Find The Best Credit Score For Your Needs:

The credit score that you are looking for varies, depending on what type of credit you are looking to apply for. Each credit score version has different benefits, and lenders pull certain scores in accordance with your application.

Below we will go over the best credit scores for various financial products and where you can get them. Refer to our list above to see if you can access the credit score for free, as not all scores are available for free.

What It The Highest Credit Score

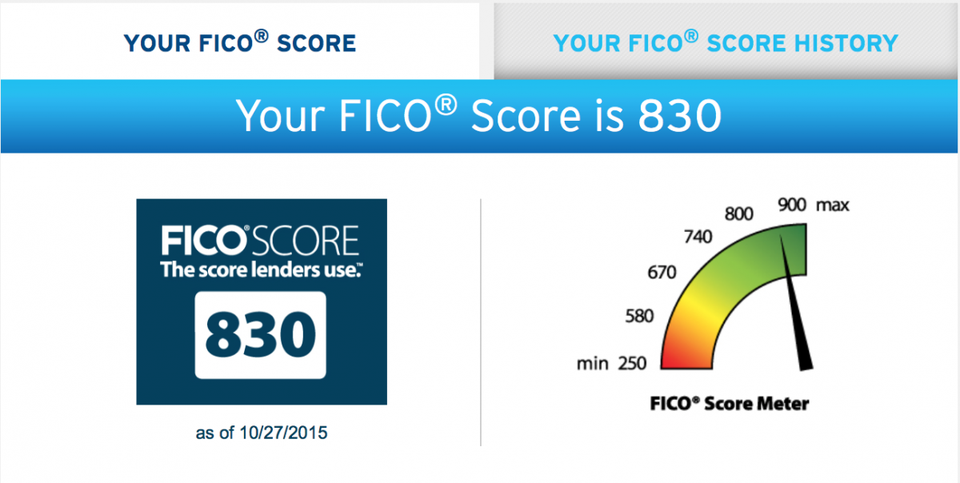

Most credit scoring models follow a credit score range of 300 to 850 with that 850 being the highest score you can have. However, there can be other ranges for different models, some of which are customized for a particular industry . While the majority follow the 300 to 850 range, there are some scores that range from 250 to 900 and others that may use other score ranges. For more information on the different scoring models, view Understanding the difference between credit scores.

How To Check My Credit Score

Before we dive in, you should know that you actually have several different types of . FICO scores and VantageScores are by far the most common ones and these are further broken down into other versions that are used by separate lending industries. The best way to think of them is as brand names. FICO scores and VantageScores are the Walmarts and Targets of credit scores, if you will.

Checking your credit score often is a smart money move. Doing so wont affect your score at all simply looking at your own credit is whats referred to in terms as a soft inquiry. In contrast, when youre applying for a loan and the lender pulls your credit information, thats called a hard inquiry, and that may affect your score temporarily.

Whats more, it is becoming easier to check your credit score. In some cases, its automatic. In many cases, its free. Sometimes companies will still try to get you to pay for your credit score. Its not a scam per se, but with all the free options out there, were hard pressed to find a legitimate reason youd need to pay anymore.

Here are several ways to check your credit score.

Read Also: Ccb/ppc Credit Inquiry

Your Fico Score From Fico

90% of top lenders use FICO® Scoresdo you know yours?Choose your plan.

- Scores for mortgages, auto loans & more

- $1 million identity theft insuranceImportant information 33

- 24×7 identity restoration

Automatically renews at $19.95/month. Cancel anytime, no refunds. Includes FICO Score 8. Your lender/insurer may use a different credit score. See important information belowImportant information 11.

Free Business Credit Score Services

- Get a summary of your Dun & Bradstreet, Experian and Equifax business credit report

- Receive business credit grades for each score, plus your personal Experian credit score

- Tools to help you build business credit

What’s missing: You don’t receive your full business credit reports and scores with the free version. But you can upgrade to a paid version, starting at $29.99 per month for Nav Business Manager, to receive your full report and score with Dun & Bradstreet, Experian and Equifax, plus the ability to dispute errors on business credit reports and more. Compare Nav business credit products. There are alternative paid options to view your actual score, which we break down below.

Don’t Miss: Realpage Inc Hard Inquiry

I Opted In But It Says No Score Is Available Why

The most common reasons a score may not be available:

- The credit report may not have enough information to generate a FICO® Score

- The credit bureau wasnt able to completely match your identity to your Wells Fargo Online® information. To keep your information current, sign on to Wells Fargo Online®, visit the Profile and Settings menu, select My Profile and then Update Contact Information. Make sure your email addresses, phone numbers, and mailing addresses are current.

- If you’ve frozen your credit with the credit bureau, you may not immediately receive a credit score. A score should become available for you to view after the next monthly update. Contact Experian® with further questions.

If I Dont Agree With My Fico Score What Should I Do

Your FICO® Score is provided to Wells Fargo by Experian® based on information within your credit report on the calculation date . If you feel this information is inaccurate, your next step should be to request a free credit report from annualcreditreport.com. If theres incorrect information within any of your credit reports, follow each bureaus instructions on how to dispute that information. If theres incorrect information about your Wells Fargo accounts, please call the Wells Fargo phone number in your credit report.

You May Like: Notify Credit Bureau Of Death

How Is A Fico Score Calculated

The company applies a proprietary formula to the data in your credit reports to produce a score.

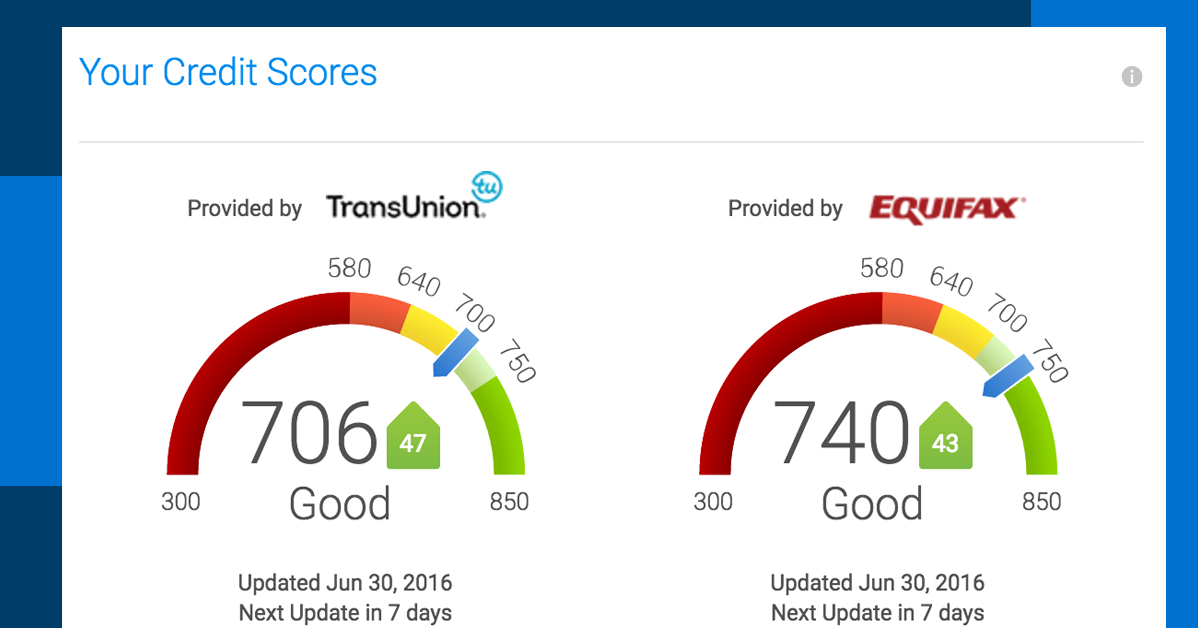

Often, the three credit bureaus that create your credit reports Equifax, Experian and TransUnion have slightly different data from one another. So your score may vary depending on which bureau’s data was used.

How Many Points Off Is Credit Karma

The only possible answer is a few points, if any. Your credit score can vary every time it is calculated depending on whether the VantageScore or FICO model is used, or another scoring model, and even on which version of a model is used.

The important thing is that this number should be in the same slice of the pie chart that ranks a consumer as “bad,””fair,””good,””very good,” or “exceptional.”

Don’t Miss: Whats A Good Credit Age

How Can I Check Credit Scores

Reading time: 2 minutes

Highlights:

-

You may be able to get a credit score from your credit card company, financial institution or loan statement

-

You can also use a credit score service or free credit scoring site

Many people think if you check your credit reports from the three nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports from the three nationwide credit bureaus do not usually contain credit scores. Before we talk about where you can get credit scores, there are a few things to know about credit scores, themselves.

One of the first things to know is that you dont have only one credit score. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time. Credit scores are calculated based on a method using the content of your credit reports.

Score providers, such as the three nationwide credit bureaus — Equifax, Experian and TransUnion — and companies like FICO use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the three nationwide credit bureaus will also vary because some lenders may report information to all three, two or one, or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you get credit scores? Here are a few ways:

What Are The Minimum Requirements To Produce A Fico Score

In order for a FICO® Score to be calculated, a credit report must contain these minimum requirements:

- At least one account that has been open for six months or more.

- At least one account that has been reported to the credit reporting agency within the past six months.

- No indication of deceased on the credit report .

You May Like: Do Student Loans Fall Off Your Credit

Get Your Credit Score From A Credit Bureau

Thanks to the Fair Credit Reporting Act , the three major Equifax, Experian and TransUnion are required to provide you with a free credit report once per year, upon request. But they arent legally required to provide your credit score.

Still, you can get your credit score from all three bureaus, though it wont be free in every case.

Equifax and Experian will provide you with your credit score for free, while TransUnion requires you to sign up for a monthly subscription that includes a bulk of other services.

All three credit bureaus have several subscription tiers and product packages, so if all youre trying to do is check your credit score, be sure youre selecting the most barebones option available. Otherwise, youll be shelling out for unwanted add ons.

Here are the most basic plans at all three bureaus:

The free plans from Experian and Equifax also come with basic credit tracking features and tips to boost your score. TransUnions basic plan includes similar credit tracking and educational features, as well as identity theft insurance, credit monitoring for all three bureaus, and more.

The free credit scores from Experian and Equifax are updated monthly. TransUnions plan says credit score updates are available daily.

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

You May Like: Report Death To Credit Bureaus

What Is A Good Fico Auto Score

While different lenders use different standards for rating credit scores, when it comes to base FICO® scores, many lenders consider a 700 or higher to be a good credit score. But how high do FICO® Auto Scores need to be to qualify you for an auto loan?

When it comes to high scores versus low scores, Jim Houston, senior director of the automotive finance practice at J.D. Power, says its not written in stone.

It varies by lender, he says. So there is no absolute low.

Every lender has its own score requirements, which can change based on a variety of factors, including market conditions.

How To Check My Business Credit Score

Businesses also have credit scores, which are used by lenders, banks, partners and other agencies to determine their creditworthiness and/or legitimacy. Business credit score ranges are usually on a scale of zero to 100. A businesss credit score is in many ways shorthand for does this business repay its debts, but the score itself could be determined by a host of factors including number of credit accounts, payment history, credit utilization and more.

A good credit score for a business is 80 or above.

To establish business credit and obtain a credit score, your business will need to meet a few benchmarks. It must be registered as its own legal entity , and it must have either a Taxpayer Identification Number or an Employer Identification Number through the IRS, as well as a Data Universal Numbering System number through Dun & Bradstreet.

Once your business is properly registered and has a credit history, you can start checking its credit score in a number of ways.

Don’t Miss: Does Usaa Report Authorized Users

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

More Accurately Assess Consumer Credit Risk

The FICO® Score is used by lenders to help make accurate, reliable, and fast credit risk decisions across the customer lifecycle. The credit risk score rank-orders consumers by how likely they are to pay their credit obligations as agreed. The most widely used broad-based risk score, the FICO Score plays a critical role in billions of decisions each year.

Don’t Miss: What Credit Score Do You Need For Chase Sapphire Reserve

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

How Does Refinancing Impact My Fico Score

Refinancing and loan modifications may affect your FICO® Scores in a few areas. How much these affect the score depends on whether its reported to the consumer reporting agencies as the same loan with changes or as an entirely new loan. There are many reasons why a score may change. FICO® Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history , amounts owed , length of credit history , new credit and credit mix . If a refinanced loan or modified loan is reported as the same loan with changes, two pieces of information associated with the loan modification may affect your score: the new credit inquiry and changes to the amounts owed. If a refinanced loan or modified loan is reported as a new loan, your score could still be affected by the new credit inquiry and an increase in amounts owed, along with the additional impact of a new open date which may affect the credit history category. In the end, a new or recent open date typically indicates that it is a new credit obligation and, as a result, may impact the score more than if the terms of the existing loan are simply changed.

You May Like: When Does Comenity Report To Credit Bureaus

What If I Dont Want Wells Fargo To Display My Fico Score Anymore

You can opt out of the service at any time. On the FICO® Score screen, select the I no longer want Wells Fargo to display my FICO® Score link. If you decide to start the service again in the future, you can select View Your FICO® Credit Score on the Account Summary and follow the instructions to opt back in.

What Are The Different Categories Of Late Payments And Do They Impact Fico Scores

A history of payments is the largest factor in FICO® Scores. FICO® Scores consider late payments in these general areas how recent the late payments are, how severe the late payments are, and how frequently the late payments occur. So this means that a recent late payment could be more damaging to a FICO® Score than a number of late payments that happened a long time ago. Late payments are listed on credit reports by how late the payments are. Typically, creditors report late payments in one of these categories: 30-days late, 60-days late, 90-days late, 120-days late, 150-days late, or charge off . Of course a 90-day late is worse than a 30-day late, but the important thing to understand is that people who continually pay their bills on time tend to appear less risky to lenders. However, for people who continue not to pay debt, and their creditor either charges it off or sends it to a collection agency, it is considered a significant event with regard to a score and will likely have a severe negative impact.

Read Also: What Bureau Does Comenity Bank Pull

Why Its Important To Check Your Credit Score

Viewing your credit score can alert you to potential problems, like a fraudulent account opened in your name or a bill you forgot about that went to collections.

If you check your score regularly, you can deal with these problems as they come up. If you dont check your credit score until youre applying for a mortgage or other major loan, you may discover a huge mistake that takes weeks to fix.

What Are Fico Scores

FICO® Scores are the most widely used credit scores and are used in over 90% of U.S. lending decisions. Your FICO® Scores are based on the data generated from your credit reports at the three major credit bureaus, Experian®, TransUnion® and Equifax®. Each of your FICO® Scores is a three-digit number summarizing your credit risk, that predicts how likely you are to pay back your credit obligations as agreed.

You May Like: Coaf Hard Inquiry

How Do You Check Your Credit Score

You can check your credit score from many sources, including Experian. Learning what your credit scores mean and what affects them can help you when you’re getting ready to apply for new credit.

Lenders use credit scores to decide how likely it is you will repay your debts on time. There are hundreds of credit scoring models in existence, though the FICO® Score is the most common. The higher your credit scores, the better offers you are likely to receive from lenders in the form of lower interest rates and other favorable terms.