Minimum Credit Score By Mortgage Loan Type

The minimum credit score you need to qualify for a mortgage in 2021 depends on the type of mortgage youre trying to obtain. Scores differ whether youre applying for a loan insured by the Federal Housing Administration, better known as an FHA loan one insured by the U.S. Department of Veterans Affairs, known as a VA loan or a conventional mortgage loan from a private lender:

|

Type of loan |

|

|

FHA loan requiring 3.5% down payment |

|

|

FHA loan requiring 10% down payment |

500 – Quicken Loans® requires a minimum score of 580 for an FHA loan. |

|

VA loan |

Keep Old Accounts Open And Deal With Delinquencies

The age-of-credit portion of your credit score looks at how long youve had your credit accounts. The older your average credit age, the more favorably you appear to lenders.

If you have old credit accounts that youre not using, dont close them. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio. That could knock a few points off your score.

And if you have delinquent accounts, charge-offs, or collection accounts, take action to resolve them. For example, if you have an account with multiple late or missed payments, get caught up on what is past due, then work out a plan for making future payments on time. That wont erase the late payments but can improve your payment history going forward.

If you have charge-offs or collection accounts, decide whether it makes sense to either pay off those accounts in full or offer the creditor a settlement. Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. Paying off collections or charge-offs might offer a modest score boost. Remember, negative account information can remain on your credit history for up to seven yearsand bankruptcies for 10 years.

Become An Authorized User On Someone Elses Account

If you have a family member who has good credit, ask if theyd consider allowing you to become an authorized user on their account. As an authorized user, you get a credit card in your name that is attached to their card, allowing you to make purchases and use the card as if it is yours, but you are not legally responsible for the debt.

The cardholders positive credit history will help you build your own credit, as long as they dont have an excessive balance and payments are made on time.

Read Also: Comenity Bank Soft Pull Credit Cards

Boost Your Credit To Buy A House

With some financial discipline and the use of these tips, you can effectively increase your credit score.

It may not be instant, but you might see the improvement in two to three months with proper management. When your goal is to build your score, time is on your side. The more you do to improve your credit, the more time it can take.

Any extra amount you spend when going for fast credit repair for a mortgage will be worth it. With a better credit score, you might be able to qualify for a decent mortgage. It will also save you from some added insurance expenses when you are qualifying for a mortgage. In the long run, you will be able to save much more when you have a higher credit score.

After youve taken these steps to increase your increased credit and you are ready to buy a home, contact one ofour agents to get that process started. We can help you through the buying process and get you the home of your dreams.

How To Buy A House With Bad Credit: 5 Steps You Can Take

goodluz / Shutterstock.com

Your credit history is one of the most important factors that lenders consider when deciding whether to approve a home loan. Potential borrowers with bad credit may have trouble getting a loan, but it may be possible to be approved despite the low credit score.

Read Also: Syncb/ppc Credit Card Login

Improve Your Credit Score With Sensible Credit

Not enough or too much credit? You might think not having any credit at all is a good thing. Actually, having no credit leads to a low credit score because theres no evidence that you are a prompt and responsible repayer.

Try using a credit card with a low spending limit to buy your weekly food shop or petrol and then pay off the balance straight away. Or, use a no-interest credit card deal to buy your bedroom furniture and pay it off in full before the offer ends.

Relying too heavily on credit is also damaging. Having one or two high loan balances that youre paying off is not the end of the world. But having lots of credit cards or overdrafts that are either maxed-out or close to their limit can knock points off your score.

Using less than 30% of a cards limit can lift your Experian score by around 90 points.

How Credit Scores Affect Mortgage Interest Rates

Your credit score can have a major impact on the overall cost of your loan. Each day, FICO publishes data that shows how your credit score could affect your interest rate and payment. Below is a snapshot of the monthly cost of a $200,000, 30-year fixed-rate mortgage in December 2021:

| 4.424% | $1,004 |

That’s an interest variance of over 1% and a $178 difference in monthly payment from the 620 to 639 credit score range to the 760+ range.

Those differences can really add up over time. According to the Consumer Financial Protection Bureau , a $200,000 home with a 4.00% interest rate costs over $40,000 more overall over 30 years than a mortgage with a 2.75% interest rate.

Also Check: What Is Syncb Ppc On My Credit Report

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Check Your Credit Report For Errors

The FTC found in 2012 that one in five credit reports contained errors. This is why you should periodically review your credit reports for any erroneous items. These mistakes can add up and drastically impact your score if theyre not removed. And thanks to the Fair Credit Reporting Act , you have every right to dispute your credit report whenever you find inaccurate information.

Buying a home can be more complicated when you have below-average credit. This is why its important to work on repairing your credit errors long before it comes time to buy property. Itll take some time, but its doable with the right resources. Follow our tips above to raise your score and open the door to a better home loan.

You have the will, we have the way. Let us help you fix your credit. Call today to get started

Reviewed by Brittany Sifontes, an Associate Attorney at Lexington Law Firm. by Lexington Law.

Brittany is an attorney practicing in the area of consumer advocacy with Lexington Law Firm. At Lexington, Brittany assists clients with credit repair. Brittany attended the University of Colorado at Boulder for her undergraduate degree and attended Arizona Summit Law School for her law degree. At Arizona Summit Law school, Brittany graduated Summa Cum Laude and ranked 11th in her graduating class.

You May Like: Affirm Credit Score Needed For Approval

Does Getting A New Credit Card Hurt Your Credit

Getting a new credit card can hurt or help your credit, depending on your situation. It can help to increase your credit mix and improve your credit utilization percentage, but it will add a new hard inquiry to your account and make your average credit age youngerboth of which could lower your score. For those in the credit-building stage, adding a new credit card will most likely lower your score in the short term but also lead to a stronger credit score in the long term.

Increase Your Available Credit

Once you get a better handle on things and have started improving your score, increasing your available credit can help raise it a little faster. You can do this by either paying down balances or making a credit limit increase request. This effort helps increase your score because you will decrease your credit utilization, which is a huge factor in determining your credit score.

And guess what: Most credit card companies allow you to request as many increases as you like without it causing a hard pull on your credit.

Don’t Miss: How To Remove A Repossession From Your Credit

How Is My Credit Score Determined

Your credit score is a combination of data from the three credit reporting bureaus. Each bureau may give you a slightly different score depending on which lenders, collection agencies and court records report to them, but your scores should all be similar. The following is a rough breakdown of how credit bureaus calculate :

- Payment history:Your payment history includes factors like how often you make or miss payments, how many days on average your late payments are overdue and how quickly you repay an overdue payment. Each time you miss a payment, you hurt your credit score.

- Current loan and credit card debt :Your current debt comprises factors like how much you owe, how many and the types of cards that you have and how much credit you have available. Maxed-out credit cards and high loan balances hurt your score, while low balances raise your score assuming you pay them off, of course.

- Length of your credit history :The longer your credit history, the higher the probability that youll follow the same credit patterns. A long history of on-time payments improves your score.

- Account diversification :Creditors like lending to borrowers who have a mix of account types, including home loans, credit cards and installment loans.

- Recent credit activity :When you open a bunch of cards or request a sudden increase in credit, creditors may believe that youre in financial trouble. Dont apply for multiple accounts at once, or your credit may take a hit.

The Minimum Credit Score Needed To Purchase A Home Can Be Anywhere From 580 To 640 Depending On The Type Of Mortgage

Your credit score is one factor that can make or break your house hunt since it plays a big role in a lenders decision-making process.

In addition to dictating the types of loans youre eligible for, your credit score is also one factor that helps lenders determine your interest rate and other fees related to the loan. This is why its important to take a look at your credit score and understand all of the ways it will impact the purchase of your future home.

Weve updated this guide for 2021 to make sure you understand what you need during your search this year. Our guide identifies the ideal credit scores for different types of loans and explains both how your credit score influences the home-buying process and what you can do to improve your credit score.

Don’t Miss: Syncb/ppc Account

Pull Your Credit Report

There are three major U.S. credit bureaus , and each releases its own credit scores and reports . Their scores should be roughly equivalent, although they do pull from different sources. For example, Experian considers on-time rent payments while TransUnion has detailed information about previous employers.

To access these scores and reports, financial planner Bob Forrest of Mutual of Omaha recommends using AnnualCreditReport.com, where you can get a free copy of your report every 12 months from each credit-reporting company. It doesnt include your credit score, thoughyoull have to go to each company for that, and pay a small fee.

Or check with your credit card company: Some, including Discover and Capital One, offer free access to scores and reports, says Michael Chadwick, owner of Chadwick Financial Advisors in Unionville, CT. Once youve got your report, thoroughly review it page by page, particularly the adverse accounts section that details late payments and other slip-ups.

Avoid Taking On Further Debt

During the period when youre preparing to buy a home, and even while youre going through the process of taking out a mortgage, its imperative that you avoid taking on any further debt.

Opening up new debt accounts will negatively impact your credit score. So its important to wait until after youve closed on your home to consider taking on a new loan.

Pro tip: Even if youve already applied for a mortgage and been approved by your lender, you could jeopardize your home loan if you take on additional debt before the deal is closed. Mortgage lenders monitor your credit throughout the entire lending process, which takes an average of 45 days nationally to complete. Any changes could delay or even upend your financing.

Also Check: Delete Hard Inquiries

Dont Open Any New Accounts

Its not a good idea to apply for new credit accounts before trying to get approved for a home loan. A credit card or loan application can lead to an inquiry on your credit, which can hurt a credit score if too many inquiries are made at one time.

Having six or so inquiries on a credit report in a short period can make you look desperate for money and make lenders suspicious of your creditworthiness. Even if the inquiries are stretched out over time, it can look like youre in need of extra credit.

The one bit of good news here is that if youre shopping for the best interest rate for a car loan or a home loan, the credit reporting agencies will consider inquiries made within 14 days of each other as only one inquiry. FICO ignores inquiries made within 30 days of scoring.

What Do Mortgage Lenders Consider A Bad Credit Score

Most borrowers dont know this, but many lenders dont require a specific minimum credit score to buy a house. The catch-22 is that a conventional mortgage lender is free to set their own requirements when it comes to your credit score. Although government-backed loans give mortgage lenders some peace of mind, they still have credit score requirements, even if they are usually much lower.

If you have a credit score lower than 500, you might find getting a mortgage a bit hard and will probably need to focus on increasing your score first.

Also Check: Klarna And Credit Score

Paying A Mortgage Shows You Can Be Trusted

Provided a change in circumstances doesnt cost you your home, you can expect to eventually pay off the mortgage. Whether you remain in the house for the duration of the loan term or sell the home, the fact that you paid off a large debt will appear in your credit report. The paid-off mortgage will remain within your credit history for seven years and demonstrate to future lenders that you can be trusted to pay your debts responsibly.

How To Quickly Improve Your Credit Score

Recommended Reading: Is Opensky Reliable

Challenge Discrepancies That Affect Your Credit To Buy A House

This should be one of the first things you do when attempting to fix your credit. Credit reporting companies are liable to give you one free credit report a year, its a detailed breakdown of your credit history.

According to an FTC study, one in four credit reports had errors with a noticeable impact on the credit score. No matter the mistake on the report, you can challenge them.

Challenging credit discrepancies also works for removing late payments from your credit score.

People managed a jump up more than 80 points in their credit score, in a single month due to them disputing late payment discrepancies with their credit reporters. It also works with any score drop you incurred because of hard inquiries from applying for credit cards.

Whats A Good Credit Score To Buy A House

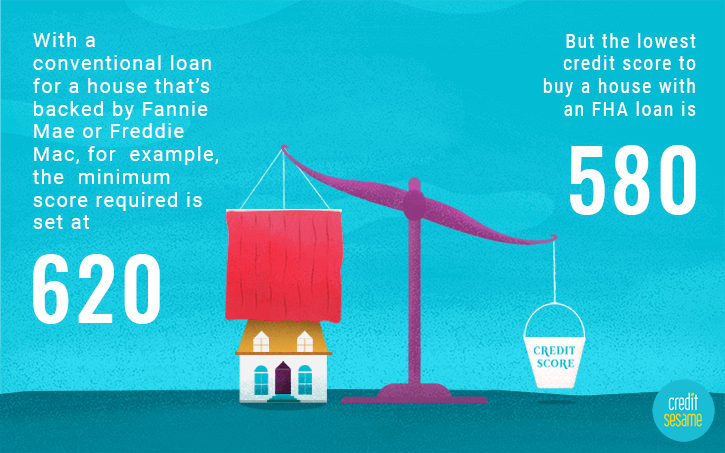

Generally speaking, youll need a credit score of at least 620 in order to secure a loan to buy a house. Thats the minimum credit score requirement most lenders have for a conventional loan. With that said, its still possible to get a loan with a lower credit score, including a score in the 500s. How?

You May Like: Eviction Credit Report

Get Late Payments Removed

Before disputing late payments you should contact your creditors and tell them you have a late payment on your credit report on your account and you believe its inaccurate. They may remove it as an act of goodwill for customers who have been with them for awhile.

I had a creditor remove a late payment from my credit report by calling and coming up with an excuse for why it was late. They removed it as an act of goodwill because I had been a customer for several years. If that doesnt work, you can start disputing it with the three major credit reporting companies.

I had four late payments with two different creditors at one point. I contacted the creditors and got one removed and disputed the other 3 with the Credit Bureaus. I was able to get another one removed, and my credit score jumped up by 84 points.