Your Credit Score Is Low Because You Dont Have A College Degree

This credit myth is simply not true. Education level is irrelevant in credit scores. It is not part of the credit reportonly debt information is.

The same goes for demographic information. Your age and where you were born have no bearing on your credit scoring.

Lenders and creditors are more concerned with your ability to pay off a loan, so they focus on your history of paying bills.

Equal Credit Opportunity Act

A creditors scoring system forbids credit discrimination on the account of race, color, religion, national origin, sex, marital status, or age as factors as stated under the Equal Credit Opportunity Act.

As long as its not on your credit report, it wont affect your credit score.

What is included in a credit report?

The data included in credit reports is usually debt-related information. You have personal identifying information, credit account information, inquiry information, bankruptcies, and collections accounts.

We have things that will not be in a credit report such as income, investments, assets specified as stocks or bonds.

Also, savings accounts, checking accounts, certificates of deposit or other non-debt banking relationships are not included.

How To Get Good Credit

If you want a good credit score, you need to understand how credit scores are calculated and how to build credit.

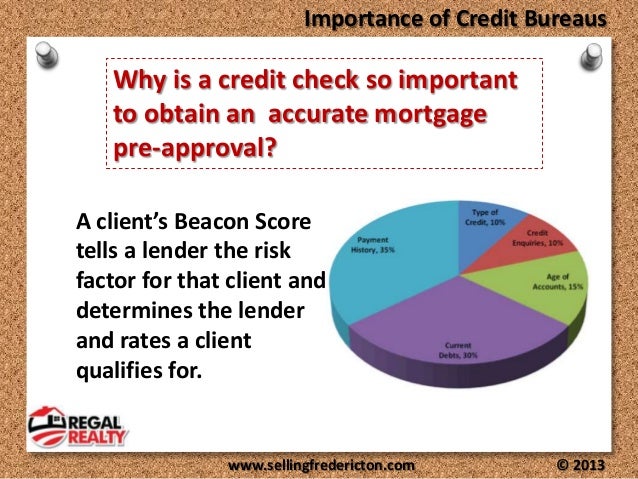

Your FICO credit score is made up of the following five factors:

- Payment history: 35 percent

- Length of credit history: 15 percent

- 10 percent

- Recent credit inquiries: 10 percent

If you want to get your credit score into the good credit score range, you need to improve your credit habits as they relate to those five factors.

What Is A Credit Report Used For

A variety of businesses check your credit report to make decisions about you. Banks will check it before approving you for and loans, including mortgages and auto financing. Potential landlords will review your credit report to decide whether to rent to you. Some employers even check credit reports as part of the job application process.

Your credit report is the sole source of information used to calculate your credit score, a three-digit number that lenders often use to determine how likely you are to pay back or default on a loan. They might use your score instead of, or in addition to, your credit report.

High credit scores generally indicate that your credit report includes positive information, while low credit scores indicate the presence of negative information. Usually, the higher your score, the more likely you are to be approved for a loan.

Recommended Reading: What Is A Tri Merge

Why Does Your Credit Report Matter

Your credit report is a key component of your overall financial health. While it doesn’t include information like your employment history or income, it can provide companies a clue to your money management skills. If it’s maintained well, a credit report can open doors to new opportunities. Here’s how:

What Does It Cost

The catch to checking your credit score is that it isnt free. Depending on where you live and which score you check, youll likely have to pay to see that information.

This is where its important to know the differences between FICO and VantageScores. FICO scores are the standard that most lenders use to evaluate your creditworthiness. If you want to know what scores lenders will see when you apply for a loan, then you want to see your FICO score. But theyre not cheapcurrently it costs around $20 per score, so getting your score for all three credit bureaus would cost around $60.

VantageScores are an alternative designed by the bureaus themselves. They cost about half of what a FICO score costs. When you go to www.annualcreditreport.com and get a free credit report, the bureaus will offer to sell you your score as wellthis is a VantageScore theyre offering. And we usually dont recommend people pay the extra for a score when getting their free annual report. This is nothing against VantageScoreits just that checking your report and score arent synonymous usually you only want the report, and should only pay for the score when the time is right.

Also Check: Does Zzounds Do A Credit Check

Ways Credit Reports Can Help You Achieve Financial Goals

Whether you see your credit report as a friend or foe, it will always be there to vouch for your reliability when youre in the market for a house or a new car. But credit reports are used for a variety of other important things, too. Here are some of the less obvious ways your credit report might be used:

- Getting a job. Prospective employers can look at your credit report to determine your dependability and inform employment decisions about you.7

- Car insurance rates. Car insurance companies may check a credit report to determine your premium.8

- Renting an apartment. Solid credit history can indicate the likelihood youll pay rent on timethus making you a better prospective tenant.

- TV, internet, and cell phone services. Some cable, internet, and cell phone providers might look at your credit report to determine whether or not you have to make a security deposit before starting service.9

Why Your Credit Score Matters

You can leverage great scores into great deals on loans, credit cards, insurance premiums, apartments and cell phone plans. Bad scores can hammer you into missing out or paying more.

The lifetime cost of higher interest rates from bad or mediocre credit can exceed six figures. For example, according to interest rates gathered by Informa Research Services:

-

Someone with FICO scores in the 620 range would pay $65,000 more on a $200,000 mortgage than someone with FICOs over 760.

-

On a five-year, $30,000 auto loan, the borrower with lower scores would pay $5,100 more.

-

A 15-year home equity loan of $50,000 would cost a low scorer $22,500 more than someone with high scores.

Since credit scores have become such an integral part of our financial lives, it pays to keep track of yours and understand how your actions affect the numbers. You can build, defend and take advantage of great credit regardless of your age or income.

Don’t Miss: Does Renting A Storage Unit Build Credit

Benefits Of A Credit Report

Your credit report, much like your academic report cards from school, is a reflection of your performance and areas requiring extra effort but financially. Therefore, having a good credit report is very helpful when raising some money from the finance market. In addition to assessing your financial abilities, your credit report also provides your potential creditors with an insight into your financial performance to offer you the best. These are very basic but long-lasting benefits:

Why Can A Credit Score Differ

When it comes to your credit score, there are generally two scores and they can be different from each other.

The first is the score that is stored with a credit reporting agency. This file is accessible to all credit providers and lenders to help assess your eligibility when applying for a loan. There are multiple credit reporting agencies, so there will also be differences in their scoring systems as there is no universal system.

The second credit report is completed internally by the credit supplier with which youve applied. This is their own score, based off the information you have supplied them, where they assess your eligibility for the loan.

Recommended Reading: What Credit Bureau Does Drivetime Use

How To Improve Credit Score

The following are some of the basic ways to improve your credit score:

- Monthly loan and debt repayment on time before the due date

- Avoiding extension of credit and not using unsolicited new card arrivals

- Self-caution goes a long way so itâs a strict no on ignoring overdue bills

- Keep an open line of communication and arrange for repayment arrangements when experiencing financial difficulty with the creditor

- Being aware of the type of credit card in use

- Limiting the number of credit card applications is a sure-shot way of never extending your credit amount not going over the top while spending is the wisest of decisions one can take while trying to improve credit score.

The Main Credit Report Agencies

There are three main credit reporting agencies operating in the U.S.Equifax, Experian, and TransUnion. Below, youll find a link to each credit reporting agency, along with basic information drawn from their respective websites.

Equifax:

With its headquarters in Atlanta, Equifax operates or has investments in 24 countries in North America, Central and South America, Europe and the Asia Pacific region. Equifax employs approximately 9,500 employees worldwide and organizes, assimilates and analyzes data on more than 820 million consumers and more than 91 million businesses worldwide. Its database includes employee data contributed from more than 7,100 employers. The companys common stock is traded on the New York Stock Exchange under the symbol EFX.

Experian:

Experians corporate headquarters is in Dublin, Ireland, and the company operates across 37 countries with 17,000 employees. Experian maintains credit information on approximately 220 million U.S. consumers and 25 million active U.S. businesses. The company also maintains demographic information on some 235 million consumers in 117 million living units across the U.S. Experian is listed on the London Stock Exchange under the symbol EXPN.

TransUnion:

The Fair Credit Reporting Act states that consumers have the right to know what information is in their credit report and to correct any errors. This legislation was designed to promote accuracy and ensure privacy of consumer information in credit reports, says Ross.

Also Check: Unlocking Credit Report

Make The Most Of A Thin Credit File

Having a thin credit file means that you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isnt normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score. Its free to use and designed for people with limited or no credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, there are several services that allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO score. Some rent-reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: Cbcinnovis Credit Check

How Often Should You Check Your Credit Score

You should check your credit score regularly to check for errors, but make sure that you are doing so through soft inquiries so that your score isnt dinged. Many banks offer free credit monitoring to their customers check with yours to see if you can enroll in their service and get alerts whenever your score changes.

How To Check And Monitor Your Credit For Free

Experian makes it easy to check your , and also offers a free service that provides access to credit reports and credit scores, and monitors your Experian credit report and alerts you anytime it changes. The service also makes it seamless to report and correct any inaccuracies that may turn up in your credit reporta rare occurrence, but one that can have negative consequences for your credit score. You can also get your credit reports for free from all three bureaus through AnnualCreditReport.com.

You May Like: How To Get Repossession Off Credit

Benefits Of Good Credit

There are many benefits to having good credit. Landlords are more likely to rent you an apartment, for exampleand if youre job hunting, you might benefit if your employer reviews your credit as part of the hiring process. That said, the biggest benefits of good credit are all financial. Here are three ways in which good credit can make your life both easier and more affordable.

Why Should I Check My Credit Reports And Credit Scores

Reading time: 4 minutes

Highlights:

-

Checking your credit history and credit scores can help you better understand your current credit position

-

Regularly checking your credit reports can help you be more aware of what lenders may see

-

Checking your credit reports can also help you detect any inaccurate or incomplete information

Your credit history and credit scores are vital pieces of information that are important to your overall financial wellbeing. Viewing your credit history as shown on your credit reports and your credit scores may help you understand your current credit position.

Generally speaking, a is a three-digit number designed to represent your credit risk . Your credit history is the record of how you have managed your credit accounts. It may include your current and past credit accounts, information on your payment history and the total amount you owe. Credit scores are calculated using information from your credit reports, although credit scoring models are different.

Along with many other pieces of information, potential lenders and creditors including credit card companies, mortgage lenders and auto lenders may use your credit scores and credit history to help make lending decisions. These companies want to know how likely you are to pay the money they lend back as agreed.

It’s a good idea to check your credit reports at least once a year. Follow our checklist to review your Equifax credit report.

Identify inaccurate or incomplete information

Don’t Miss: Is An 850 Credit Score Possible

So When Should I Buy A Credit Score

If youre simply trying to ensure your credit report is accurate, stick with the report and dont worry about the score. If youre investigating possible identity theft, or recovering after being a victim, you should also stick to the report and dont pay for a score. If accuracy is what youre trying to ensure, dont waste money on a score.

But if youve already verified that your report is accurate and up to date, and you want to evaluate how good your credit really is, you can get a score to see where you stand. Its important to do this check well in advance of taking out a major loan. At least a few months before filling out that loan application, check your score, and if its not as good as it needs to be, take steps to improve your scorepay off overdue charges, pay down balances, make sure everything is accurate and up to date. It may take the creditors a few billing cycles to report the new balances and payments to the bureaus, so you need as much advance time as you can get to see how much your score improves.

See our article on 5 Actions You Can Take to Improve Your Credit Score for more advice on improving scores over time.

Why Your Credit Report Matters

Your credit report and credit score are objective measures of your financial reliability, and therefore can carry a lot of weight in a number of circumstances. Depending on the current status of your credit accounts and the history of your bill and loan payments, you might think of your credit report as a trusty companionor perhaps a looming shadow.

If lenders deem you creditworthy, your credit report might help you get approved for a new credit card with great perks, and even help you land a job or a new apartment.

But if your financial history is rocky, the credit or loan application process might seem daunting. Understanding whats in your credit report and how it translates into your credit score can help you know what to expect.

Also Check: Is Opensky Reliable

Your Credit Report Can Help You Spot Credit Fraud

Left unchecked, could temporarily damage your credit, and require lots of time and hassle to correct. Unusual credit report entries, such as hard inquiries you don’t recognize or accounts you didn’t open, can indicate criminal efforts to borrow money or buy goods in your name. Spotting those signs early and taking immediate action to address them can spare you major headaches.

Because credit reports and credit scores can affect your life in many ways, it’s a good idea to keep aware of them. Checking your credit report and credit scores regularly, and monitoring them for any changes can help you know how lenders will view your applications, and prevent unpleasant surprises.