How To Get A Credit Report

The Fair Credit Reporting Act requires Experian, Equifax and TransUnion to provide you a free copy of your credit report once, every 12 months.

There is a charge for credit scores, but the credit report is free.

To get a free credit report, go online to www.annualcreditreport.com or call 1-877-322-8228 and request it. This is the only website authorized to fill orders for free credit reports. Once there, each agency must supply you one credit report every 12 months. You could receive all three reports at once, or spread them out over 12 months depending on the purpose you have.

If you want to examine the three together and compare all the information contained in each report to be sure its accurate , you should request all three at the same time.

Since the information on all three should essentially be the same, you may want to ask for one report every four months and verify each time that the information remains accurate.

If you already received a free report from each of the bureaus and want to check your credit report again, you can contact any of the three reporting agencies and order one for a small charge, usually under $10.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

Don’t Miss: Report Death To Credit Bureaus

Will Unpaid Taxes Affect My Credit Score

Yes! As we mentioned above, filing your income taxes late, or owing a little bit likely wont be cause for the CRA to report you to the credit bureaus, assuming of course that youve worked out a payment plan with them. However, owing a large amount can definitely ruin your credit when the CRA takes you to court and your tax debt is made a matter of public record. In fact, if your debt is too large, you might even end up having to file for a consumer proposal or bankruptcy, which will, in turn, damage your credit score significantly for up to 7 years.

To find out how a consumer proposal will affect your credit, .

Inquiries Made By Other Organizations

When a bank or lender reviews your credit report because youve submitted an application with them, its known as a hard inquiry. Hard inquiries will cause your credit score to drop slightly and will show up on your credit report for 3-6 years. This means that if you submit too many credit or loan applications all within a short period of time, your score could drop significantly. Multiple hard inquiries can also make potential lenders suspicious of your financial stability, as applying for too much credit is not a financially responsible thing to do.

Soft inquiries, on the other hand, can happen if you give permission to a potential employer during a job application, or when credit card companies wish to send you promotional offers. In fact, when you yourself request a copy of your credit report, its also known as a soft inquiry. However, soft inquiries have no effect on your credit score.

Also Check: Does Affirm Hurt Your Credit

What Does A Credit Score Mean

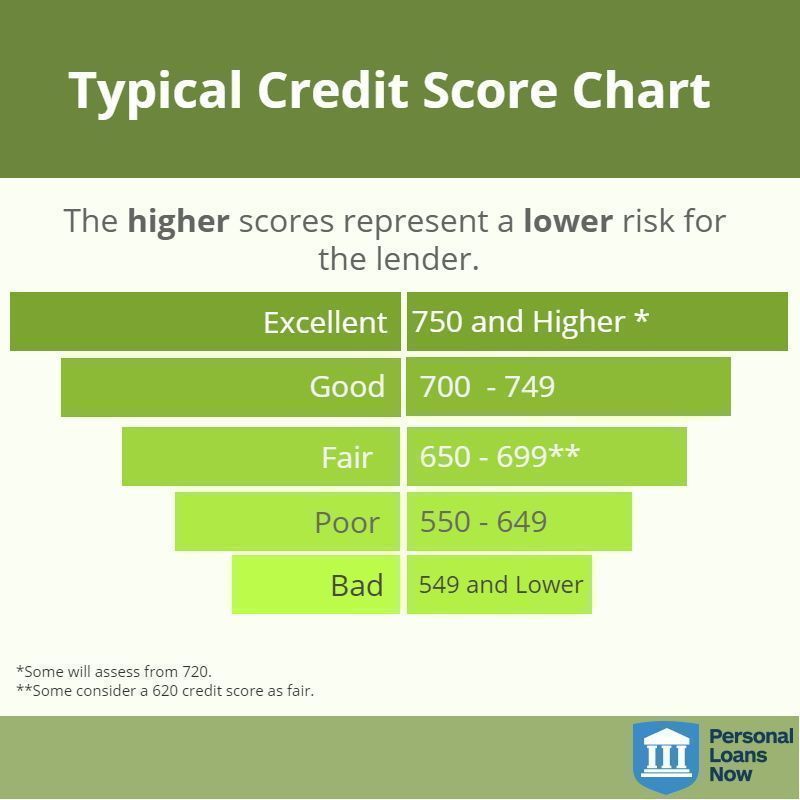

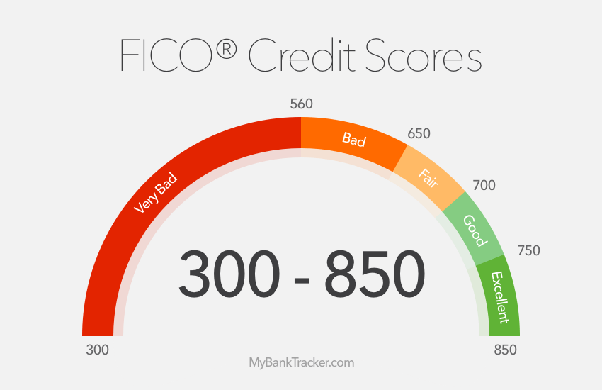

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

Dispute Errors On Your Credit Report

If your credit report has wrong information, you can dispute the error so that it is fixed. Here is how to dispute an error:

First, write a letter to the credit reporting companies that have the wrong information to ask them to fix the information. Include all of the following:

- Your name and address

- The specific information in your credit report that is wrong

- Why that information is wrong

- Copies of any receipts, emails, or other documents that support why the information is wrong and

- Ask that the information be deleted or corrected.

You may use the Federal Trade Commissions sample dispute letter to credit reporting companies and attach a copy of your credit report with the wrong items circled. Send the letter by certified mail or priority with tracking, and keep a copy of the letter and receipt.

If you cannot get the disputed information corrected or deleted, you may ask the credit reporting companies to add a statement noting your dispute in your file and in future credit reports.

Recommended Reading: Navy Federal Auto Loan Rates By Credit Score

How To Read Credit Report Codes

Youll find a variety of different codes on your credit reports. Each major credit bureau has its own codes though, so dont assume a code used by one bureau means the same thing on another bureaus report.

Each bureau offers a guide explaining the codes youll see on that particular bureaus report. Heres where you can access those guides.

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Recommended Reading: How To Unlock My Transunion Credit Report

Also Check: What Does Syncb Ppc Stand For

You May Still Have Credit Reports

A lack of a score doesn’t always mean you have a complete lack of credit history. Equifax, Experian, and TransUnion each track things a bit differently, but one or all could have data on you. It’s also possible that your credit report will show activity that’s too old to be counted in a or too recent to show up. Scores generally only count the past two years in their scoring model.

Will Credit Karma Work If I Have No Credit

4.5/5Youâvegethave no credit

Hereof, can I use credit karma if I have no credit?

Youâve just signed up for to get your free scores, but thereâs one problem: You have no credit scores. Because your scores are based on information in your reports, your reports might not contain enough history for the bureaus to score.

Similarly, can you get a mortgage with no credit history? Borrowers without a strong often use FHA mortgages, backed by the Federal Housing Administration. FHA loans allow lenders to use nontraditional histories to qualify borrowers. Successful applicants must be able to show at least one year of: No delinquency on rental payments.

Similarly, it is asked, what is your credit score if you have no credit?

No credit, on the other hand, means you havenât had any recent activity that the bureaus can use to generate a . No one actually has a of zero, even if they have a troubled history with . The FICO scoring model, for instance, ranges between 300 and 850.

Why do I not have a credit score?

In a nutshell: If you donât have a credit score, itâs usually for one of two reasons: 1) you donât have a credit history or 2) your history is too old. reference agencies donât usually disclose under 18âs reports, either. accounts include current accounts, cards and loans.

So read on and find out the best credit cards to get if you donât have any credit.

Recommended Reading: How To Get Credit Report With Itin

How Many Points Will A Hard Inquiry Cost You

According to FICO, one new inquiry will generally lower a credit score by less than five points. As that inquiry grows older, the impact on your score should be less until it no longer counts at all. Of course, the real credit scoring process is a bit more complicated when you break it down.

Hard credit inquiries dont count toward your credit score calculation nearly as much as other factors. With FICO scoring models, for example, credit inquiries influence 10% of your credit score. By comparison, your payment history is worth 35% of your FICO Score. Hard inquiries matter even less under VantageScore credit scoring models. VantageScore calculates just 5% of your score based on hard inquiries.

Individual credit inquiries dont have a specific point value across the board. For example, you cant say that a new hard inquiry will lower your credit score five points. Thats not how credit scoring works.

Instead, a credit scoring model considers the total number of inquiries that appear on your credit report along with the age of those inquiries. The rest of your credit information matters too. A new hard inquiry might have a bigger score impact for people with little credit history versus those with older, more established credit reports.

States That Ban Credit Checks For Employment

Several states have passed laws restricting when employers can pull your credit report.

For instance, in Colorado, employers are generally prohibited from checking your credit unless youre applying to be a police officer or for a job at a financial institution.

The following 11 states either restrict or ban employment credit checks:

- California

- Vermont

- Washington

Cities like Chicago, New York City, and Philadelphia have also passed laws to limit employer credit checks.

Contact your states Department of Labor if youre unsure if your prospective employer can run your credit in your area.

You May Like: Removing Repossession From Credit Report

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

How Can A Credit Report Help Over Time

Good credit can set you up for other financial successes. For example, you may be more likely to receive a loan or you may qualify for a lower interest rate, which can save you money in the long run. A clean credit reportand its positive effect on your credit scorecan make it easier to get rewards credit cards, which offer perks, such as travel deals or cash back. And you may qualify for higher credit limits on your cards.

Don’t Miss: How To Get Credit Report Without Ssn

About Consumer Protection Bc

We are responsible for regulating specific industries and certain consumer transactions in British Columbia. If your concern is captured under the laws we enforce, we will use the tools at our disposal to assist you. If we cant help you directly, we will be happy to provide you with as much information as possible. Depending on your concern, another organization may be the ones to speak to other times, court or legal assistance may be the best option. Explore our website at www.consumerprotectionbc.ca.

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Read Also: Credit Score For Comenity Bank

Best For Single Bureau Access: Credit Sesame

In addition to your TransUnion credit report information, youll also have access to your TransUnion credit score online or through the Credit Sesame mobile app. Reviewing your information often gives you an idea of where your credit stands and whether you need to improve your score. Credit Sesame analyzes your credit information to make recommendations for credit cards, loans, and other financial products, but you dont have to apply if youre not on the market for a new loan.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Read Also: What Company Is Syncb Ppc

Read Also: Aargon Agency Scam

What’s A Credit Score

The first thing to understand is that credit reports and credit scores are totally different products.

Credit scores are an interpretation of that data in your credit reports that creditors use to gauge your creditworthiness.The higher your credit score, the better access you have to desirable financial products, like and low-rate loans. Credit reports do not typically include credit scores. However, Experian adds a credit score to reports that are mailed to consumers.

Because credit scores are calculated from the data in credit reports, a mistake there could be reflected in a lower-than-deserved score.

How A Credit Score Is Calculated

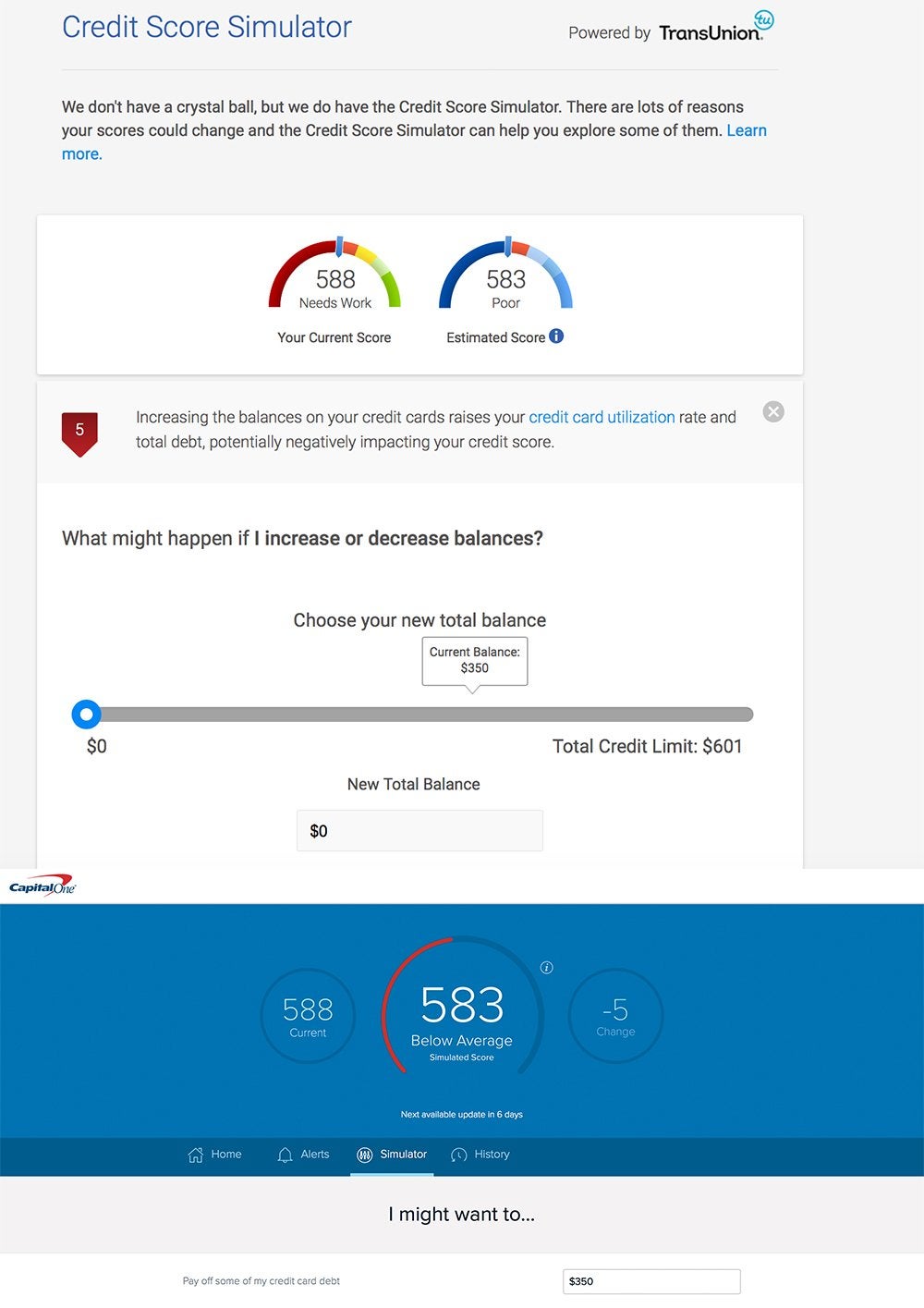

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Read Also: How To Check Credit Score Without Ssn

How Do You Obtain A Credit Report

You might be able to get your credit report for free from your financial institution or credit card issuer, or you may have to pay to get it. Also, your credit report must be given to you free of charge once a year by each of the major credit bureaus if you ask for it. Its important to check your reports from all three bureaus because they may contain slightly different information. Thats three opportunities a year to make sure the information kept on you and your credit is accurateand to ensure that no one is fraudulently opening accounts in your name.

Youre also entitled to a free report if you apply for a credit card or loan and are declined.