What Are The Benefits Of A Good Credit Score

The benefits of good credit can include everything from lower credit card interest rates to lower car insurance premiums.

Since credit scores are based on information in your credit reports, a higher score is a sign of healthy creditâand that can be the key to enjoying these eight benefits:

1. Get Better Rates on Car Insurance

First up: car insurance. Some insurance companies may use your credit scores to make all kinds of decisions when you apply for coverage.

According to the CFPB, insurance carriers can use your credit reports to help decide whether to approve your application and how much to charge you. Once youâre a customer, they may check your credit to help decide whether to raise your premiums or even deny you the chance to renew your policy.

2. Save on Other Types of Insurance

Companies offering other kinds of insuranceâhome insurance, for exampleâmay also look at your credit history.

Thatâs because insurance companies may want the same information that other lenders look for. That could include your history of on-time bill payments as well as how much debt you owe. What insurance companies learn about your credit may help them determine how much youâll pay in premiums.

3. Qualify for Lower Credit Card Interest

When you apply for a credit card, the card issuer will likely check your credit. If youâre approved, a good credit score may make you eligible for things like a lower annual percentage rate .

4. Get Approved for Higher Credit Limits

Do Products Bought With Klarna Ship After The First Payment

It generally works the other way around: When you buy something with Klarna Pay in 4, you wont make any payments until after the order ships. Since online orders can sometimes take a few days to process, you might not make a payment until a couple of days after placing the order. If you choose Pay in 30, you wont receive an invoice until the product has shipped.

Dont Miss: Syncb Toys R Us

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Also Check: Speedy Cash Change Due Date

What Is A Credit Report

A is a summary of how you pay your financial obligations. It contains information based on what you have done in the past. Lenders use it to verify information about you, see your borrowing activity and find out about your repayment history. Some of the information on your credit report is used to determine your credit score.

Low Interest Rates On Credit Cards And Loans

The interest rate is one of the costs you pay for borrowing money and, often, the interest rate you get is directly tied to your credit score. If you have a good credit score, youll almost always qualify for the best interest rates, and youll pay lower finance charges on credit card balances and loans. The less money you pay in interest, the faster you’ll pay off the debt and the more money you have for other expenses.

Recommended Reading: How To Check Your Credit Score With Itin

What Is A Soft Credit Check

A soft credit check is when your credit report is pulled but you havent applied for credit. For example: Insurance companies or potential landlords may look at your credit report to assess risk potential employers may do background checks. Credit card companies can also pull a soft copy of your credit to service and manage any existing relationships you may have with them. Soft checks do not affect your credit score or show up on your credit report.

Some Fine Print On Government

FHA loans are the most broadly accessible, as there are no income or geographic restrictions on who can qualify.

USDA loans are available nationwide, but you must meet the income limits and buy a home in a USDA-eligible rural or suburban area.

VA loans are only available to active-duty military servicemembers, veterans, and some surviving spouses. The VA does not set a hard-and-fast credit score minimum and encourages lenders to consider all facets of an eligible borrowers finances.

You May Like: Does Klarna Improve Your Credit Score

What Is A Personal Loan And Why Might You Consider One

A personal loan is a form of credit you can use to pay for just about any large purchase home renovations, funeral expenses, medical bills, debt consolidation or even unexpected emergencies if you don’t already have an emergency fund that can cover the cost.

Much like a credit card, personal loans accrue interest while you pay off the balance. But unlike credit cards, personal loans usually have terms that allow you to repay equal amounts over a span of a few months to a few years. Because of this, personal loans are considered installment loans.

People may consider taking out a personal loan to cover an expense because they typically carry lower interest rates compared to credit cards, though the rates may also be variable. You may also be able to get a larger personal loan compared to your credit card’s credit limit.

According to the Federal Reserve, the current average APR for a two-year personal loan is 9.58% while the average APR for a credit card is 16.30%. However, using a credit card with a 0% intro-APR period could save you even more money, but you’ll likely be subject to a shorter lending period.

Personal loans are also really simple to use once you’re approved for a loan, the amount is delivered straight to your checking account and you can start using the money as you see fit. Read our list of the best personal loans to find one that’s right for you.

What Qualifies As A Good Credit Score

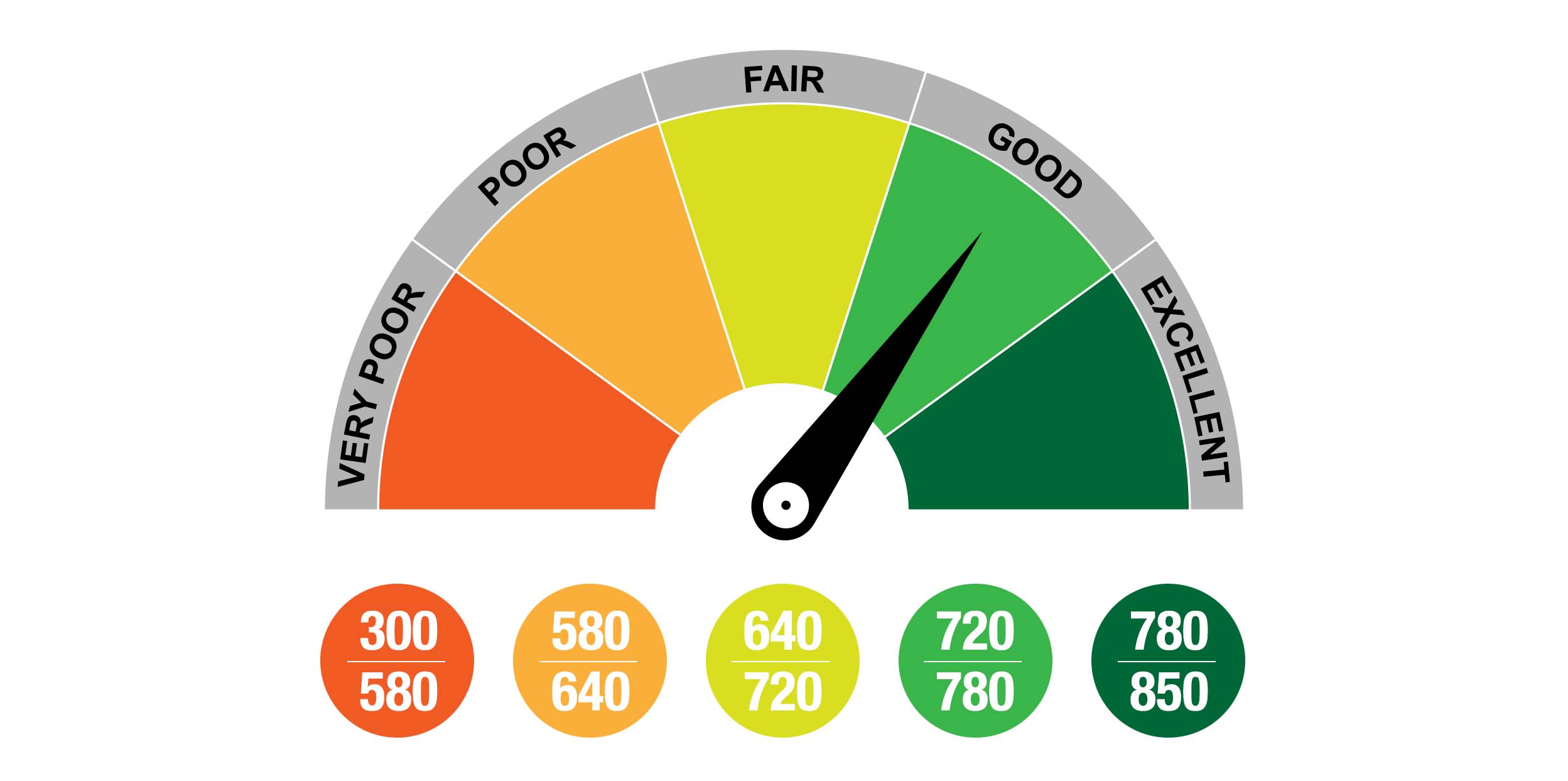

For those who arent as familiar with their credit score, its a three-digit number that encompasses all your credit-related activity into one cumulative average. In Canada, credit scores range anywhere from 300 to 900. The higher your credit score is, the better your chances are of getting approved for various loans and other credit products. Generally speaking, a score of 650 and above is considered good and means that you are a low default risk and a better candidate for lending. A credit score of 750 or higher is deemed excellent.

Loans Canada Lookout

Also Check: What Fico Score Does Carmax Use

What Credit Score Do You Need For A Car Loan

Home \ Auto \ What Credit Score Do You Need For A Car Loan?

Join millions of Canadians who have already trusted Loans Canada

Want To Lower Your Car Payments?

Speak with a Loans Canada representative today and learn how you can refinance your car loan and save. Call us today at:

Note: Program is currently not offered in Quebec.

Credit scores play an essential role in our financial life. Whether youre searching for a personal loan, mortgage or credit card, boosting your score can get you more affordable loan options. When it comes to car loans, the same rules apply. Instead of searching for what credit score will merely gain you loan approval, its best to figure out what credit score will get you the best deal on your car loan. Lets learn more.

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Read Also: How To Remove A Repossession From Your Credit Report

Why Does Your Credit Score Matter When Applying For A Personal Loan

You’ll need a few things before you apply for a personal loan, but the first thing you should do is take a look at your and review your credit reports. Equifax, Experian and TransUnion, the three main credit bureaus, each report a different score based off of different scoring models.

Your are important because they provide lenders with clues to determine whether they think you’ll be a responsible borrower who will pay back the loan on time and in full.

“Lenders want to ask themselves, ‘if I lend you money, will you pay me back?'” said Jim Droske, the president of Illinois Credit Services.

Plus, the better your credit, the more likely you are to get favorable terms like lower interest rates on your loan. You can use a number of services to check your Equifax and TransUnion scores, which use the VantageScore model, or use Experian to check your score based on the FICO 8 model. Note, the FICO 8 model gets used in about 90% of lending decisions in the U.S.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

Also Check: When Do Things Fall Off Your Credit Report

Who Has The Best Buy

Overtime by MoneyLion is the best buy-now-pay-later app because it offers so much more than loans from specific vendors. Instead, youll be able to buy anything you need and pay for those purchases over time, all while having access to a suite of financial solutions for your loans.

MoneyLion offers more than one solution to secure the capital you need. We also offer payday loans and cash advances. Even with bad credit, you can get up to $1,000 through a no-interest payday loan or cash advance!

Plus, youll be able to manage your money from anywhere with MoneyLions apps, which are available on iOS and Android devices. They will also introduce you to an array of other financial solutions to the money-related problems in your life!

What Are Disadvantages Of Direct Debit

Disadvantages of direct debit

- One of the major disadvantages of direct debit is the time that it takes to get paid for the first time. …

- Even though the rates of failure for direct debit transactions are lower than that for credit and debit cards, there is still a possibility that transactions will not go through.

Also Check: Ccb On Credit Report

How Klarnas Buy Now Pay Later Scheme Could Damage Your Credit Score

Online shopping can be addictive, literally, not to mention time consuming. By the time youve ordered, had your purchase delivered, and discovered it doesnt suit you/you dont like it then you have to wait for your refund.

Its probably for this exact reason that buy now, pay later schemes like Klarna have seen such a rise in popularity in recent years. Split the cost into monthly instalments or pay in full up to 30 days later, Klarnas website reads, explaining the proposition. And its an appealing one since being introduced to retailers including ASOS, Topshop, H& M and Boohoo, customers have been able to purchase clothes without having to pay the full balance immediately. Its popularity is undeniable in Klarnas most recent statistics, the Swedish fintech company revealed it was attracting 25,000 new UK users each week.

But now, concerns are being raised that such schemes could potentially be damaging to your credit score. And with so many young people being enticed into using the pay later option, are they aware of the toll it could take on their finances and the longer term consequences?

When I was getting married a few years ago I wanted some nice clothes for my honeymoon, but had spent loads of my money on the wedding itself, 33-year-old Laura* tells Cosmopolitan. So when an online shopping site said I could spread the cost of my holiday wardrobe it seemed a good solution.

*Name has been changed.

Finding The Right Mortgage

As we said, if your credit score is below your lenders standards, its possible that your first mortgage application wont be approved but, dont give up right away. If everyone with a score under 680 got rejected for mortgages, the population of homeowners in most cities would be sparse, to say the least. That being said, before applying for a mortgage with any lender, its best to improve your credit score as much as you can, since doing so will help you gain access to better interest rates.

Remember, applying for a mortgage is the same as for any other credit product, in the sense that the lender will have to make a hard inquiry on your credit report, causing your score to drop a few points. So, when youre starting to get serious about buying a house, make sure to do some research in advance to find the best lender for your specific financial needs. Loans Canada can help match you with a third-party licenced mortgage specialist that meets your needs, regardless of your credit.

Note: Loans Canada does not arrange, underwrite or broker mortgages. We are a simple referral service.

Rating of 5/5 based on 91 votes.

Also Check: Raise Credit Score 50 Points In 30 Days

Why Are There Different Fico Scores

There are dozens of different FICO® scores, under two general categories.

- Base FICO® scores

- Industry-specific FICO® scores

Every so often, FICO also releases new credit score versions that are meant to improve upon the last iteration and create a more predictive and reliable score for lenders.

As a result, there may be multiple editions of each scoring model, but lenders can choose to stick with an older version if they prefer.

FICO also creates three versions of its base FICO® scores to work with data from each of the major consumer credit bureaus: Equifax, Experian and TransUnion. The most recent edition is FICO® Score 9, though lenders may still be using FICO® Score 8 or an earlier version.

Industry-specific scores include the FICO® Bankcard Score and FICO® Auto Score. There are multiple versions and editions of these as well.

You may be able to contact a creditor and ask which credit-scoring model it uses to evaluate applicants. Even if you cant find out, the good news is that the primary scoring criteria are similar for most FICO® credit scores. Therefore, if one of your FICO® scores is in the very good range, then your other FICO® scores may also be in that range.

What To Do If You Have A Low Credit Score

Everyone’s financial situation is unique, and your credit score will reflect that fact. Whether you’re recovering from bankruptcy or building credit for the first time in your life, there’s a chance that you may have a sub-650 credit score.

Don’t panic! A score below 650 doesn’t mean that you’ll never be able to rent your dream apartment. However, itll take additional effort on your part to make it happen. Here are some tips that will help you rent with bad credit.

Also Check: How To Get Rid Of A Repo On Your Credit

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Best Practices To Mitigate Hard Inquiries

Because the impact on your credit history is relatively small, you shouldnt worry too much about hard inquiries if you are responsibly shopping around for a new lender.

The best way to reduce the effect of hard inquiries on your credit score is to improve your overall credit history. Focus on making loan repayments on time and reducing your overall amount of debt.

The first step toward improving your credit report is to see it yourself. There are now manyfree ways to check your credit score and credit report. Many banks now offer this service free to customers.

Recommended Reading: Ashley Furniture Credit Card Score

Don’t Miss: Prosper Webbank On Credit Report