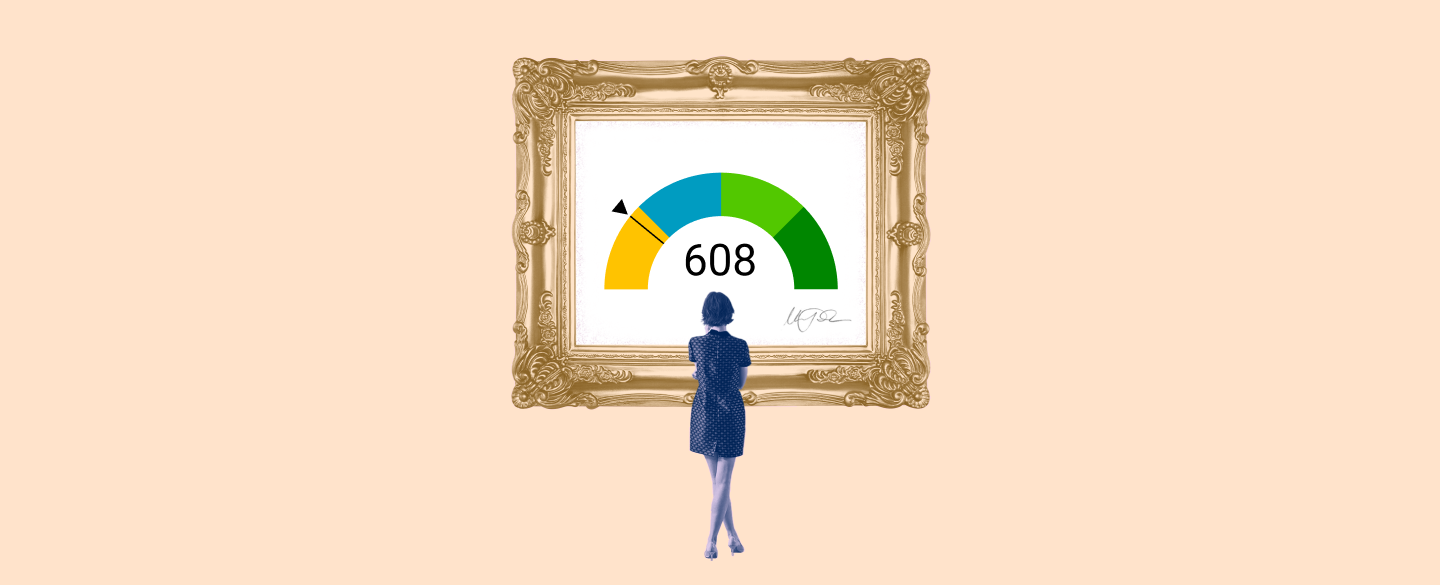

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Consider Bringing Your Own Financing

While dealerships do provide financing, checking with your local bank or credit union is a good idea, too. You can even compare car loan rates online. Compare quotes from the top potential lenders and, once youve settled on your top choice, you can get preapproved to make the process run smoothly,

Keep in mind that getting financing results in a hard pull on your credit. It helps to cluster applications closely together when rate-shopping for a loan.

If you end up with a loan with a higher rate than you wanted, keep an eye on your scores. You may be able to refinance your auto loan at a lower rate after youve made on-time payments for six to 12 months.

You May Like: What Should Your Credit Score Be To Buy A Car

Best For People Without Credit History

Who’s this for? Sometimes, a potential borrower may have a low credit score because they have extremely limited credit activity. Other times, a lack of credit history may result in them having no credit score at all. Because of this, Upstart accepts applicants with no credit history though this lender also looks at applicants with a FICO score of 600 or higher. Just keep in mind that if you are approved for the loan with a lower credit score, you may be subject to a higher interest rate.

You can apply for loan amounts as low as $1,000 and as much as $50,000. And while there are no penalties for paying off your balance early, Upstart does charge an origination fee and late fees .

When it comes to repaying the balance, loan terms range from 36 to 60 months, which can be appealing to borrowers who think they may need a longer time horizon to repay the entire loan.

Getting A Credit Account With A 608 Credit Score

With a credit score of 608, youll be able to get a credit card, but you might not have a lot of options other than subprime credit cards, and you wont be able to get rates as good as those offered to people in higher credit score ranges.

The types of credit cards you can get with a credit score of 608 generally fall into two categories:

- Secured credit cards: With these cards, creditors mitigate their risk by requiring you to pay a security deposit, which theyll keep if you default on your debt.

- Unsecured cards with high interest rates: With these, creditors compensate for the lack of a security deposit by charging very high interest rates and additional fees .

Given the choice between those two options, a secured credit card is always your best bet if your main goal is to build your credit. Unsecured subprime credit cards can be dangerous because their high interest rates and fees might jeopardize your finances.

Dont apply for a credit card if you know your credit score doesnt meet the companys requirements. Most applications will trigger a hard inquiry, which will cause your score to temporarily drop. To find out if the card issuer has a minimum credit score, check their website or give them a call.

Takeaway: A 608 credit score is below average, but its not far off from a good credit score.

Additional Credit Scores

You May Like: How To Get Your Free Credit Report

What Credit Score Is Needed To Buy A House

You dont need perfect credit to buy a house. In fact, you might not even need good credit.

The minimum credit score to get a mortgage is 580, which is considered only fair. And with a score of 620 or above, you have access to most home loan programs.

But mortgage lenders will look beyond your credit score.

They also look at your credit report, debts, and down payment. The stronger you are in these areas, the more likely you are to qualify with a lower credit score.

In this article

What’s So Good About A Good Credit Score

A credit score in the good range may reflect a relatively short credit history marked by good credit management. It may also characterize a longer credit history with a few mistakes along the way, such as occasional late or missed payments, or a tendency toward relatively high credit usage rates.

Late payments appear in the credit reports of 29% of people with FICO® Scores of 708.

Lenders see people with scores like yours as solid business prospects. Most lenders are willing to extend credit to borrowers with credit scores in the good range, although they may not offer their very best interest rates, and card issuers may not offer you their most compelling rewards and loyalty bonuses.

Recommended Reading: What Is A Perfect Credit Score 2020

A 608 Credit Score Can Be A Sign Of Past Credit Difficulties Or A Lack Of Credit History Whether Youre Looking For A Personal Loan A Mortgage Or A Credit Card Credit Scores In This Range Can Make It Challenging To Get Approved For Unsecured Credit Which Doesnt Require Collateral Or A Security Deposit

| Percentage of generation with 300639 credit scores |

|---|

| Generation |

| 27.3% |

Poor score range identified based on 2021 Credit Karma data.

Your credit scores are numbers calculated by credit bureaus, like FICO and VantageScore. Lenders use scores as at-a-glance information to help decide how risky they think you might be to lend to.

If your credit history includes signs of past credit challenges, such as late or discharged payments or accounts in collections, or little to no credit at all, you may find it more difficult to be approved for new credit. And if you are approved, you may find that approval comes with high rates and fees.

Building your credit scores can help. That said, theres no specific credit score that will guarantee approval or better terms or offers. Not only do you have multiple credit scores that are calculated using data from several possible , but its not always clear which score a lender might choose to check or what its criteria might be for approval.

We recommend thinking of your credit scores as a gauge to help you understand what lenders see when they check your credit. Understanding the factors that go into your scores can help you learn which ones to focus on to improve your overall credit picture in lenders eyes.

Heres what you need to know about building your credit and how to navigate credit applications in the meantime.

| 7.3 |

Ranges identified based on 2021 Credit Karma data.

Tips To Get A Perfect Credit Score

The first thing to keep in mind is that obtaining a perfect credit score takes time.

Its rather easy to remove negative items from your credit report and get a better score, but a perfect score is another story.

Now, assuming you dont have any negative items on your credit report like late payments or a collections account, lets get into the more advanced credit behavior youll need to learn and put into practice.

Keep in mind that all of the steps outlined below are based on my personal experience, not random advice Ive read on the internet.

Also Check: How Can You Remove A Collection From Your Credit Report

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Build Your Credit Before Car Shopping

If you still arent getting car loan rates that work for you, it might be time to delay your car purchase and work on building your credit. That means:

-

Paying bills on time. A payment that goes 30 days past due can devastate your score, so pay at least the minimum on time.

-

Keeping credit card balances low compared to your credit limits. How much of your limits you’re using is called your credit utilization, and it has a big effect on your score. You can try a number of tactics to lower your credit utilization in order to bump up your score.

-

Avoiding applications for other credit within six months of applying for a car loan.

-

Keeping credit card accounts open unless there’s a compelling reason to close them. Closing cards reduces your overall credit limit, which can hurt your credit utilization.

Also Check: What Is An Inquiry On My Credit Report

Regularly Read Your Reports

Since your credit score is based off of the information in your credit report, take time to review your reports regularly. You want to be sure everything is an accurate, true reflection of your financial story. As you become more comfortable reading and understanding the data in your report, the easier it is to identify which information is potentially causing changes in your credit score.

To help you understand your credit report, weve created an interactive guide that breaks down each section and explains how the information may impact your credit score.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located .

A 698 Credit Score Is Generally A Fair Score While A Lot Of People Have Fair Scores You May Still Find It Difficult To Get Approved For Credit Without High Fees And Interest Rates With A Score In This Range

| Percentage of generation with 640699 credit scores |

|---|

| Generation |

| 16.1% |

Fair score range identified based on 2021 Credit Karma data.

Fair credit does open the door to some possibilities. With fair credit scores, you might qualify for loans with better terms than you would if you were building credit from scratch. You may also be approved for an unsecured credit card with decent interest rates and fees and maybe even some modest rewards and cash back.

To understand what fair credit means, its helpful to first understand exactly what a credit score is. A credit score is a three-digit number that gives potential lenders a sense of your credit health. In other words, it helps lenders understand how likely you are to pay back money if they decide to lend to you. Credit scores arent the be-all, end-all of lending decisions, but they can be an important aspect.

Of course, it gets a bit trickier from there.

You can have many different credit scores based on different credit-scoring models created by companies like FICO and VantageScore. These models might weigh certain aspects of your credit history differently, so one of your credit scores may end up different from another. And even if the scores are calculated using exactly the same factors and weighting, the information in them may be different, since credit-scoring models may rely on data from different credit bureaus.

Lets explore a bit more about what it means to have fair credit, and where you can go from here.

Don’t Miss: How To Remove Charge Off Credit Report

Credit Score Car Loan Options

You should be able to get a car loan with a 608 credit score without a problem. Truthfully, people can get a car loan with almost any credit scorethe difference will be what kind of interest rate you can secure.

A score of 608 may get you an interest rate of between 11.92 percent and 4.68 percent on a new car loan. In comparison, if you can improve your credit score by a few points and move up to the good credit score range, your interest rate can potentially decrease by a decent amount.

If youre having difficulties getting approved for an auto loan with a 608 credit score, your best alternatives are:

- Find a cosigner

- Save up a large down payment

- Find a lender that specializes in lending to individuals with bad credit scores

Could Inaccurate Credit Information Be Hurting Your Score

The average credit score for Americans is 703 according to Experian, one of the three major credit bureaus. Experian contributes data to compile your FICO credit score.

On the credit score range, 703 is considered a good score. But its not good enough to have a full selection of loan choices when you need to borrow.

Your good credit could use some fine-tuning if you want a higher credit score.

So lets say youve already built a good credit mix, a good payment history, and an established length of credit history as I described above.

If this is true, you may be wondering whats holding you back from achieving a different credit score?

Also Check: Does Optimum Report To Credit Bureaus

Bring Documents Showing Financial Stability

If your credit score is low, potential lenders are less likely to see you as a risk if they can see you have stability in other areas of your financial life. Bringing documentation like your most recent pay stubs and proof of address to show lenders how long you have lived at your current address and worked at your employer could help you seem more reliable.

Have At Least Three Credit Cards But Only Use One

This first step comes completely from my own experience after experimenting with different techniques.

To optimize your credit score, it works best to have no more and no less than three major credit cards.

These cards should have long, good payment histories, and low credit utilization .

Its best to use only one of these cards on a regular basis and simply keep the other two cards with a $0 balance.

Its not that you cant ever use the other two cards, but generally, I like to keep their balances at zero. This technique will maximize your credit score.

Read Also: How Long Does It Take To Get A Credit Score

Check Your Credit Reports To Understand Your Scores

Its a good idea to check your credit reports periodically to make sure there arent any errors or mistakes that could be affecting your scores. Its also important to check your reports so you can spot any potential signs of identity theft.

If you do spot any inaccuracies, you can dispute them directly with the credit bureaus. Credit Karma even lets you dispute errors on your TransUnion report directly with our Direct Dispute feature.

Steering Clear Of Bankruptcy

Bankruptcy is a highly feared word in the world of finances. Its something that we all hope we will never have to endure the mere thought or possibility of it is enough to make us quiver in fear.

Bankruptcy is definitely not something that should be underestimated. It will be one of the biggest blows not only to your finances, but to your state of mind and well-being as well. Plain and simple, a bankruptcy is something that you want to avoid at all costs. And as you may have guessed, a bankruptcy is not going to look good on your credit report .

But while it is universally acknowledged that bankruptcy is something that you should try to avoid at all costs, there are still many mistaken beliefs that surround how to avoid it, too. A bankruptcy will immediately lead to a huge drop in your credit rating and will be visible on your report for over ten years at least. This means that if your credit score has already fallen thanks to late/missed payments or defaults, with a bankruptcy, things arent exactly going to look so sunny.

What if you are forced to file for bankruptcy? Is it still possible to rebuild your credit?

Yes, it still is. Even though your bankruptcy will be listed on your report for ten years, you can still slowly but steadily rebuild your credit by paying each of your bills when you need to. In this scenario, however, its vitally important that you repay each of those bills without exception.

You May Like: Does A Credit Report Show Credit Score