What Is A Credit Limit

When youre approved for a credit card, youll be given a credit limit. That limit represents how much money you can borrow. When youre not carrying a balance on your credit card, your credit limit and available credit will be the same. When you’re carrying a balance, your available credit will be your credit limit minus your balance.

Your credit card issuer may request your score from the various credit bureaus, including Equifax®, Experian® and TransUnion®, when determining your creditworthiness.

Navy Federal Credit What Bureau Do They Use

So I finally decided to give up on Penfed.. Because it’s quit obvious they don’t like my profile.. Lol

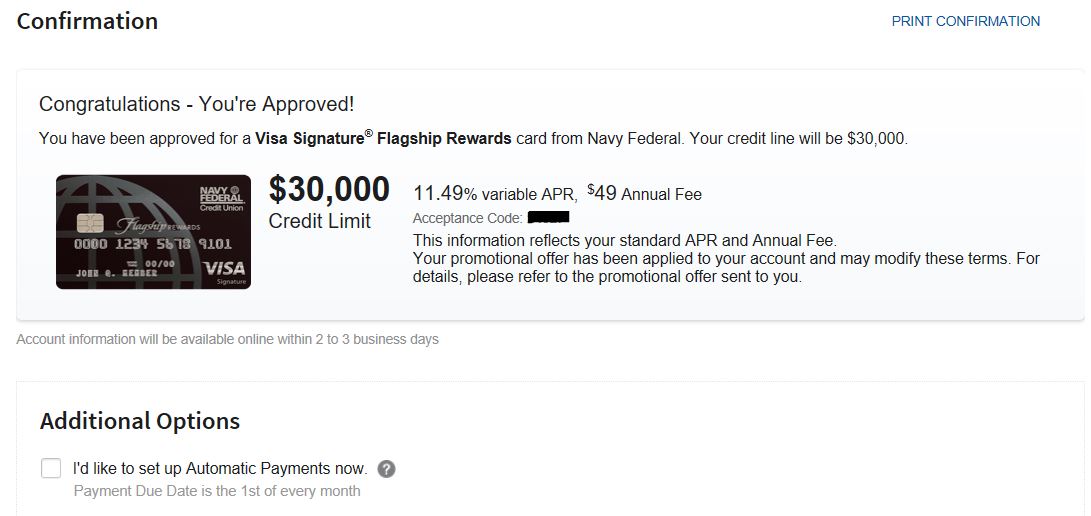

So I joined Navy federal and I applied for the credit card.. And it wasn’t the flagship I saw here that’s a hard one to get fresh out the gate.

But I got the 5-7 message.. But none of my reports were pulled. Should I have waited a few days before applying for the credit card?

Also can anyone tell me which credit bureau they pull?

My current scores are as follow.. Trans 700 Exp 687 EQ 766 These are my fico scores

Thanks in advance

I have a old student loan that’s keeping my Trans and Ex score dow which is now paid off.. But it does have some lates.

Disco 1,184/6500

paypal master card 0% of 900

Neiman Marcus 0% of 14,000

Capital one 0% of 9,000 AU

Capita onel 0% of 1350

When Should I Investigate Increasing My Credit Limit

There are several reasons you may want to consider asking for a new card or line of credit with a higher credit limit. Try timing your request for when:

- your credit has improved. If you see your credit has improved after reviewing your latest credit report, contact your creditor for an increase.

- you want your credit to improve. Increasing your credit limit may reduce your credit utilization ratio and can increase your credit score. For example, a balance of $300 with a $1,000 credit limit means youre utilizing 30% of your credit. If youre approved for a credit limit increase to $2,000, your credit utilization is instantly halved to 15%, provided you dont increase your balance.

- you need to buy a big-ticket item. Should you need to cover a larger expense, a credit limit increase can be helpful. If you have good credit and make payments on time, your creditor may approve an increase in the amount of credit available to you.

Recommended Reading: When Do Things Fall Off Your Credit Report

Applying For A Loan W/ Navy Federal Credit Union

Whether you’re applying for an auto, mortgage, or personal loan, Navy Federal Credit Union has extremely competitive rates. The problem? You need great credit to get those loan terms . Your first step to determine if you’re eligible for top-tier rates is to pull your Credit Report.

You can review your Credit Report and find every inaccurate , or contact a Credit Repair company, like Credit Glory, to walk you through that entire process.

You can schedule a free consultation with Credit Glory, or call one of their Credit Specialists, here 412-6805″ rel=”nofollow”> 412-6805 â).

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How Long Will A Repo Stay On My Credit

Business Credit Report Vs Personal Credit Report

Aside from the personal credit report of each individual, every business has a credit report that records the credit accounts connected with it. When applying for a business credit card, the business report is often referenced in the card approval process to augment information on the business. Things like size and age of the business can be gleaned from the report.

The business credit report is not typically used in the decision for approval since the data there is fuzzy and lacking. Even someone who doesnt have any reporting on their business can get approved for a business credit card based on their personal credit worthiness. After getting a business card, most banks will report the new business and associated account to the business credit bureau, and a business credit report is thus established.

While most banks will report a business credit card on your business credit report, many will not report it on the all-important personal credit report .

Even reporting on the business credit report is inconsistent, though. Some banks will report to all bureaus while others will only report to one. Amex officially says that they report business cards to the business, but from what Ive heard, they dont report at all to business bureaus .

Navy Federal Credit Union Mastercard Business Card Reviews And Complaints

Navy Federal Credit Union isnt accredited with the Better Business Bureau, though it does receive an NR rating as of August 2021. Over 90% of its customer reviews are negative, resulting in a composite score of 4.7 out of 5. Of the nearly 900 complaints filed against the credit union, customers cited difficulty getting unauthorized charges taken off of their account and issues with their credit card payments being reported on time. Other complaints about this card specifically revolved around hidden fees. To avoid this, make sure you read the fine print and ask any questions before applying for this card.

You May Like: 691 Credit Score Auto Loan

Best For Business: Nfcu Go Biz Rewards Mastercard

Heres why: This card is great for business owners who want a card with no annual fee.

Its recommended that business owners , which makes getting a specific card for business a good idea.

The Navy Federal Credit Union GO BIZ Rewards Mastercard has no annual fee and offers up to one point for every $1 spent. You can score rewards points with no limits or earning caps.

Compare business credit card offers on Credit Karma.

How Does Positive Payment History Impact Your Credit

Payment history is the biggest factor in credit scores, so paying your bills on time, every time is the most important thing you can do to build a strong credit history.

If you are just starting to establish your credit, it can take time to build a solid history of positive payments. Here some tips to help you begin building your credit history:

Also Check: How Long Before Repossession Is Off Credit

What To Watch Out For

-

No signup bonus.

This is one of the rare business credit cards that doesnt have a signup bonus.

-

No intro APR period.

Most business credit cards offer an intro APR period on purchases and balance transfers, but you wont get that with this card.

Does the Navy Federal Credit Union Business Card show up on personal credit reports

No, the credit union doesnt report activity for this card to consumer credit bureaus.

The Positive: Reporting On

When you regularly report rental payments to the credit bureau, most of these payments will be standard, on-time payments. When the credit bureaus receive this information, it shows that a positive tradeline is active on the account.

If credit reporting is something that you are thinking about doing, its important to learn about the benefits for yourself and for your tenants. With this information, you can build stronger relationships with all of your tenants.

Read Also: Credit Wise Is Not Accurate

Tips For Building Business Credit With Credit Cards

If one of your goals is a good business credit rating, consider getting a business credit card. Many entrepreneurs think their business has to be well-established and profitable to qualify, but that is not always the case. Card issuers are often more interested in the personal credit score of the owner who applies, and will often consider income from a variety of sources, not just the business itself.

To build strong business credit using a business credit card, make sure you:

How To Get A Business Credit Card To Build Credit

Small business credit cards are available to small business owners with good personal credit scores and sufficient income to meet the issuers minimum income requirements. A few important qualifiers to keep in mind:

Also Check: Experian Unlock

Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders youre unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

How To Report Late Rent

Report Late Rent and Reduce tenant delinquencies by 36%

Report Late Rent and Reduce tenant delinquencies by 36%

For Canadian Landlords and Property Managers there has never been a tenant registry that enables them to report tenants rent payments. Leaving many asking the question, how do I report late rent on a tenant?

The Landlord Credit Bureau empowers Landlords and Property managers to report rent payments, paid, late or otherwise owing. For tenants who consistently pay rent on time LCB will reward them with a positive Tenant Record. For those tenants who choose to not pay rent, they will receive a negative Tenant Record. To start reporting rent payments to Landlord Credit Bureau visit FrontLobby.

LCB is a Reporting Agency in Canada.

LCB handles notifying tenants that their rent payments are reported to LCB and of the benefits and consequences for late rent payments and non-payment of rent. Tenants can view and monitor their records, and if information is disputed, there are multiple mechanisms in place to handle such disputes. LCB will then investigate.

With LCB you can also report former tenants. In the case of former tenants who owe unpaid rent, the amount you record will automatically roll over each new month, until you login and record it as paid. You can also report a positive rent payment history for former tenants.

How to report Late Rent Payments?

It is easy with Landlord Credit Bureau, and it is free to sign up.

Disclaimer

You May Like: When Does Self Lender Report To Credit Bureaus

Navy Federal Credit Union Settlement

If you want to settle a debt with Navy Federal Credit Union, ask yourself these questions first:

These are not the only things to consider when dealing with debt collectors. We are here to help you answer the questions above, and much more. Whether its harassment, settlement, pay-for-delete, or any other legal issue with Navy Federal Credit Union, we at Agruss Law Firm are here to help you.

Re: Navy Federal Credit What Bureau Do They Use

Yes I stalk my credit to like a jilted lover who can’t let go.. and thankfully so.. I got an alert prior to me knowing about credit freezes. That someone tried to obtain a Verizon Wireless account in my name.. I was able to have the application shut down. However Verizon refused to remove the hard Inquiry that came with it. So when I called Eq about it. They suggested security freeze.. But like you said sometimes it’s a hassle to have them removed.

You May Like: What Credit Score Do You Need For An Apple Card

How Being An Authorized User Affects Your Credit

As soon as the credit card is listed on your consumer credit reports, anyone who reviews your credit reports will see the account history. Credit scoring systems, including FICO and VantageScore, compute credit scores monthly from the information listed on your credit reports.

If this is your first and only credit account, you will earn a FICO Score within three to six months. VantageScores are posted after a single account is listed in as little as one or two months.

The credit card issuer does not deem you responsible for making the payments to this card, so how card payment is handled is up to the primary cardholder. But your credit standing will benefit if that person manages the account responsibly by making all payments on time and keeping the balance under 30% of the credit line. Thats because payment history and credit utilization are the two most important factors in credit score development.

Best For Cash Back: Nfcu Cashrewards Credit Card

Heres why: This card offers a competitive cash back rate on all eligible purchases, with no annual fee.

This card earns 1.5% cash back, which can be boosted to up to 1.75% cash back if you have direct deposit at Navy Federal.

You can redeem for cash, merchandise or gift cards, with no rewards limits.

For a limited time, new cardholders can also earn $250 welcome bonus after spending $2,500 on eligible purchases within 90 days of account opening.

For more info on this category, take a look at cash back cards on Credit Karma.

Don’t Miss: How Does A Landlord Report To Credit Bureau

When Are Credit Scores Updated

Your credit score isnt included on your free weekly reports, but knowing the information in your report can help you understand credit score movements. When information is received by the credit reporting agencies, its typically added to your credit reports immediately. And when the information in your credit report changes, your scores may as well. How much they change depends on what information is updated. For example, making one more on-time payment may not cause your score to jump significantly after a year of consistent payments. But if you significantly lowered your balances across your credit cards, you may see some positive score movements. Making payments consistently and keeping balances low are good ways to keep your credit on track. Over time, with these good habits, you should see your score continue to improve.

Navy Federal Credit Union

Creditors like Navy Federal Credit Union cannot harass you over a debt. You have rights under the law, and we will stop the harassment once and for all.

THE BEST PART IS

If Navy Federal Credit Union violated the law, you may be entitled to money damages and Navy Federal Credit Union will pay our fees and costs. You wont owe us a dime for our services. Plus, some of our clients also receive debt relief and cleaned-up credit reports. You have nothing to lose! Call us today at 888-572-0176 for a free consultation.

You May Like: What Credit Bureau Does Drivetime Use

How Do We Use The Law To Help You

We will use state and federal laws to immediately stop Navy Federal Credit Unions debt collection. We will send a cease-and-desist letter to stop the harassment today, and if Navy Federal Credit Union violates the FDCPA, EFTA, FCRA, or any state law, you may be entitled to money damages. For example, under the FDCPA, you may receive up to $1,000 in damages plus actual damages. The FDCPA also has a fee-shift provision, which means the debt collector will pay your attorneys fees and costs. If you have a TCPA case against the agency, we will handle it based on a contingency fee and you wont pay us a dime unless you win.

THATS NOT ALL

We have helped thousands of consumers stop phone calls. We know how to stop the harassment and get you money damages. Once again: you will not pay us a dime for our services. We will help you based on a fee-shift provision and/or contingency fee, and the debt collector will pay your attorneys fees and costs.