Does Your Credit Reset After 7 Years In Canada

Late payments remain on a credit report for up to 6 years from the date reported. This is also known as previous high rate based on the system used in Canada to rate payments. … Bankruptcy stays on your Equifax credit report for 6 years after the discharge date, or 7 years after the date filed without a discharge date.

How Should You Deal With A Charge

Your best strategy depends on which course of action the creditor uses to try to get some of its money back.

If the creditor has not yet sold your debt to a collector or tried to sue you, you can negotiate a settlement in the same manner that I discussed in the section about dealing with collection accounts. Generally, this is the case for the first three to six months after your account became delinquent, although the timetable can certainly be longer or shorter than this.

On the other hand, if the creditor sues you for the debt or sells it to a third-party debt collector, it gets a little more complicated. To be clear, either of these situations will likely result in two negative items on your credit report — the original charged-off account as well as the resulting collection account or legal judgement.

You’ll probably need to deal with the collection and charge-off individually, especially if the debt has been sold to a third-party collector. A debt collector has no control over what the original creditor reports to the credit bureaus. Plus, the original creditor has no incentive to help you out simply because you paid off the debt collector.

Why Would You Want To Resolve Charge

A charge-off may lower your FICOcredit score. Thirty-five percent of your FICO score is determined by your payment history, while 30% is determined by the amount of money you currently owe.

This means that an unpaid charge-off negatively impacts both areas as it indicates a history of late payments as well as a balance you still owe. This bad debt may cause your score to tumble out of the good range, which may cause future lenders to think twice about lending to you.

But keep in mind, a charge-off can hurt your credit score before its made official by a credit card issuer or other lender. The months of missed or late payments that lead to a charge-off will start hurting your score well before the account is closed.

Also Check: Is Fico Score Different From Credit Score

If Its Listed By Multiple Companies

It is all-too-common for debts to be sold to a third-party debt collector and then re-sold by them to another debt collector with very little documentation. Therefore, if you see the same charged-off account listed several times with multiple collection agencies, it is worth it to have each debt collector verify the debt before proceeding further.

Confirming who actually owns the account will ensure that you dont pay an unscrupulous debt collector who will take the money even if they no longer own the debt.

Will Paying A Charge

Paying a charge-off will not automatically get it removed from your credit report. The status will change to show that it has been paid, but the mark remains on reports for seven years since the first missed payment.

Before you pay a charge-off, you can sometimes make an agreement with the credit issuer that they will remove the charge off in exchange for your payment. If you make this type of agreement, make sure to get it in writing.

Also Check: What Makes Up Your Credit Score

How Can You Prevent A Charge Off

Pay your bills on time.

As long as you stay current on your payments, your account cannot be charged off. If its an installment agreement, this means paying the same amount every month. If its a credit card, this means making at least your minimum payment, but its always best for your credit to pay the full balance owed.

That said, circumstances beyond your control may prevent you from making timely payments, like a loss of income or an emergency medical situation. Whatever the reason you are falling behind, contact your creditors about it. Together you can talk about the situation and hopefully work out a doable payment arrangement.

Beyond that, look at your budget. What can you cut from your expenses to help you get back on track?

Recommended Reading: What Is A Fair Credit Score

Should You Pay Charged

The outstanding balance on a charge-off account is still your debt, and you are legally responsible to pay itto the original creditor or the agency that buys the debt. Furthermore, lenders who see unpaid charge-offs or collections may question your willingness and ability to repay future debts. Some will likely consider any charge-off grounds for declining a credit application, but some lenders will view paid charge-offs more favorably than unpaid accounts.

You May Like: How To Send A Credit Report By Email

Is It Necessary To Pay A Charged Off Account

Again, a charge-off does NOT mean debt forgiveness. Unless the charge-off on your reports is inaccurate, youre bound to pay off that debt. The first thing to do when you learn about a charge-off on your reports is to verify the accuracy.

Here are some things you may look for:

- The outstanding balance: If the due balance on your account looks more than it should be, ask your creditor to explain why. If there are no explanations for the additional cost, ask them to correct the derogatory entries.

- Collection agencies: Once your account is charged off, it could be sold to more than one third-party collection agency.

For instance, if your account has been sold to three different agencies, ensure that each sold account is marked closed and has a zero balance. Its only accurate to have the most current collection account as open or active.

- The original delinquency date: The charge-off date on all of your collection accounts should be identical to the original delinquency date, i.e., your first missed payment that led to a charge-off.

If you figure out that the charge-off on your reports is legitimate, you must take action and pay it off.

What If You Ignore A Charge

Even though your original creditor has taken a tax write-off and closed your account, you still owe the debt. If you completely ignore the charge-off, the creditor or a collector that purchases the debt and potentially get a judgment to garnish your wages or pursue other legal actions.

If possible and you have the means to pay at least something, then it may be in your best interest to avoid the risk of getting taken to court.

Work with a debt relief specialist to find the best way to deal with your debt.

Recommended Reading: How Long Does Bad Credit Stay On Your Credit Report

Does Paying To Remove A Charge

Charged-off accounts are not going to be deleted from the credit report even if you offer to pay them. So its important for creditors and borrowers alike, that there is enough information provided when negotiating with a lender who has excess charge-offs on their books of business because they cant remove these debts any faster than usual!

What If The Creditor Wont Budge

This situation is entirely possible and can certainly take the wind out of your sails. That said, you should still make an effort to repay the debt, as having a paid charge-off is much better than an unpaid one on your credit report. If the creditor wont settle or remove it, however, it will remain on your report for seven years.

Don’t Miss: When Do Credit Card Companies Report Payments

How Can A Legit Charge

Once a charge-off is on your credit report, it will remain there for seven years. As time passes, it will affect your score less and less, but the damage will still linger. Most info on your credit report remains on there for seven years, although some informationlike bankruptcies, for instancewill remain on your report for longer.

If the charge-off is legitimateaka, if you really didnt pay back that debtthen getting the charge-off removed from your credit report is going to be exceedingly difficult. You cant simply ask nicely that the credit bureau removes it. After all, that charge-off is an accurate reflection of your credit history. That would be like asking your teacher to change a wrong answer on a test just to be nice.

What you can do is contact your original creditor. You can ask themvery politelywhat it would take in order to have the charge-off removed. At the very least, theyll likely ask you to pay back at least a portion of what you owe.

You and your creditor can then enter a Pay for Delete agreement. Under the terms of this agreement, you will pay off a certain percentage of your debt in return for the creditor updating your information with the credit bureaus and having the charge-off removed.

The Collection And Charge

Usually, creditors charge off a debt about six months after you stop making payments on the account.

- Accounts placed in collection. If your account is placed in collection, but not charged off, the original creditor still owns the debt. When you stop making payments, the creditor will often move the account into collections in-house for approximately six months. If successful, the creditor will retain all of the money it collects.

- Accounts charged off. After about six months, most creditors will sell the debt to a debt collector associated with the creditor or a company with no affiliation. Once sold, the creditor charges-off the account. A charge off doesn’t mean collection efforts will stop. Instead, the new owner of the debtthe debt collectorwill continue to take steps to collect on the account.

Read Also: Is 801 A Good Credit Score

When You Cant Remove A Charge

Even if you eventually pay off your debt to a credit issuer or collection agency, charge-offs typically stay on your account.

As charge-offs age, their overall impact lessens. Charge-offs remain on credit reports for seven years before falling off entirely.

Suppose your charge-off occurred at a young age, and you arent looking to get a mortgage, car loan, credit card, or another loan soon.

In that case, you might be able to deal with a lower credit score until the charge-off removes itself from your credit history.

However, having a good credit score carries several advantages. When you cant eliminate a charge off from your credit report, you can take other steps to fix your bad credit.

Related: How to Build Credit as a College Student

Beware Of This Credit Repair Strategy When It Comes To Collections And Charge

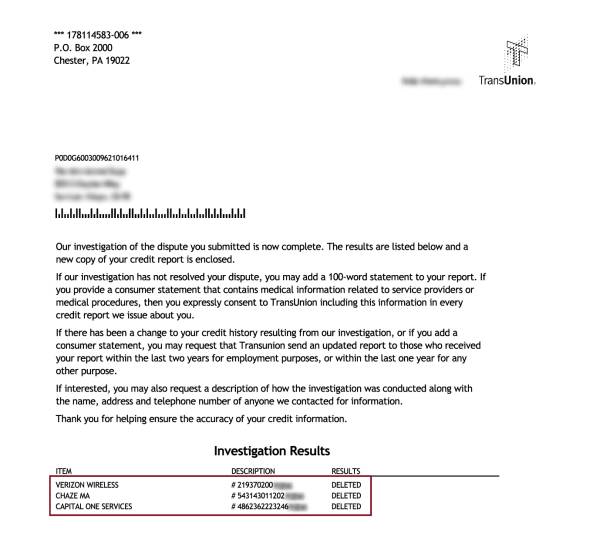

There are many so-called ” that coach you to raise your credit score by abusing the dispute process. In a nutshell, they instruct you to send letters to the three major credit bureaus disputing the legitimacy of every negative item on your credit report — late payments, collections, charge-offs, judgments, you name it.

- It doesn’t always work. If you have lots of negative information on your credit report, it’s likely that some of the creditors will verify the account on time. Many creditors are aware of this technique and do everything in their power to keep negative information on your report for as long as possible, especially if you owe a balance so you are incentivized to pay it.

- The negative item can come back. Just because a creditor doesn’t verify an item within 30 days and it gets removed doesn’t mean it’s gone for good. In most cases, a creditor can report a negative item for up to seven years from your first delinquency, even if the item was previously removed. So, many people find that their credit score increases significantly at first, only to fall again as the accounts reappear.

- It can backfire. For instance, let’s say that a creditor reports an account as delinquent, but doesn’t update their information often. By legally forcing them to verify it, they’ll also update their files. If one of your accounts is really a charge-off, but was still being reported as 60 days late, confirmation could actually have a negative effect.

Recommended Reading: How To Dispute A Judgment On Credit Report

You Arent Sure You Owe The Amount Listed On The Charge

Sometimes a collection agency will attempt to tack on bogus fees and interest. Unless the agreement you signed with the original creditor stipulates that a third-party debt collector can add their own fees and interest, they cannot do this.

It is also possible that you paid off the balance, but your account was flagged as a charge-off due to an error in the system. If you have any proof that the balance was paid, you absolutely should not pay it.

However, even if you dont have proof, having the debt verified may still work in your favor. A professional credit repair specialist will be able to advise you on the best course of action if you arent sure how to proceed.

A Charge Off Means Your Debt Is Overdue

Despite what its name may imply, a charged off account doesnt actually go anywhere. Instead, an account will become a charge off when it is significantly past due. For most account types, a charge off will occur after 180 days of missed payments, although installment loans can be charged off after 120 days of nonpayment.

After this time, most creditors will assume their chances of recovering the money are somewhere between zero and nil. The creditor consequently removes the account from active status and marks it as a charge off in its ledgers and on your credit report.

For the lender, the charge-off process is basically an accounting action. Deeming an account a charge off allows the creditor to write off the loss of the debt on their taxes, rather than count it as potential income.

From the consumer side, a charge off is an extreme form of credit delinquency. However, unlike an account with a mild delinquency, such as a single missed or late payment, an account that has been charged off is considered to be bad debt. When reported to the credit bureaus, a charge off will have a significant negative impact on your credit scores.

Paying off the full amount of the delinquent debt can lessen the credit score impacts of the charge off, but will not eliminate the impacts entirely. For some, the easiest way to deal with a charged off account may be to hire a reputable credit repair company to do the legwork for you.

+See More Credit Repair Companies

Read Also: How To See Your Credit Score

The Following Example Shows How The Credit Reporting Timeline Of A Charge

1/1/15: You become 30-days late on a payment to Imaginary Bank and Trust . 7/1/15: At 180-days past-due, IBT closes your account and marks it as a charge-off.1/1/22: The charged-off account must be deleted from your credit report by this date.

The credit bureaus and creditors can make mistakes. Whether on purpose or intentional, a mistake could result in a charge-off remaining on your credit report for too long.

Do you think a charge-off has been on your credit report longer than seven years? You or your credit repair professional may need to dispute the outdated account to try to fix the problem.

Improving Your Credit After A Charge

Whether you resolve your charge-off or not, in most circumstances, a charge-off will stay on your credit report for seven years from when the account first became delinquent. The rules established by the Fair Credit Reporting Act require that negative items be removed after this time frame. However, if you resolve your charge-off, the account will be marked as either paid in full or settled on your credit report.

While a paid charge-off account wont be removed from your credit report right away unless you reach a pay-for-delete agreement it can improve how future lenders perceive you. When you try to open a new credit account, the lender will see that you either paid off the account in full or settled the debt.

Since a paid charge-off may still appear on your credit report for a while, what effect will it have on your credit score, and what can you do to improve your credit score?

The act of paying a charge-off account may improve your score, depending on the scoring system used by a particular lender.

-

VantageScore doesnt include zero-balance charge-off accounts when calculating your score.

-

If a charge-off was due to medical collections, newer versions of the FICO scoring model will weigh it less heavily than other charge-offs and collections accounts. Medical collections wont be counted at all once theyve been paid off.

There are other actions you can take to improve your score and avoid additional charge-offs in the future, such as:

Read Also: Can Medical Bills Affect Your Credit Score

It’s Possible To Negotiate A Pay

Your is important for buying a home, getting a car loan in your name, or just opening a credit card account. A significant part of your score is based on how you manage payments for loans, credit cards, and other types of credit. Having an account fall delinquent can lead to a charge-off, which can cost you major credit score points.

Negative information, including charge-offs, can remain on your credit history for up to seven years. But it may be possible to remove a charge-off from your credit sooner than that so you can begin rebuilding your credit score.

How Does A Charge

Once the creditor writes off your account, it may report the account as charged off to the credit bureaus, which translates as a derogatory mark on your reports.

This derogatory mark can stay on your reports for up to a seven-year period from the date of the first payment you missed.

The creditor may have sold your account to a third-party collections agency if the debt was unsecured. In that case, the account could also appear as an account in collections on your reports.

If this happens, your may dip, and it may be more difficult to qualify for credit or get competitive interest rates.

You May Like: Does Checking Your Credit Report Hurt Your Credit