What Does Fico Rate Me On

FICO bases its current rating system on the following factors:

- Payment History

- Length of Credit History

- New Credit

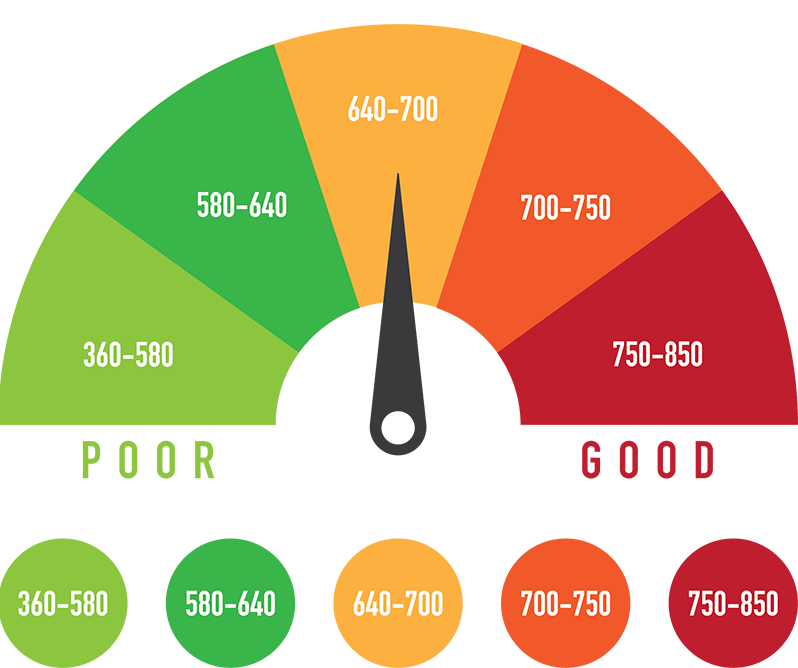

And, like other credit rating systems, you will want your score to be as high as possible.

A score that is considered poor would be a FICO score of 579 or below, while a FICO score that would be considered exceptional would be in the 800+ range.

Which Credit Score Matters Most: Fico Or Vantagescore

Your FICO score matters more. Lenders and creditors use FICO scores in 90% of lending decisions. That means if you decide to apply for a credit card or a loan of any kind, 9 times out of 10, that company will check your FICO score to see if youre creditworthy.

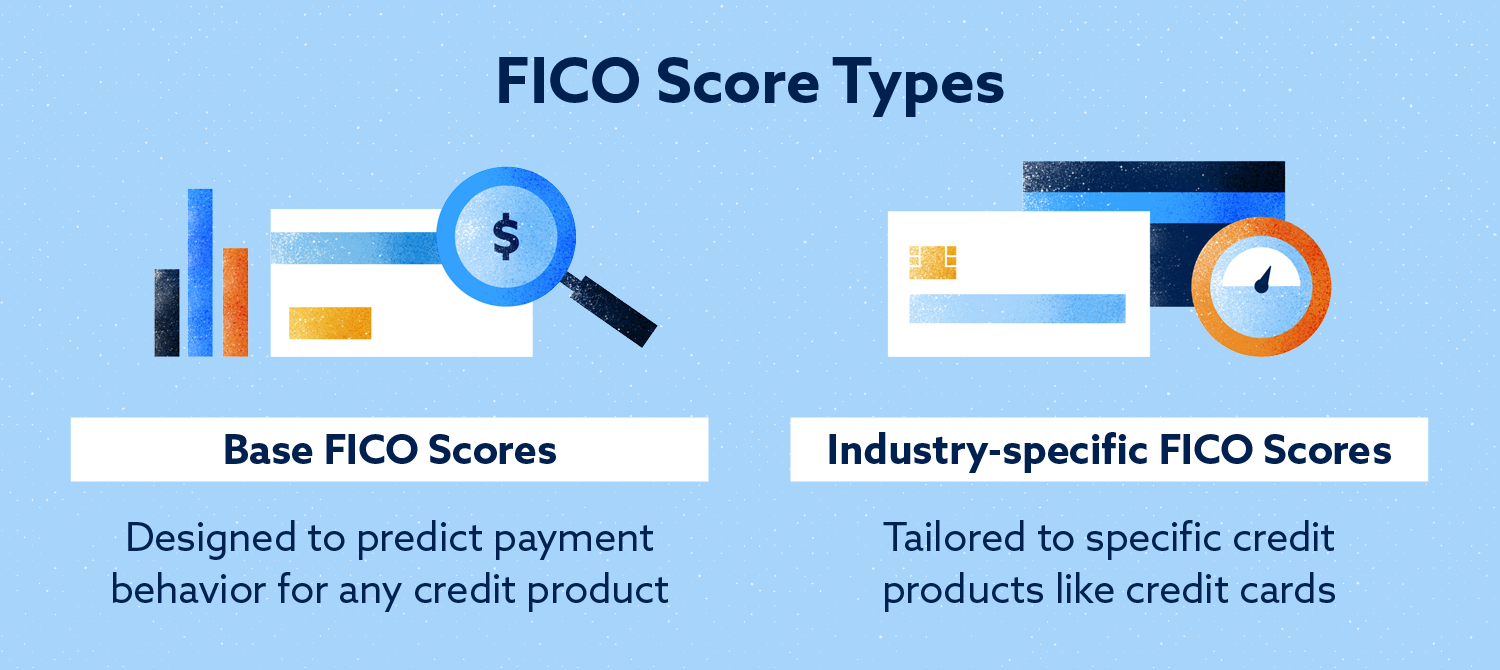

However, its important to know that there are multiple versions of your FICO credit score. There are industry-specific versions of your FICO score , and bureau-specific versions of your FICO score .

While your FICO score matters most, its also important to know which version your lender is using.

Fico Score Vs Credit Score: What Is The Difference

Recapping

In our FICO Score vs Credit Score article, well help you understand the differences between the two and how they are usedwhich will be extremely useful when tracking your credit score or why your credit card application was denied. What is the difference between credit score and FICO score is a question everyone asks when looking into their credit history.

Don’t Miss: What Information Is On A Credit Report

How Are Credit Scores Generated

When someone refers to a “credit score,” they’re generally referring to a three-digit rating that represents a borrower’s history of repaying loans and lines of credit. The credit score is generated by applying credit rating company’s algorithm like VantageScore® and FICO® to a borrower’s credit report.

Do You Need To Track All Of Your Credit Scores

Consumer credit behavior has changed over the years. In order to offer credit scores that are as accurate and competitive as possible, both FICO and VantageScore update their scoring systems from time to time. Releasing new credit score versions also gives FICO and VantageScore new products to sell and more ways to make money.

Yet just because FICO or VantageScore releases a new credit score doesnt mean that every lender will upgrade and use it. Instead, different lenders may use different credit score versions. The concept is similar to the idea that all PC owners dont automatically update their computer software when Microsoft introduces a new operating system.

Because there are so many credit scores on the market, tracking all of them would be virtually impossible. But you dont need to track all of your credit scores either. Its far better to keep tabs on the information that influences your credit scores. In other words, you need to review your credit reports. Clean credit reports should equal solid credit scores under any FICO or VantageScore brand scoring model.

Also Check: Is 608 A Good Credit Score

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Amounts Owed: 30 Percent

Thirty percent of your FICO® Score is based on the amounts you owe, also commonly referred to as. Its not a bad thing to have several credit accounts open at once, but owing too much money across various accounts could have a negative impact on your score.

As a rule of thumb, try to keep your credit utilization ratio under 30 percent. If you can, using as little as 10 percent of your credit line can be greatly beneficial to your score .

Read Also: Does Opensky Report To Credit Bureaus

Length Of Credit History: 15 Percent

The length of your credit history accounts for 15 percent of your FICO® Score and considers the age of your credit accounts, the activity level of these accounts and more. Note, FICO also factors in the average age of your accounts and the age of the oldest account you own.

Knowing this, its important to think twice before closing accountssuch as canceling a credit card you no longer find a use for. Keeping a semi-dormant credit card account open, for example, and making small purchases each month can strengthen your FICO®Score.

Why Should You Know The Differences

One difference between FICO score and credit score can affect your overall credit report. Scores may vary from one system to another. You might end up not knowing which score is better or worse for your potential loan. Scores can be significantly different with various credit bureaus, as well.

Its advisable, when you compare scores, to keep in mind that there are thousands of credit scores, and they all use different scoring models. Understanding which areas of your scores bring your overall score down will help you learn how to fix your credit score.

You May Like: Does Chime Report To Credit Bureaus

Difference Between Credit Score And Fico Score

Planning on buying a new house or a new car? If you are, then you should know the importance of a credit score or a FICO score. These are the scores that banks or lenders refer to in order to know if you qualify for a loan. However, if youre not too familiar with these scores, you came to the right place. Well lay down the important information about a credit score and a FICO score, as well the differences between the two.

| Numbers banks use to evaluate creditworthiness | Brand of credit score used by 90% of top lenders |

| Not all credit scores are FICO scores | All FICO scores are credit scores |

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

You May Like: Does Debt Consolidation Show Up On Credit Report

Length Of Credit History

This component of your credit score details the length of time your credit accounts have been active. Longer credit history is better since it shows your previous payment track record and consistency. However, this can be frustrating if youre just starting to build credit for the first time.

FICO looks at three key things in its calculation:

Although you cant turn back time and create a credit history earlier, you can strengthen this factor by keeping older accounts open and in good standing.

What Are Older Fico Models

FICO 8 and 9 arent the only versions in use. Some lenders and industries use older versions like FICO 2, 4, and 5. In fact, these are still used by the mortgage industry when assessing creditworthiness for new mortgages and deciding on interest rates.

FICO 2, 4, and 5 are very similar. The main differences between the three is that 2, 4,and 5 use data from Experian, TransUnion, and Equifax respectively. Mortgage lenders pull one of each and compile the reports in a document called a Residential Mortgage Credit Report. Duplicate data is screened and removed, and the middle score of the three is picked to represent your worthiness to pay back the mortgage.

FICO 8 and 9 use data from a single credit bureau, so using FICO 2, 4, and 5 together gives mortgage lenders a more complete view of your creditworthiness because they can see the history of every account youve opened. This is especially helpful for mortgage lenders as many creditors don’t report account history to all three credit bureaus.

You May Like: How Long Hard Inquiries Stay On Credit Report

Why Is There More Than One Fico Scoring Version

The first broad-based credit bureau scores were introduced by FICO more than 30 years ago, helping to expand access to credit in a trusted, responsible and objective manner. Needless to say, a lot has evolved since the FICO Scores were first introduced, from the role of consumer credit in this U.S. economy to evolving consumer credit practices and behaviors to enhanced modeling tools and new data.

Not to mention, different types of lenders base their decisions on varying degrees of the five factors that make up the common FICO® Score blueprint. What matters to a mortgage lender might not be as crucial to a credit card issuer, while a bank issuing you a car loan might be interested in some other aspects of your financial behavior.

This has resulted in multiple FICO scoring versions being supported in the market that address various lender and consumer needs. Each lender determines which FICO Score version it will use when evaluating a request for credit.

Very similar to an iPhone analogy where Apple releases a new version of iPhone, you may say, I need this, and those new features are really important to me, whereas I would say, I dont really need that, Im okay with my current version, explains Tom Quinn, vice president of Scores at FICO. So, Apple has multiple versions being used by consumers and being supported. Its a similar phenomenon with FICO Scores we have lenders using different versions of the score depending on their needs.

Why Do I Have Different Scores From Different Credit Bureaus

FICO and other credit bureaus all use different mathematical algorithms and criteria to determine their scores. In addition, not all lenders send reports to the same credit bureaus. If you pay a credit card bill late, and that credit card company only sends its report to one bureau, your score would be lowered on just that bureaus credit report.

You May Like: How Do You Check Your Business Credit Score

Does A Fico Credit Score Accurately Predict A Borrower’s Future Ability To Repay Debt

FICO did a study on how well its credit scores mirrored borrowers’ risks for defaulting on their debt, and according to an analysis for the Federal Reserve, it looks like its credit score does correlate with a borrower’s ability to repay debt in the future. It looked at the actual performance of borrowers between 2008 and 2010, relative to their credit scores and found this:

|

FICO® Score |

|---|

The Importance Of Different Credit Scoring Factors

The impact of a specific action on your credit scores will depend on your overall credit profile and the scoring model. However, FICO® and VantageScore only consider the information that’s in one of your credit reports when determining a score, and they generally place similar relative levels of importance on the same types of information.

The main factors that impact your score can be separated into several categories:

- Payment history. Whether you’ve made on-time payments, late payments, have accounts in collections, defaulted on debts or declared bankruptcy.

- . Your credit utilization rate, or the amount of available credit you’re currently using with your revolving credit accounts, such as credit cards. To a lesser extent, the amount you owe on installment loans is also important.

- Length of credit history. How much experience you have managing credit accounts.

- Types of accounts. Whether you have experience using and paying off different types of credit accounts.

- Recent activity. Whether you’ve recently applied for new accounts that led to hard inquiries.

Within each category, FICO® and VantageScore may take different approaches to how they use or weight specific pieces of information. Three examples are how the scores treat revolving account balances , collection accounts and hard inquiries.

Read Also: How To Remove Inquiries From Credit Report Fast

How To Get Your Credit Score

In the past, the only way to receive your credit score was by purchasing it from FICO or through one of the major credit bureaus. Now, there are a number of free apps and websites that allow you to see your credit score for free.

Most online bank sites have an option to view your credit score for free. You can also sign up for tools like CreditWise from Capital One or Experian, to keep track of your scores and see how to improve them.

When you visit some websites to get your free report, you will be offered the opportunity to purchase your credit score. This score is typically your VantageScore, but as most lenders use FICO, it may not be worth your money to pay for your score from that vendor.

There are also a lot of banks, lenders and credit card companies that offer free FICO scores to their customers through the FICO® Score Open Access Program. Over 200 financial institutions and 100 financial counseling agencies participate in this program.

To learn more about credit scores, check out our Understanding Your Credit Reports and Scores course. Or, if youre looking to improve your credit score, check out our service.

About The Author

Melinda Opperman is an exceptional educator who lives and breathes the creation and implementation of innovative ways to motivate and educate community members and students about financial literacy. Melinda joined credit.org in 2003 and has over two decades of experience in the industry.

Most Recent

Top 3 Reasons You Should Choose Fico Scores Over Non

“For years, there has been a lot of confusion among consumers over which credit scores matter. While there are many types of credit scores, FICO Scores matter the most because the majority of lenders use these scores to decide whether to approve loan applicants and at what interest rates.” The Wall Street Journal1

So why choose FICO Scores over other scores? Here are just a few reasons:

2.You can make more informed financial decisions. With FICO Scores, you’re better prepared to know when to apply for credit because you’re viewing the scores used by 90% of the top lenders.

Remember, non-FICO credit scores can differ by as much as 100 points. Other credit scores may vary from your FICO Score by several points. This variance could cause you to overestimate your likelihood of getting approved. According to a recent Consumers Union report, “score discrepancies can give consumers the false hope that they qualify for credit or low-interest rates when they do not. Consumers can face higher interest rates than expected, or be denied credit.”2

On the flip side, non-FICO credit scores can lead you to underestimate your creditworthiness, keeping you from purchasing a much-needed family car or refinancing a mortgage that could save you thousands in interest.

Don’t Miss: Does Credit Karma Lower Your Score

Fico Score Vs Credit Score What Is The Difference

FICO score or not, all measure your credit risk. A healthy score can open doors, help you purchase, sell, and do a lot of other things without spending a fortune on premiums. Beware of a poor credit score because it may make it difficult to access the finances you may need to fuel your dreams.

But not all credit scores are alike. Two major credit systems are used to determine creditworthiness VantageScore, and FICO. Well show you why it matters and how to calculate them.

If It Doesn’t Say Fico Score It’s Probably Not A Fico Score

“62% of consumers who received a non-FICO credit score mistakenly believed they received a FICO® Score.” BAV Consulting Survey3

There’s simply no substitute for FICO Scores. Remember, before the creation of FICO Scores there was no industry-standard to make sure access to credit was more fair and accurate. When you want to know where your credit stands, it just makes sense to get the scores your lenders will use.

A note of caution: some sites may try to sell a credit score and pass it off as a FICO Score. If it doesn’t clearly say FICO Score, it’s probably not a FICO Score.

Recommended Reading: Which Information Can Be Found On A Person’s Credit Report

What Is A Credit Rating

Your credit rating is your individual score on how trustworthy you will be for paying a lender back on a loan.

This rating is usually calculated on several factors based on your financial history.

Although the factors range between credit score providers, some of the major factors can include:

- Your credit history How long have you had lines of credit? In most cases, the longer you have had lines of credit, the better.

- Your payment history How often have you missed payments? And, if you miss payments, how much were the amounts? Or, are payments made on time and consistently? All of these factors generally go towards your credit rating.

- Public Records Have you declared bankruptcy? Do you have a history with collections? These factors can have an impact on your credit rating.

- Inquiries Any time your credit file is accessed, it is recorded. Now, this is not necessarily a bad thing. It usually only affects your credit score when you are applying for a new loan or line of credit.

Your overall score can range depending on which credit score system and rating you are using, however, in general, the higher the credit score, the better.

A higher credit score means that there is less risk associated with the borrower. And the lender can expect to have their loan repaid on time and with interest.