The Reality: Reduced Credit Card Utilization

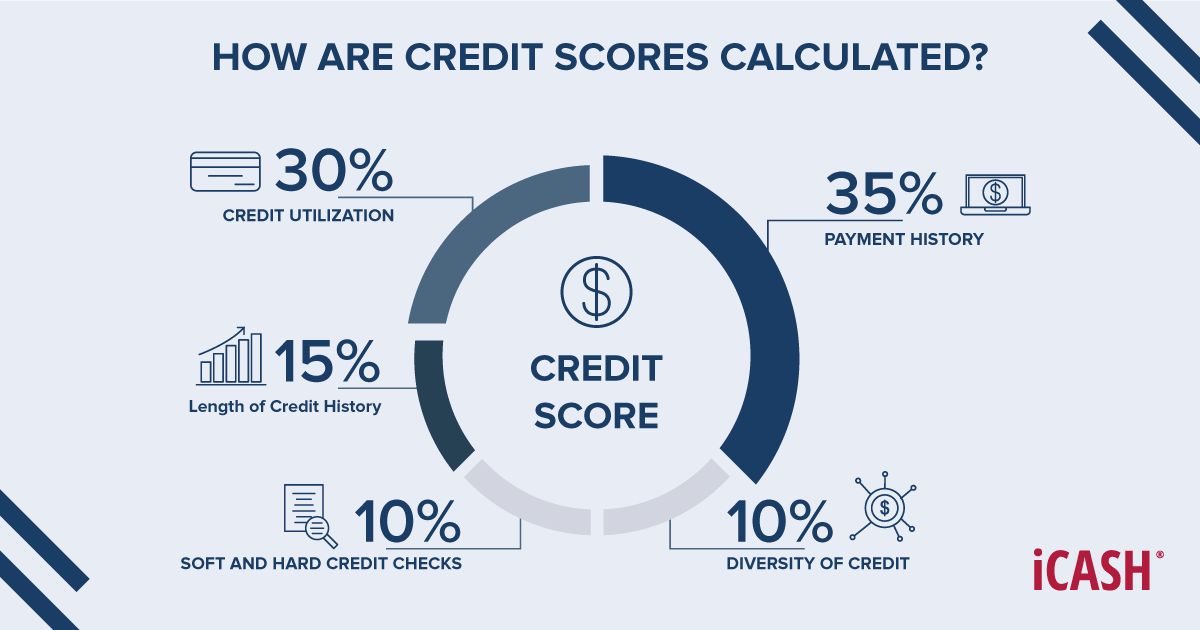

While it wont double your payment history, the 15/3 credit card payment hack can help you reduce your reported amounts owed, which is worth 30% of your FICO score .The 15/3 Credit Card Payment Hack: How, Why, and When It Works Click To Tweet

More specifically, it reduces your credit card utilization ratio, which is the percentage of your available credit that youve used to make purchases at any given time. It equals your outstanding balance divided by your credit limit.

For instance:

In the example above, John had a credit card balance of $100 on his statement date and a credit limit of $2,000.

His credit card utilization ratio would be $100 divided by $2,000, which equals 5%.

In general, the lower your ratio is, the better your credit score will be. If you show lenders that you max out your credit cards each month and consistently carry around a utilization ratio nearing 100%, it would suggest youre more likely to overspend, miss a payment, or default.

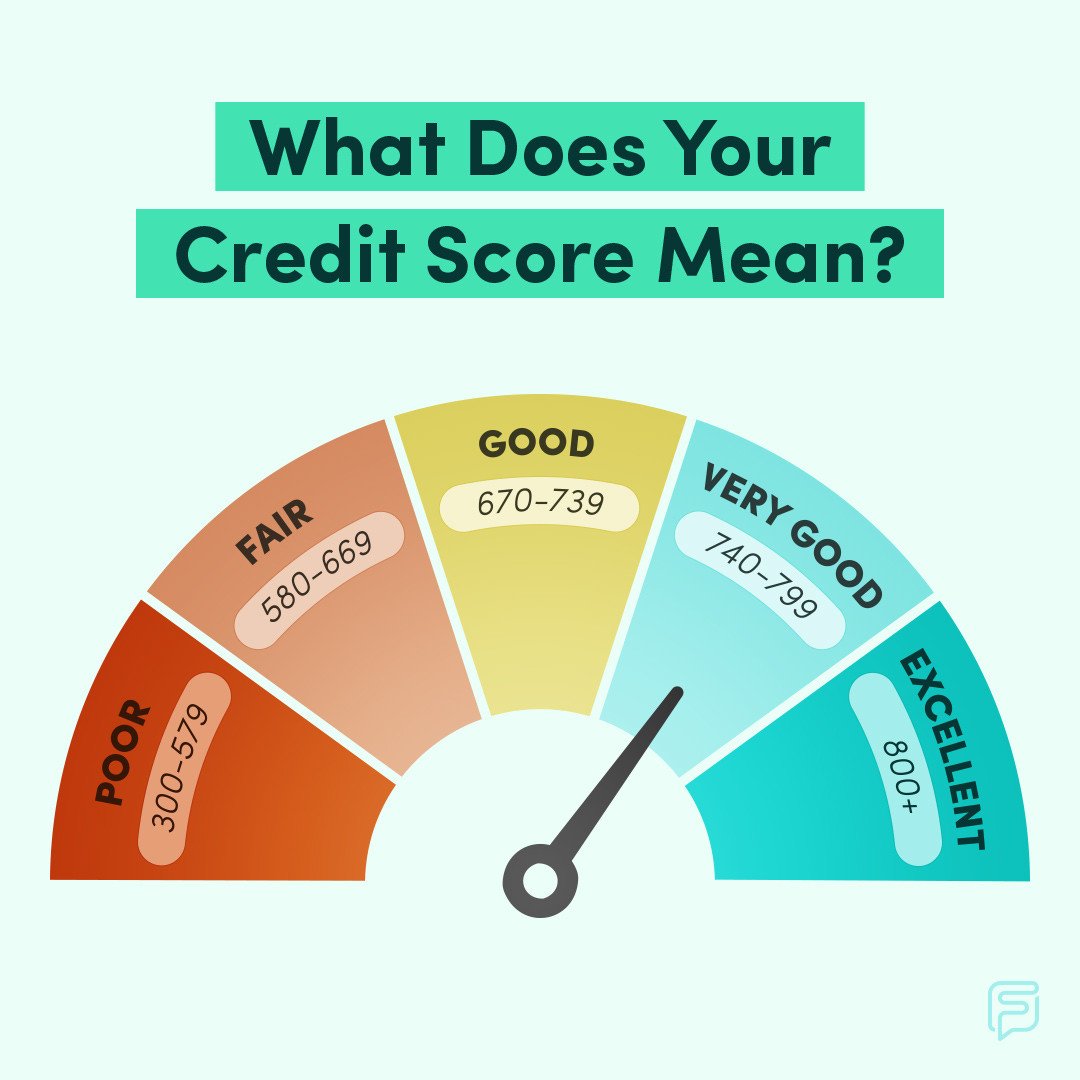

A popular rule of thumb is that 30% is the maximum ratio you can get away with, but the ideal is usually between 1% and 10%. Note that a 0% ratio might not be optimal, but it will still be far better than a high ratio. Consumers with FICO scores over 795 have an average 7% credit utilization rate.

Both your total and per-card utilization ratios matter. If you have multiple credit cards, use this credit utilization calculator to determine the best approach to paying off your balances.

How Paying More On Your Car Payment Affects Your Credit

Paying more on your car loan affects your credit scoreand not necessarily in a positive way. Here’s what you need to know.

If you make an extra car loan payment once or twice, it probably won’t impact your credit score at all. However, if you consistently make extra payments and pay off your car loan early, it can actually hurt your credit scoreespecially if you’re just starting to build credit, don’t have many credit accounts or are trying to improve your credit score.

Once your loan is paid off, the account will be closed. Although closed accounts may show you successfully managed credit in the past, open credit accounts have a greater impact on your credit score because they show lenders how well you’re managing credit in the present. Your credit score also takes into account how long you have been using credit, so if your auto loan is your oldest credit account, closing it can hurt your credit score.

Finally, paying off your car loan could hurt your credit score if all of your other credit accounts have high balances. That’s because is a factor in your credit score. Find out more about how paying off a car loan early can hurt your credit score.

Pay Down Your Debt Faster

Using the same principle for paying down your mortgage more quickly, the same can be accomplished with your .

With a mortgage, you can split your monthly payment in two and pay it every two weeks. That results in 26 half payments, which is equivalent to 13 monthly payments. That one extra payment each year reduces the time it takes to pay off a 30-year mortgage by seven years. You can accomplish the same thing by dividing your monthly credit card payment in two and paying it every two weeks.

The faster you pay down your debt, the less you pay in monthly finance charges. How much could you save? Check out our Debt Payoff Calculator to find out!

Don’t Miss: How Long Late Payments Stay On Credit Report

This Easy Trick Will Improve Your Credit Score And Avoid Late Payments

Paying bills on time is one of the easiest ways you can raise your credit score. Your credit payment history accounts for up to 35% of your FICO score, according to myFICO. Keeping track of due dates is one way to curb late fees. Splitting your bills into bimonthly payments also helps you avoid late or missed payments, and it can save you money, too.

Learn how to raise your credit score by splitting your monthly payments in two and paying off debt bimonthly. This trick can help you better manage your finances while showing creditors youre a reliable borrower. Heres how to improve your credit score and avoid late payments and fees.

Do Frequent Payments Affect Credit Score

There are just a few small issues to be aware of. How frequent payments affect your credit score: Your payment history makes up 35 percent of your score and is the most important factor for your credit rating. The rating agencies base this factor entirely on whether you make your minimum payments on time.

Recommended Reading: What Is 11 Sprint On Credit Report

‘tricking’ Yourself Into Paying More

If you created a steady repayment plan for yourself, a quirk of the calendar means youll pay more overall if you pay more often. Say youre paying $400 per month toward your credit card balance. Instead, try paying $100 per week.

Isnt that the same thing? It would be if the year consisted of 12 months of four weeks each. But a year has 52 weeks. Paying $100 per week instead of $400 per month means youll pay an extra $400 annually toward debt.

How Does Credit Utilization Work

As youve probably deduced by now: Debt plays a major role in ones financial life. Not only can it affect your spending ability, but debt can severely impact your as well as your ability to borrow money and/or pay a low insurance rate.

So, how does credit utilization work exactly? Lets breakdown some numbers:

If you have $5,000 total credit available over three cards and a balance of $2,500 then you are using half of your credit, which when calculated leaves you with a 50 percent credit utilization rate. Additionally, if you feel so inclined, you can calculate your credit utilization ratio for each credit account, known as individual utilization ratio or per-card ratio.

To calculate, simply readjust your calculations to represent the balance on an individual card and then use that cards credit limit. For example: $2,000 is your credit limit on one card and the balance on the card is $500. So, your calculations should look like this: .

Recommended Reading: How Often Do Credit Cards Report

Does Getting More Credit Cards Affect Your Credit Score

When it comes to your credit score, how you use credit cards is more important than the number of cards you have. Whether you own two credit cards or 12, your score will suffer if you accrue debt you can’t pay.

On the other hand, if you use your cards to pay for purchases that you then pay off right away, having more credit cards can result in a credit score increase. That’s primarily because more cards result in a higher combined credit limit. If you use only a small portion of that limit each monthexperts recommend 30% or lessthe credit scoring algorithms will reward you for responsibly managing credit.

But this means that it’s important to keep spending in check. Consider sticking to a monthly budget to help, or using certain credit cards only for specific purchases. It’s also crucial to pay off your balance completely each month, and on time. That will ensure your credit cards are working as hard as possible for you and your credit score.

Request A Credit Increase By Phone

If you dont think your case is straightforward, you may want to call your card issuer and speak with a representative. Speaking by phone will allow you to provide additional information beyond what will be available through online forms.

Calling is also a good way to find out what type of credit check your issuer requires in order to process your request. Soft inquiries wont be evident to other lenders who evaluate your credit report, but hard inquiries are visible for at least 12 months. Hard inquiries can also temporarily lower your credit score by a few points. A hard pull vs. a soft pull on your credit matters if you anticipate applying for a mortgage, auto loan or new credit card in the near future.

You may also want to make your request by phone if you have an urgent need for a credit increase, such as a large, imminent purchase. The associate you speak with can expedite the information collection process so that you dont have to wait for follow-ups. Of course, you still might not get an instant decision.

Dont Miss: When Do You Get A Credit Score

You May Like: What Credit Score Do You Need For Care Credit Dental

Do Credit Card Companies Like When You Pay In Full

Credit card companies love these kinds of cardholders, because people who pay interest increase the credit card companies’ profits. When you pay your balance in full each month, the credit card company doesn’t make as much money. … You’re not a profitable cardholder, so, to credit card companies you are a deadbeat.

Figure Out How Much Money You Owe

Gather all your bills and come up with a plan to pay them off. The snowball method focuses on paying off the lowest balances first, while the avalanche method focuses on paying off the balances with the highest interest rates first. If you have too many credit cards to keep track of, you could also consolidate your credit card debt into one balance transfer card to make it easier to manage your monthly payments.All three strategies could help you pay off your credit card debt more quickly, lower your credit utilization ratio and raise your credit scores. So, choose the plan that works best for you, and stick with it.

Recommended Reading: How To Dispute Credit Score

Downsides Of Increasing Your Credit Limit

Even if you think youll be able to manage borrowing more, increasing your credit limit might not be the best thing to do.

Having a higher credit limit might encourage you to spend more. This means you would end up facing larger repayments than you would have done.

If youre regularly using your overdraft, this can also affect your chances of qualifying for other kinds of credit, such as a mortgage.

However, having a high credit limit doesnt necessarily impact your chances of being approved for further credit.

Apply For A Secured Loan Or A Credit

Another great first step for establishing credit is to get a secured credit-builder loan. It works like this: youll deposit a few hundred dollars into a secured loan savings account, which acts as collateral on a loan from the lender.

Youll then make scheduled payments which are reported to the credit bureaus until the amount you owe is paid back. The deposit is then released back to you after the account is closed. Secured loan groups like Kikoff and Self may be worth considering. After youve proven that you can pay back the loan, your FICO score may improve and credit card issuers can be quick to offer credit.

Don’t Miss: Do Student Loans Show On Your Credit Report

Factors That Affect Your Credit Scores

As we mentioned above, there are several factors that go into determining your credit scores.

How Can I Get Capital One To Raise My Credit Fast

With that in mind, let’s look at some tips for using a credit card to build or rebuild credit.

You May Like: Does Eviction Go On Credit Report

Can You Pay More On Your Car Payment

Has your financial situation changed since you bought your car? With two-thirds of new car loans now lasting six years or more, according to Experian data, there’s a good chance it has. Perhaps you bought your car flush with the excitement of landing your first entry-level job. Now you’re a manager with a bigger salary and an annual bonus. With extra cash on hand, should you pay extra on your car payment? You can pay more on your car payment in many cases, but before doing so, make sure you fully understand the effects it will have on your auto loan, your credit score and your personal finances.

Which Cards Are Best To Pair Together

If you can qualify for cash-back or rewards cards, you can maximize your rewards by having more than one. A good strategy is to choose one card with an overall high earnings rate on all purchases and another card or two that earn extra points on a category of spending that is important to you. Here are some card pairings you could consider.

You May Like: Will Closing A Credit Card Hurt My Credit Score

Youll Always Remain In The Black

It can be easy to overcharge with a credit card, and many accounts come with large limits that can be too tempting. However, if you pay off each charge as it happens, youll avoid racking up unmanageable card debt. All you have to do is ensure you have enough money in your checking account to cover your charges.

Is It Bad To Pay Your Credit Card Twice A Month

Making Multiple Payments Can Help You Avoid Late Payments You’re not required to wait for your monthly statement to make payments on your credit card you can make a payment at any point in the month, either to cover your full balance or part of it. The best reason to do so is to avoid late credit card payments.

Don’t Miss: How To Check My Fico Credit Score

Improve Your Credit Score

While making multiple payments each month wont affect your credit score , you will be able to better manage your credit utilization ratio. Usually when you make a credit card payment on the due date, say on the 15th of the month, the credit card companies wait until the end of the month to report your activity. By then, you could have racked up additional credit card balances, which increase your credit utilization. That helps to improve your credit score.

Does Paying Off A Loan Help Or Hurt Credit

Paying off a loan frequently hurts credit because it impacts your credit history and your credit mix. If the loan that you have paid off is your oldest credit line, then the average age of your credit will become newer and your score will drop. If the loan that you pay off is your only loan, then your credit mix suffers.

Don’t Miss: Which Of The Following Most Impacts Your Credit Score

Become An Authorized User On A Credit Card

Ask a friend or family member to contact their credit card issuer and have you registered as an authorized user. The card issuer will need your personally identifiable information in order to process the request. And the payoff can be big: you may find yourself with a credit score boost in a few months time.

What Is The 15/3 Credit Card Payment Hack

The 15/3 credit card payment hack is a credit optimization strategy that involves making two credit card payments per month. You make one payment 15 days before your statement date and a second one three days before it .

Your statement date is the last day of your credit card billing period, upon which your card issuer will send you a summary of your activity and your balance due. Billing periods usually last around 30 days, though they dont necessarily correspond with calendar months.

Note that your statement date is separate from your payment date, which is the day you must pay off your statement balance to avoid incurring interest charges. Its usually 20 to 25 days after your statement date .

Heres how the 15/3 credit payment hack would work in practice.

Say that Johns card has a credit limit of $2,000 and a billing period of 30 days. His current billing period is from June 15th to July 15th. On June 30th, 15 days before his statement date, he has a balance of $1,000 on his credit card.

He decides to make a $750 payment and reduce his balance to $250. Over the next 12 days, he spends another $500 on the card. On July 12th , he makes a second $750 payment, reducing his balance to $0.

Over the next three days before his statement date, he spends $100, which his card issuer would record and report as his balance for the billing period.

You May Like: How To Get A Copy Of My Credit Report