Review Your Credit Report

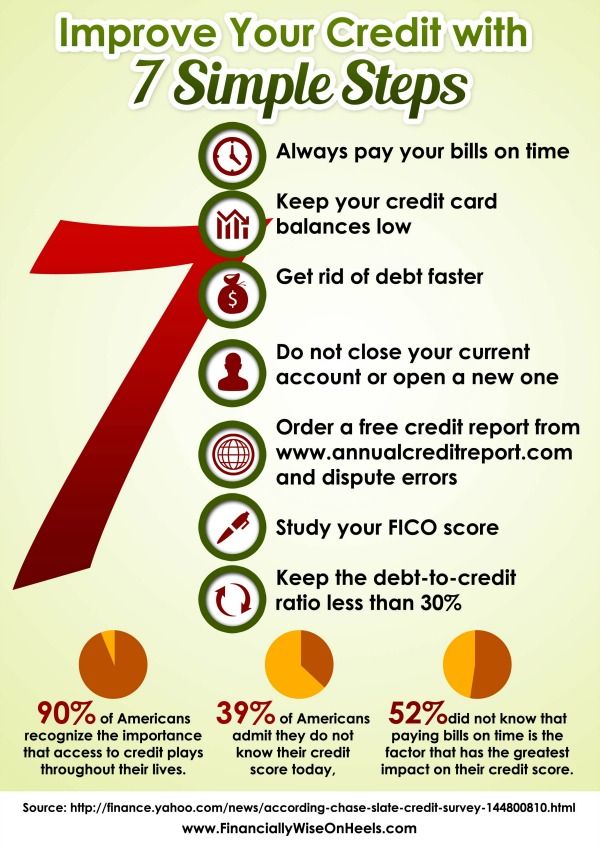

You are entitled to one free a year from each of the three reporting agencies and requesting one has no impact on your credit score. Review each report closely. Dispute any errors that you find. This is the closest you can get to a quick credit fix.

A government study found that 26% of consumers have at least one potentially material error. Some are simple mistakes like a misspelled name, address, or accounts belonging to someone else with the same name. Other errors are costlier, such as accounts that incorrectly are reported late or delinquent debts listed twice closed accounts that are reported as still open accounts with an incorrect balance or credit limit.

Notifying the credit reporting agency of wrong or outdated information will improve your score as soon as the false information is removed. About 20% of consumers who identified mistakes saw their credit score increase.

How To Raise Your Credit Score By 100 Points In 45 Days

Insurance carriers use credit scores as part of their calculations to determine the level of risk you would pose to them as an insured. They have found a direct correlation between credit scores and claim activity. Knowing that, it’s important to keep your credit scores in good shape so that your insurance premiums stay in line.

Clever Ways To Improve Your Credit Score Fast

Playful girl biting credit card, thinking of doing online shopping, standing over yellow background

getty

Your credit score is a critical piece of your financial life.

If you want a good rewards credit card, youll need a good credit score. If you want to get a low mortgage interest rate, youll need a good credit score.

There are also other non-obvious places where a good credit score can help – like when you want to get a new cell phone or when youre getting car insurance.

Building credit can be a long process where good behavior helps increase your score gradually. Achieving good credit can take years but there are a few steps you can take to give your score a boost.

These wont work for everyone because many solve specific problems but review the list to see if you can take advantage of any of these ideas.

You May Like: Affirm Credit Score Approval

Get Credit For Rent And Utility Payments

Rent reporting services can add your on-time rent payments to your credit reports. Rent payments are not considered by every scoring model VantageScores include them but FICO 8 does not, for example. Even so, if a would-be creditor looks at your reports, rent records will be there, and a long record of consistent payments can only help.

Experian Boost also can help, but in a more limited way. You link bank accounts to the free Boost service, which then scans for payments to streaming services and phone and utility bills. You choose which payments you want added to your Experian credit report. If a creditor pulls your FICO 8 using Experian data, you get the benefit of that additional payment history.

Impact: Varies.

Time commitment: Low. After initial setup, no additional time is needed.

How fast it could work: Boost works instantly rent reporting varies, with some services offering an instant “lookback” of the past two years of payments. Without that, it could take some months to build a record of on-time payments.

Here Are Top Rules That Will Help You Stay Away From Debt Traps

A credit card comes in handy in various emergency situations. Moreover, it offers several benefits and discounts to the card holder. However, you should be careful and when it comes to using the credit card as there is a high possibility you will over use it. Here are some easy steps that will help you keep aways debts.

23 May 2018

You May Like: Which Business Credit Cards Do Not Report Personal Credit

Decrease Your Interest Rates

If youre stuck dealing with bad credit, of course, telling you to pay down your debt is likely quite redundant. Many people would happily pay down their debt if they could they simply cant afford to do so. One way to make repaying your debt more affordable is to lower your interest rates, thus decreasing your monthly payment as well as the amount of time it takes to pay off your debt.

While this can mean negotiating with creditors directly to secure a lower rate and/or negotiate a payment plan, you may be able to consolidate at a lower rate, instead. This involves taking out a personal loan with a lower APR, then using the loan to pay off your high-interest credit card debt. Consolidation will also turn multiple credit card bills into a single, easy loan payment. Our favorite loan providers offer amounts from $500 up to $35,000.

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- Not available in NY or CT

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- Quick loans up to $5,000

- Submit one form, get multiple options

- All credit ratings welcome

- Requires bank account and SSN

- As seen on CNN, FoxNews, and others

Take Advantage Of Score

The number of accounts and average age of your accounts are both important factors in your credit score, which can leave those with a limited credit history at a disadvantage.

Experian Boost and UltraFICO are programs that allow consumers to boost a thin credit profile with other financial information.

After opting into Experian Boost, you can connect your online banking data and allow the credit bureau to add telecommunications and utility payment histories to your report. UltraFICO allows you to give permission for your banking data, like checking and savings accounts, to be considered alongside your report when calculating your score.

Read Also: Can I Buy Appliances With Affirm

Factors That Affect Your Credit Scores

As we mentioned above, there are several factors that go into determining your credit scores.

Leave Old Accounts Open

Once you finally get rid of student debt or pay off your auto loan, you may be impatient to get any trace of it wiped from your report.

But as long as your payments were timely and complete, those debt records may actually help your credit score. The same is true for your credit card accounts.

An account thats paid in full is a good thing however, closing an account isnt something that consumers should automatically do in the hopes that it will positively impact their credit score, says Nancy Bistritz-Balkan, vice president of communications and consumer education at Equifax. Having an account with a long history and solid track record of paying bills on time, every time, are the types of responsible habits lenders and creditors look for.

Closing a credit card account can actually lower your credit score, as you will now have a lower maximum credit limit. If youre still carrying balances on other cards or loans, your utilization ratio will go up. Youre better off keeping the card with a $0 balance.

Any bad debts that can impact your score negatively are automatically removed over time. According to Ulzheimer, bankruptcies can stay on your credit report no longer than 10 years, while late payments and delinquencies such as collections, repossessions, foreclosures and settlements stay on your report for seven years.

Read Also: How Personal Responsibility Affects Credit Report

So How Long Does It Take To Repair Bad Credit Anyway

How long it takes to repair bad credit depends on your individual circumstances. Your current score, the factors that are affecting your score and more all go into how long it takes to repair bad credit.

If an error on your credit report is dragging your score down, you can dispute the error with the credit reporting agency. Unless the reporting agency considers your dispute frivolous, it has to investigate, usually within 30 days.

If bankruptcy or delinquent payments are the reason for a lower score, it might take a little longer to repair.

But most things wonât impact your score forever, and the effects of negative factors may lessen over time.

The moral of the story? Building better credit can lead to great things. In fact, you can start right nowâlearn more about monitoring your credit and then get to work improving your credit score.

Avoid Expensive Credit Repair Companies

You might see adverts from firms that claim to repair your credit rating. Most of them simply advise you on how to obtain your credit file and improve your credit rating but you dont need to pay for that, you can do it yourself.

Some might claim that they can do things that legally they cant, or even encourage you to lie to the credit reference agencies.

Its important to not even consider using these firms.

Read Also: Ccb Ppc Credit Inquiry

Create A Spending Plan

One of the key reasons that so many people end up with credit problems and low credit scores is they havent made a spending plan, or if they have, they havent followed it. A spending plan is another name for a budget. If you really want to fix your credit and maintain good credit going forward, you have to have a spending plan or a budget. Without one, you will likely spend more than you earn and end up in trouble. .

There is one critical part of a budget that many people overlook, and that is allocating some money every month to a separate savings account. You need to do this even if you are up to your eyeballs in debt . If you dont have any savings, what will you do when the next emergency or unplanned expense pops up? Will you put it on credit? Unplanned expenses happen all the time. It is part of life. If you dont have any savings, it will be extra hard to get out of debt.

To begin your savings, put aside a few hundred dollars and then work up to $500 and eventually $1,000. If this seems like a lot of money to keep in savings, think about how much emergency car repairs or home repairs could cost. How much would an emergency trip to visit an ill family member cost? Hopefully you can see that having some savings on hand is critical to staying within your budget and getting out of debt .

What To Do If Youve Been A Victim Of Credit Fraud

If youve been a victim of identity impersonation or credit fraud, your credit score might have taken a hit. Improving your credit score in these situation involves taking many of the steps on this page.

When you check your credit file, keep an eye out for a Victim of impersonation notice. This marker is provided by Cifas, a not-for-profit fraud prevention service.

Cifas markers are put on credit files by lenders in cases where they believe there has been an attempt at fraud by people mis-using a loan applicants identity. Lenders are legally obliged to report such concerns.

Having a Cifas marker on your file serves as a warning to future lenders that youve been a victim, or are vulnerable to becoming a victim, of fraud.

The marker will stay on your file for 13 months.

The good news is that having a Cifas marker doesnt affect your credit score and doesnt stop you from taking out credit. But it may create problems if youre applying for credit that is processed automatically, such as store finance. This is because a lender would have to carry out a manual review of your file to understand why the marker has been added.

Find out more on the Cifas website

Don’t Miss: Mortgage Tri Merge Credit Report

Pay Your Bills On Time Every Time

Your payment history accounts for 35% of your FICO Score, making paying on time, every time, the most important thing you can do to build a good credit score.

If you struggle to keep track of payment dates, you may want to set up autopay through either your card issuer or your bank. You may also be able to set email or text message reminders for when a due date is approaching.

It can also help to use a budgeting website or mobile app especially if you have multiple credit cards, because then you can easily see when charges appear.

The good news is that if you do miss a payment by a day or two, it typically wont be reported late to the credit bureaus until its at least 30 days past due. That said, you may still face a late fee and an increased penalty interest rate, so its best to avoid missing your due date even by a little.

Tips To Increase Your Credit Score

If you are like many consumers and dont know your credit score, there are several free places you can find it. The Discover Card is one of several credit card sources that offer free credit scores. Discover provides your FICO score, the one used by 90% of businesses that do lending. Most other credit cards like Capital One and Chase give you a Vantage Score, which is similar, but not identical. Same goes for online sites like Credit Karma, Credit Sesame and Quizzle.

The Vantage Score comes from the same place that FICO gets its information the three major credit reporting bureaus, Experian, TransUnion and Equifax but it weighs elements differently and there could be a slight difference in the two scores.

Once you get your score, as Homonoff suggested, you might be surprised if its not as high as you expected. These are ways to improve the score.

Recommended Reading: When Do Collections Fall Off Credit Report

Apply For Loans Within A Short Time Period

Lots of hard inquiries in a short time could be an indication to lenders that you’re searching for lines of credit you won’t be able to pay. Smart borrowers, though, will apply for a few loans of the same typesuch as a mortgage, car or personal loanto compare rates. For that reason, credit scorers treat multiple hard inquiries of the same loan type made around the same time as one, reducing the negative effects on your credit score. So try to submit applications within a short time frame, ideally two weeks. Keep in mind, though, that the scoring models don’t offer this same allowance for credit card applications all of these will count individually regardless of when you submit them.

How Long Does It Take To Rebuild Credit

It’s hard to say with certainty how long it takes to rebuild credit because each person’s credit history is different. If you’ve had credit difficulties in the past, how long it will take to rebound depends in part on the severity of the negative information in your credit report and how long ago it occurred. While some actions can have an almost immediate effectsuch as paying down credit card balancesothers may take months to make a significant positive impact.

If you’re disputing information in your credit report you believe is fraudulent or inaccurate, the investigation can take up to 30 days. If the credit reporting agency finds your dispute valid, the information will be removed from your credit report, and your score will reflect that change as soon as it’s calculated again.

If you’re making payments or reducing your credit card balances, don’t worry if your credit report isn’t updated right away. Creditors only report to Experian and other credit reporting agencies on a periodic basis, usually monthly. It can take up to 30 days or more for your account statuses to be updated, depending on when in the month your creditor or lender reports their updates.

Read Also: Does Affirm Check Credit Score

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These servicesmany of which are freemonitor for changes in your credit report, such as a paid-off account or a new account that youve opened. Also, they typically give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Get A Free Credit Score

It used to be difficult to get a free credit score. Today, both FICO and VantageScores are widely available from these and other sources:

-

Experian , if you sign up for a free account

-

Equifax , by signing up for a free account

-

Many major credit card companies, including American Express, Bank of America, Citibank, Commerce Bank, and Discover

-

Personal finance sites like Credit Karma and Credit Sesame

Understand that when you sign up for a free credit score, the company providing it may use your data for marketing purposes.

Don’t Miss: Ic Systems Pay For Delete