Stay On Top Of Industry Trends And New Offers With Our Weekly Newsletter

Your credit cards journey is officially underway.

Keep an eye on your inboxwell be sending over your first message soon.

ADVERTISER DISCLOSURE CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear within listing categories. Other factors, such as our proprietary website’s rules and the likelihood of applicants’ credit approval also impact how and where products appear on the site. CreditCards.com does not include the entire universe of available financial or credit offers.CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

EDITORIAL DISCLOSURE All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

How Can I Repair Or Build My Credit Score

- Find out your current credit score: The first thing you need to do is find out where you stand. Request your credit report from at least one credit monitoring agency, if not all of the three main providers, TransUnion, Equifax and Experian.

- Make sure your information is accurate and up to date: Inaccuracies or old information can have a detrimental impact on your score, especially if any inaccurate accounts or financial ties listed reflect badly on you. If you find anything suspicious or wrong on your report, contact the credit reference agency with an amendment request. In addition, if your credit report doesn’t include an up-to-date home address, you should address this too.

How To Quickly Boost Your Credit Score

Lastly, if you’re looking for an easy way to boost your credit score before signing up for your own credit card, you can always opt to become an on someone else’s account.

Becoming an authorized user on a primary cardholder’s account means their credit history for that card is reflected on your own credit score as long as the primary cardholder makes their payments on time and in full, the authorized user’s credit score will improve as well. However, if the primary cardholder is delinquent on their payments, it will end up negatively impacting your credit score, too.

Keep in mind that the primary cardholder may choose not to provide the authorized user with an actual credit card. The authorized user is also not the one on the hook for making payments.

You can check and monitor your credit score with a free like and Experian. And using a service like Experian Boost can you help you quickly raise your FICO® score* if you’re trying to achieve a fair, good or excellent score by taking regular bills you pay on time like Netflix and adding that to your credit profile.

*Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost.

Petal 2 Visa Credit Card issued by WebBank, Member FDIC.

For rates and fees of the Discover it® Secured Credit Card, click here.

Catch up on Select’s in-depth coverage of personal finance, tech and tools, wellness, and to stay up to date.

Read Also: Syncb Inquiry

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters

| Installment | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan. | |

| Open | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R. | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M. |

Numbers

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

Read Also: What Does Serious Delinquency Mean On Credit Report

Handle Delinquencies & Inaccurate Information

When you pull your credit reports, you should check to make sure all of your debt, accounts, and information are correct.

If you have some inaccurate information, like an account you never opened, you need this to be removed from your credit report immediately. You may even want to report identity theft or fraud, depending on what all the account entails.

If all of the information is correct, but you have delinquent accounts, charge-offs, or accounts in collections, youll need to resolve them, since they can negatively impact your score. Depending on the time of these debts, you may want to wait until they fall off, or get an agreement for a Pay For Delete.

Related: Repair Your Credit: 6 Tips on How to Raise Your Credit Score

Why Credit Scores Matter

With a bad score, few banks will take a chance on you. Those that do will likely offer you only their highest rates. Even a so-so score may jack up rates compared to those offered to people with excellent credit.

A bad credit score can also increase your insurance rates or cause insurers to reject you altogether. It can stand between you and the apartment you want to rent. Negative items in your can even hurt you when you apply for a job.

Lets take a look at what is considered a bad credit score, how you might have gotten there, and what you can do to fix it.

Don’t Miss: Report To Credit Bureau Death

Should You Worry About Your Credit Score Dropping

Changes in your credit score are completely normal, so theres no need to worry about small fluctuations! That being said, its good to check your credit report at least once a month so you can monitor these changes when they occur.

You may want to take note of large changes in your score as they could be an indication that something bigger is happening for example, if you have unauthorized accounts opened in your name, or youve been a victim of identity theft.

What Is My Credit Score Why It Exists And Why You Need To Build It

Some types of financing — such as personal loans or mortgages — may also be out of reach for someone who doesn’t have a good credit history,

Money, loans, and credit aren’t always comfortable or interesting topics to discuss, but understanding how credit scores and reports work can be critical to your personal financial success.

Most of our education systems don’t emphasize financial literacy. We may learn the Pythagorean Theorem as teenagers, but not the basics of managing money, much less how a credit card works or what a credit score is. For many young people starting their professional life, knowing how to manage money is far more important than knowing how to determine the angle and sides of a triangle.

When it came to credit cards, what was drilled into my head was: “If you can’t afford it, you don’t buy it.” Furthermore, as a golden rule, I was taught never to use this payment method, as credit was viewed simply as a gateway to debt.

For affordability, that’s sound advice. Still, as I found to my detriment when I tried to sign up for my first mobile phone contract , it’s far more beneficial to manage affordability and at the same time build a strong credit history and score.

And, the earlier you can start, the better.

Here’s what you need to know about credit scores, credit files, and how to either build or repair your existing credit score.

Also Check: Does Zebit Report To Credit Bureaus

How To Improve A Bad Credit Score

If you have bad credit, take some time to review your credit score and identify the cause. Perhaps you’ve missed payments or carried a balance past your bill’s due date. In order to achieve a fair, good or excellent credit score, follow the below.

- Make on-time payments. Payment history is the most important factor in your credit score, so it’s key to always pay on time. Consider setting up autopay to ensure on-time payments, or opt for reminders through your card issuer or mobile calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate, which is the percentage of your total credit limit you’re using. To calculate your utilization rate, divide your total credit card balance by your total credit limit.

- Don’t open too many accounts at once. Every time you submit an application for credit, whether it’s a credit card or loan, and regardless if you’re approved or denied, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score by roughly five points, though they rebound within a few months. Try to limit applications as needed and shop around with prequalification tools that don’t hurt your credit score.

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

You May Like: When Does Self Lender Report To Credit Bureaus

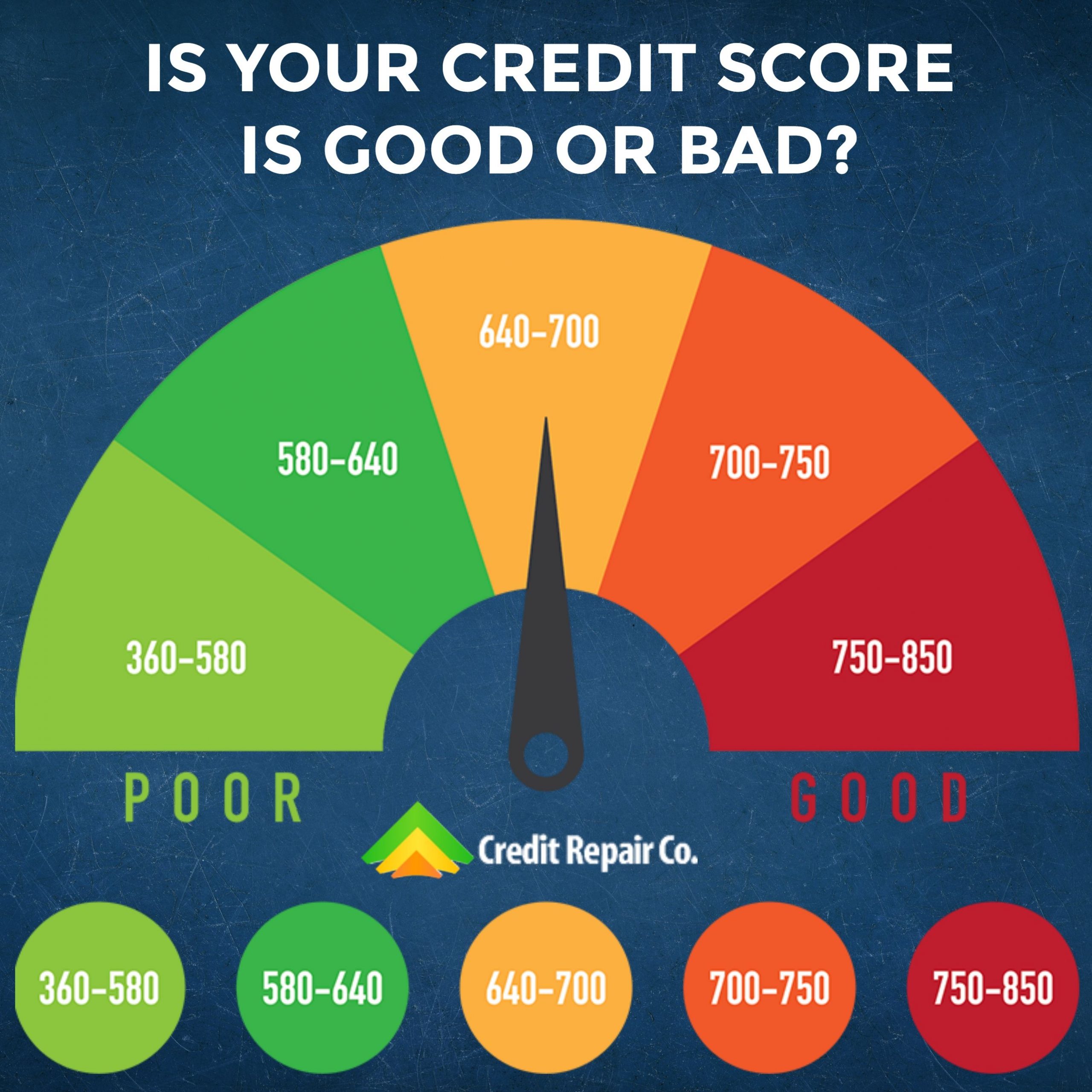

What Is A Good/bad Credit Score

There is no âmagicâ credit score that will guarantee that you get accepted for credit. Also, different lenders are looking for different things, so you might get refused credit by one lender and accepted by another.

Remember, your credit score is a useful indication of your creditworthiness, but lenders will look at other factors before deciding whether to lend to you.

You Pay Your Bills Late

Your payment history has a major impact on your credit score. U.S. News & World Report estimated that a single late payment can lower a credit score by 100 points or more. However, borrowers might be able to mitigate the damage, assuming they act fast. While missing a payment by just a few days likely wont put your scores at risk, paying bills 30 or more days late can have a serious effect on your credit.

How to avoid it: Do whatever is necessary to avoid being late on payments. If you are forgetful, set up reminders on your phone or computer. If you spend too much, tighten your belt so youll have the cash to make your payment.

How to fix it: If you paid a bill late, contact your lender to get its policy on reporting late payments. Unfortunately, if the lender has already reported the late payment, you probably wont be able to get it removed from your credit report. Youll just have to make sure all future payments are made on time.

You May Like: How Long Do Repossessions Stay On Your Credit

You Rent A Car With A Debit Card

Renting a car with a debit card allows you to assume the risk of damage done to the car in case of an accident. Renting with a debit card will also subject you to paying for a deposit and renters insurance.

Using a credit card to rent a car will protect your liquid assets in the case of an accident. Some credit cards offer collision protection and towing charges just as a perk of having the card.

Find: Surprising Ways Gen Z and Millennials Are Worlds Apart Financially

Instill A Proactive Approach To Credit And Personal Finances

Because credit scores have such a tremendous sway over future borrowing opportunities, you want to start prioritizing the good habits that result in good credit at a young age, and maintain those good habits throughout the ensuing years. If you miss a payment or forget to pay a bill one month, dont fall into a stupor of disappointment. Be proactive. Sometimes a polite phone call immediately placed to a lender can stave off a red flag. Be your own master of motivation. Tell yourself that you will achieve exceptional credit and then start making it happen. Contest inaccuracies, pay down loans in a timely manner, and make sure you have an updated understanding of your credit score and your credit range.

Don’t Miss: How To Check Credit Score Without Ssn

Is Credit Karma Accurate

Yes and no. The short, simple, and sweet answer to this is that the credit scores you see on Credit Karma come directly from TransUnion and Equifax, which are two of the three major consumer credit bureaus.

However, the third credit bureau, Experian, isnt reported. So if there is anything on your Experian account that isnt on the other two, there may be a discrepancy between your Credit Karma score and your actual score.

To get the most accurate information about your credit score, pull your credit reports before asking for lending.

Related: What Are Inquiries On My Credit Report?

Bad Or Poor Credit Score Ranges

A credit score represents âa snapshot of a personâs creditworthiness,â the Consumer Financial Protection Bureau says. And thatâs why the CFPB says potential lenders might use your credit score to make decisions about things like approving loans and extending credit.

Credit-scoring companies use different formulas, or models, to calculate credit scores. There are many different credit scores and scoring models. That means people have more than one score out there. Most range from 300 to 850, according to the CFPB. And the CFPB says some of the most commonly used credit scores come from FICO® and VantageScore®.

But how they determine scores and their definitions of what constitutes poor credit differ. Itâs important to remember that credit decisionsâand whatâs considered a bad scoreâare determined by potential lenders. But here are some more details about how FICO and VantageScore generally view credit scores.

Don’t Miss: 824 Credit Score

Being The Subject Of A County Court Judgement

As long as you repay money you owe on time, you should never have to worry about County Court Judgements. If you are issued one, pay the full amount within one month and get a certificate from the court to say youve paid off the debt, otherwise the CCJ could affect your credit rating for six years.

If youre worried theres been a mix-up and a CCJ has been added to your credit history in error, you can request to see a copy of your statutory credit report for free by visiting the Experian, Equifax or Callcredit sites.

For more on keeping track of your credit history, read our article How to check your credit score.

Something Fell Off Your Credit Report

Thankfully, missed payments and derogatory marks wont stay on your credit report forever. The greater the age of those marks on your credit score, the less impact they have, so you may see your score recover over time while your behavior is kept consistent.

Late payments over 30 days will remain on your credit report for 7 years, while derogatory marks like bankruptcy can remain on your report for up to 10 years. Over time your score will recover, and once these marks fall off your credit report, you may see an instant boost in score.

Recommended Reading: Cbna Bby Inquiry

What Is A Soft Inquiry

A soft inquiry happens whenever you check your credit report, or when a lender checks your credit report without your knowledge or permission.

Soft inquiries have no effect on your credit score. Lenders cant even see how many soft inquiries have been made on your credit report.

Here are some examples of a soft inquiry:

- Inquiries made by lenders to make you a pre-approved credit offer .

- Inquiries that come from employers.

- Checking your own .

- Inquiries made by a lender whom you already have an account with.