Applying For A Flexshopper Account

The FlexShopper online application involves providing basic personal details and financial information. The form is protected by bank-level security software, and your personal information is never shared with third parties, according to FlexShopper.

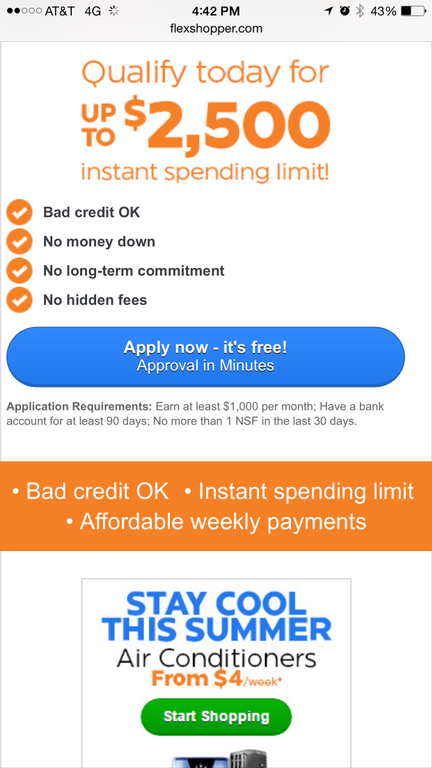

While you dont need to have a good credit score to apply, and you dont need to own a credit card, you do have to show that you are gainfully employed and earning a minimum of $1,000 per month. You may earn this amount at one job or several jobs. Additionally, you need to show that you have a personal bank account , and the account must be at least 90 days old. Once you meet these two mandatory requirements, approval is fairly quick. After approval of your application, a spending limit decision is produced in mere seconds. That means you can start shopping right away. FlexShopper offers spending limits of up to $2,500.

Is Stoneberry Like Fingerhut

Stoneberry is fairly similar to sites like Fingerhut in the sense that it offers a wide range of credit-related features for its customers while also offering a large catalog of products to choose from. The fact that this site offers low monthly installments makes this among the best Fingerhut alternative out there.

You May Like: Unlocking Credit Report

What Is Mdg Usa Inc

MDG brings leading consumer financing programs to you! As an ecommerce company we understand the importance of being able to buy the products you want at affordable prices. MDG offers customers brand name electronics, televisions, computers, appliances, furniture and mattresses at competitive prices.

Related

Recommended Reading: Does Opening A New Credit Card Hurt Your Credit Score

Is Mdg Canada Legit

MDG has a consumer rating of 4.26 stars from 5,175 reviews indicating that most customers are generally satisfied with their purchases. Consumers satisfied with MDG most frequently mention customer service, fast delivery and payment plan. MDG ranks 4th among Electronics sites.

Related

We only ship orders from www.mdg.com to locations within the United States.

Related

Perpay Will Report Your Payment History To The Credit Bureaus As You Make Automatic Installment Payments

. Based on results observed across more than 5000 Perpay members customers enrolled in credit building starting in November 2020 observed an average credit score VantageScore 40 increase of 39 points by April 2021. We will report up to 24 months of your payment history. So according to the site you can get an average of 39 points every time you complete payments.

Get a constantly updating feed of breaking news fun stories pics memes and videos just for you. Here is how it works. Best for Bad Credit.

And when they do reply its usually then saying I dont know when I ask why it takes 6-8. Reddit gives you the best of the internet in one place. Alternatively find out whats trending across all of Reddit on rpopular.

Passionate about something niche. Installments are automatically scheduled into four equal payments that are spread across six weeks. When your profile is complete you will receive an Estimated Spending Limit to use on Perpay.

A Perpay-backed credit card with which consumers Perpay history could help improve their real-life credit. You need to sign up for an account and they will provide customized accounts based on profiles. Afterpay is quite safe compared to credit cards personal.

Perpay users can earn 200 when referrals make their first payment. How Does Perpay Work. Although youll need to make payments totaling at least 200 to qualify for Perpay it can be a useful option for those looking to build credit.

Perpay Review How It Works Complaints More Finder Com

You May Like: Can You Get A Credit Card With Bad Credit Rating

Is Fingerhut A Hard Inquiry

Yes, Fingerhut will be a hard inquiry. When you apply for an account, they will pull your credit report. This will show up as a hard inquiry.

They will offer you an initial credit line, and they will report to the credit bureaus when you make on-time payments over a period of time.

Many people find it worthwhile because Fingerhut offers them a chance to rebuild their credit. However, they will pull your credit report, and it shows up as a hard inquiry.

What Is The Flexshopper Personal Shopper

Sometimes you have your heart set on a certain item that you dont see anywhere on the FlexShopper site. When this happens, you can use the FlexShopper Personal Shopper to order items from alternative merchant sites. FlexShopper works with merchants such as Amazon, Best Buy, Dicks Sporting Goods, and Overstock.com. Simply browse your favorite shopping site, select items you want to rent, and select shipping or store pick up options. Youll pay for these goods using your FlexShopper leasing plan.

Recommended Reading: How To Calculate Credit Score From Report

What Our Clients Say About Us

Agruss Law Firm, LLC has over on our website, an A+ BBB rating, and over . Heres what some of our clients have to say about us:

Michael Agruss handled two settlements for me with great results and he handled them quickly. He also settled my sisters case quickly and now her debt is clear. I highly recommend Michael.

Agruss Law Firm was very helpful, they helped me solved my case regarding the unwanted calls. I would highly recommend them. Thank you very much Mike Agruss!

Agruss Law Firm was very helpful to me and my veteran father! We were harassed daily and even called names for a loan that was worthless! Agruss stepped in and not only did they stop harassing, they stopped calling altogether!! He even settled it so I was paid back for the problems they caused!

The Three Major Consumer Credit Bureaus Are Equifax Experian And Transunion

A credit bureau is a company that gathers and stores various types of information about you and your financial accounts and history. It draws on this information to create your credit reports, which in turn form the basis for your credit scores.

The three major credit bureaus are often grouped together. But theyre separate companies that compete for the business of , who may use the credit reports and scores from these bureaus to help them make lending decisions. And theyre not the only three bureaus out there.

Keep reading to learn about the data the credit bureaus collect, how credit bureaus get the information they use to create your reports and scores, and how you can contact them if you think somethings wrong.

Also Check: Does Car Insurance Show On Your Credit Report

Do I Need A Credit Card To Subscribe To Mdg Club

No credit card needed at time of registration. You will not be charged if you do not make a purchase. After your 90 day free trial MDG Club Subscription is $8.95/month. Cancel anytime. Already have an account? Sign in. Enter your email address You must enter a valid email address Something went wrong with the email you provided…

I Went From 400 To 600 In 4 Months

Congrats on the jump in score. Stay away from the SCT as too many approvals in a short period of time will result in all the accounts being shut down. You have a good credit mix right now, so gardening would be a good idea. Give it 6 months, then check the prequal for Cap 1 again and if it shows a hit, then consider applying for whatever it show approval for, and if approved, close the Open Sky account, but keep the Citi card as it could open up the door for a long term relationship with them.

Time and good payment history is the best way to improve your scores. You’ve done well so far. Keep up the good work.

Read Also: How To Improve Credit Score To Buy A House

Does Stoneberry Credit Charge Interest

Stoneberry Credit charges interest if you dont pay the new balance in full within 25 days of the statement datethis arrangement is similar to a credit card. Your annual percentage rate depends on where you live and, in some states and territories, the amount of your order:

| States | |

| 18% up to $750, 12% over $750 | |

| All other states and U.S. territories | 23.99% |

To compare, the average credit card interest rate is 20.29%, according to data collected by The Balance. The average interest rate on a two-year personal loan is 9.46%, according to the Federal Reserve.

Stoneberry Credit allows you to make additional payments to reduce your balance. While this wont reduce future payment amounts, it can help you pay off the debt early.

You May Like: Syncb Ppc Account

Are Gettington And Fingerhut The Same Company

Gettington and Fingerhut are both brands under the parent company, Bluestem Brands, Inc. They are different companies with similar formats, and they offer financing through WebBank.

If you have one, you dont need the other because they offer very similar items. Most people choose one and use it to build credit or obtain items on credit.

You May Like: How To Get Rid Of Collections On Credit Report Canada

How Do We Use The Law To Help You

We will use state and federal laws to immediately stop Flexshoppers debt collection. We will send a cease-and-desist letter to stop the harassment today, and if Flexshopper violates the FDCPA, EFTA, FCRA, or any state law, you may be entitled to money damages. For example, under the FDCPA, you may receive up to $1,000 in damages plus actual damages. The FDCPA also has a fee-shift provision, which means the debt collector will pay your attorneys fees and costs. If you have a TCPA case against the agency, we will handle it based on a contingency fee and you wont pay us a dime unless you win.

THATS NOT ALL

We have helped thousands of consumers stop phone calls. We know how to stop the harassment and get you money damages. Once again: you will not pay us a dime for our services. We will help you based on a fee-shift provision and/or contingency fee, and the debt collector will pay your attorneys fees and costs.

Can You Use Flexshopper On Amazon

FlexShopper breaks with the old stereotypes regarding brick-and-mortar rent-to-own showrooms and brings the lease-purchase model into the 21st-century with an online shop filled with more than 140,000 items customers can choose from many from top retailers like Best Buy, Overstock.com, Amazon, and Walmart.

Read Also: How To Remove Late Payments From Credit Report Sample Letter

Who Is Acima Financing Good For

If you have less-than-perfect credit, need to buy something immediately and only need the loan short-term strictly less than 90 days Acima could work for you.

But if theres any doubt you can repay it that quickly, youll want to avoid this lease-to-own financing. If your credit is in pretty good shape, consider other financing such as a personal loan or a credit card, which may cost less and come with longer repayment terms than Acima offers.

Does Acima Have An App

You can then use the Acima mobile app to easily check out with your approved retailer or to switch locations if you change your mind and would like to shop somewhere else. See your lease details, make payments, get support, access your agreement, and more. And look for new ways to shop online with the app coming soon.

You May Like: What Credit Score Is Needed To Refinance A House

Can You Remove Badcock From Your Credit Report

It depends. In some instances, you may be able to get a hard inquiry deleted from your credit report.

If you applied for a card from Badcock, their inquiry on your credit report is legit.

However, if you didnt apply, online or in-person, for financing from Badcock, theres some reason for concern.

The inquiry could signal a reporting error, or more troubling, identity fraud.

Heres what you need to do if Badcock winds up on your credit report by mistake.

Can I Use My Fingerhut Credit Card At Walmart

You cannot use your Fingerhut credit card at Walmart. Fingerhut extends credit to people to shop at their store through their online catalog.

It isnt a Visa or Mastercard, so it functions more similarly to a store credit card. However, they do have some partners, and you will receive offers to use your account for purchases from them.

You can find out who these partners are each month on your statement, and if you want to take advantage of an offer, you can use it then.

Recommended Reading: What Is Attcidls On My Credit Report

How Do Credit Bureaus Get Your Information

The information that the bureaus collect comes from a variety of sources.

Information reported to the bureaus by creditors Creditors, such as banks and credit card issuers, may report information about their accounts and customers to the credit bureaus. In this context, the creditors are known as data furnishers.

Information thats collected or bought by the bureaus For some types of information, the credit bureaus buy the data. For example, a consumer credit bureau might buy public records information from LexisNexis, another credit bureau, and use this information when generating your credit report. Examples of information that a credit bureau may buy include government tax liens or bankruptcy records.

Information that gets shared among the bureaus Although they are competitors, sometimes the credit bureaus must share information with one another. For example: When you place an initial fraud alert with one of the bureaus, its required to forward the alert to the other two.

Also Check: Aargon Agency Debt Collector

Getting Badcock Deleted From Your Report

Applying for a Badcock store card or financing may result in a hard credit check.

While your score might be hit as a result of the inquiry, you dont need to be too concerned.

Inquiries only stay on your report for 2 years and typically only have a minor impact.

But no matter how small the effect is on your score, if you ever suspect identity fraud or a reporting error, you shouldnt let it go unchecked.

At the very least, you should follow up with Badcock about the entry and file a quick dispute with the credit bureaus.

And if you need help, consider working with one of the top .

If you did apply for Badcock financing and were approved, the best thing you can do moving forward is to make timely payments.

Your payment history has a far bigger impact on your credit than a hard inquiry does.

Read Also: Does Drivetime Report To Credit Bureaus

How Long Does It Take To Get Approved For Stoneberry

4.6/57-10 daysthis is here

Account DetailsSimply log in to your Stoneberry account to check the status of your order here or call one of our friendly customer service representatives at 1-800-704-5480.

Additionally, how do you use Stoneberry credits? No Formal Application Process Applying for Stoneberry Credit is as easy as placing an order!

Also know, how long does it take Fingerhut to approve credit?

10 days

What does unprocessed credit order mean?

An order is marked as unprocessed or authorized when a payment is due. This can happen when you have a pending card authorization, or the customer has chosen a payment method which requires him/her to make payment by some other means.

You May Like: Aargon Com

In Trouble With Snap Finance

So I had a loan with Snap Finance. I was paying on time and was about to pay it off when I noticed that the balance was not going down even though I have paid it. I called them back and went over the bill and they charged me even more money! This is the third time this has happened so I did call and curse them out . They called the police on me because I stated I had a mental breakdown due to them and I guess they thought of suicidal thoughts. Needless to say I will no longer deal with them. After arguing with the manager and their specialty department I threatened to sue them out of anger. Ever since then they have referred me to write their legal department and they automatically charged me off. They said I can only speak to the legal department going forward.

I have never heard of a company that does this but this is absolutely nuts. My question is usually how long does it take a company to send it to third party collections because they will not tell me over the phone? Should I write to their legal department? What do I do. I owed $250 but they told me $333 and when I threatened to record the conversation they hung up on me. I really can not deal with another ding to my credit.

Also Check: What Credit Score Do You Need For Paypal Credit

Anonymous Problems With Product/service Complaint

Complaint Type: Status:

06/20/2022

Business Response

06/24/2022

We apologize for the consumers recent experience with FlexShopper and any miscommunications that occurred. Our investigation revealed the consumer called on 04/13/2022 and advised us not to attempt charges on their card ending in *************************************************************************************** **** for payments. After several calls, the consumer was informed this the request was taken care it was at this same time that the consumer was again charged on the **** card unfortunately. Customer was told this payment would be refunded and they did have a Past Due balance of $25.76. Consumer advised they would not be paying anything else that they would like the refund and a shipping label to have the item returned altogether, Label was provided to the consumer on 06/14 and on 06/24. If the customer returns the leased item within the next 21 days, the lease will be closed without further charges and refund the last change. If the consumer has any further questions or concerns, please reach out to our *************************** at ************** or email us at **************************************.

Customer Response

How Do I Cancel My Membership With Club Fitness

We are sorry to hear you have decided to end your membership with Club Fitness. Cancellation notices can be submitted in person by the member with the Manager or Assistant Manager of any open location. Photo ID and an email address are required to fill out the form. A 30-day notice is required for all cancellations.

Also Check: How To Remove Repossession From Credit Report