Financing Options With The Amazon Store Credit Builder Card

The following finance options are available:

Special Financing Option

No interest is charged if you pay in full within the stipulated time frame. Depending on your purchase amount, this timeframe can be six, twelve, or 24 months.

Remember that this is deferred interest and not a 0% APR offer. If you fail to pay within the designated time frame, youll be charged the full interest accrued.

This financing option applies only to qualifying items. With this finance option, youll not be eligible for the 5% rewards rate.

Equal Pay Option

This option extends equal monthly installments, which must be paid back within a fixed timeframe. Depending upon your purchases, the time frame can be six, twelve, or 24 months. If you pay within the fixed timeframe, no interest will be charged.

This financing option applies only to qualifying items. Youll not be eligible for the 5% rewards rate with this finance option.

Does Afterpay Run Your Credit Score

No credit check is required to use AfterPay, and no interest is charged. Customers can sign up for a free AfterPay account, shop at select online retailers, and then use AfterPay to make purchases. Requirements include: … Customers may pay in four installments every two weeks until the entire purchase is paid off.

What Credit Score Do You Need For An Amazon Credit Card

For the Amazon Prime Rewards Visa Signature Card, a credit score of 640 or better is recommended.

Rewards cards in general, including the Amazon Rewards cards typically require good to excellent credit as defined by FICO. Amazon generally defines a good score as above 680 and an excellent score as above 720.

If you have fair or poor credit, consider the Amazon Credit Builder Card as you can be approved even with limited or bad credit.

Don’t Miss: How Long Do Inquiries Stay On Chexsystems

Drawbacks Of Amazon Prime Rewards Visa Signature Card

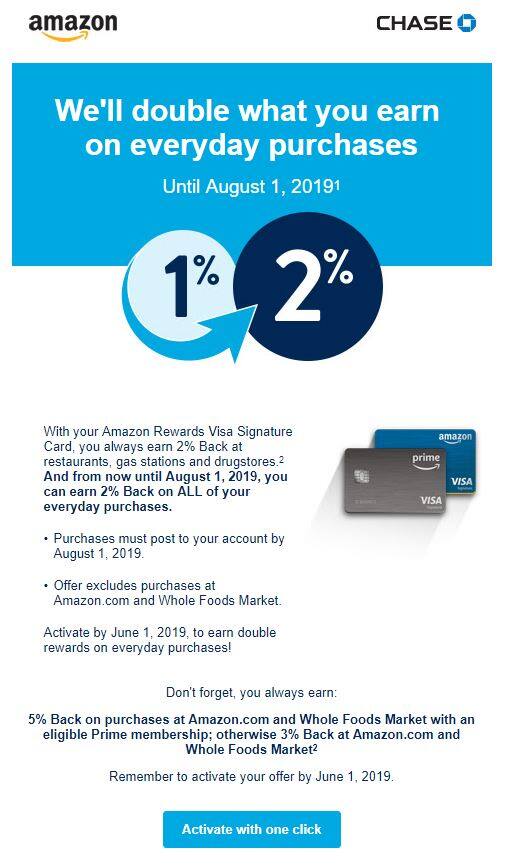

Like any co-branded card, the Amazon Prime Rewards Visa Signature has rewards most beneficial for frequent Amazon shoppers. And while the additional everyday rewards categories restaurants, gas stations, and drugstores can help add value, there are other cards with better rewards rates in these categories. If you dont have a Prime membership, buy from the online retailer often, or do most of your grocery shopping at Whole Foods, youll probably get a better value elsewhere.

Another drawback of this card is its relative lack of added benefits. The travel and purchase protections offered through Visa Signature are robust, but you wont get any annual credits, additional perks, or intro APR offer which some competitors may provide.

Get Your Foot In The Door With The Amex Charge Card

American Express offers both credit cards and charge cards. These are two different products, and its a little easier to qualify for a charge card since your credit score doesnt need to be as high.

Charge cards are unsecured lines of credit, just like credit cards.

But the major difference is that charge cards dont come with a credit limit. That sounds exciting at first, though it means you can get into serious trouble if youre not careful with how much you purchase on the card.

Charge card statements are issued at the end of every month, and you owe the full balance when it hits. Fail to pay back what you charged, and AMEX will charge you about 3% of whatever you put on the card.

AMEX could also cancel your card if they feel you exceed your reasonable ability to repay your balance. So be careful if you apply and receive one of these cards.

If you cant qualify for an AMEX credit card or dont think your credit score is high enough to get approved you can try a charge card first. This helps you get your foot in the door with the issuer since youll have an account with them.

That, in turn, could help increase your chances of getting approved for a credit card in the future.

Just track your spending and card usage carefully, so you never spend more than you can afford to repay and maintain a good history of on-time, in-full payments.

And now its time for our last strategy

Don’t Miss: Credit Inquiries Fall Off

Unlimited 2% Cash Back On Common Business Expenses

Heres a handy reward for business owners that isnt specific to Amazon purchases. Youll be earning an unlimited 2% back on common business expenses, including:

- US restaurants

- US gas stations

- Wireless telephone services purchased directly from US service providers

Because these are common business expenses, the Amazon Business Prime card might be more useful for your business.

Business Expense Management Tools

This card gives you access to a host of expense management and tracking tools, such as a mobile app that allows you to save receipt photos and oversee employee spending. You can also send your transactions over to your QuickBooks account, should you have one. Furthermore, you can use your card to pay bills with Vendor Pay by Bill.com, though youll have to enroll in the program, and there may be monthly fees involved if theres more than one user.

You May Like: Optimum Outcomes Inc Collections

How The Amazonca Mastercard Compares To Others

Beyond the Amex Cobalt and Scotiabank Gold Amex which I mentioned above, there are quite a few credit cards that compare to the Amazon.ca credit card, but it really comes down to where you shop.

For example, the PC Financial World Elite Mastercard gives you a much higher earn rate at Loblaws owned stores, Shoppers Drug Mart and Joe Fresh. If you paired that with PC Insiders, you could be rolling in the PC Optimum points. Despite the higher earn rate, this card only benefits you if you shop at stores where you get a higher earn rate. In other words, the PCF World Elite Mastercard wont benefit you if you do all your shopping on Amazon.

The other comparable card is the Triangle World Elite Mastercard which is targeted at people who do a lot shopping at Canadian Tire, Sports Check, Marks and Atmosphere locations. Like the PCFWEMC, the Triangle card is good where you can earn additional points, but its pretty basic if youre shopping on Amazon.

A lot of people like this card because it has no foreign transaction fees. While thats true, there are other credit cards out there that are better and have no foreign transaction fees. For example, the Wealthsimple Cash Card has no foreign transaction fees on purchases and ATM withdrawals. This is handy for people who need cash when travelling. Plus, you get $10 for free when you sign up with my referral link.

How Can I Pay My Chase Credit Card

Rewards vs. Fees. If youre paying your mortgage or rent with a credit card,youre probably looking to accumulate points.

How do you get a Chase credit card?

Select Chase credit card members are already eligible for a year of complimentary DashPass membership when they enroll by March 31,2022.

Which Visa card has the best rewards?

Earn 5% cash back on travel purchases made through Chase Ultimate Rewards,3% on dining and 3% at drugstores.

Are Amazon credit cards worth it?

With the Amazon Prime Rewards Visa Signature card, you get 5% cash back on every purchase that you make on Amazon or Whole Foods. Because this 5% offer is available year-round, it beats the rewards rate for Amazon purchases on any other rewards card.

You May Like: Does Capital One Report Authorized Users To Credit Bureaus

Amazon Credit Cards: What Are Your Options And Which Is Right For You

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you’ve found those ubiquitous “smiling” cardboard boxes piling up at your front door after rounds of online shopping, you may have considered an Amazon credit card.

Charging your purchases on an Amazon credit card can be a rewarding decision if youre a frequent Amazon shopper. But just as Amazon has a dizzying amount of choices to shop for on their website, the retailer also offers many credit card options.

Heres everything you need to know about the five different Amazon credit cards that span personal and business credit card options, and how to choose which one is right for you.

How To Use The Amazon Prime Rewards Visa Signature Card

To make the most of the Amazon Prime Rewards Visa Signature Card, youll want to add it as the default form of payment to your Amazon.com account right away. Youll have the $150 gift card earned upon opening your account in there already, and you can begin earning 5% back on all your Amazon.com purchases without any limits. It can also occasionally earn you up to 20% back on rotating categories and products.

Really maximizing that 5% category may require changing your shopping habits to ensure you purchase more of your regular budget items with the online marketplace or at your local Whole Foods. Consider setting up automatic shipments of toilet paper or diapers, for example, or trying out Amazons grocery delivery service.

In the meantime, you can also boost rewards by using the card for your purchases in 2% cash back categories: restaurants, gas stations, and drugstores. If you have another card that earns a higher rewards rate in these common everyday categories though, you may find more value in reserving this card solely for Amazon.com and Whole Foods purchases.

Also Check: Leasingdesk Screening Reviews

Flexible Financing Options On Qualifying Purchases

If you look to periodically finance larger Amazon.com purchases and wish to defer payments as long as possible, then you should consider the Amazon Prime Store Card. Both the Amazon Prime Store Card* and the Amazon Prime Rewards Visa Signature Card* offer 0% financing options that allow you to split your purchases into equal monthly payments. But only the Prime Store Card offers another option.

The Amazon Prime Store Card* comes with equal payment 0% financing offers available in one of the following ways:

- 6 months on purchases of $150 or more

- 12 months on purchases of $600 or more

- 24 months for select purchases.

The Amazon Prime Store Card* also offers a twist on these options for purchases of $150 or more. At checkout you may receive an offer for different promotional terms, which they call special financing and could come in one of the following ways:

- 6 months of financing on on purchases of $150 or more

- 12 months on purchases of $600 or more

- 24 months on select purchases

The Amazon Prime Rewards Visa Signature Card* only offers equal payment financing on purchases of $50 or more in one of three ways:

- Six equal monthly payments on purchases of $50 or more

- Twelve equal monthly payments on purchases of $250 or more

- Eighteen equal monthly payments on purchases of $500 or more

There are no other financing options offered on the Amazon Prime Rewards Visa.

What Credit Score Do You Need For Amazon Credit Card

Asked by: Dr. Zachery Schamberger I

You must have a good credit scoreat least 670to be considered for either of the co-branded Amazon Signature Visa cards. Amazon also offers two store cards, but these cards are not credit cards. The cards are used for purchases on Amazon.com but eligible for use in Whole Foods markets.

Recommended Reading: Does Overdraft Affect Credit Score

Which Credit Card Should You Use On Amazon Gift Card

The Amazon Prime Rewards Visa Signature Card is arguably the best option for Amazon Rewards or cash rewards. However, you must be an Amazon Prime member to use this card. It is also a metal credit card that has no annual or outgoing transaction fees. You can also receive a $100 Amazon gift card immediately upon approval.

How Does Amazon Compare With Other Providers

Amazon credit card customers gave the brand 71% in our latest , placing it towards the bottom of our table in joint 17th place.

| Mobile app on a smartphone or tablet |

3 out of 5 |

Star ratings out of five show levels of satisfaction for each category. Where no stars are given, we received too few responses in our survey to give a rating.

You May Like: Speedy Cash Late Payment

Don’t Miss: Comenity Bank Shopping Cart Trick

What Credit Score Do You Need For Amazon Rewards Card

As a traditional credit card, youll likely need a of at least 660 to be approved for the Amazon.ca Rewards Mastercard. Note that your credit score takes a hit of 10 points when you apply.

Besides the credit score, you only need to be a resident of Canada and the age of majority in the province or territory where you live. Getting approved is easy, so it could be handy for people who are looking to maximize their rewards.

How Do You Activate An Amazon Prime Card

Find the application code. Remark. For plastic gift cards, you may need to scratch off the cover on the back of the card to see the redemption code. Log in to your account. Click Add gift card to your account. Enter the app code and click Apply credit. Remark. You can also enter a claim code during checkout.

Don’t Miss: Removing Repossession From Credit Report

How To Pay An Amazon Credit Card

To complete your payment for your or Amazon Rewards Visa Signature, follow these steps:

1. If you have not set up an online Chase account yet, go to . If you have already set it up, sign in to your online Chase account.

2. Scroll down to locate your Amazon Visa Card and click Pay credit card.

3. Select Statement Balance, Current Balance, Minimum Due or specify another amount youd like to pay. Then, click Next.

4. Verify that the payment information is correct and click Schedule Payment.

To complete your payment for your Amazon Store Card or your Amazon Secured Card, follow these steps.

1. Sign in to your Synchrony Bank account at or link your Amazon and Synchrony accounts at to navigate directly to Synchrony from the Amazon site.

2. Hover over Payments at the top of the page, and then scroll down and click Make a Payment.

3. Select Minimum Payment, Statement Balance , Current Balance or Other.

4. Enter your banks routing number and checking account information in the requested fields and confirm your banking information.

5. Verify that the information is correct and click Make a Payment.

Looking For A Credit Card With Poor Credit

If you currently have only limited, poor, or average credit, and are looking for a real credit card, we currently recommend theMilestone® Gold Mastercard®instead of the Amazon.com Card.

This is because the Milestone® Gold Mastercard® allows you to see if youre pre-qualified before you apply for the card so you dont have to risk having your credit pulled, only to be denied a card.

The Milestone® card is a Mastercard® which means that it can still be used on Amazon and at millions of merchants around the world.And your application will be considered even if you have a prior bankruptcy.

Recommended Reading: How To Remove Hard Inquiries Off Your Credit Report

What Credit Score Do You Need For A Kohl’s Card

The Kohl’s Credit Card approval requirement is a credit score of 640 or higher this means you need at least fair credit to get approved for this card, in most cases. Keep in mind, though, that credit card issuers also consider your credit history, income and existing debt obligations when making approval decisions.

How Is The Amazon Credit Builder Card Different From Other Cards

Those familiar with credit cards know that they are different than regular prepaid cards or debit cards. For one thing, the payments made with them come from a credit line, not a bank account or prepayment. You also have to make monthly payments for however much you spent using the credit card, usually with significant interest. You probably know about visa credit cards and others credit cards companies that work in the same way. Many of them are in the market and be secured cards to use*.

But the real question is:

Don’t Miss: Comenity Bank Uses What Credit Bureau

Quick Look: Amazon Store Cards Vs Credit Cards

| Amazon.com Store Card | |

| Good | Excellent, Good |

Now well jump into the details of the four Amazon credit cards and compare how they stack up against each other, especially in regards to their rewards program. This will help you understand whether one of the Amazon store cards or one of the Amazon Rewards Visa cards would be a better fit for you.

Quick Note: Amazon Store Card Vs Amazon Prime Store Card

It can get confusing talking about Amazon store cards as a whole because theyre actually two different cards. Where it gets more confusing, though, is that you can only apply for the Amazon.com Store Card.

To get the Amazon Prime Store Card, you have to already have the standard Amazon Store Card and an eligible Amazon Prime membership. This will qualify you for an automatic update to the Amazon Prime Store Card.

If youre approved for the Amazon Store Card and dont have a Prime membership, youll end up with the non-Prime Amazon.com Store Card, which doesnt offer any earning potential.

The two Amazon Rewards Visa cards work similarly. Whether you receive the Amazon Rewards Visa Card or Amazon Prime Rewards Visa Card depends on whether you have an eligible Amazon Prime membership.

Recommended Reading: Does Uplift Report To Credit Bureaus