Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Read Also: Does Marriage Affect Credit

File A Complaint About A Debt Collector

Report any problems you have with a debt collection company to your State Attorney General’s Office, the Federal Trade Commission , and the Consumer Financial Protection Bureau . Many states have their own debt collection laws that are different from the federal Fair Debt Collection Practices Act. Your state Attorney Generals office can help you find out your rights under your states law.

What Goes Into A Credit Score

Each company has its own way to calculate your credit score. They look at:

- how many loans and credit cards you have

- how much money you owe

- how long you have had credit

- how much new credit you have

They look at the information in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit report. If your report is good, your score will be good. You can decide if it is worth paying money to see what number someone gives your credit history.

Your credit history is important. It tells businesses how you pay your bills. Those businesses then decide if they want to give you a credit card, a job, an apartment, a loan, or insurance.

Find out what is in your report. Be sure the information is correct. Fix anything that is not correct.

Read Also: Aargon Agency Settlement

Fair And Accurate Credit Transactions

The Fair and Accurate Credit Transactions Act provides you with better access to your credit information. Under FACTA, consumers are entitled to one free credit report every 12 months from each of the three credit bureaus . Reviewing these reports allows you to correct any errors in your credit history and protect your credit identity. Learn more about identity theft on the Federal Trade Commission website and in the OCC’s “Answers About Identity Theft.”

To order your free credit reports,

- complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281

Do not contact the three nationwide consumer reporting companies individually.

Why Should I Check My Credit Report

Your credit report has information that can affect whether you’re approved for a loan or credit card and the amount you’ll be approved for. Getting a copy of your credit report is valuable to:

- Make sure the information is accurate, complete and updated before applying for a line of credit

- Help protect yourself from identity theft

Also Check: How To Unlock Experian Account

How To Get Your Annual Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Until April 20, 2022, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Heres how to use AnnualCreditReport.com.

Ask The Collection Agency To Validate The Debt

If you cant find inaccuracies on your credit reports, write to the collection agency and ask it to validate your debt.

Under section 809 of The Fair Debt Collection Practices Act, collection agencies are required to validate debts they are attempting to collect, if you request that they do so.

The main issue here is that you have only 30 days to make the request after the collection agency first contacts you.

If they are unable to validate the debt, you can ask them to remove it from your credit report.

Dont Miss: Www Bpvisa Syncb

Don’t Miss: Tri Merge Credit Report Mortgage

What Is A Credit Report

When you apply for a credit card, mortgage or loan, the lender will most likely request access to your credit report. Your credit report provides important insights into your financial background and gives your lenders a look at your payment history and creditworthiness so they can determine your eligibility for credit.

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Read Also: Does Applying For Paypal Credit Affect Credit Score

Accessing Your Credit Report

Your credit report is compiled when you or your lender request it. It contains information that is supplied by lenders, by you and by court records.

In order to obtain your credit report, you must provide your name, address, Social Security number, and date of birth. If you’ve moved within the last two years, you should include your previous address. To protect the security of your personal information, you may be asked a series of questions that only you would know, like your monthly mortgage payment.

Since lenders may review your FICO® Scores and credit report from any of the three credit bureaus, it’s suggested that you check your credit report from all three and make sure they’re all accurate.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

You May Order Your Free Annual Credit Report In Any Of These Three Ways:

- Call 322-8228. You should generally receive a credit report ordered by phone in 15 days.

- Online: Visit www.annualcreditreport.com. You should be able to access a credit report ordered online immediately.

- Write to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281. Your report should generally be mailed to you within 15 days after your request is received.

Also Check: Unlock My Experian Credit Report

Specialty Consumer Reporting Agencies

Specialty consumer reporting agencies prepare reports on consumers’ histories for specific purposes. The reports cover employment, insurance claims, residential rentals, check writing, and medical records. Think about ordering a specialty report if you are ready to buy homeowners or automobile insurance, open a checking account, apply for private health or life insurance, or rent a home or apartment.

Property Insurance Claim Reports: Insurance companies often check reports of this kind when you apply for homeowners or automobile insurance. One of these reports is the CLUE report .2 CLUE reports contain information on property loss claims against homeowner’s insurance and automobile insurance policies. A CLUE report contains personal information, such as your name, birth date, and Social Security number. It also contains a record of any auto or homeowner property loss claims you submitted to an insurance company. It includes the type of loss, date of the loss, and amount paid by the insurance company. It lists inquiries, or companies that have checked your claim history.

Another property loss report is called A-PLUS . The A-PLUS database is compiled by a smaller company and is less commonly used than the CLUE database. You may order a CLUE report and an A-PLUS for free once every 12 months.

Tenant History Reports: Landlords sometimes check your tenant history as well as your credit history. You may order a free copy of your tenant history report once every 12 months.

Whats The Difference Between A Credit Report And A Credit Score

Although they are interconnected, your credit report and credit score are separate.

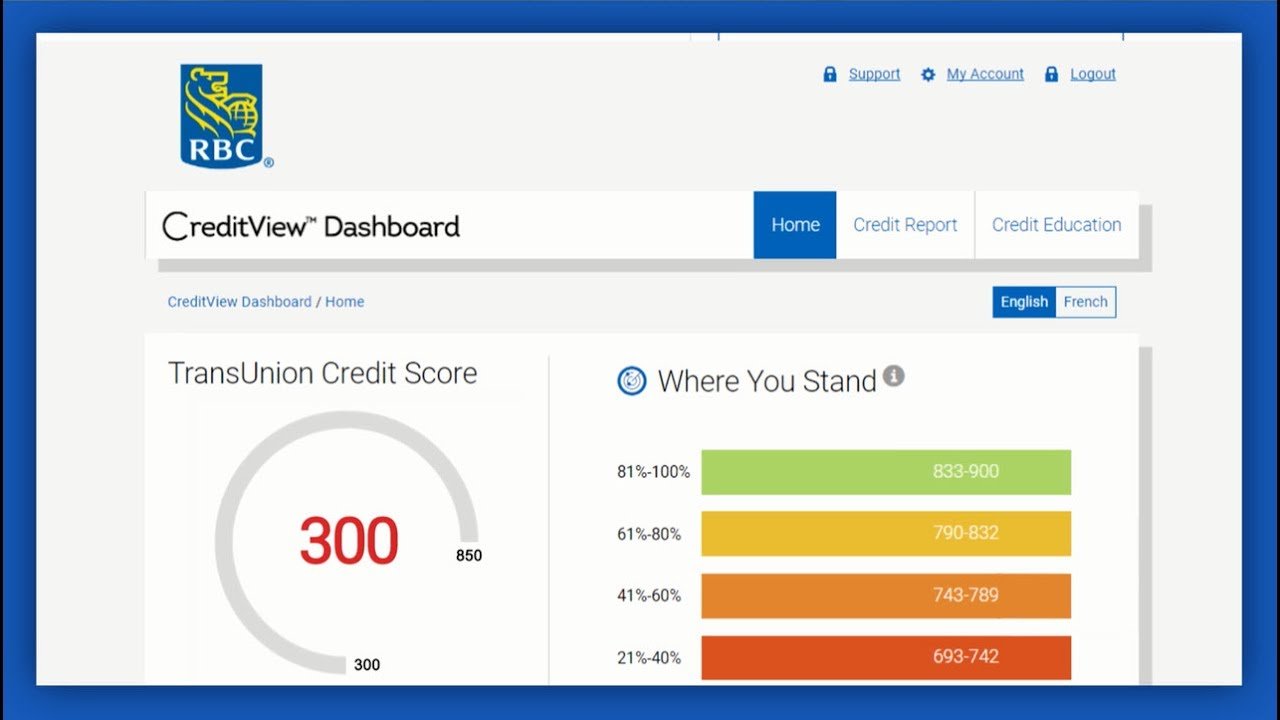

Your credit report contains information about your credit accounts, including any balances you owe and your payment history. Your , on the other hand, is a three-digit number that usually ranges from 300 to 850. Credit scoring models, such as FICO, use the information listed in your credit reports to calculate your score.

Recommended Reading: Does Monroe And Main Report To Credit Bureaus

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

What Does A Guarantor Need To Provide

Guarantors who co-sign on a rental application must meet the same criteria as the primary applicant. Typically, the landlord imposes additional requirements.

For example, a guarantor usually needs to prove that their annual income is 80 times the monthly rent and have excellent credit.

Guarantors should be able to support themselves and guarantee the tenants rent. A landlord will often require a credit check and additional financial information to verify this.

Guarantors must also provide their promise to pay rent in writing.

Most states will not accept a guaranty agreement unless it is in writing.

Don’t Miss: Does Ashley Furniture Repossession

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Why Is My Credit Report Important

Businesses look at your credit report when you apply for:

- loans from a bank

- jobs

- insurance

If you apply for one of these, the business wants to know if you pay your bills. The business also wants to know if you owe money to someone else. The business uses the information in your credit report to decide whether to give you a loan, a credit card, a job, or insurance.

Recommended Reading: Usaa Credit Monitoring Experian

What Is The Fact Act

The Fair and Accurate Credit Transactions Act was signed into law in December 2003. The FACT Act, a revision of the Fair Credit Reporting Act, allows consumers to get one free comprehensive disclosure of all of the information in their credit file from each of the three national credit reporting companies once every 12 months through a Central Source.

Successfully Answer Security Questions

For each report request, youll be asked a few questions about your finances that presumably only you can answer for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you cant recall those details, you can request your reports by mail or phone this process doesnt require security questions.

You May Like: What Credit Bureau Does Paypal Credit Use

How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit transunion.com/disputeonline and well start an investigation.

How Often Should You Check Your Credit Report

Experts recommend that you check your credit report at least once a year. Taking a full deep dive with a credit report to ensure no inaccuracies, make sure you know where you stand and use a monitoring service that keeps you informed. We can help you stay informed with a credit monitoring service. Sign up for Chase Credit Journey to help monitor your credit.

If you’re planning to make a major purchase soon, or even in the somewhat distant future, you should regularly check up on your credit report. You want to make sure your report is as accurate as possible to get the best interest rates.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Recommended Reading: Do Pre Approvals Affect Credit Score

What Practices Are Off Limits For Debt Collectors

A debt collector may not:

- Contact you at inconvenient times, for example, before 8 AM or after 9 PM, unless you agree to it.

- Communicate with you at work if you tell the debt collector your employer disapproves.

- Contact you after you send a letter to the collector telling them to stop, except to notify you if the creditor or collector plans to take a specific action.

- Communicate with your friends, relatives, employer, or others except to find out where you live or work.

- Harass you with repeated phone calls, profane language, or threats to harm you.

- Make any false claim or statement that you will be arrested.

- Threaten to have money deducted from your paycheck or to sue you, unless the collection agency or creditor intends to do so and it is legal.

Establishing A Credit History Without A Social Security Number

If you are a recent arrival to the U.S., you will have to establish a credit history so that you can get a car loan or rent an apartment, for instance. Any credit history you had before arriving here will not carry over.

To establish your U.S credit history, you could get a , open a bank account or get a loan with a U.S.-based financial institution. Utility providers could also be reporting on your accounts to the credit bureaus.

And if you need to take out a loan before your U.S. credit history is available, at least one company, Nova Credit, translates your overseas credit history into an equivalent report for the benefit of U.S. lenders.

See related: How to get a credit card without a Social Security number

Don’t Miss: Remove Hard Inquiries In 24 Hours