What Is A Chime Spending Account

A Chime Spending Account is similar to a traditional banking account but is an online bank account that has no monthly fees, foreign transaction fees, no minimum balance, and overdraft fees. You have access to over 60,000 fee-free ATMs at locations you already shop at such as CVS, 7-Eleven, and Walgreens.

Another benefit of the Chime Spending Account is that Chime will spot you up to $200 on debit card purchases with no overdraft fees when you sign up with SpotMe.

Instead of charging your overdraft fees as other banks do, Chimes SpotMe allows you to overdraft up to $200 with no fees as long as you monthly qualify for direct deposits of $200 or more.

This bank account is a great option if you have struggled with overdraft fees in the past or have a bad experience with ChexSystems and are having a hard time opening up a bank account because of those overdraft fees.

With the Chime Spending Account, you also get a Visa debit card that you can use anywhere Visa cards are accepting, set money aside with their automatic savings feature, and you can get paid up to 2 days earlier if you set up direct deposit.

What Is Chime Credit Builder Card

The Chime Credit Builder card is a secured credit card that makes building your credit simple and without the need to incur debt. Its especially useful for people with little or no credit history since you arent required to pass a credit check to qualify. Using it can help you build up your credit score relatively quickly with next to no effort or risk.

First Progress Platinum Prestige Mastercard Secured Credit Card Vs Chime Credit Builder Card

The First Progress Platinum Prestige Mastercard® Secured Credit Card might be a bit of a tongue twister to say, but the benefits of this card might just make it worth the mouthful.

The First Progress Platinum Prestige Mastercard Secured Credit Card, unlike the Chime Credit Builder Card, does have an annual fee.

The annual fee is $49 and allows cardholders to carry a balance sometimes instead of having to pay the card off at the end of every month.

The APR is only 9.9% variable which is considerably lower than other cards that allow cardholders to carry a balance.

The First Progress Platinum Prestige Mastercard has a fully refundable security deposit, but this deposit comes with an impressive credit limit of $200 to $2,000.

While the Chime Credit Builder Card has no fees and no security deposits, the only way a cardholder can get a credit limit of $2,000 is to have $2,000 in their Chime Secured Builder Account to fully secure the purchases made on the card.

Of the secured credit cards on the market, the First Progress Platinum Prestige Card has one of the lowest interest rates on purchases when cardholders think they will need to carry a balance.

Also Check: How To Get Public Record Off Credit Report

What Doesnt Chime Report On

Because Credit Builder is different than traditional credit cards, there are a few items Chime doesnt report on:

Chime Credit Card Builder Review

Is chime credit builder totally worth it? Yes, the Chime Credit Builder card is worth getting for anyone with bad or no credit. You can use the card anywhere Visa is accepted and there are no fees.

You will need to make a Chime Deposit when you open your account but that money will be applied towards your credit limit as well as help increase your credit score.

Do you have bad credit, no credit, or want to learn how to become a credit expert?

Signup for the #1 DIY Credit Repair Course

The Credit Repair Course includes:

- How to find your credit report and your ACTUAL Credit Score

- A breakdown of how your credit score is calculated

- How to increase your credit score in each category

- The best tools to increase your credit score fast

- How to dispute negative items from your credit report

- The best credit cards for your credit score

- How to use credit cards to leverage your money and business

- How to use credit cards to get free travel, bonuses and rewards

Learn how to fix your credit for life by enrolling in The Credit Repair Blueprint today!

You May Like: How To Get A Repossession Off Your Credit Report

How Fast Does Chime Credit Builder Work

How long does it take to move money between my Credit Builder secured account and Spending Account? Moving money between Chime Checking Account and Credit Builder takes ~60 seconds! Once the transfer is complete, your transaction history will reflect the change and your Available to Spend will update.

How Can I Apply For A Citi Prepaid Card

If youre looking for a prepaid card, you may want to consider applying for the Citi® Secured Mastercard® instead. Whether youre looking to establish, improve or rebuild your credit, the Citi® Secured Mastercard® can help you get there.

This card comes with no annual fee1. However, please note that a security deposit is required for this product . The security deposit is always equal to your credit limit. If you are approved and you deposit $200, your credit limit is $200.

Take the first step toward achieving your financial goals by applying for the Citi® Secured Mastercard®.

Recommended Reading: Why Is My Credit Karma Score Higher

Is There An Alternative To The Chime Credit Builder Card

Yes, the alternative to the Chime Credit Builder Card is the Self Credit Builder Visa Credit Card.

The Self Visa Credit Card is similar to the Chime Credit Builder Card as they offer a Credit Builder Account when you add your deposit into your Account and that money will be used for your Credit Card.

There is no credit check required to open an account but the Self Credit Card does have a credit limit. If you stay in good standing they will increase your credit limit.

Before you can apply for the Self Credit Card you do need to have a Self Credit Builder Loan which is designed to help someone with bad credit quickly increase their credit score.

1. How does chime credit builder work?

There are four steps to showcase how does chime credit builder work:1. Bad credit applicants are approved for a chime card within 365 days2. After setting up an account, use it for daily purchases like gas and groceries3. Each payment is reported to credit bureaus4. Lastly, it will increase your credit score and makes up 35% of your FICO credit score

2. Can I use my chime credit builder card at ATM?

Yes, you can use a chime credit builder card to carry out cash at any ATM but you wont pay any interest or money to ATM.

3. Does chime work with Zelle?

Yes, chime works with Zelle which means that you can use it to send money to your Chime account.

4. Is chime credit builder card a credit card

Does Credit Usage Impact Your Credit Score

Yes. Generally, the more you use credit, the lower your score will be. Its best to use credit sparingly and only when necessary .

Good use of credit, such as taking out $100 worth of credit, then paying the $100 back within a month, will increase your credit score. Using credit irresponsibly will decrease your credit score.

Read Also: What Credit Score Is Needed For Carecredit

How To Use Your Secured Card To Build Credit

Now that you understand how secured credit cards work, how do you handle one correctly? It only takes 3 easy steps:

- Pay on time. While it takes months to build your credit with good payment habits, one or two late payments can cause a big drop in your score. And not only is paying on time good for your credit, it keeps you from having to pay late fees and even losing your card.

- Pay in full. In fact, pay multiple times a month to keep your utilization ratio low because you dont know when your issuer will send your account information to the 3 major credit bureaus. This will also help you avoid interest charges.

- Place a small charge on the card. Dont forget to use the card each month. If you lose your card to inactivity, you cant build credit month by month. Put a recurring reminder on your calendar to ensure that you dont forget. Or better yet, place an auto debit for a small charge on your card.

Chime Credit Builder Review: Can The Service Really Improve Your Credit

Sarah SharkeySome of the links included in this article are from our advertisers. Read our Advertiser Disclosure.

A good credit history can open the door to better financing options for major purchases. Its possible to save thousands over the lifespan of a major loan, like a mortgage, if you have a good credit score.

If you want to increase your credit score, Chime Credit Builder could be the tool youve been searching for. It gives you the opportunity to build credit without annual fees, interest or a security deposit.

Our Chime Credit Builder review can help you determine if this secured credit card is the right solution for you.

Summary

The Chime Credit Builder Secured Visa Credit Card offers a twist on the traditional secured credit card. Its specialized features will help you build credit and unlock more attractive financing on major purchases.

Pros

- Reports to three major credit bureaus

Cons

- Must have a Chime Spending Account

- Must have a direct deposit of at least $200 to Chime

- No unsecured credit card options available

You May Like: Syncb Qvc

How To Sign Up For The Chime Credit Builder Card

You need to have a Chime Spending Account to open the Chime Credit Builder. You can apply for a Chime Spending Account in as little as 2 minutes and you can even complete the process on your smartphone. Youll start by entering your email. Youll need to provide identifying information that is a typical requirement for all financial accounts. That may include a copy of your drivers license and any other documentation needed to establish your identity.

Other information you should expect to provide includes the following:

- Your full name

- Your date of birth

- A valid Social Security number

Once your account is open, you can link it to your bank account, or even fund it with payroll deposits.

Once again, one of the major advantages of Chime is that they dont pull your credit report, nor do they run your name through ChexSystems. Its financial app is set up specifically to work with those who have either poor credit or no credit at all.

Once your Chime Spending Account is open, youll need a qualifying direct deposit of $200 or more within the previous 45 days.

Building Good Credit Habits

The Chime Credit Builder Card effectively automates many of the processes that go toward building good credit. This can be a great thing, but its also necessary to be aware of the dangers associated with automated credit management. Chime is assisting users through the difficult process of building credit. The danger, and the primary word of warning that well give, is that the Chime Credit Builder Card doesnt facilitate customers building these habits themselves.

So, while the Chime Credit Builder Card can be a fantastic tool for helping customers climb out of poor credit, they also need to be diligent in understanding how to keep this good credit going forward. Because, once they stop using the card, it all becomes more difficult.

Here are some habits we recommend to build and maintain good credit:

Recommended Reading: Does Applying For Paypal Credit Affect Credit Score

Myth #: Credit Bureaus Make Lending Decisions

A common misconception about credit bureaus is that they make lending decisions. But the truth is credit bureaus have no say in whether or not someones credit is approved or denied for a loan. Credit bureaus merely collect and arrange information about an individuals and give that information to lending institutions. The decision to deny or approve ultimately lies with the lender or creditor.

No Security Deposit Required

The Chime Credit Builder Card does not require a security deposit, but the card cannot be opened without a Chime Spending Account or Chime Savings Account.

The balance in these accounts can be transferred into the Chime Builder Secured Account and this account is what is used to fund the card purchases.

There is no minimum-security deposit on paper, but cardholders will only be able to spend on their card the amount that is secured by in their Chime Builder Secured Account.

Read Also: Remove Transunion Inquiries

Chime Credit Builder Visa Card Review

Alison Kimberly is a freelance content writer with a Sustainable MBA, uniquely qualified to help individuals and businesses achieve the triple bottom line of environmental, social, and financial profitability. She has been writing for various non-profit organizations for 15+ years. She is passionate about helping individuals achieve personal and financial freedom.

Steve Rogers has been a professional writer and editor for over 30 years, specializing in personal finance, investment, and the impact of political trends on financial markets and personal finances. His work has appeared in The International Herald Tribune, Foreign Affairs, and The Journal of Democracy, among many others. On rare occasions he has been known to throw a shield.

The Chime Credit Builder Visa® Card puts a new spin on the secured card, offering excellent value and low risk. It has no interest and no fees and theres no credit check, making it a low-cost way to build credit.

On the downside, you can only use the card if you have a Chime spending account.

Here is everything you need to know to decide if this is the right card for you.

What You Need To Know About The Chime Card

Lets take a look at some of the important factors of the Chime Credit Card.

- No annual fees or interest to worry about. That means theres no APR either

- No minimum security deposit you can choose the maximum credit limit for the credit card

- Live support 24/7 for card users

- Its a Visa card and can be used anywhere Visa is accepted. This includes everyday purchases for things like groceries or gas

- Includes an auto-pay feature called Safer Credit Building. When you turn this feature on, your monthly balance will be paid automatically on time, every time

- Chime reports on-time payments to all three big credit bureaus: Equifax, TransUnion, and Experian

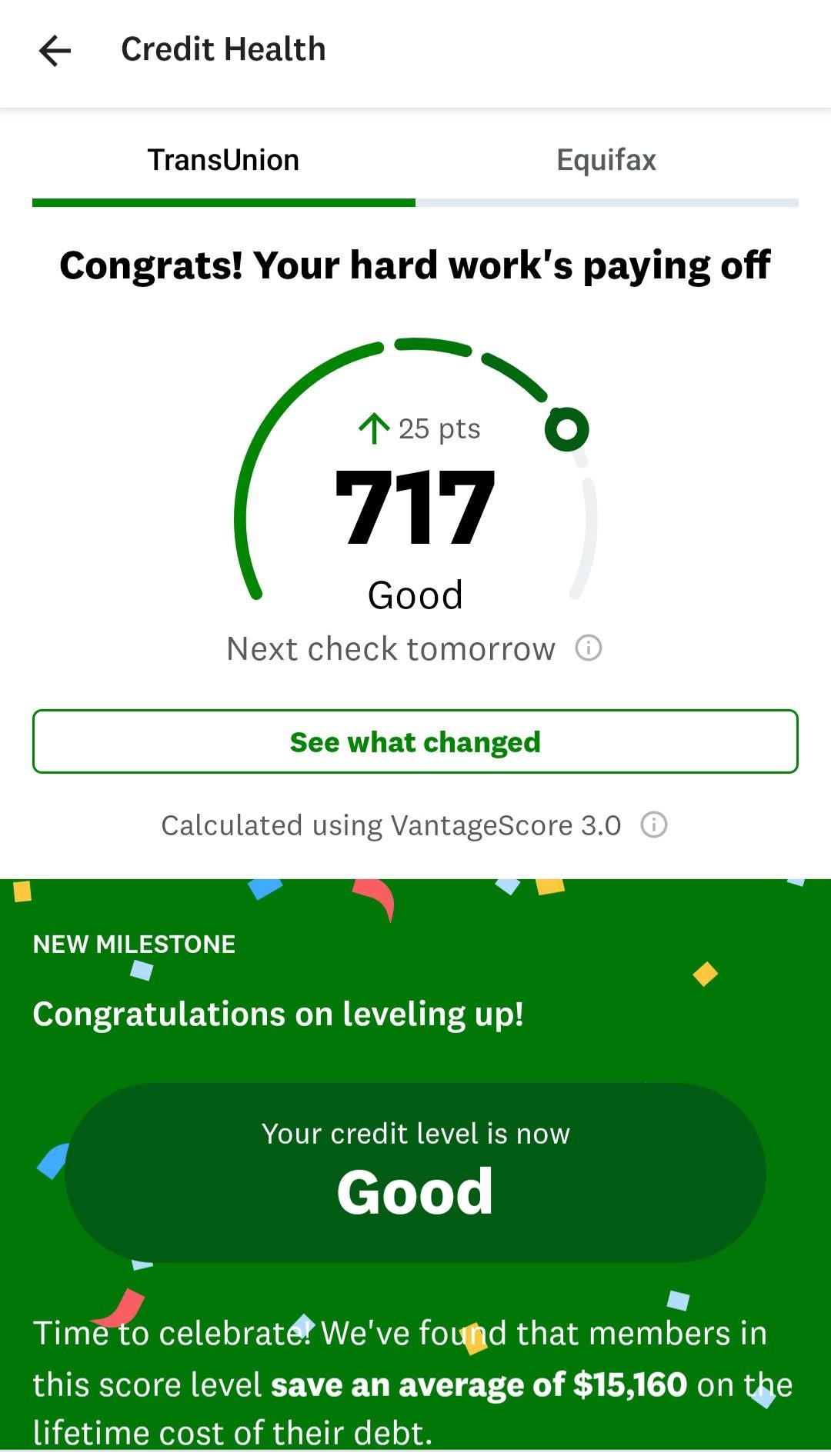

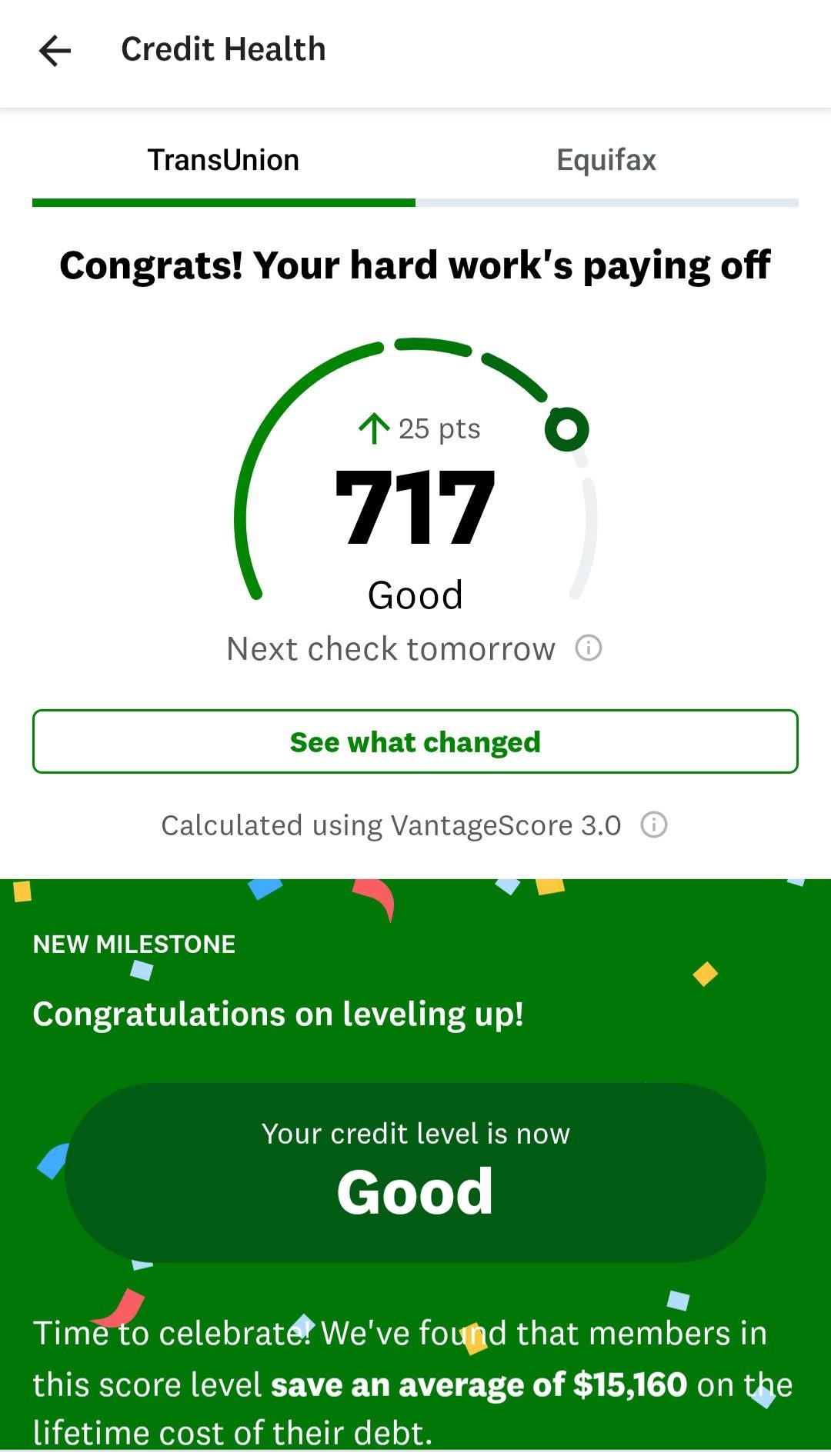

- You can theoretically increase your credit score by up to 30 points over several months so long as you make on-time and regular payments

- Includes access to an app from Chime. The app allows you to disable your card remotely to prevent people from using it without your permission. You can also turn on transaction notifications and receive real-time alerts for each time the card is utilized

- You can apply at www.chime.com

- No credit score is needed to qualify, although you will be more qualified if your credit is between 300 and 689

- Prequalification is available

- No credit check, so you dont need to worry about your credit score being negatively impacted by a hard inquiry

Don’t Miss: Syncb Ppc Account

Its Not A Typical Secured Credit Card

Secured credit cards usually require a minimum deposit of a few hundred dollars to open an account. The deposit becomes the cards credit limit that the cardholder uses to make purchases. Secured deposits arent accessible to the cardholder until the entire balance is paid off and the account is closed.

Chime is different. Cardholders dont have to make a minimum security deposit to open an account. They can transfer money into their secured account at any time. Each transfer becomes part of the spending limit for the month. At the end of the billing cycle, the money transferred is used to cover all the purchases. Cardholders can budget and keep track of how much they spend, but it can get out of control if the cardholder frequently transfers money over to make up for large purchases.

Chime Credit Builder Card* Vs First Progress Platinum Prestige Mastercard Secured Credit Card

The First Progress Platinum Prestige Mastercard® Secured Credit Card has one of the lowest APRs youll find on any card, secured or unsecured. It offers an ongoing 10.74% variable APR, but it also comes with an annual fee of $49. If you think you might need to carry a balance occasionally while you work on building up your credit, this card could be a better option than a card with no annual fee and a higher interest rate.

Don’t Miss: Check My Credit Score With Itin Number

How To Build Your Credit Score Using Chime

To build your credit score using Chime, first create a one-time payment on the card by providing debit or credit card information. Then make more payments or purchases with Chime.

Once you’ve spent at least $500 for four months on the card consecutively, your one-time payment will turn into a revolving line of credit. If you’re still using cash and checking accounts, it’s probably because you don’t want to deal with banks.

And that makes sense: Banks require a lot of personal information and charge fees even for mediocre products. You can avoid this hassle by signing up with Chime and getting a free card without worrying about annual fees or interest rates.

Chime keeps things simple by only providing you with a free card without a credit score check or application fee. All your purchases are digitally charged to your bank account, which means they won’t appear on your credit report until you make payments.

This means Chime will not affect your credit score. Authorized users’ payment activity will continue to be reported to the primary cardmember’s credit report.

Everything you need to know about your credit score can be found on Credit Sesame, including your current credit score, how it is calculated, and why they are important.