Opening A Credit Card To Increase Your Available Credit

Responsible handling of your finances, potentially with the opening and use of a credit card, can help build a good credit history over time. For example, while FICO® Scores are made up of several components, one important category is amounts owed, which typically makes up 30 percent of your overall score. This component addresses your debt-to-credit ratio, or utilization rate. Essentially, it measures how much of the credit extended to you is being used and paid off. Per FICO, a low credit utilization rate will more positively affect your FICO® Scores than not using your available credit at all because it shows that you are capable of handling credit responsibly.

How many credit cards do you need to build credit? The answer depends on your;credit utilization;and how much credit you need, so consider the ratio of how much you spend compared to how much credit is available to you on your card, or cards. For example, opening a credit card may lower your debt to credit ratio. Say that you double your total credit lines available from $5,000 to $10,000 by opening a second card, but you simply spread out your current spending of about $1,000 per month across those two credit cards. This would improve your utilization ratio, meaning that youre spending $1,000 out of $10,000 available to you, for a utilization of 10 percent instead of 20 percent when you had $5,000 available.

How Does Opening A New Credit Card Affect Your Credit Score

First, let’s look at how a new credit card might help you improve your credit score:

- Increase available credit: Opening a new credit line increases your available credit, which can positively affect your credit score. The key is to keep the balance relatively low so your available credit stays high. This is known as your , and it’s best to keep your overall credit usage under 30%. For the best impact on your scores, keep your credit utilization as low as possible.

- Improve credit mix: Your refers to the different types of accounts you have in your credit file. There are many types of debt accounts and two broad categories: installment credit and revolving credit. Installment credit refers to loans you take out and repay a single time, such as mortgages, car loans and personal loans. Revolving credit refers to accounts you can charge a balance on, repay and reuse, such as credit cards and home equity lines of credit. Credit mix makes up 10% of your score, so opening a new credit card may be helpful if most of your existing accounts are installment loans. That said, avoid opening a credit card solely to diversify your credit accounts.

- Opportunity to establish strong payment history: Payment history comprises 35% of your credit score, making it the No. 1 influence on your credit. When you open a new credit line, you have a chance to build up a history of on-time payments by paying your bill by the due date every month.

Opening A New Card Account For A Balance Transfer: Potentially Good Credit Score Impact

Opening a new balance transfer credit card can help your credit score by increasing the overall amount of credit you have available, improving your credit utilization ratio.

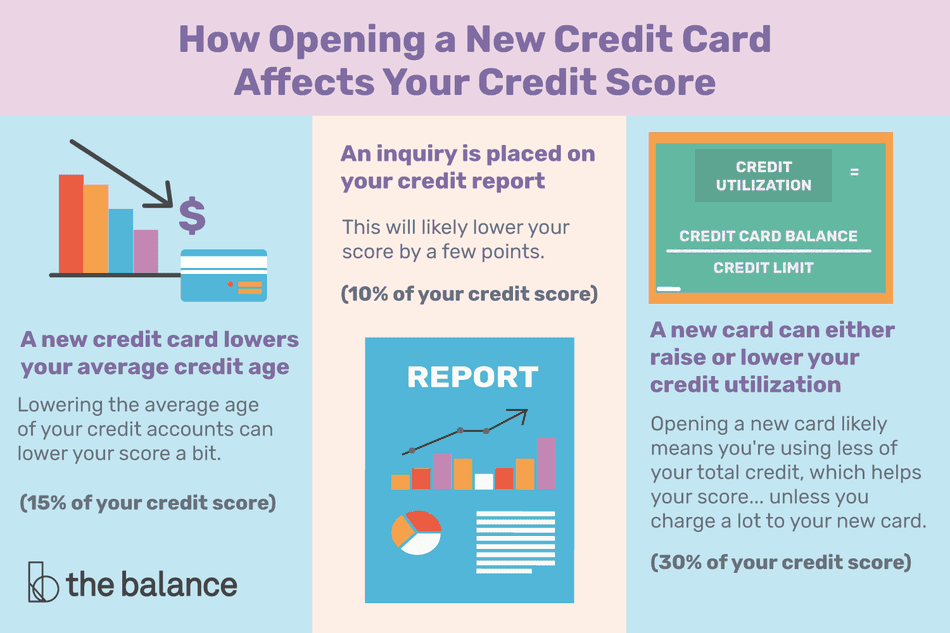

However, at the same time, a new card will lower your average account age, which makes up 15% of your credit score. And if you apply for several balance-transfer cards at once, that can throw up a red flag to creditors, as these types of inquiries made for new credit accounts represent 10% of your credit score.

You May Like: Why Is There Aargon Agency On My Credit Report

How Many Credit Checks Are Too Many

If you have a good credit score, the effects on your score could be minimal, especially if you’ve been keeping your balances low. But if you have a poor credit score and a high amount of unpaid balances, those credit inquiries may lead to application rejections and an even lower credit score.

To minimize the impact of opening up a new card account, try lowering your current debt first, to help bolster your credit score ahead of your application.

Does Applying For A Credit Card Hurt Your Credit Score

Yes, applying for a new credit card can hurt your credit score a little. According to FICO, a hard inquiry when a card issuer pulls your credit after you apply can lower your score by five points or less. However, the impact is temporary. Hard pulls stay on your credit report for two years, but their credit score effects wear off after one year, according to national credit bureau Experian.

Additionally, new credit is among the five most important factors in your FICO score, though it only counts for 10%. So new credit card accounts will have a much smaller effect than a truly negative credit report item, like a missed credit card payment or a maxed-out card.

Though the credit score impact of a single card application can be small, too many of them in a short amount of time can add up to a significant loss. And if youre in the process of applying for a mortgage, hard inquiries from new credit card applications can give your prospective lender the impression that youre about to overextend yourself or go on a credit card spending spree.

Don’t Miss: What Credit Report Does Paypal Pull

Avoid Bad Credit Habits

After transferring a balance, it’s important that a cardholder assesses how they accumulated the high balance in the first place. Review past statements and evaluate where the money was spent. Someone might have relied on credit availability or just lived beyond their means without considering the consequences in interest and fees.

Steps to take going forward might include establishing a new or stricter budget or making drastic changes to get on track for better debt management. A credit counselor can also help.

Does Adding A Credit Card Improve Your Credit Score

If you’re thinking about opening a new credit card and are wondering whether it will help your credit score, the answer is yesand no.

Applying for a new card can initially lower your score because the card issuer will do a hard credit pull when deciding whether to approve your application. Further, a new account can potentially work against your scores as it will lower the average age of your accounts. On the other hand, a new credit card can help your credit utilization, which is an important factor in your scores. A new card can help you in the long run, especially if you keep it open for several years and make payments on time, but you may feel some short-term pain.

Also Check: Does Zzounds Report To Credit Bureau

How Opening A New Credit Card Affects Your Credit Score

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina. He is a CFP, registered investment advisor, and he owns his own financial advisory firm. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Before you submit another credit card application, be aware of three ways opening a new credit card negatively affects your credit score. This knowledge may lead you to decide against establishing a new credit card account.

A new credit card might;boost your credit score;if it is your first credit card or if you had little credit history before opening the account. You might not have had a credit score at all before getting your first credit card.;Within six months of opening the account, however, there should be enough information to generate a credit score for you.

In other circumstances, opening a new credit card account could hurt your;, at least in the short term.

What Are Hard And Soft Credit Score Inquiries

There are two types of credit score inquiries lenders and others can make on your credit score: a “hard inquiry” and a “soft inquiry.” The difference between the two is that a soft inquiry won’t affect your score, but a hard inquiry can shave off some points.

Here’s what hard and soft inquiries are all about: why there’s a difference, and who makes them.

Don’t Miss: What Is Aargon Agency

Should You Apply For A New Credit Card Or Improve Your Credit Score First

by Lyle Daly | Updated July 21, 2021 – First published on May 17, 2021

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Making the right choice depends on your credit score and your financial situation.

Sometimes it’s hard to decide between applying for a new credit card or raising your . A new credit card could be a valuable addition to your wallet. You may have even found one that will earn you more rewards on your purchases and has other features that save you money.

The issue is that credit card applications aren’t helpful when you’re working on your credit. An application results in a hard inquiry on your credit file, which can cause your credit score to drop by a small amount. If you’re approved for a new credit card, it will reduce the average age of your credit accounts. That can also ding your credit.

You have to figure out whether you’d benefit more from a new credit card or from a higher credit score. Fortunately, there’s a simple way to do this.

Does Having Credit Cards With A Zero Balance Hurt Your Credit Score

A zero balance credit card can impact your credit score, and heres why.

Too many financial consumers dont understand their credit scores, and thats a scenario that can lead to negative outcomes.

Data from GoBankingRates.com shows that 40% of Americans dont know their credit scores. Additionally, a third of U.S. adults;didnt know what credit score level was necessary for securing a good mortgage, auto, or personal loan.

To compare credit card companies fully and accurately,;visit multi-lender marketplace Credible.

One area where credit scores are particularly vexing for consumers is when zero balances on credit cards come into play. Here’s everything you need to know about how a zero balance;impacts credit.

Recommended Reading: Comenitycapital/mprcc

A Couple Of Ways Closing An Old Card Can Hurt

While never helping your score, closing a card can hurt your score in a couple of ways one of them immediately; the other one, about 10 years after closing.

These are:

- In the short run, eliminating the closed cards available credit can lead to a higher existing percentage if you carry a balance on any other cards.

- In the long run, your closed card and all of the positive history associated with it will be removed from your credit report after about 10 years, which could lower your score at that time.

But thats not always the case.

Then again, closing a card may not hurt your score at all, provided that:

- Any other cards you have carry low utilization, as the loss of the Slates available credit isnt likely to raise an already low percentage.

- You have other open cards of a similar vintage as the Slate, so that its future loss wont be felt in the score calculations that measure your length of credit history.

Tip: The negative effects of both opening a card and opening a new one can be minimized if you keep a low balance on any existing accounts and pay their balance on time.

A New Hard Inquiry Will Appear On Your Credit Report

When you apply for a new account, you give a lender permission to access your credit report. This type of credit access is known as a hard inquiry.

Hard inquiries can damage your credit score, but the impact is generally small and doesnt last for long. In some cases, a new hard inquiry wont affect your credit score at all.

But if youre taking care of the rest of your credit health, you shouldnt worry too much about credit inquiries. They have a minor impact thats short-lived.

Also Check: Why Is There Aargon Agency On My Credit Report

Other Ways Opening A New Credit Card Can Hurt Your Credit

Simply applying for a new card can cause your score to slip a bit, but a new card can result in a bigger drop if you use a lot of that new line of credit. Or if you have only one or two other cards, and they are only a few years old.

Heres how opening a new card might hurt your credit:

Higher balances. A new credit card might hurt your score if make a big purchase or you get a balance-transfer card and transfer your higher-interest debt to the card so that you have high . The amount of your credit limit that you use is weighted heavily. Credit utilization is calculated both per-card and overall.

Experts recommend going no higher than 30% on any card, and lower is better.

However, its smart to look at overall finances, not just your credit score. Accepting a drop in your score due to high credit utilization because you got a 0% balance transfer card deal to pay off debt may be worth it.

Lower average age of accounts. How long youve had credit also affects your score. Your new card can reduce the average age of your credit. If you have few credit cards, it will have a bigger impact than if you have many.

Length of credit history, however, is a relatively minor factor in credit scores. It counts as 15% of your FICO score. VantageScore, another credit score provider, lists age and type of credit as highly influential.

Where To Access Your Free Credit Reports

Thanks to the Fair Credit Reporting Act, you can access a free credit report from Experian, TransUnion and Equifax once every 12 months . Your free reports are available at AnnualCreditReport.com.

You may be entitled to additional free reports under any of the following circumstances as well.

- Youre unemployed and plan to apply for a job within 60 days

- A company denies your application or offers you worse terms based on your credit when you apply for credit, insurance or employment.

- You receive public assistance income

- Youre a victim of identity theft or fraud

Read Also: Does Paypal Credit Report To Credit Bureaus

What Is A Store Credit Card

Store credit cards are similar to traditional credit cards. You use them to make purchases and pay down the balance over time. And, as the Consumer Financial Protection Bureau explains, âThese cards typically provide additional discounts and frequent shopper rewards when used exclusively at their stores or with affiliate retailers.â

There are two types of store credit cards:

- Private Label: These can usually be used only at the store or group of stores that issued them.;

- Co-Branded General Purpose: These are similar to traditional credit cards and can be used outside of the store or group of stores that issued them.;

Like traditional credit cards, both types of store cards are examples of revolving credit. This means they can be used and paid down repeatedly for as long as the account stays open. And if your card issuer reports your use of the card to the credit bureaus, your card will appear on your .

If You’re Approved But Your Credit Limit Isn’t Enough To Buy A Device With Apple Card Installments

You can;apply for Apple Card;when you buy a new iPhone, iPad, Mac, or other eligible Apple product with Apple Card Installments.;If your application is approved with insufficient credit to cover the cost of the device;you want to buy, you can choose a different device that’s covered by your credit limit. You can also choose a different payment method or;use Apple’s Trade-in program.

Don’t Miss: When Does Paypal Credit Report To Credit Bureau

Learn About Retail Store Credit Cards And What To Look For When Youre Thinking About Applying For One

Youâre at checkout to make your new purchases. The store assistant says you can get a discount on the spot if you sign up for and pay with the store credit card. What do you do?

A store credit card can offer you savings and perks now and in the future. And a store credit card can be a great financial tool if you use it responsibly. But before you decide whether to apply for one, read on for tips to help you make an informed decision.

Do Unused Credit Cards Hurt Your Score

Earlier we discussed how a card you got when you were first starting out may be one that you dont use much anymore. But that card is important to two scoring factors: your length of history using credit and your utilization rate.

Your length of credit history is a factor that makes up 15 percent of your overall FICO score. This is really the only portion of your overall score that you have relatively little control overthat is until you decide to close one or more accounts.

Length of credit history is calculated two waysboth by the age of your oldest account and by the cumulative age of all of your accounts. When you are first starting out in the credit world theres no way to magically age your history unless you are an authorized user on someone elses old account.

VantageScore and FICO both will bring the age of the account on which you are an authorized user over to your file and it will score as an oldie. Otherwise, just like your actual age, your credit age can only be as old as it is. If you later choose to close an old account, your closed account continues to be taken into consideration in the score, but only as long as it is still reported .

You must also consider your , which calculates how much of your available credit you have used. While my recommendation is to keep that number below about 25 percent of your overall credit line, people with the best credit scores tend to have a number in the single digits.

Don’t Miss: Is 739 A Good Credit Score