Dispute Credit Report Errors

Experian, TransUnion and Equifax all accept online disputes. You can easily fill in your information online or dispute by mail or over the phone.

- Equifax: You can dispute online or by mail to Equifax Information Services, LLC, P.O. Box 740256, Atlanta, GA 30374-0256. Dispute over the phone at 349-5191.

- Experian: You can dispute information online or over the phone using the toll-free number included on your credit report. Dispute by mail at Experian, P.O. Box 4500, Allen, TX 75013.

- TransUnion: Call the toll-free number 916-8800, dispute online or by mail to TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA, 19016-2000. Make sure to complete and include the request form on the website.

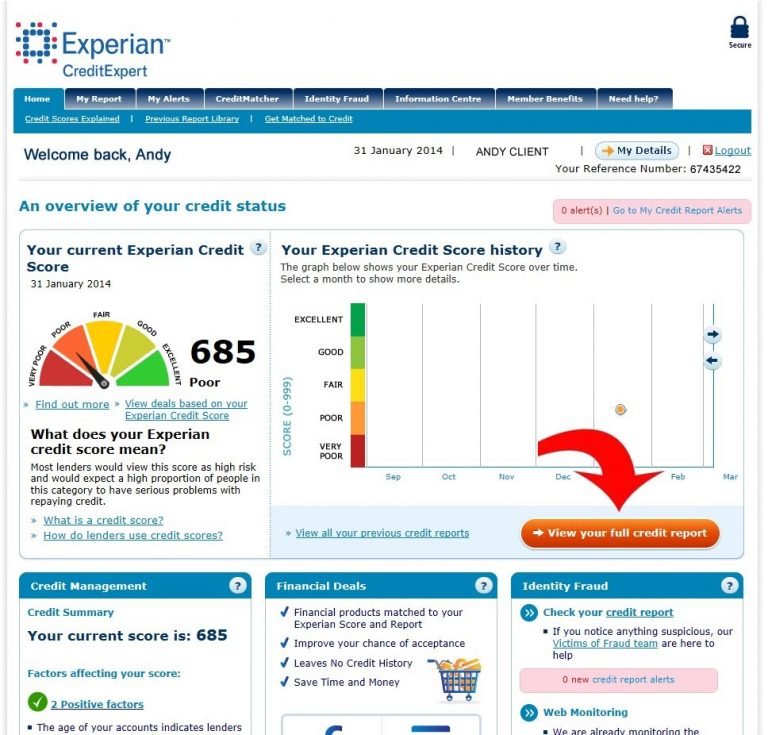

How Do You Interpret A Credit Score

Heres a quick rundown of how I assess credit scores:

- 800 850 Excellent! Its not often that credit scores come in this high. If you see anyone north of 800, its a good sign theyve been doing something right.

- 700 800Good! When someones credit score is in this range, their financial situation isnt necessarily perfect, but its still in great shape.

- 650 700Pretty Good. However, there may be a few dings against their credit that are worth investigating.

- 600 650Meh this applicant probably has some questions to answer . Keep a close eye on any red flags that come up in their credit report. Figure out what has caused their score to be less-than-stellar, and why.

- Less than 600Poor. There are most likely some significant issues you need to be aware of. Be very careful when you score in the range.

Keep in mind, these bullet points are how I look at credit scores. If you want to see more of an official industry standard, these pie charts from Experian convey another perspective:

Remember, the credit score never tells the whole story. Simply focusing on these three digits doesnt tell you WHY the credit score is high, low, or average.

If you want to understand whats going on with a persons financial picture, you need to dig into the details. A credit report has several parts that can uncover a persons past and current financial obligations.

Check Your Credit History For Accuracy

Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

Your credit report contains a wealth of information about your financial history and actions. If you have , those accounts and how you pay them, are included in your credit report. Its important to review your credit report at least once a year so you know what your creditors are saying about you.

Understanding your can be confusing, especially if youre reading your credit report for the first time. Here is a breakdown of the types of information contained in your report.

Also Check: Chase Sapphire Preferred Score

Remember Your Credit Report Matters

A credit report is more than a string of numbers and letters. Nor will knowing how a credit report should be read and understood put you in good financial standing. But when you can make sense of why your credit score is the way it is, you are in a better position to maintain and improve your credit score.

How To Understand Your Credit Score

A combination of factors make up your credit score, the single number that holds all the weight in your credit report. The factors include:

- Payment history: ensuring you have a steady habit of making payments on time

- Utilization ratio: the amount of credit you use divided by the amount of credit available to you

- History of accounts: longstanding accounts are valuable as they show a lengthy history of being a good borrower

- The number of inquiries youve made: seeking credit too often may make you look like a risky candidate

You can find out more about the key factors that are used to calculate your credit score. However, its good to be aware that your credit score can vary between credit bureaus and financial institutions. This can be because each credit bureau may have different information about your debts and because each bank often creates its own proprietary credit score that it requires its employees to follow when lending money. At the end of the day, though, all of these credit scoring systems are fairly similar. Each one just puts a little more or less emphasis on certain aspects of your credit history.

Don’t Miss: Syncb Zulily Credit Card

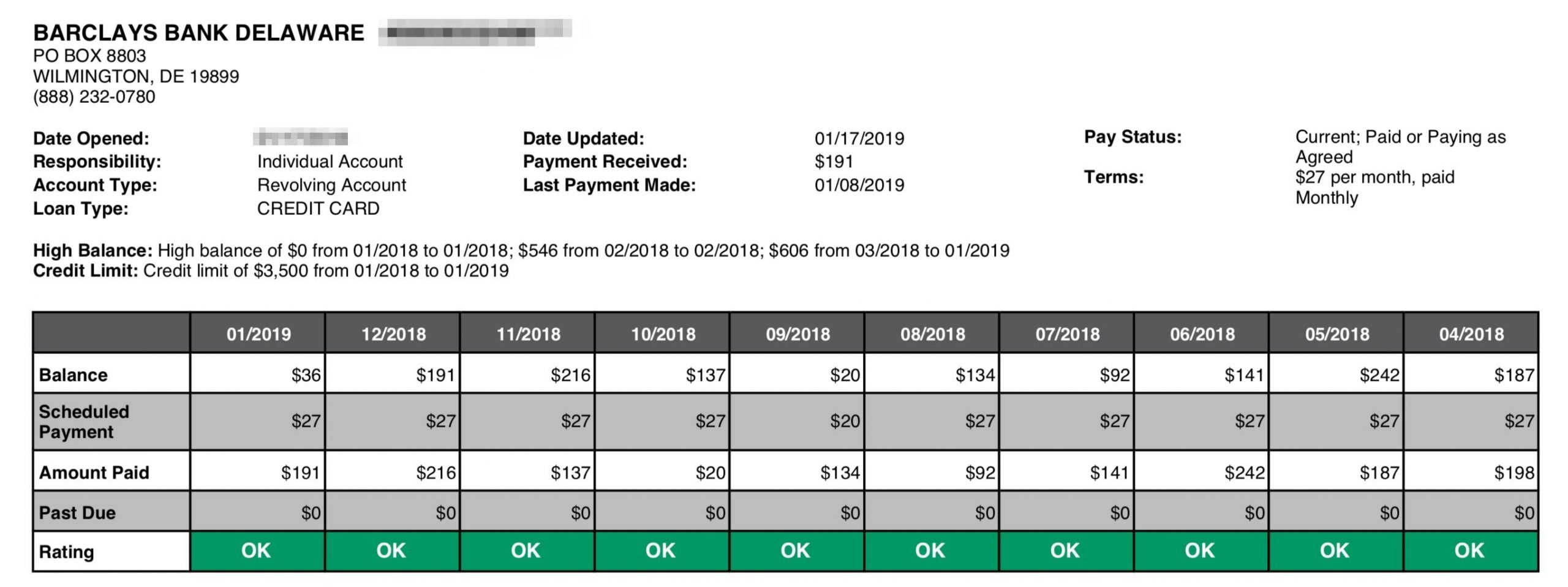

What Does A Full Credit Report Look Like

A full credit report looks like a financial statement, depicting various information on an individual’s credit profile. It has personal information on the top and is broken down by the various credit that an individual has, such as credit cards, loans, and mortgages, as well as other sections such as public records.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

You May Like: Does Wells Fargo Business Credit Card Report To Bureaus

Are Statements Of Dispute A Good Idea

It can be very appealing for a consumer to tell his side of the story, especially when he feels like he has been wronged by a creditor or collection agency. Unfortunately, a Statement of Dispute is unlikely to have any impact whatsoever on a future lenders decisions on credit card and loan applications.

The right to add one of these consumer statements has been around for over 25 years, well before automated credit scoring and underwriting systems. The idea behind the consumer statement was to allow lenders to actually read them while considering your application. Today its rare that a lender will actually print and read through your credit reports, so the value of the consumer statement just isnt there any longer.

So it could just be a waste of time, but there are other, more practical reasons why you may not want to add certain consumer statements.

For example, if you add a general consumer statement explaining why you paid late on an old account, but that account then drops off your credit report, there will be no record of the late payment except your consumer statement. This could alert lenders to the late payment if they happen to read through your credit report, and could affect their decisions. In this case you should remove your consumer statement when the account in question drops off your reports.

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

You May Like: How To Check Credit Score On Usaa

How To Read A Credit Score

Its a simple three-digit number, but your credit score matters to all sorts of financial goals. Take a mortgage: Improving your credit score by more than 100 points may help knock a half point off your interest rate. And a careful review of your credit report can alert you mistakeseven instances of identity theft.

Ready to learn more?

What’s In A Credit Report

Your credit report lists what types of credit you use, the length of time your accounts have been open, and whether you’ve paid your bills on time. It tells lenders how much credit you’ve used and whether you’re seeking new sources of credit. It gives lenders a broader view of your credit history than do other data sources, such as a bank’s own customer data.

A credit report also includes information on where you live, and whether you’ve been sued or arrested, or have filed for bankruptcy.

Also Check: Carvana Down Payment Bounced

How To Read A Consumer Credit Report

A good can impact your finances in more ways than one, so its vital that you know how to read your consumer credit report. When attempting to qualify for loans, credit cards, or lines of credit, lenders take your into account. Your score determines in part whether youre approved for new credit and what interest rate you’ll receive on money that you borrow.

Reading Your Credit Report

Once you have the three reports in hand, its time to delve into the alphabet soup of abbreviations, terms and numbers to see what theyre actually saying about you.

The first thing youll notice is that each of the credit reports have slightly different information, which is why experts suggest you order all three. Reporting is a voluntary system set up between creditors and the credit bureaus this means creditors can supply information to whichever agency they want, or to all of them, or none of them.

The basic setup, however, is the same. Each report will contain information that identifies you, your credit history, public records and any inquiries that were made about your credit.

Read Also: Comenity Bank Approval Odds

Accounts With Adverse Information

If you fail to make timely payments or an account falls into collection, it will show up in this section.

What To Look For:

Look at the names of the accounts listed in this section to be sure you recognize them. If youve been the victim of identity theft, a fraudster may have opened an account in your name.

While you cant dispute negative information in your credit report just because its negative, you can dispute accounts that are inaccurate or the result of fraud.

How This Impacts Your Credit Score:

Missed payments are a major credit score factor. Adverse information will typically remain on your credit report for up to 7 years.

Account Name

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

Also Check: Syncppc

Who Generates Credit Scores

Credit scores dont just appear out of thin air. Theyre calculated using the information in your credit report. The FICO score, originally developed by the Fair Isaac Corporation, is the most popular. This score ranges from 300 to 850, with 850 considered to be the perfect score. The VantageScore is another credit-scoring model.

While the FICO and VantageScore models use different algorithms to generate credit scores, they both rely on for information. Understanding how to read your credit report is the first step to better credit health.

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Don’t Miss: Experian/viewreport

How To Read A Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Regularly reviewing your credit reports lets you check for errors that might be lowering your credit scores, and it can tip you off to potential identity theft. You can use the dispute process to get mistakes removed, which may help you qualify for credit or get better terms.

If You See Errors Dispute Them

If you spot inaccuracies that may be lowering your scores, gather documentation to back up your claim. You can dispute credit report errors with the credit bureau showing them. You’ll need to provide copies of documents proving your identity and showing why the item is wrong. The bureau has 30 days to investigate and respond, although the Consumer Financial Protection Bureau has guidance extending that to 45 because of the pandemic

You can request your free credit reports from the three major bureaus or a personal finance site that provides free credit report details, like NerdWallet. Then, review the information and check for inaccuracies.

Credit reports include your personal information, accounts, credit inquiries and any negative marks you may have, such as bankruptcies.

A good credit score is generally between 690 and 719. Learn more about the and how to build credit.

About the authors:Lindsay Konsko is a former staff writer covering credit cards and consumer credit for NerdWallet.Read more

Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Don’t Miss: Does Ginny’s Report To Credit Bureau

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

Two: Take A Look At Your Personal Information

Your credit report will always list out some basic information to ensure the report youre reading actually belongs to you, which is a useful tool when it comes to protecting yourself from identity theft. It will contain any variations of your name youve used in the past including maiden names or nicknames as well as previous addresses youve lived at.

Youll also see your social security number or at least the last four or the first three digits of it as well as your birthday. The report will also include a list of employers youve listed on any applications for credit.

None of the information in this section of your credit report will impact your credit score.

Make sure we land in your inbox, not your spam folder.

Don’t Miss: What Credit Bureau Does Ox Publishing Report To

Where Can I Find My Credit Score

If you got a free credit check, dont be surprised when it doesnt include your . To see that, youll have to use a free web service or pay for it through myFICO or another credit bureau.

Remember, when it all comes down to it, a credit score is really just an I love debt score. Thats right, a good score simply shows how well youve played the debt game. It doesnt reflect your actual net worth or the amount of money you have in the bank. In other words, its really nothing to be proud of. The only way to keep your stellar credit score is to live in debt and stay thereno, thanks!

It is possible to live life without a credit score, which is exactly what Dave recommends. But that doesnt mean you should trash your credit to lower it! Just start paying off your debt, close your credit accounts once theyre paid off, and dont take on any new debt. If youre following the Baby Steps, you should reach that indeterminable score within a few months to a few years. Remember: No credit is not the same as having a low credit score.