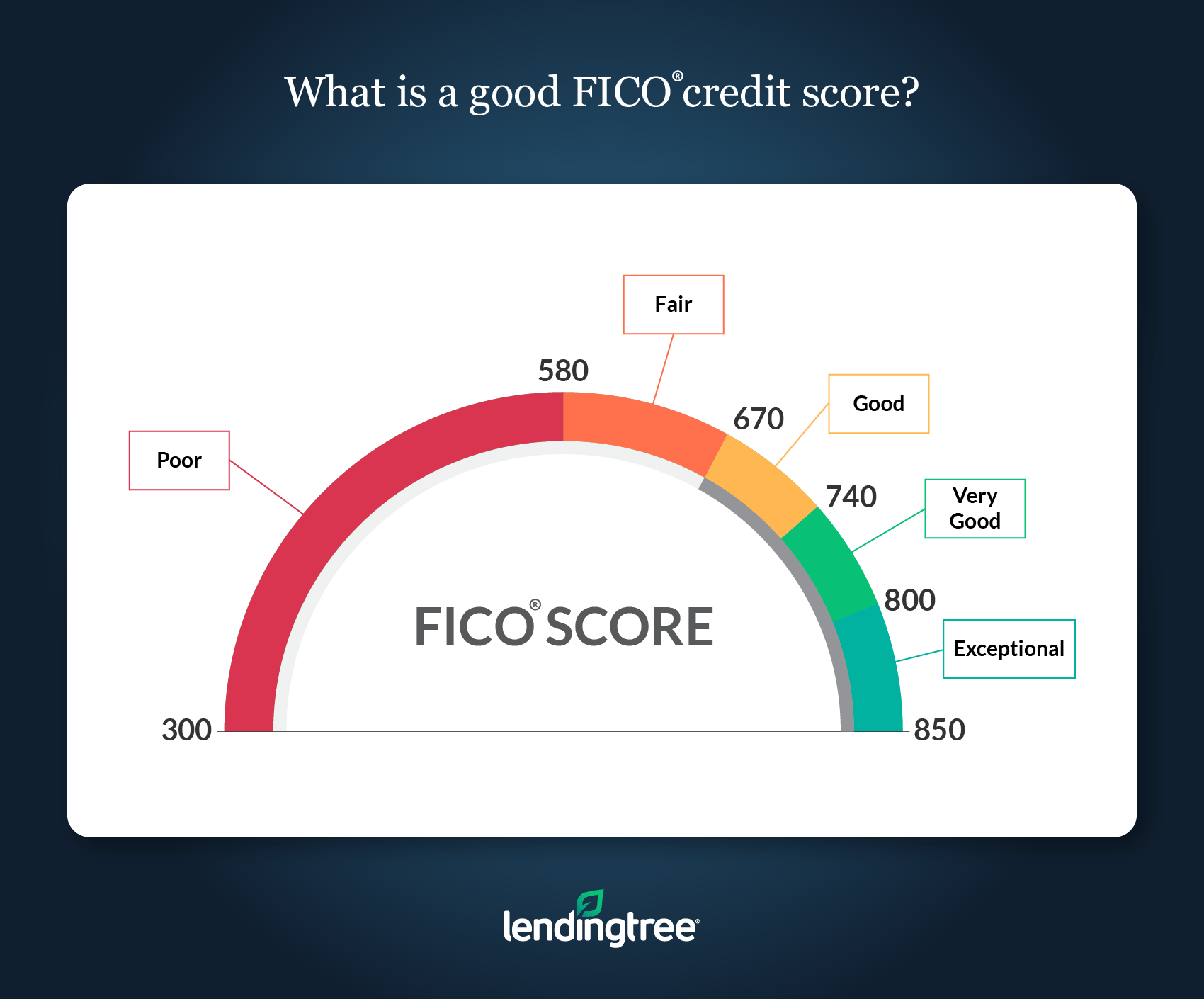

FICO® and VantageScore credit scores range from 300 to 850, and group consumers by . For example, a FICO® Score of 800 to 850 is considered “exceptional.” However, even if they use the same range and information from the same credit report, each scoring model takes a unique approach that may result in a different score.

FICO® also creates other types of scores that are based in part, or entirely, on your credit reports. For example, FICO® offers and bankruptcy scores, which try to predict the chance you’ll file an insurance claim or declare bankruptcy, respectively.

Variations In Scoring Requirements

If you dont have a long credit history, VantageScore is the score you want to monitor. To establish your credit score, FICO requires at least six months of credit history and at least one account reported to a credit bureau within the last six months. VantageScore only requires one month of history and one account reported within the past two years.

Because VantageScore uses a shorter credit history and a longer period for reported accounts, its able to issue credit ratings to millions of consumers who wouldnt yet have a FICO Score. So, if youre new to credit or havent been using it recently, VantageScore can help prove your trustworthiness before FICO has enough data to issue you a score.

Old And New Fico Scores

In addition to having FICO® Scores from each of the three credit bureaus, it’s also important to realize that the FICO methodology has been updated several times throughout the years in an effort to do the best possible job of predicting consumer credit behavior. And not all lenders have upgraded to the latest version.

The most recent version of the FICO® Score is known as FICO® Score 9. This version made some pretty significant changes to the FICO® Score — specifically, paid-off collections no longer have a negative impact, medical collections are treated more favorably than other types, and rental history can be a factor in the score if it’s reported.

However, the most commonly-used version in practice is FICO® Score 8. Lenders have historically been slow to upgrade to the latest FICO® Score versions, and as FICO® Score 9 has been in existence for several years now, that’s definitely still the case.

So, in addition to the three credit bureaus, there are two rather different versions of the FICO® Score that could potentially be used when assessing your credit risk.

You May Like: How Long Does Repossession Stay On Credit Report

Why Is My Fico Score Different Than Other Scores Ive Seen

There are many different types of credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, but different lenders may use different versions of FICO® Scores and some lenders may use different versions of FICO® Scores for different credit products, as discussed more fully here.

Additionally, FICO® Scores are based on credit report data from a particular consumer reporting agency, so differences in your credit reports between credit reporting agencies may create differences in your FICO® Scores. The FICO® Score being made available to you through this service is the score provided by TransUnion. Scores provided by Experian and/or Equifax will likely vary due to differences in the customers credit reports with those credit reporting agencies. When reviewing a score, take note of the score date, consumer reporting agency that provided the credit report for the score, and score type.

What Is A Credit Score

A credit score is a numerical representation of financial health, telling lenders at a glance how responsible you are with credit and debt. Generally speaking, a higher credit score suggests that you borrow and pay back what you owe on time. A lower credit score, on the other hand, may hint that you struggle with managing debt obligations.

So where do credit scores come from? They’re generated by companies like Equifax, Experian, and TransUnion based on information that’s included in your credit reports. A is a collection of information about your financial life, including:

- Your identity

- Existing credit accounts

- Public records, including judgments, liens, or bankruptcy filings

- Inquiries about you from individuals or organizations that have requested a copy of your credit file

Credit reports are maintained by . Equifax, Experian, and TransUnion are the biggest in the U.S. These companies compile credit reports based on information that’s reported to them by creditors as well as information that’s available as part of the public record.

Don’t Miss: What Is Leasingdesk

What Are Fico Scores

FICO® Scores are the most widely used credit scores and are used in over 90% of U.S. lending decisions. Your FICO® Scores are based on the data generated from your credit reports at the three major credit bureaus, Experian®, TransUnion® and Equifax®. Each of your FICO® Scores is a three-digit number summarizing your credit risk, that predicts how likely you are to pay back your credit obligations as agreed.

What Is A Credit Bureau

A credit bureau, also known as a consumer reporting agency, collects and stores individual credit information and provides it to creditors so they can make decisions on granting loans and other credit activities. Typical clients include banks, mortgage lenders, and credit card issuers. The three largest credit bureaus in the U.S. are Equifax®, Experian®, and TransUnion®.

You May Like: Credit Score To Qualify For Care Credit

How Does Applying For New Credit Impact My Fico Score

Applying for new credit only accounts for about 10% of a FICO® Score. Exactly how much applying for new credit affects your score depends on your overall credit profile and what else is already in your credit reports. For example, applying for new credit may have a greater impact on your FICO® Scores if you only have a few accounts or a short credit history. That said, there are definitely a few things to be aware of depending on the type of credit you are applying for. When you apply for credit, a credit check or inquiry can be requested to check your credit standing.

If you dont see the answers to your questions:

Also Check: How Much Income To Qualify For 1 Million Mortgage

What Affects Your Fico Score

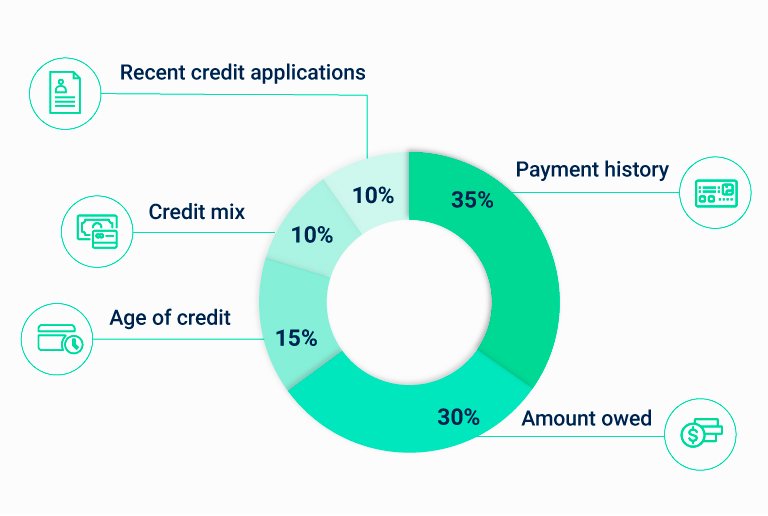

While FICO doesnt reveal its scoring formula, it gives useful guidelines about the factors that matter for scores. As you can see, paying on time and keeping balances low account for about two-thirds of your score:

-

Payment history : Late payments can really hurt your score, as can accounts in collections or a bankruptcy.

-

Amount of debt relative to credit limits : This is how much of your available credit you are using the less, the better for your score.

-

Age of credit : This refers to how long youve had credit and the average age of your credit accounts.

-

Recent applications for credit : A so-called hard inquiry when you apply for new credit can nick your score for up to six months. That’s why it’s important to research credit card offerings and eligibility requirements before applying to one.

-

Whether you have more than one type of credit : Having both installment loans and revolving credit can help your score.

Read Also: Care Credit Score Needed 2021

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Fico Score Vs Credit Score: What Is The Difference

Recapping

In our FICO Score vs Credit Score article, well help you understand the differences between the two and how they are usedwhich will be extremely useful when tracking your credit score or why your credit card application was denied. What is the difference between credit score and FICO score is a question everyone asks when looking into their credit history.

Also Check: Credit Score Of 611

What Are The Different Categories Of Late Payments And Do They Impact Fico Scores

A history of payments is the largest factor in FICO® Scores. FICO® Scores consider late payments in these general areas how recent the late payments are, how severe the late payments are, and how frequently the late payments occur. So this means that a recent late payment could be more damaging to a FICO® Score than a number of late payments that happened a long time ago. Late payments are listed on credit reports by how late the payments are. Typically, creditors report late payments in one of these categories: 30-days late, 60-days late, 90-days late, 120-days late, 150-days late, or charge off . Of course a 90-day late is worse than a 30-day late, but the important thing to understand is that people who continually pay their bills on time tend to appear less risky to lenders. However, for people who continue not to pay debt, and their creditor either charges it off or sends it to a collection agency, it is considered a significant event with regard to a score and will likely have a severe negative impact.

If I Dont Agree With My Fico Score What Should I Do

Your FICO® Score is provided to Wells Fargo by Experian® based on information within your credit report on the calculation date . If you feel this information is inaccurate, your next step should be to request a free credit report from annualcreditreport.com. If theres incorrect information within any of your credit reports, follow each bureaus instructions on how to dispute that information. If theres incorrect information about your Wells Fargo accounts, please call the Wells Fargo phone number in your credit report.

Don’t Miss: Syncb Ppc What Is This

Fico Is The Most Widely

Since there are so many free credit score options out there, you should know that FICO is the most widely used credit score among lenders. In fact, 90% of lenders check FICO Scores rather than any other types of credit scores. So if youre looking to take out a loan anytime soon, we recommend checking your FICO Score.

FICO actually has multiple scoring models, such as FICO Auto Score and FICO Bankcard Score, used in different lending industries. The most popular score across industries is the FICO Score 8, while the FICO Score 9 is the most recently released FICO scoring model.

You can purchase your FICO credit score and report from each credit bureau individually for $19.95 or all three credit bureaus scores and reports for $59.85. Purchasing your credit score through FICO will include your FICO Score 8, as well as other important industry-specific scores.

What If I Dont Want Wells Fargo To Display My Fico Score Anymore

You can opt out of the service at any time. On the FICO® Score screen, select the I no longer want Wells Fargo to display my FICO® Score link. If you decide to start the service again in the future, you can select View Your FICO® Credit Score on the Account Summary and follow the instructions to opt back in.

You May Like: What Is Syncb/ppc

What Is A Vantagescore

VantageScore was created by the three major credit reporting agenciesExperian, Equifax, and TransUnion. It uses similar scoring methods to FICO but yields slightly different results.

Featured Topics

One of the primary goals of VantageScore is to provide a model that is used the same way by all three credit bureaus. That would limit some of the disparity between your three major credit scores. In contrast, FICO models provide a slightly different calculation for each credit bureau, which can create more differences in your scores.

Key Differences Between A Fico Score And Credit Score

FICO is short for Fair Isaac Corporation, the first company to offer a credit-risk score. Its the most widely used type. FICO uses a formula to measure and assign your creditworthiness. In order of importance, its based on these factors:

- Payment history

- New credit

Using these criteria, credit users are assigned a number in the FICO score range between 300 and 850, with a higher score indicating better credit. FICO also has a variety of scores based on loan types, such as a FICO Mortgage score, FICO Auto Score and more. Its possible to have dozens of different types of different FICO scores, each with a different number.

In addition, the FICO credit score changes in 2020 with the UltraFICO score. This new score is good news for people who are just starting to build a credit history or those who are looking to repair their credit. It is based on the same number scale but also uses deposit account activity to calculate a score.

Another type of credit score is your VantageScore, which was created in 2006 by the three major credit bureaus: Equifax, Experian, and TransUnion. A VantageScore uses the same range, but it is generated with just one month of credit history, making it better for new credit users. VantageScore also uses a different formula to calculate a persons score. In order of importance, its based on:

- Near prime: 601-660

- Subprime: 300-600

You May Like: How To Get Rid Of A Repo On Your Credit

Fico Scores Are Commonly Used By Lenders To Assess Your Credit Risk But Other Credit Scores Can Also Give You A Good Idea Of Where You Stand

In other words, your FICO® scores are just one type of credit score you can get. This is because FICO is a company that creates specific scoring models used to calculate your scores. But there are other companies that use different scoring models to determine your credit scores, too.

VantageScore is an example of one of these companies. Both FICO and VantageScore offer credit-scoring models to evaluate the information in your credit reports and issue a corresponding credit score. These scoring models evaluate many of the same factors when looking at your credit reports and calculating your scores, but they differ very slightly.

Thats why you may see different credit scores depending on which scoring model is used. Your scores can also differ depending on which consumer credit bureau report Equifax, Experian or TransUnion the scoring model pulls your information from.

Will Closing A Credit Card Account Impact My Fico Score

It is possible that closing a credit account may have a negative impact depending on a few factors. FICO® Scores may consider your credit utilization rate, which looks at your total used credit in relation to your total available credit. Essentially, it measures how much of your available credit you are actually using. The more of your credit that you use, the higher your utilization rate and high credit utilization rates may negatively impact your FICO® Score. Before you close any credit card account, Wells Fargo recommends that you should first consider whether you really need to close the account or if your real intention is just to stop using that credit card. If you really just want to stop using that card, it may make sense if you stop using the card and put it somewhere for safe keeping in case of an emergency. Its also important to note that length of your credit history accounts for 15% of your FICO® Score calculation. Therefore, having credit card accounts that are open and in good standing for a long time may affect your FICO® Score.

You May Like: How Often Does Bank Of America Report To Credit Bureaus

How Do Fico Scores Consider Loan Shopping

In general, if you are loan shopping – meaning that you are applying for the same type of loan with similar amounts with multiple lenders in a short period of time – your FICO® Score will consider your shopping as a single credit inquiry on your score if the shopping occurs within a short time period depending on which FICO® Score version is used by your lenders.

Check Your Fico Score For Free

While there are newer FICO® Score versions available, FICO® Score 8 remains one of the most widely used versions. Partially, this is because lenders need to invest time and money into switching to a new scoring model. You can check your FICO® Score 8 based on your Experian credit report for free online. You’ll also learn about which factors are most helping or hurting your scores and can track your score over time.

Read Also: Getting Public Records Removed Credit Report